Business credit cards for sole proprietors: How to quality and choose

- What is a sole proprietorship?

- Can I get a business credit card as a sole proprietor?

- What to consider when choosing a sole proprietorship business credit card

- Why sole proprietors should use business credit cards

- Best business credit cards for sole proprietors

- How to choose a business credit card for a sole proprietorship

- Benefits of business credit cards for sole proprietors

- How to apply for a business credit card as a sole proprietor

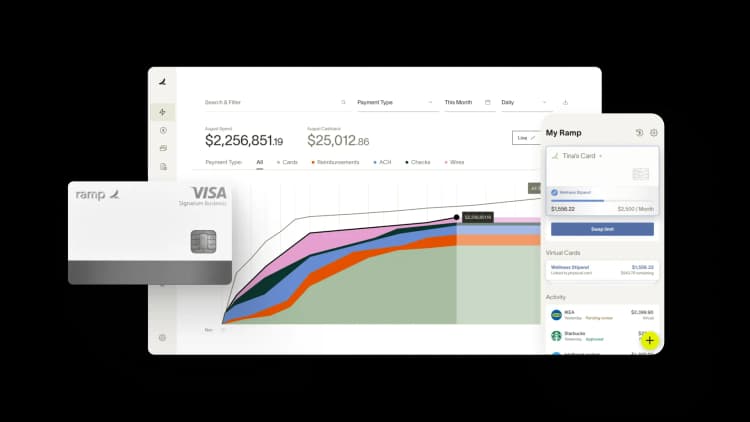

- Consider Ramp's Business Credit Card once your business is established

Running a business as a sole proprietor makes it harder to keep finances clean, especially when personal and business expenses end up on the same card. The good news is that you don’t need an LLC or corporation to qualify for a business credit card, and many issuers allow you to apply using your Social Security number.

Choosing the right card can help you separate expenses, earn rewards on everyday spending, and build a stronger financial foundation for your business.

What is a sole proprietorship?

A sole proprietorship is the simplest type of business structure, where you and your business are legally the same entity. There’s no formal separation between your personal and business finances, which means you’re personally responsible for any debts or obligations the business takes on.

Most freelancers, consultants, and independent contractors operate as sole proprietors by default, even if they’ve never formally registered a business. From a credit card issuer’s perspective, this structure is common and well understood, which is why many business credit cards are available to sole proprietors without requiring incorporation.

Can I get a business credit card as a sole proprietor?

Sole proprietors can get a business credit card using their Social Security number and personal address, even if they don’t have a registered business.

Most small business owners don’t have the business credit history to avoid a personal guarantee to qualify for a credit card. Some business credit cards for sole proprietors may ask for proof of income during the application process, which you can provide through tax returns or business bank account statements.

Do sole proprietorships need separate credit cards?

As a sole proprietor, it’s a good idea to use a dedicated credit card for business expenses so you can easily track costs and calculate your business tax deductions. Using a personal credit card for business expenses puts your personal assets and credit score at risk and makes it hard to distinguish your personal expenses from business purchases.

Can I get a credit card for a self-employed business?

Business credit cards aren't just for large corporations. A variety of credit cards are specifically designed to cater to the needs of small businesses, even for sole proprietors, freelancers, and gig workers who are self-employed only part-time.

What to consider when choosing a sole proprietorship business credit card

The best business credit cards for sole proprietors offer low fees, a high credit limit, and low interest rates. Here are some factors to consider when choosing a card:

Fees and interest rates

To avoid paying interest on a business credit card, it's important to pay your balance in full every month. Look for credit cards with no activation, annual, or monthly fees. Compare intro APR rates, regular interest rates, and fees for balance transfers to find the most favorable card offers.

Examples of business credit cards with favorable fees for sole proprietors include the Blue Business Plus card from American Express and the Capital One Spark 1% Classic for Business, both of which have no annual fees for card membership. If you frequently travel internationally, consider a business credit card with no foreign transaction fees.

Reward options

Consider card providers that offer card rewards, perks, or signup bonuses. Cashback rewards can be lucrative, and signup bonuses provide extra membership rewards when you spend a certain amount within a specific timeframe after your account opening.

For example, the Chase Ink Business Unlimited credit card offers hundreds of dollars in cashback rewards if you spend a certain amount in your first three months. Alternatively, the Amazon Business Card from American Express is a great option for sole proprietors with lower spending needs who prioritize shopping with Amazon.

Consider the full range of card membership benefits you’ll get outside of just the card’s rewards program. For example, if you’re planning to make a large business purchase, a card that offers an introductory 0% APR period would be a good choice.

Integrations and automation

Look for business credit cards that integrate with finance automation software to simplify financial tracking, bookkeeping, and accounting processes. As a sole proprietor, you may not have employees or contractors to pay, but you’re still obligated to report your income for tax purposes, which can take hours or even days if you aren’t prepared.

Discover Ramp's corporate card for modern finance

Why sole proprietors should use business credit cards

Business credit cards give sole proprietors practical advantages that personal cards don’t. They make it easier to stay organized, manage cash flow, and prepare for taxes while earning rewards on everyday business spending.

Separate business and personal expenses

Using a dedicated business credit card keeps your finances clean from the start. Every transaction creates a clear record of business spending, which simplifies bookkeeping and makes tax preparation far less time-consuming.

Mixing business purchases into a personal card can create problems later. It makes deductions harder to track, increases audit risk, and blurs the line between personal and business finances when you need clarity most.

Build business credit separate from personal credit

Some business credit cards report activity to business credit bureaus, which helps establish a credit profile tied to your business. Over time, that history can make it easier to qualify for loans, higher limits, or better vendor terms.

Most business cards still require a personal guarantee, so missed payments can affect your personal credit. Used responsibly, though, business cards help you build credit without relying entirely on personal accounts.

Earn rewards on business spending

Business expenses can generate meaningful returns when you use the right card. Software subscriptions, advertising, office supplies, and travel can all earn cash back or points that offset everyday costs.

| Reward type | Best for | Typical earning rate |

|---|---|---|

| Cash back | Simple, predictable savings | 1.5–5% by category |

| Points | Flexible redemptions and travel | 1–5x points per dollar |

| Miles | Frequent business travel | 1–3x miles per dollar |

As an example, $2,000 in monthly expenses earning 1.5% cash back adds up to $360 per year, enough to cover several recurring business tools.

Access better cash flow management

Irregular income and delayed payments are common for sole proprietors. Business credit cards help bridge those gaps by giving you short-term flexibility without turning to loans or personal savings.

Many cards offer 0% introductory APR periods for 12–15 months, which can be useful for large purchases. Business cards also tend to come with higher credit limits than personal cards, providing more breathing room as your expenses grow.

Simplify expense tracking and tax preparation

Most modern business credit cards integrate with accounting software and automatically categorize transactions. This reduces manual data entry and keeps your books up to date throughout the year.

When tax season arrives, categorized transactions and year-end summaries make it easier to claim deductions accurately. Instead of sorting through months of receipts, you have organized records ready to go.

Best business credit cards for sole proprietors

The right business credit card depends on your spending habits, credit profile, and what you want the card to help you accomplish. The options below are grouped by primary benefit to make it easier to compare cards based on how you plan to use them.

Best for cash back rewards

Chase Ink Business Cash Credit Card

- If you spend a lot on office supplies or on internet, phone and cable services, this card caters to that

- Cardholders are automatically checked for a credit line increase every 6 months or sooner

- The card offers 5% cash back on Lyft rides through March 2025

- Earn 1% cash back on all other purchases with no limit

- Bonus cash back categories are capped at $25,000 in combined purchases per account anniversary year

- A foreign transaction fee of 3% is charged on purchases made outside the U.S.

- Cash back rewards are limited to 1% on all purchases outside the bonus categories

- 10% Business Relationship Bonus is only available if you have a Chase Business Checking account on your first card anniversary

The Chase Ink Business Cash card is a strong option for sole proprietors who spend heavily on office-related expenses. It offers elevated cash back on common business categories, making it a good fit for businesses with predictable monthly costs like internet, phone service, and office supplies.

With no annual fee and a generous welcome bonus, this card provides solid value without adding overhead. The introductory 0% APR period can also be useful if you’re managing upfront expenses or making a larger purchase.

Chase Ink Business Unlimited Credit Card

- No annual fee

- Introductory APR supports large upfront expenses

- Simple rewards program with 1.5% cashback on all purchases

- Foreign transaction fees apply

- Rewards structure may not suit category-specific spending

Ink Business Unlimited is a good choice if you want simplicity. It earns a flat cash back rate on every purchase, which works well for sole proprietors whose spending doesn’t fall neatly into bonus categories.

Because there’s no annual fee and no category tracking required, this card is easy to manage day to day. The welcome bonus and introductory 0% APR period add extra value for new cardholders.

American Express Blue Business Cash Card

- 2% cashback on purchases up to first $50,000, then 1% thereafter

- Employee cards, QuickBooks integration, and automated bill pay via BILL

- Acount alerts for irregular spending activity on employee cards

- No annual fee, plus 0% intro APR for first 12 months

- Expanded Buying Power lets you spend beyond your credit limit

- $50,000 annual limit on 2% cashback

- Not ideal for businesses with significant spending needs

- 2.7% foreign transaction fee

- Requires good to excellent credit

The American Express Blue Business Cash card is designed for straightforward, everyday spending. It earns a higher cash back rate on all purchases up to an annual cap, then drops to a lower rate once you exceed it.

This card works well for sole proprietors with moderate, consistent expenses who want predictable rewards without worrying about rotating categories or bonus limits. The lack of an annual fee and introductory APR period make it accessible for early-stage businesses.

Best for travel rewards

Ink Business Preferred Credit Card

- High earning potential: 3x points on certain business expenses

- Flexible rewards: Ultimate Rewards® points can be redeemed for travel through Chase, transferred to airline and hotel partners, or used for other travel expenses.

- Extra benefits: Includes travel insurance, purchase protection, and cell phone protection.

- Annual fee: $95 annual fee may not be suitable for all businesses.

- Low credit limit: The Chase Ink Business Preferred credit card typically starts with a credit limit of $5,000.

- Spending limit on bonus categories: 3x points are capped at $150,000 per year, which may limit rewards for high-spending businesses.

Ink Business Preferred is a strong option for sole proprietors who spend on travel, shipping, advertising, or internet services. It earns bonus points in categories that matter most to growing businesses and offers flexibility through point transfers to airline and hotel partners.

While it does have an annual fee, the value can outweigh the cost if you regularly spend in its bonus categories or redeem points for travel. No foreign transaction fees make it a practical choice for international travel as well.

Capital One Spark Miles for Business

- Strong travel-focused rewards program

- No fees for international transactions

- First-year annual fee waiver

- Annual fee applies after the first year

- Not ideal for businesses preferring cashback over miles

Capital One Spark Miles Select is well suited for sole proprietors who want travel rewards without paying an annual fee. It earns a flat miles rate on all purchases, making it easy to accumulate rewards regardless of spending category.

Miles can be redeemed for travel purchases or transferred to multiple airline partners, offering flexibility without complexity. The lack of foreign transaction fees adds value for businesses that travel or spend internationally.

Best for building credit

Capital One Spark 1% Classic

- Unlimited 1% cashback on all purchases

- Unlimited 5% cashback on hotels and rental cars booked through Capital One Travel

- No annual or transaction fees

- Fair credit scores accepted

- Cashback rewards are slightly less than average

- High APR

Capital One Spark Classic is designed for sole proprietors with fair credit who want to establish or rebuild their credit profile. While the rewards rate is lower than premium cards, the card reports to business credit bureaus, which can help you build business credit over time.

This card can be a practical starting point if you don’t yet qualify for higher-tier business credit cards but want to begin separating business expenses and building credit history.

Secured business credit cards

Secured business credit cards require a refundable security deposit that typically becomes your credit limit. These cards are intended for sole proprietors with damaged credit or no credit history who need a path toward approval.

With consistent, on-time payments, many secured cards allow you to transition to an unsecured card after 6–12 months. This makes them a useful stepping stone toward better credit options in the future.

Best for expense management and automation (for future LLCs)

Ramp Business Credit Card

- Higher credit limits: Up to 30x higher than traditional cards, based on revenue and funds raised.

- Flexible qualification: Uses sales data from platforms like Stripe, Shopify, and Amazon (1 year of history).

- Exclusive partner rewards: $350k+ in rewards (UPS, Amazon Business, AWS, etc.).

- Simplified spend control: Customizable expense policies, limits by vendor/category/transaction, automated flagging.

- Comprehensive financial tools: Expense management, reporting, integrations, travel booking, and AP automation.

- Eligibility: Only available to corporations, LLCs, or LPs; sole proprietors are ineligible

- US operations: Requires primary operations and corporate spending to be within the US, although international purchases are allowed without foreign transaction fees

- Balance transfers: Balance transfers are not supported

The Ramp Business Credit Card is built for businesses that want more control and automation around spending. It combines cash back with advanced features like automatic receipt matching, real-time spend controls, and direct accounting software integrations.

