Ramp expands into expense management, is the fastest-growing corporate card in America

- The traditional process that companies have used to issue cards, manage expenses, and reconcile their books is complicated and wasteful.

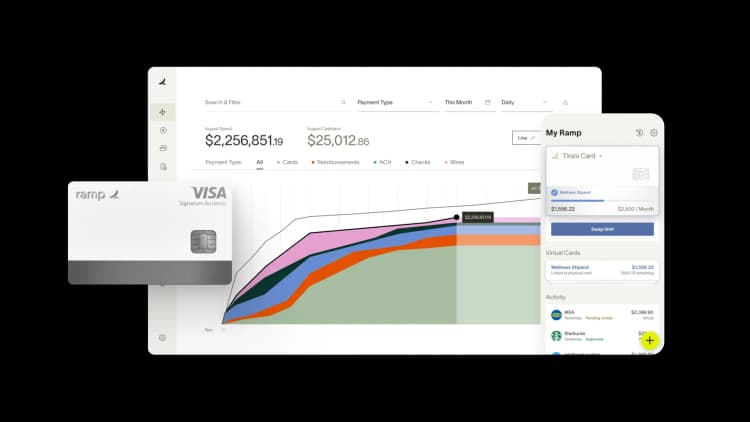

- Ramp is more powerful than the traditional approach of splitting purchases between basic corporate cards and into a separate expense management product.

- Ramp has become America's fastest growing corporate card by helping companies spend less.

Ramp, the first corporate card built to help businesses spend less, is expanding into expense management.

While Ramp only launched six months ago, we are already powering hundreds of millions of dollars of purchases each year for our customers.

Today, we are thrilled to share that Ramp now comes built-in with sophisticated expense management for all customers. Our customers are saving an average of 5 days of work per month by replacing inefficient and costly expense report processes with Ramp.

The traditional process that companies have used to issue cards, manage expenses, and reconcile their books is complicated and wasteful.

Traditionally, companies have limited controls built in to their corporate cards, have to wait several days after a transaction for a bank feed to sync from their corporate card into an expense management software, and make employees spend a great deal of time after the fact to code expenses. Following this, finance teams spend hours manually nagging employees for receipts, and employees often footed the company bill interest free until they were reimbursed. This tedious process has created a culture of expense reports that are normally completed days to weeks late, incomplete books, and limited visibility into spend until the following month.

Ramp is more powerful than the traditional approach of splitting purchases between basic corporate cards and into a separate expense management product.

On Ramp, companies can review/approve employee spend requests in real time on the website or via Ramp’s industry-first slack integration, issue physical or virtual cards that can be restricted by merchant for one time or recurring spending, and once the purchases are made, Ramp automatically codes and syncs expenses through to the company’s books.

“Getting started with Ramp was extremely quick and painless,” said Clubhouse’s senior accountant Shafak Ilyas. “Ramp has helped us automate and cut days off our month-end closing process. Before Ramp, closing the books used to take us days — now it takes about an hour a month. With Ramp, everything is quicker." Christina Cooksey, Head of Creative Production at Red Antler, noted that, "It is a point of stress and a mental burden lifted off. No more stacks of receipts sitting on my desk staring me in the face or finance charges ticking up personal cards."

Ramp has become America's fastest growing corporate card by helping companies spend less.

Ramp is the only corporate card that helps its customers spend less. Since the COVID-19 pandemic has started, Ramp has identified millions in savings opportunities for its customers, finding the average customer $130,000 in annual cost reductions. With expense management built-in to Ramp, customers can cut their costs even further. Generally, companies paying over $100 per employee for expense management software, and the typical cost of reviewing and processing is estimated to be an additional $50 per report in time overhead. On Ramp, sophisticated expense management software comes fully built-in and employees are able to complete their expenses in a fraction of the time, leading to additional cost savings for companies.

We hope that in the years to come, all cards look and feel more aligned with their customers’ best interests. That’s how it should be.

Thanks for reading, and we hope you'll try us out for your company by applying at: www.ramp.com. If you have any questions, feel free to give us a shout at [email protected].

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits