Can you get a business credit card without a business?

- Do you need a formal business to get a business credit card?

- Who qualifies for a business credit card?

- Business credit card requirements for sole proprietors

- How to apply for a business credit card without an LLC or EIN

- What do business credit card issuers look for?

- Benefits of a business credit card vs. a personal card

- The risks of mixing personal and business expenses

- How to improve your approval odds with little or no revenue

- Modern alternatives to traditional business cards

- Make every dollar count with smarter spend controls

You can get a business credit card even if you don’t have a formal business. Issuers accept many types of independent income as qualifying business activity, including freelancing, gig work, online selling, and other side hustles.

If you earn money outside a traditional W-2 job, you can usually apply as a sole proprietor using your name and Social Security number. That flexibility makes business credit cards accessible long before you form an LLC or generate consistent revenue.

Do you need a formal business to get a business credit card?

No. You can qualify for a business credit card without forming an LLC, corporation, or any other formal business entity. Issuers treat many income-earning activities as legitimate businesses, including freelancing, gig work, consulting, or selling products online.

If you operate on your own and haven’t registered a business, you can apply as a sole proprietor. Most applications allow you to use your legal name as the business name and your Social Security number instead of an EIN.

Who qualifies for a business credit card?

If you earn money outside a traditional W-2 job, you likely qualify as a business in the eyes of most card issuers. Freelancers and sole proprietors can apply using their legal name and Social Security number, even if they haven’t formed an LLC or registered a business. You don’t need a registered business name or a set number of clients to qualify.

Issuers generally follow the same principle the IRS uses when determining whether an activity is a business: you engage in work with the intention of earning a profit, even if the income is small or irregular. This includes people who earn money from multiple sources, such as driving for a rideshare service while also selling handmade products online or tutoring during certain seasons. Informal or cash-based earnings can also qualify, as long as you can reasonably estimate what you expect to make over the next year.

Here are some examples of nontraditional business activities that can qualify for a business credit card:

Transportation and delivery services

- Rideshare driving

- Food or package delivery

- Moving or hauling work

Creative and professional services

- Writing or editing

- Graphic design, web development, or coding

- Photography or videography

- Consulting or coaching

Online selling and e-commerce

- Selling items on marketplaces like eBay, Etsy, or Facebook Marketplace

- Amazon FBA or retail arbitrage

- Selling digital products or courses

Personal and home services

- Babysitting or pet sitting

- Tutoring or teaching lessons

- Lawn care, landscaping, or snow removal

- Home cleaning, organizing, or handyman work

Even occasional or seasonal income can qualify. You do not need consistent revenue or a formal business name to apply.

Business credit card requirements for sole proprietors

As a sole proprietor, you can apply for a business credit card using your legal name and Social Security number. Issuers ask for basic information about your work and expected income, even if your business is new or part-time.

| Application field | What to enter as a sole proprietor | Why it matters |

|---|---|---|

| Business structure | Sole proprietor | Tells the issuer you operate independently rather than as an LLC or corporation |

| Business name | Your full legal name | Use your name unless you have a registered DBA |

| Tax ID number | Social Security number | An EIN is optional for sole proprietors |

| Business revenue | Estimated income from your work over the next 12 months | Issuers allow reasonable projections for new businesses |

| Total income | Business income plus other income sources | Many issuers review total income to assess ability to repay |

How to apply for a business credit card without an LLC or EIN

You can complete a business credit card application as a sole proprietor using your legal name and Social Security number. Follow these steps to avoid common mistakes and ensure each field is filled out correctly:

1. Choose ‘sole proprietor’ as the business structure

Select this option if you haven’t registered an LLC or corporation. It tells the issuer you own and operate the business yourself.

2. Use your legal name as the business name

Enter your full legal name in the business name field unless you’ve registered a DBA. Keeping this consistent helps the issuer verify your identity.

3. Report your total income

Follow the issuer’s instructions for income. Many allow you to include all income sources, not just business income, which can strengthen your application.

4. Agree to the personal guarantee

Nearly all small-business cards require a personal guarantee. This makes you responsible for the balance and allows the issuer to review your personal credit during approval.

What do business credit card issuers look for?

When you apply without an established business credit history, issuers rely mostly on your personal credit score and total income. A FICO score of 670 or higher is generally competitive for many business credit cards, and stronger scores may qualify you for higher limits or rewards programs.

Issuers also review your broader credit profile, including your payment history, length of credit history, recent hard inquiries, and overall debt levels. A clean record of on-time payments and responsible use of existing credit lines helps demonstrate reliability, especially when your business is new or your work is part-time. Keeping your personal credit utilization below 30% and maintaining steady payments across all credit accounts can support your approval odds.

Will a business credit card appear on my personal credit report?

Most business card activity does not appear on your personal credit report unless the account becomes delinquent, but the hard inquiry from your application will appear temporarily. Some issuers do report ongoing activity to personal credit bureaus, so it’s worth checking the issuer’s policy if you want to keep your business and personal credit entirely separate.

Benefits of a business credit card vs. a personal card

A dedicated business credit card gives you access to features designed for business use and makes it easier to manage your work-related spending. It also helps you build a financial track record for your business before you create a formal entity.

Key benefits include:

- Clearer expense separation: Keep business and personal transactions distinct for easier bookkeeping and tax preparation

- Business-focused rewards: Earn rewards in categories like software, office supplies, advertising, and travel

- Build business credit: Establish a business credit history when issuers report your on-time payments to business bureaus

- Higher credit limits: Access more purchasing power to cover inventory, equipment, or other business needs

Discover Ramp's corporate card for modern finance

The risks of mixing personal and business expenses

Using a business credit card for personal purchases can create accounting and compliance problems that are difficult to fix later. Issuers often prohibit personal transactions in their cardholder agreements, and violating those terms may lead to account restrictions or closure.

Blending personal and business spending also complicates tax reporting because it becomes harder to document deductible expenses and maintain clean records. If you operate through an LLC or another registered structure, mixing transactions can weaken the financial separation that supports your liability protections.

How to improve your approval odds with little or no revenue

You can strengthen your application even if your business is new or has irregular income. If your side hustle is pre-revenue or has earned only a small amount so far, issuers will usually evaluate your total income rather than focusing solely on business earnings.

For example, if most of your income comes from a full-time W-2 job and you’re launching a part-time gig, your personal income can support your application. If you’ve only recently opened your business checking account or started freelancing, showing consistent deposits or invoicing activity over a few months can help establish that your business is active.

It’s acceptable to enter $0 in business revenue if you’re just getting started, since issuers base approval primarily on your total income and personal credit history. The following steps can help you demonstrate legitimacy and responsible credit use.

- Open a business checking account: A dedicated account shows consistent cash flow and makes it easier to document revenue

- Register for a free EIN: An EIN can make your business appear more established and keeps your SSN off vendor and issuer forms

- Start with a secured or charge card: These products have simpler approval requirements and help you build a record of on-time payments

- Keep your credit utilization low: Using less than 30% of your available credit improves your personal credit profile, which issuers review for most small-business cards

Modern alternatives to traditional business cards

Newer financial platforms offer business cards and spend tools that work differently from traditional bank-issued credit cards. Many corporate charge cards require the full balance to be paid each month and use your business’s cash flow, not your personal credit score, to determine eligibility. Some fintech platforms rely on real-time banking data to set limits and manage risk, which can make them more accessible to new or fast-growing businesses that don’t yet have a long credit history.

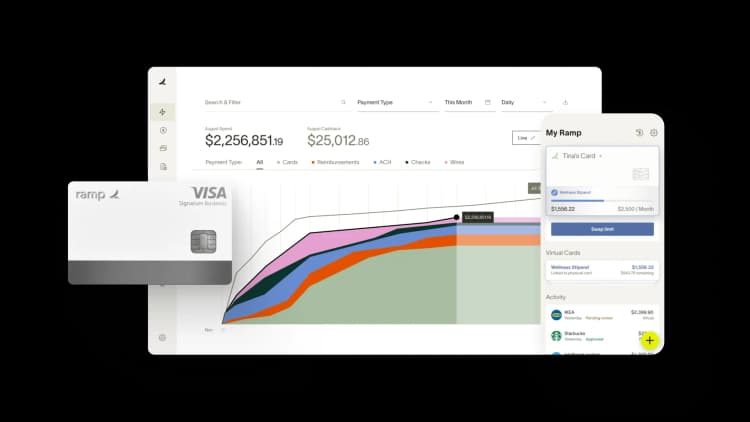

- Corporate charge cards like Ramp: Charge cards pair purchasing power with real-time insights, automated receipt collection, and spend controls, and many are approved based on cash flow rather than personal credit

- Fintech platforms with credit-building features: Some providers report on-time payments to business credit bureaus, helping new businesses establish a credit profile

- Secured business cards: Cards that require a refundable security deposit can be easier to qualify for and offer a path to an unsecured product over time

Make every dollar count with smarter spend controls

A business card is most useful when it’s paired with tools that help you stay on top of spending. Automated controls, real-time alerts, and clean transaction data make it easier to manage budgets and avoid surprises.

Ramp gives you those controls by linking every transaction to rules you set, from category limits to vendor-specific budgets. Features like automatic receipt matching, policy enforcement, and accounting integrations help you spend confidently as your business grows.

Explore how Ramp works with an interactive demo.

FAQs

Yes. Most issuers accept income from side hustles, gig work, or freelance projects and allow you to apply as a sole proprietor using your legal name and SSN.

You may begin seeing activity reported within a few months, but building a meaningful business credit profile typically takes consistent on-time payments over 6–12 months.

Most applications trigger a hard inquiry on your personal credit report, which can cause a small, temporary dip. Responsible use after approval helps offset the impact.

You can usually update your business information with the issuer once your LLC is formed. Some issuers may require a new application, but many simply update the existing account.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Compared to our previous vendor, Ramp gave us true transaction-level granularity, making it possible for me to audit thousands of transactions in record time.”

Lisa Norris

Director of Compliance & Privacy Officer, ABB Optical

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°