Business loan vs. business credit card: key differences

- Business loan vs. business credit card: 6 key differences

- What is a business credit card?

- What is a business loan?

- Business loans vs. business credit cards

- Business loans vs. business lines of credit

- Is it better to have loan debt or credit card debt?

- How to choose the best financing option

- Ramp: Your automated financing solution

As an entrepreneur or small business owner, you may face the dilemma of choosing between a business loan and a business credit card. Deciding which option suits your situation best is important for the success of your business.

To help you understand the distinctions, here's a comprehensive comparison of the advantages and disadvantages of each option.

Business loan vs. business credit card: 6 key differences

Business loan | Business credit card | |

|---|---|---|

Average funding amount | The average business loan amount is $663,000, though funding can range from $50,000 to $5 million or more. | The average business credit card limit is $56,100. Corporate credit cards may offer between $100,000 and $500,000 or more. |

Interest range | Business loans from traditional banks range from 6% to 12% on average. | Business credit card interest ranges from 18% to 36% on average. Some business credit cards, like corporate cards, don’t have any interest because the balance must be paid in full. |

Qualification requirements | Good personal or business credit score Strong business financial history At least one year in business | For business credit cards: Good personal credit score No revenue requirements For corporate credit cards: Capital in a business bank account Usually no credit score requirements |

Terms of repayment | A fixed payment loan where a certain amount is received and then paid back with interest in scheduled installments over a set duration. | A flexible credit line that allows you to borrow from your credit card whenever necessary and requires minimum monthly payments. To avoid paying interest, it’s recommended to fully pay off your balance each month. |

Time to be approved | 30 days or more, depending on the loan. | Credit card approval is usually instantaneous or may take up to a couple of business days. |

Best suited for | Large capital investments like real estate, heavy machinery, or business expansion. | Day-to-day business expenses like office supplies, software subscriptions, and travel costs. |

What is a business credit card?

A business credit card is a type of credit card that's specifically designed for business owners. This type of card allows businesses to make purchases on credit, simplifying the process of managing cash flow and expenses.

Business credit cards typically have more favorable features than traditional consumer cards, such as higher spending limits, rewards points, and access to exclusive business-related benefits.

Application process and eligibility requirements

The application process and eligibility requirements for business credit cards vary greatly from lender to lender. However, some key factors will impact the decision of whether or not you qualify. These include:

- Credit score: Lenders will review your business credit score when deciding if you are eligible for a business credit card. Generally, lenders prefer applicants with higher scores as this is an indication of a financially healthy company.

- Business revenue and profitability: A look into your business revenue and profitability can help lenders determine the creditworthiness of your business. They'll want to see that you have a steady stream of income and that your business is making a profit.

- Years in business: The longer your business has been in operation, the more likely it is that the lender will approve it for a business credit card. This is because lenders want to make sure your business is stable and has a track record of success.

If you meet the eligibility criteria of the lender, then you'll have to provide some additional information, such as:

- Your business name and contact details

- The category and type of your business

- The structure of your business

- Business Federal Tax ID

- Business revenue and expenses

Discover Ramp's corporate card for modern finance

Pros of using business credit cards:

- Convenient and easy to use: Business credit cards are easy to apply for and use.

- Access to funds quickly:You can access the funds almost immediately after approval, making it a great option for businesses that need access to short-term credit.

- Rewards programs: Many business credit cards offer rewards and cash-back programs.

- Usage flexibility: You can use the funds for whatever your business needs, such as office supplies and travel expenses.

Cons of using business credit cards:

- High interest rates: Business credit cards generally have higher interest rates than other types of financing, ranging from 13 to 30%.

- High fees: Business credit cards often come with high annual fees, late payment fees, foreign transaction fees, and other hidden costs that can add up quickly.

- Debt accumulation: It's easy to get into debt with a business credit card if it isn't used responsibly.

Can I get a business credit card without business income?

Yes, you can get a business credit card without business income, but there are caveats. Lenders often consider your personal credit score and may require a personal guarantee, making you responsible for the debt if the business cannot pay. When applying, you might need to provide business information, and if you lack business income, you can sometimes use personal income to qualify. As a sole proprietor or startup, you can use your name as the business name and your Social Security number as the business tax ID. Requirements vary by card issuer, so research options and understand the terms before applying.

Can you get a loan from a credit card company?

A cash advance is a type of short-term loan that you can borrow from a credit card company. This involves borrowing money against the credit limit on your card, and typically comes with its own APR rate and a separate fee.

What is a business loan?

A business loan is a financial arrangement where a lender provides funds to a business entity, which must be repaid over a specific period of time, typically with interest. It's a form of financing that can be used for various purposes such as starting a new business, expanding operations, purchasing equipment, or managing cash flow. Business loans are typically offered by banks, credit unions, and other financial institutions, and the terms and conditions of the loan may vary depending on the lender and the borrower's creditworthiness.

Application process and eligibility requirements

The process of applying for a business loan may differ among lenders but usually involves submitting specific documents, including:

- Business plan

- Tax returns

- Bank statements

- Cash flow projections

- Financial statements

Eligibility requirements for a business loan vary depending on the lender, but generally, you will need to demonstrate that your business is profitable and well-established. Lenders may use the following criteria to determine your eligibility:

- Years in business

- Cash flow and assets

- Business credit score

- Ability to repay the loan

Can I get a business loan with a 500 credit score?

Getting a business loan with a credit score of 500 can be challenging as it is considered poor by most lenders, which may lead to higher interest rates or outright rejection. However, some alternative lenders might offer loans with less emphasis on credit score, focusing instead on business revenue or offering secured loans.

Pros of taking out a business loan:

- Low interest rates: Business loans typically have lower interest rates than business credit cards, ranging from 6.5 to 13.5%.

- Large loan amounts:You can typically borrow up to $5 million with a business loan.

- Long repayment terms: Business loans usually have longer repayment terms than business credit cards.

Cons of taking out a business loan:

- Strict eligibility requirements:Getting approved for a business loan can be difficult due to strict eligibility requirements such as a high credit score and income history.

- Collateral required: Most business loans require some form of collateral, such as real estate or business assets.

- Long application process: The application process for a business loan can be long and complex, taking several weeks to complete.

Business loans vs. business credit cards

Here’s a quick comparison of the main differences between a business credit card and a business loan:

- Interest rates: A business loan typically has a much lower interest rate than a business credit card. However, business credit cards may offer rewards and cash-back programs that can provide significant savings.

- Loan amount:Business loans generally allow you to borrow more than a credit card. Most business loans can cover up to $5 million, while most business credit cards have limits of around $50,000.

- Repayment terms:Business loans usually require regular payments over a set period, while business credit cards allow you to pay off the balance in full or in smaller payments over time.

- Eligibility requirements:Due to stringent eligibility requirements, business loans can be difficult to get approved for. Business credit cards, however, typically have fewer eligibility requirements and better approval odds.

- Risks:Business loans require collateral, and failure to meet payment requirements can put your assets at risk of foreclosure or repossession. Business credit cards, on the other hand, can lead to serious debt if not used responsibly.

Business loans vs. business lines of credit

Another option you might be considering is a business line of credit. Here are the main differences between a business line of credit and a business loan:

- Interest rates: Business loans often have fixed interest rates, which means the rate remains constant throughout the loan term. A business line of credit, however, typically has a variable rate, which can fluctuate over time based on market conditions.

- Loan amount: Business loans usually provide a lump sum amount that can be substantial, often suitable for large, one-time investments. In contrast, a business line of credit offers a credit limit that can be tapped into as needed, making it more flexible for ongoing or unexpected expenses.

- Repayment terms: For a business loan, repayment terms are usually fixed, with regular payments over an agreed period. With a business line of credit, you only pay interest on the amount you borrow, and the repayment terms can be more flexible, often resembling those of a credit card.

- Eligibility requirements: Getting approved for a business loan generally requires a solid business plan, good credit, and sometimes collateral. A business line of credit might have less stringent eligibility criteria but often requires a demonstrated history of business revenue.

- Risks: With a business loan, there's the risk of defaulting on a fixed repayment schedule, which can affect your credit score and business finances. A business line of credit, while more flexible, requires discipline in managing the revolving credit to avoid excessive debt.

Is it better to have loan debt or credit card debt?

While it's best to avoid any type of debt, it's generally better to have loan debt over credit card debt.

Credit cards usually have higher interest rates, averaging over 17% APR, resulting in significant charges for large balances.

On the other hand, business loans often have lower interest rates and fixed repayment terms, making them a more cost-effective and manageable option.

Discover Ramp's corporate card for modern finance

How to choose the best financing option

While your company’s needs are unique, there are some factors all business owners should consider when deciding between a business loan vs. a credit card:

Funding needs

The amount of money you need will be a key factor when deciding which financing option is best for you. Business credit cards generally offer lower borrowing limits than business loans, so if you need to borrow a larger amount of money, a business loan is your best bet. While a business loan can cover up to $5 million, most business credit cards have limits of around $50,000.

Credit score

Before applying for either type of financing, check your business credit score to make sure you'll be eligible. Business credit cards generally have lower eligibility requirements than business loans, so if your credit score is on the low side, a business credit card may be a better option.

Interest rate

The interest rates of business loans and business credit cards can vary significantly depending on your creditworthiness. Weigh the interest rates carefully before deciding which one is right for you.

Repayment terms

If you need to borrow money on a short-term basis, a business credit card may be your best option. If you need to borrow for a longer period, then a business loan may be the better choice. This is because small business loans typically have longer repayment terms than business credit cards. It's also important to consider your business budget and how much room you have for the monthly payments required.

Ramp: Your automated financing solution

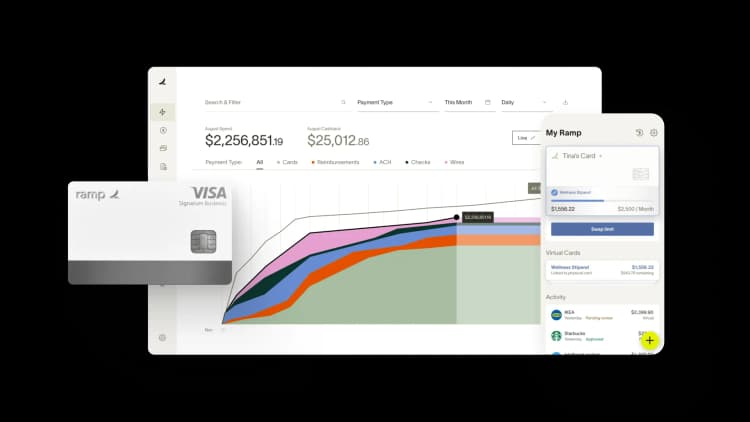

At Ramp, we understand the complexities of small business financing. That's why we created a platform to help build financially healthy businesses.

Our automated expense management platform helps you manage your finances, track expenses, and get access to credit quickly and easily. With Ramp, you can access corporate cards that work just like regular credit cards, but with extra benefits to make it easier to keep track of spending.

Get Ramp today and take control of your business financing.

Don't miss these

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits