2025 Average credit card debt statistics: Trends, usage, and debt insights

- Average credit card debt

- Current credit card landscape

- Interest rates and fees

- Credit card usage trends

- Debt insights

- Demographic insights

- Economic factors influencing credit card use

- Future trends

Credit card statistics for 2025 offer a fascinating glimpse into how Americans are managing their finances. Whether you're trying to understand trends or make informed decisions, these numbers can provide valuable insights.

You might be curious about how much debt people are carrying or how many credit cards the average person has. This data can help you benchmark your own financial habits or those of your business.

Let's dive into the current landscape of U.S. credit card debt, usage, and ownership.

Average credit card debt

The current average American credit card debt per borrower as of Q3 2024 is $6,380 (source). This number varies widely depending on demographics and regions. For example, residents of Connecticut carry the highest average debt at $9,323, while those in Mississippi have the lowest at $4,918 (source). These variations highlight the diverse financial landscapes across the U.S.

Current credit card landscape

For many, keeping track of typical credit card debt feels like an uphill battle. Understanding the current landscape can help you navigate these challenges more effectively.

Total credit card debt

As of the third quarter of 2024, Americans are carrying a lot more debt. Total household debt jumped by $147 billion, reaching a massive $17.94 trillion. Most of that debt is from mortgages, which went up by $75 billion to a total of $12.59 trillion. While people's incomes have been growing faster than their debt, these huge debt numbers suggest many families are still struggling financially.

Credit card debt increased by $24 billion, hitting $1.17 trillion (source).

Credit card ownership

According to the Federal Reserve, as of 2022, about 82% of U.S. adults have at least one credit card (source). A 2022 study from Experian found that older Americans (Gen X and Baby Boomers) carry the most credit cards, averaging over four per person, while younger adults (Gen Z, ages 18-25) have far fewer, averaging just two cards each (source).

How many credit cards does the average American have?

A report from Experian found the average American carries 3.9 credit cards.

This widespread ownership underscores the importance of credit cards in everyday financial transactions and planning. For businesses, understanding these trends can be crucial for financial planning and analysis (source).

For more detailed insights, you can explore the Federal Reserve's data on consumer credit and the New York Fed's Household Debt and Credit Report.

Interest rates and fees

High interest rates can make managing credit card debt even more challenging. Knowing the current rates and trends can help you make better financial decisions.

Average interest rates

As of Q3 2024, the current average APR for all credit card accounts stands at 21.76% (source). This rate varies depending on the type of credit card. For instance, rewards credit cards often have higher APRs due to the benefits they offer. The average APR for rewards cards is around 24.17%, while cash back cards have an average APR of 24.45% (source). These rates fluctuate frequently, and reflect the cost of borrowing on different types of credit cards and can significantly impact your overall financial health.

How much do credit card holders earn in rewards?

Credit card rewards earnings vary widely depending on spending and card type. While some earn hundreds or even thousands, the average cardholder likely earns a more modest sum, perhaps a few hundred dollars annually.

Trends in interest rates

What is the average credit card interest rate in 2025? Historical trends in credit card interest rates show a steady increase over the past few years. In Q1 2021, the average APR for all accounts was approximately 14.65%, rising to 21.47% by the end of 2024 (source). As of January 2025, 24.37% is the average APR. This upward trend has implications for consumers, as higher interest rates mean higher costs for carrying a balance on credit cards.

Federal Reserve policies play a crucial role in influencing credit card interest rates. When the Federal Reserve raises its benchmark interest rate, credit card APRs typically follow suit. For example, the series of rate hikes by the Federal Reserve in 2022 and 2023 contributed to the increase in average credit card APRs (source). These policy changes aim to control inflation but also affect borrowing costs for consumers.

Understanding these trends and their implications can help you make informed decisions about managing credit card debt and optimizing your financial strategy. For more detailed insights, you can explore the Federal Reserve's data and the LendingTree's analysis. Additionally, consider exploring financial management strategies to better navigate these challenges.

Credit card usage trends

Knowing how often people use their credit cards can offer insights into spending habits and help you plan your own usage more effectively.

Payment methods

Credit cards have become the preferred method for non-cash payments in the U.S. As of 2022, credit cards have become the most popular payment method, making up 30.77% of transactions (source). This shift reflects the growing convenience and security features that credit cards offer compared to cash. With contactless payments and digital wallets becoming more widespread, the reliance on physical cash continues to decline.

Frequency of use

Americans are using their credit cards more frequently for everyday purchases. As of 2021, the average American uses their credit card for 15 transactions per month (source). This includes a wide range of spending categories, from groceries and dining to travel and entertainment.

Who came up with the size of credit cards?

The size of credit cards was standardized by the International Organization for Standardization (ISO). They set the dimensions at 85.60 × 53.98 mm, a size inspired by earlier banking cards and ID documents.

Understanding these trends can help you make informed decisions about your own credit card usage and financial planning. For more detailed insights, you can explore the Federal Reserve's data and the Experian's analysis. Businesses can benefit from conducting an effective spend analysis to better understand and manage expenses. Additionally, modern corporate cards can bolster compliance and streamline expense management (source).

Debt insights

Rising debt levels can be a major concern for many of you. Knowing the factors behind this trend can help you take control of your finances.

How much credit card debt do Americans have?

Sources vary on how much credit card debt Americans have. LendingTree reports upwards of $7,236, whereas TransUnion’s latest report determined that the average credit card debt in America is closer to $6,380. In short: It’s multiple thousands of dollars.

Rising debt levels

Credit card debt levels have continued to rise in 2025, influenced by several key factors. Inflation has played a significant role, increasing the cost of living and pushing more consumers to rely on credit cards for everyday expenses. Economic stress, including job instability and unexpected medical bills, has also contributed to higher debt levels.

As of Q3 2024, total U.S. credit card debt reached $1.17 trillion, marking a substantial increase from previous years (source). This rise in debt reflects broader economic challenges and the increased financial pressure on households.

Delinquency rates

How many Americans are currently delinquent with their credit card payments? Delinquency rates have also seen an uptick in 2024. As of Q3, the delinquency rate for credit cards rose to 3.23%, up from 3.15% in Q1 2024 (source). This increase in delinquency rates indicates that more consumers are struggling to meet their minimum payment obligations.

Are credit card delinquency rates on the rise?

Historically, delinquency rates have fluctuated, but the current levels are the highest since the first quarter of 2012. This trend highlights the financial strain many Americans are experiencing, making it more challenging to manage their credit card debt effectively.

Long-term debt trends

Long-term debt trends reveal that a significant portion of Americans remain in credit card debt for extended periods. Approximately 18% of credit card holders have been in debt for over five years (source). This persistent debt can have long-lasting effects on financial health, including lower credit scores and higher interest payments.

The data suggests that many consumers struggle to pay down their balances, often due to high interest rates and ongoing financial obligations. Understanding these long-term trends is crucial for addressing the root causes of credit card debt and developing strategies to reduce it. For businesses, understanding financial performance metrics can provide valuable insights into managing debt effectively.

For more detailed insights, you can explore the Federal Reserve's data and the LendingTree's analysis. Additionally, consider implementing treasury policy best practices to manage your finances more effectively. For practical advice on using business credit cards, check out these business credit card tips.

Demographic insights

Different age groups face unique challenges when it comes to credit card debt. Knowing these differences can help you tailor your financial strategies.

Age and credit card debt

According to a 2023 study from Credit Karma, credit card debt varies significantly across different age groups. The highest average debt is found among those aged 43-58, with an average balance of $8,266. This age group often faces peak earning years but also substantial financial responsibilities, such as mortgages, education costs for children, and healthcare expenses.

Younger adults, particularly those aged 18-26, carry lower average credit card debt, around $2,781. This group is just beginning to build their credit history and may have fewer financial obligations. However, their debt levels are rising rapidly, driven by student loans and entry-level salaries.

For those aged 27-42, the average credit card debt stands at $5,898. This group often experiences increased spending due to family and career advancements. Meanwhile, individuals aged 59–77 carry an average debt of $7,464, reflecting ongoing financial commitments and preparations for retirement.

Seniors aged 78–95 have an average credit card debt of $5,649. Many in this group are on fixed incomes, making debt management a priority. Despite having lower overall debt, they may face challenges due to limited income sources.

Economic factors influencing credit card use

Economic factors like inflation and post-pandemic recovery can greatly impact how you use your credit cards. Knowing these influences can help you plan better.

Inflation impact

Inflation has significantly influenced how you use your credit cards. With prices rising across the board, many consumers have turned to credit cards to manage higher costs. For instance, the cost of groceries, gas, and other essentials has increased, leading to higher credit card balances as people try to maintain their standard of living (source). This trend is evident in the increased average credit card debt per borrower, which as of 2024 Q3 stands at $6,380 (source).

Higher inflation also means that your purchasing power decreases, making it more challenging to pay off existing balances. As a result, more people are carrying balances month to month, leading to higher interest payments and increased overall debt. This shift in consumer behavior highlights how inflation can strain personal finances and drive reliance on credit.

Economic recovery post-pandemic

The economic recovery following the pandemic has had mixed effects on credit card use. On one hand, increased consumer confidence has led to more spending, particularly in sectors like travel, dining, and entertainment. This surge in spending is reflected in the higher credit card balances reported in recent quarters (source). On the other hand, some consumers remain cautious, prioritizing savings and debt repayment over discretionary spending.

The recovery has also brought about changes in employment and income levels. Many people who lost their jobs during the pandemic have found new employment, leading to increased financial stability and the ability to manage credit card debt more effectively. However, the uneven nature of the recovery means that some groups, particularly those in lower-income brackets, continue to face financial challenges. This disparity affects how different demographics use and manage their credit cards.

Understanding these economic factors can help you make more informed decisions about your credit card usage. For businesses, responding to market cooldown can provide insights into managing expenses during economic shifts.

Future trends

Looking ahead, understanding future trends can help you prepare for changes in credit card usage and technology.

Predictions for credit card usage

Experts predict that credit card usage will continue to evolve in the coming years. One key trend is the increasing reliance on digital and contactless payments. As more consumers become comfortable with these technologies, the use of physical credit cards may decline, replaced by mobile wallets and other digital payment methods (source). Additionally, the trend towards personalized financial products is expected to grow, with credit card issuers offering more tailored rewards and benefits to meet individual consumer needs.

Debt levels are also expected to rise, driven by ongoing economic uncertainties and the potential for future inflation. However, financial literacy initiatives and better access to credit management tools could help mitigate some of these effects, enabling consumers to manage their debt more effectively.

Technological innovations

Technological innovations are set to transform the credit card landscape. Fintech companies are leading the way with new products and services designed to enhance the user experience and provide greater financial control. For example, AI-driven analytics can help you track spending patterns and identify areas where you can save money (source). These tools can also offer personalized financial advice, helping you make more informed decisions about credit card use.

Blockchain technology is another area with significant potential. It promises to enhance security and transparency in credit card transactions, reducing the risk of fraud and making it easier to track and verify payments. As these technologies become more mainstream, they are likely to change how you interact with your credit cards and manage your finances.

For more insights into these trends, you can explore the Forbes Advisor's analysis. Additionally, understanding the future of finance can help you stay ahead of these changes. For businesses, leveraging the best FinOps tools can streamline financial operations and enhance efficiency.

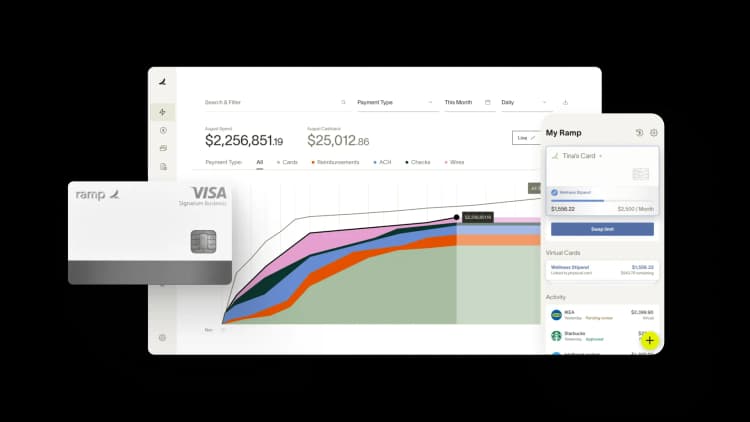

Ramp can help you navigate any changes. Join over 25,000 businesses that trust Ramp to save time and money. Request a demo or get started today.

Don't miss these

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits