Business expense cards: simplify spending

Keep your company's spending under control with Ramp's business expense cards, that are easy to manage for both employees and admins. Streamline expense management, optimize budgets, and gain real-time insights—all from a single, intuitive platform.

Instantly issue business expense cards teamwide

If an employee needs an expense card, Ramp is ready immediately. Provide quick access to funds, streamlining the purchasing process and removing hassles. All while remaining in control.

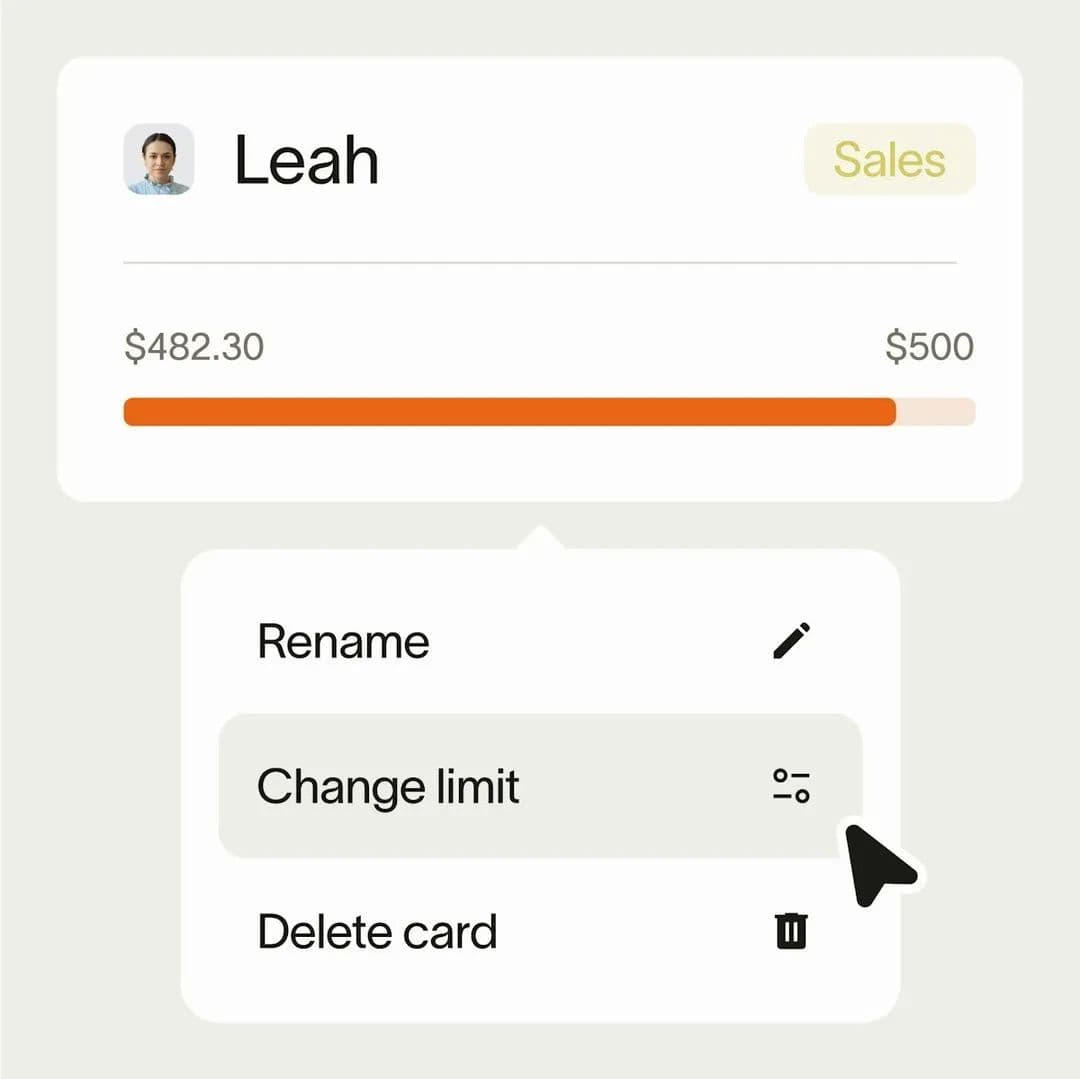

Customizable employee expense cards

Create personalized spending limits for each employee's card in just a few clicks, and adjust budgets as needed.