Ramp is best suited for businesses that have outgrown basic credit cards and need stronger visibility into expenses across vendors, categories, or time periods.

Ramp requires an established business entity, such as an LLC or corporation, and is not available to sole proprietors. It represents a natural next step for businesses ready to scale beyond entry-level credit card features.

Note: Ramp requires an established business entity, such as an LLC or corporation, and is not available to sole proprietors. It’s best suited for businesses that have outgrown basic credit cards and need more advanced expense management, automation, and controls as they scale.

How to choose a business credit card for a sole proprietorship

As with choosing a personal credit card, it’s important to pick the right business credit card for your sole proprietorship. Consider the following as you research your options:

Your credit score

The most attractive small business credit cards require good to excellent credit—typically a score of at least 700. Be sure to check your credit score before applying and narrow your search to cards that offer you good approval odds.

Your business expenses

Many business credit cards offer bonus rewards for spending in certain categories. If fuel is one of your biggest business expenses, for example, you should strongly consider getting a gas credit card. Selecting a card that gives you elevated rewards for your most frequent expenses will maximize your benefits.

Membership benefits

Consider the full range of card membership benefits you’ll get outside of just the card’s rewards program. For example, if you’re planning to make a large business purchase, a card that offers an introductory 0% APR period would be a good choice. If you frequently travel internationally, consider a business credit card with no foreign transaction fees.

Benefits of business credit cards for sole proprietors

Even if your business expenditures are limited, there are several advantages to having a business credit card as a sole proprietor:

- Separate business and personal finances: Business credit cards allow you to track business expenses separately from personal ones, which makes expense tracking easier and more accurate

- Finance larger purchases: Having a business credit card can provide the necessary cash flow to handle large orders and expenses

- Build your business credit score: As a new business, using a credit card that reports to the business credit bureaus helps establish a strong business credit history, proving to lenders that you’re financially responsible

- Efficiently manage cash flow: Many sole proprietors use credit cards for daily expenses to build business credit while ensuring funds are always available for routine costs

- Earn card membership rewards: Rewards programs may offer points or cashback on eligible purchases, like cell phone data plans or purchases at office supply stores and gas stations. If you travel, look for a card that offers business travel rewards and no foreign transaction fees.

Many of these benefits come down to time saved. When you keep business purchases separate from personal ones, you spend less time splitting out costs for tracking and reporting. Your business could save hundreds of hours by automating expense reports with the right corporate business credit card.

How to apply for a business credit card as a sole proprietor

Applying for a business credit card as a sole proprietor follows a similar process to applying for a personal credit card. Here are the steps to take:

- Do your research: Identify credit cards that are open to sole proprietors, and eliminate those with unfavorable terms

- Gather required information: Collect necessary documentation such as your tax ID number (either your employer identification number or Social Security number) and financial documents that prove your income

- Complete the credit card application: Fill out the online application. If you have all the required information readily available, you can fill most out in less than 30 minutes.

- Wait for results: Some credit card issuers offer immediate decisions, while others require manual review. Once approved, you can use a digital card while waiting for the physical card to arrive.

Consider Ramp's Business Credit Card once your business is established

Ramp’s corporate business credit cards offer an alternative to traditional business credit cards. If you have an EIN and at least $25,000 in a US business checking account, you could qualify for Ramp.

Our cards have built-in features that track and report business expenses, while also helping you build business credit. Ramp business credit cards are suitable for all business structures, with unlimited free physical and virtual cards for employees if you decide to expand your team.

Try our interactive demo to see how Ramp customers save an average of 5% a year.

FAQs

Yes. Card issuers understand that self-employed income fluctuates and typically evaluate your average annual income. Provide tax returns or bank statements showing your income over time to demonstrate overall profitability.

The account will appear on your personal credit report because of the personal guarantee. However, regular spending and payments typically don't report to personal bureaus, which protects your personal credit utilization ratio. Only the account opening and any missed payments are reported.

Most premium business cards require good to excellent credit (670+). However, options like the Capital One Spark Classic and secured business cards exist for fair credit (580–669).

While not required, getting an EIN protects your SSN from overexposure, establishes a separate business identity, and simplifies an eventual transition to an LLC. The process is free and takes about 15 minutes on the IRS website.

The initial application creates a hard inquiry (a small, temporary score decrease). Responsible use can actually help by adding positive payment history without increasing your personal credit utilization. However, missed payments will damage your personal credit score.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits