Invoice fraud: What it is and how to protect your business

- What is invoice fraud?

- Common types of invoice fraud

- Warning signs of invoice fraud

- Impact by industry or company size

- How to prevent invoice fraud

- Best practices for AP and finance teams

- What to do if you detect invoice fraud

- Prevent invoice fraud with Ramp

Invoice fraud involves submitting false or manipulated invoices to extract payments for goods or services that were never provided, or overcharging for those that were. From inflated charges to fake vendors, fraudsters are using increasingly sophisticated methods to exploit gaps in your accounts payable (AP) process for financial gain.

Incidents of attempted or actual invoice fraud increased by 10% year over year, from 14% in 2023 to 24% in 2024, according to a report from the AFP. That means it’s more important than ever to understand how invoice fraud works, what to look for, and how to prevent it using smart controls and automation.

What is invoice fraud?

Invoice fraud occurs when someone deliberately creates false or manipulated invoices to extract unauthorized payments from your business. These tactics are designed to exploit weaknesses in your accounts payable processes, vendor management systems, or internal controls.

This differs from other financial fraud in its method and target. While credit card fraud involves stolen payment information, invoice fraud specifically attacks your payment workflow.

Fraudsters may impersonate trusted vendors, alter invoice details, or create entirely fake vendor accounts. In some cases, internal employees collaborate with them or overlook key details, making the fraud harder to catch. Without strong verification processes, these invoices can pass through your systems unnoticed.

Common types of invoice fraud

Invoice fraud can take many forms, and some are easier to detect than others. Recognizing how these tactics work in practice is the first step to preventing them. Here are some common types of invoice fraud to be aware of:

| Type of fraud | How it works | Key red flags |

|---|---|---|

| Fake invoices | Criminals create entirely fictitious invoices for goods or services never ordered or delivered | Unfamiliar vendor, missing purchase order (PO) number, generic email address |

| Duplicate invoices | The same legitimate invoice is submitted multiple times for payment, often weeks or months apart | Identical invoice numbers, amounts, and dates; slight discrepancies in invoice numbers |

| Business email compromise (BEC) | Cybercriminals pose as a real vendor, often using a compromised or spoofed email account, to request payment changes | Sudden changes to bank account details, urgent payment requests, new contact person |

| Overbilling | A legitimate vendor inflates prices, adds unauthorized charges, or bills for more items than were delivered | Prices don't match contract terms, unexpected line items, quantities exceed receiving reports |

Warning signs of invoice fraud

Preventing invoice fraud requires identifying suspicious patterns before payment approval. These red flags serve as early warning signs that something may be off with an invoice:

- Unfamiliar vendors: Invoices from vendors with no prior history, or sudden changes to contact or payment information, should be verified

- Mismatched details: If invoice amounts, line items, or dates don’t match the corresponding PO or delivery confirmation, that’s a sign something may be off

- Duplicate submissions: Watch for repeated invoice numbers or amounts submitted close together. This could signal accidental or intentional duplication.

- Urgent or unusual payment terms: Requests for same-day payment or large discounts for immediate processing can be used to bypass scrutiny

- Missing documentation: A lack of supporting POs, receipts, or internal approvals should always trigger further review

- Formatting inconsistencies: Fraudulent invoices may use generic templates, lack branding, or have incorrect company details

Train your team to recognize these warning signs and establish clear protocols for flagging suspicious invoices. A culture of healthy skepticism can be the strongest defense against fraud attempts.

Invoice red flags checklist

Review every invoice against this checklist before processing payment:

Vendor information

- Vendor not in approved supplier database

- Contact information doesn't match records

- Generic email domain (e.g., Gmail) instead of a company domain

- Phone numbers that don't connect or go straight to voicemail

Invoice details

- Missing PO reference

- Vague product or service descriptions

- Incorrect tax calculations or missing tax ID

- Invoice number doesn't follow the vendor's usual format

Payment instructions

- Bank account changes without verification

- Payment to a foreign account when the vendor is domestic

- Requests for cryptocurrency or gift cards

- Instructions differ from the master vendor file

Timing and amounts

- Invoice dated before the PO

- Services billed before completion

- Amounts don't match contracts or quotes

- Rush payment demands without a valid reason

Impact by industry or company size

Understanding the specific fraud vulnerabilities within your industry is essential when developing effective prevention strategies:

| Industry | Vulnerabilities | Common fraud schemes |

|---|---|---|

| Manufacturing | Complex supply chains; high volume of raw material purchases | Phantom vendors; price inflation on materials; fraudulent shipping charges |

| Healthcare | Decentralized purchasing; highly specialized equipment; regulatory complexity | Duplicate billing; upcoding equipment; falsified medical supply invoices |

| Logistics & transportation | Global vendor networks; fuel and maintenance purchases; frequent one-time vendors | Fuel card fraud; ghost shipments; inflated distance charges |

| Construction | Project-based billing; numerous subcontractors; material quantity verification challenges | Change order manipulation; material substitution; labor hour inflation |

| Retail | High-volume, low-value transactions; seasonal inventory fluctuations; multiple locations | Inventory shrinkage disguised as vendor charges; point-of-sale manipulation; return fraud |

| Small businesses | Limited staff oversight; fewer formal controls; personal relationships with vendors | Email spoofing or phishing; duplicate invoices; fraudulent expense reimbursements |

By recognizing the common schemes targeting your sector, you can implement targeted controls or automated invoice processing software that address the highest-risk areas before fraudsters have an opportunity to exploit them.

How to prevent invoice fraud

Preventing invoice fraud requires a combination of strong internal controls for AP, automation, and team awareness.

Let's walk through how to protect your business using a practical example. Let's say you receive an invoice from your regular office supply vendor for $2,450 worth of printer toner cartridges.

1. Verify vendor details

Before processing payment, check that the vendor information matches your records. In this example, you notice that while the logo and company name look right, the invoice lists a different bank account number than previous invoices from that vendor. This is an immediate red flag.

2. Implement a multi-step approval process

Invoice approval should not come from a single person. For the $2,450 toner cartridge invoice, have one team member confirm the order was actually placed, another verify receipt of goods, and a third approve the payment amount against the original purchase order.

3. Call to confirm changes

When you spot the different bank account on the vendor's invoice, don't email the address on the invoice. Instead, call the established vendor contact using the phone number from your records (not the one on the suspicious invoice). Your point of contact confirms they haven't changed their banking details. You've just caught a fraudulent invoice.

4. Match against purchase orders

Use 2-way matching to check whether the invoice for $2,450 of toner cartridges corresponds to an actual PO. If records show you only ordered $1,200 worth of supplies, or no recent order at all, something's wrong.

5. Train your team

Make sure everyone handling invoices knows what to look for. Show them the fraudulent vendor's invoice as a training example, pointing out the subtle differences from legitimate ones.

6. Establish payment thresholds

Set up different approval levels based on invoice amounts. For example, for invoices over $2,000, require additional verification steps or senior management approval.

7. Employ technology

Use accounting software that can flag unusual transactions and provide invoice audit trails. Smart systems would note that $2,450 for toner is significantly higher than typical office supply orders and flag it for review.

By following these steps, you'll create a solid defense against invoice fraud without sacrificing efficiency. Remember, a few extra minutes of verification can save thousands of dollars and countless headaches down the road.

Best practices for AP and finance teams

Your AP team is on the front lines of fraud prevention. Equip them with the right training processes to identify and stop fraud attempts.

Train your team continuously

Conduct quarterly training sessions covering current fraud trends, real-world examples, and your company's specific procedures. Scammers are always evolving their tactics, so ongoing education is key.

Review and update processes regularly

Fraud tactics change, so your defenses need to adapt. Assess your controls annually, test their effectiveness, and adjust based on new threats or identified weaknesses.

Establish clear communication protocols

Create strict rules for handling vendor information.

- Verify any payment changes through a callback to a known, pre-verified phone number

- Never accept payment modifications via email alone

- Use a standardized form for payment updates that requires multiple signatures and verification steps

Create an invoice approval workflow

Build an effective approval process that follows these invoicing best practices:

- Invoice receipt and entry: Direct invoices to a designated email address and enter them into an AP system, which validates the vendor against an approved list

- Initial review: The AP clerk matches the invoice to a PO, verifies goods or services were received, and checks for duplicates

- Approval routing: The invoice is routed to the appropriate department manager for approval based on the amount

- Final verification: The AP manager confirms payment details match the vendor’s file and reviews for any red flags

- Payment processing: The payment is processed, with secondary approval for high-value transactions. All documentation is archived.

What to do if you detect invoice fraud

If you discover invoice fraud, you’ll need to take quick action to minimize financial impact and strengthen your business's defenses. Following these simple steps will help you address the immediate threat while creating a stronger foundation to prevent future issues:

- Stop payment immediately: If a suspicious invoice is still pending, place a hold on the payment until verification is complete

- Notify your bank or payment provider: They may be able to reverse or freeze transactions if caught early

- Alert internal teams: Include finance, legal, compliance, and IT to coordinate the investigation and response

- Preserve documentation: Collect all related invoices, emails, approvals, and transaction records. This will help support any internal or external investigations.

- Report the incident: Depending on the scale, notify law enforcement or regulatory bodies like the FTC

- Contact your insurance provider: Some business insurance policies include coverage for financial fraud. Understanding your options can help reduce losses.

When invoice fraud hits, every minute counts. Strong accounts payable document management gives you the audit trail you need to recover funds and stop threats before they happen again.

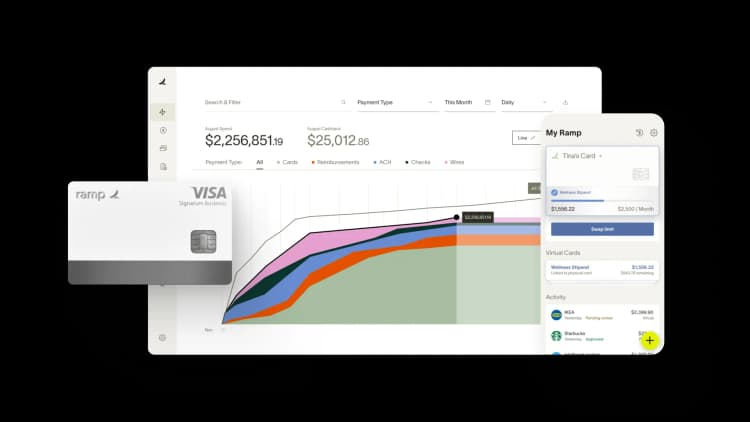

Prevent invoice fraud with Ramp

Ramp's comprehensive platform offers built-in safeguards to protect your business from invoice fraud schemes. Our intelligent features work seamlessly with your finance workflows to create multiple layers of protection.

With Ramp, you can:

- Detect duplicates and anomalies early: Ramp automatically flags unusual activity before payments are sent

- Keep your data safe: Secure, cloud-based storage keeps invoices protected with role-based access

- Automate 2-way and 3-way match: Get the ultimate protection against fraud and errors. Our automated invoice matching validates your invoices against purchase orders and item receipts.

With Ramp as a partner, you can focus on growing your business while we help keep your finances secure from increasingly sophisticated fraud attempts. See how Ramp's invoice management software works with an interactive demo today.

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide.” ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn’t just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn’t exist in Zip. It’s made approvals much faster because decision-makers aren’t chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits

“More vendors are allowing for discounts now, because they’re seeing the quick payment. That started with Ramp—getting everyone paid on time. We’ll get a 1-2% discount for paying early. That doesn’t sound like a lot, but when you’re dealing with hundreds of millions of dollars, it does add up.”

James Hardy

CFO, SAM Construction Group