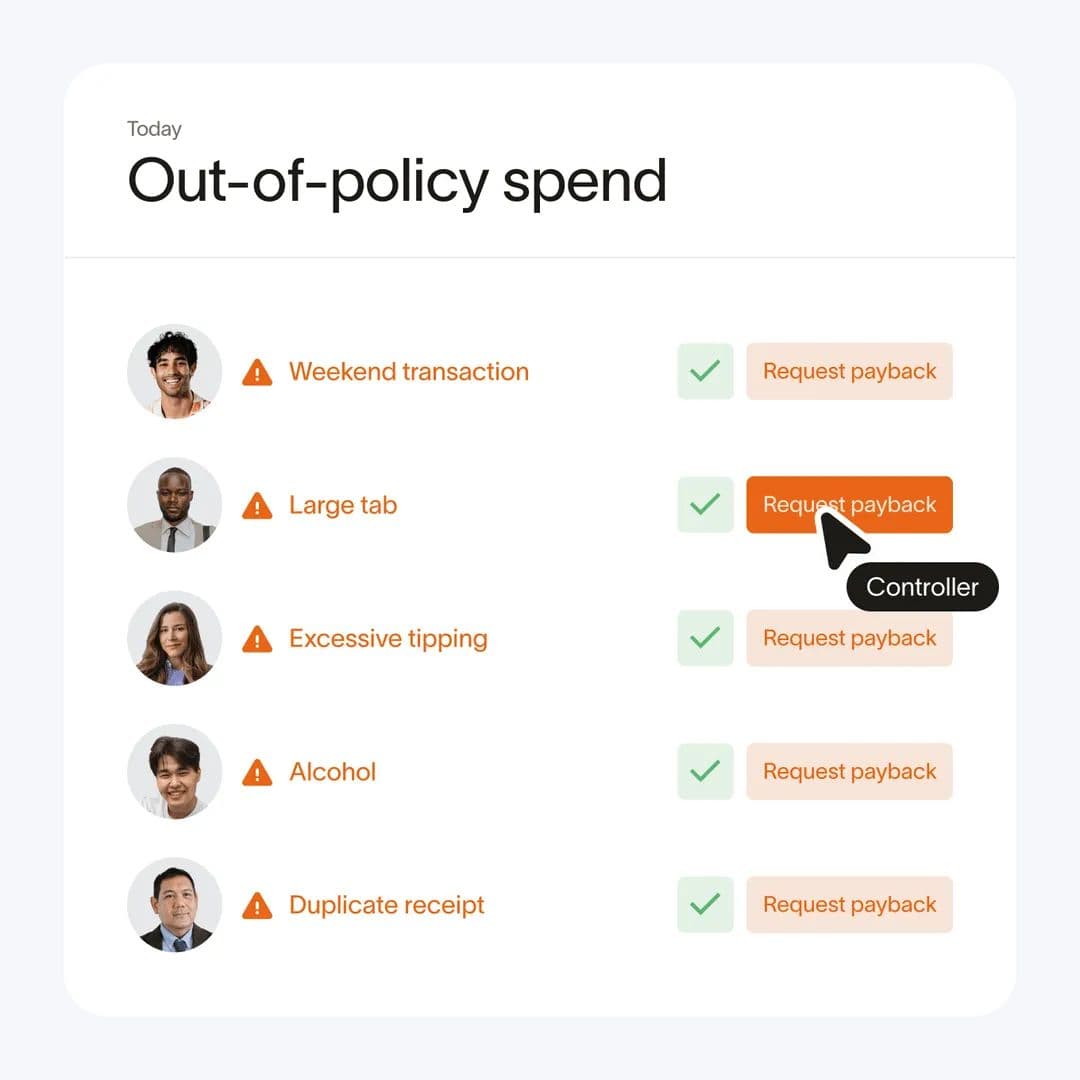

Manage spend in real time

Gain complete visibility into every transaction as it happens. With real-time notifications and detailed insights, Ramp's platform ensures you stay on top of all your company's spending.

Never miss an expense

Keep a complete, organized view of company spending across all employee expense cards, making it easier to keep financial records accurate and up to date.

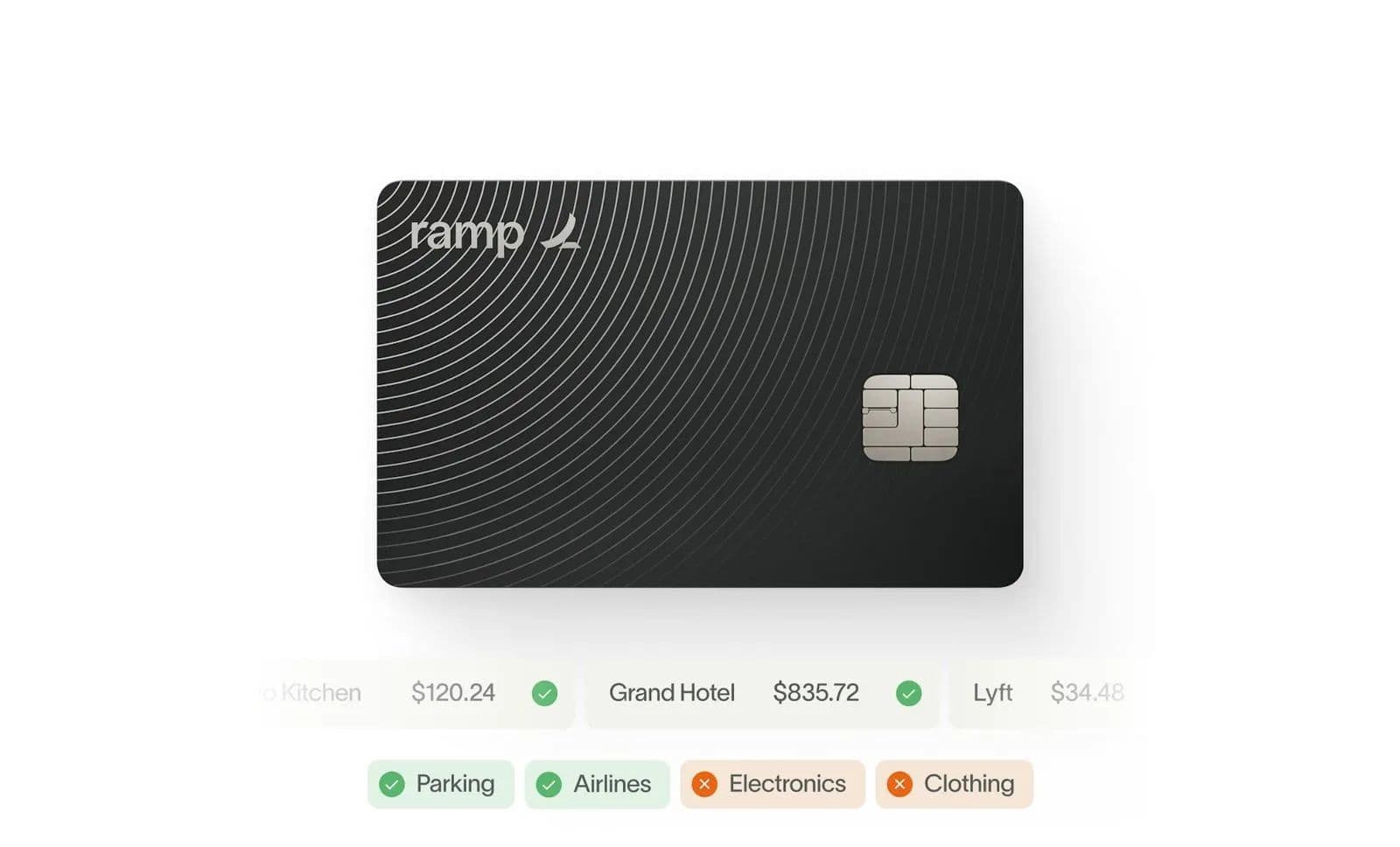

Spend responsibly from day one

Businesses can unlock an average of 5% savings on all their spending with Ramp's corporate expense cards. With transparent pricing and no hidden fees, make smarter financial decisions and drive growth.

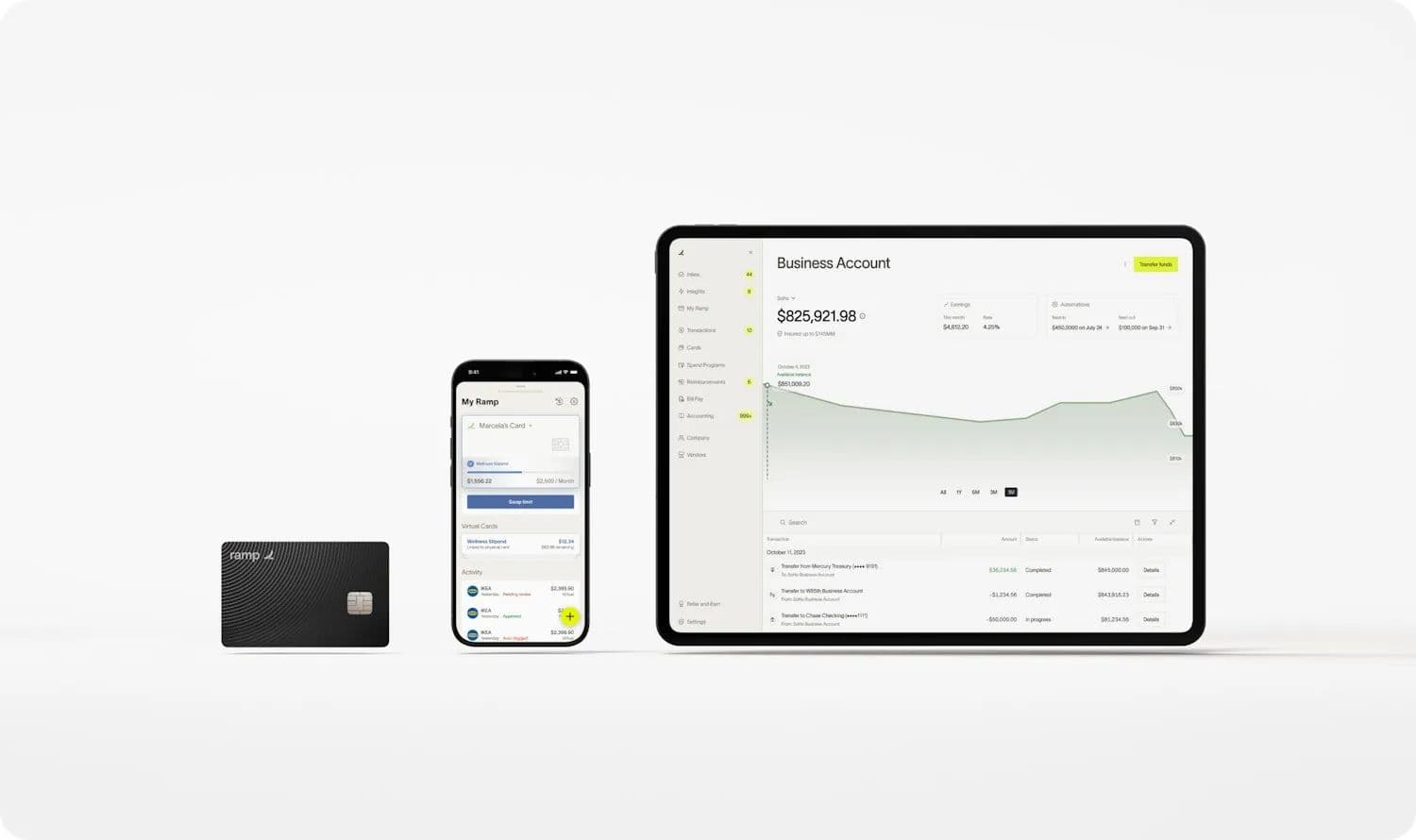

SavingsManage all your finances from one place

Track employee expense cards in one place. Effortlessly issue and monitor cards, optimize budgets, and reconcile expenses—all from one user-friendly platform.

Platform

Seamlessly integrate with existing software

Connect your expense cards with accounting software such as QuickBooks, Xero, and Sage to consolidate data. Experience real-time expense reconciliation, simplify financial management and boost efficiency.

Integrations