What is a smart card? How it works, types, and uses

- What is a smart card?

- How are smart cards used?

- How do smart cards work?

- Smart card design

- Types of smart cards

- Smart card security features

- Pros and cons of smart cards

- The history of smart cards

- Smart card trends and the future

- Simplify business spending with the Ramp Business Credit Card

Smart cards are everywhere, from the chip in your credit card to the SIM in your phone. These small but powerful cards store and process information securely, making them essential for payments, identity verification, access control, and more.

We break down what smart cards are, how they work, where you’ll encounter them in everyday life, and the pros and cons to consider. We also explore the history of smart cards, current trends, and what the future holds for this technology.

What is a smart card?

A smart card, also known as a chip card, smartcard, IC card, or integrated circuit card (ICC), is a physical card embedded with an integrated circuit that allows it to store and transfer data electronically.

Credit cards, SIM cards, and certain ID cards are all examples of smart cards. Unlike traditional magnetic stripe cards, which store limited static data, smart cards can securely process and store more information, making them more versatile and harder to clone.

How are smart cards used?

Smart cards are used to verify identities, authenticate access, store data, and transmit payments. Virtual credit cards with embedded near-field communication (NFC) technology are also examples of smart cards.

Some of the most common ways to use smart cards include:

- Payments for secure transactions at payment terminals, ATMs, and online stores, similar to using a prepaid card or a employee credit card

- Access control for restricted buildings such as workplaces, university dorms, and healthcare facilities

- Identification through cards assigned by companies or governments, such as driver’s licenses and medical records cards

- Security certificate storage and protocols for web browsers to enable secure browsing

- Telecommunications via SIM cards in cellular devices

How do smart cards work?

Smart cards can operate in two ways: contact or contactless. You insert contact smart cards into a card reader, which makes direct contact with the card’s metallic chip.

Contactless smart cards use short-range radio frequency technology, such as radio frequency identification (RFID) or NFC, to communicate with the reader without physical contact.

In both cases, the external card reader powers the smart card and enables data exchange. The chip, which contains memory and sometimes a microprocessor, communicates with the reader through a secure interface.

Here’s how the process typically works:

- The smart card connects with the reader, either physically or wirelessly

- The reader retrieves data stored on the chip

- That data is sent to the connected terminal or system for processing

The processor inside many smart cards runs an operating system that manages data storage, encryption, and secure transmission, helping to protect against unauthorized access and fraud.

What are smart card readers?

Smart card readers are devices that power and communicate with smart cards, enabling secure access and transactions. Readers handle tasks such as authenticating the cardholder, securely transferring data, and preventing fraud, all while offering fast and convenient use.

- Contact readers require the card to be physically inserted so the chip’s contact pads align with the reader’s connectors. They’re common in banking terminals and secure ID verification systems.

- Contactless readers use RFID or NFC technology to exchange data wirelessly. Their common uses include public transit access, building access control, and mobile payments.

Smart card design

Modern smart cards combine secure hardware, specialized software, and durable materials to store, process, and transmit data. At their core, they contain an integrated circuit—either a memory chip, a microprocessor, or both—embedded in a plastic card body.

A smart card’s design includes:

- Core components: Chip, memory, microprocessor for data processing, and contact or contactless interface

- Physical interface: The hardware connection between the card and a reader, such as the gold-plated contact pad on the surface

- Logical interface: The set of communication protocols and commands (ISO/IEC 7816 for contact cards or ISO/IEC 14443 for contactless cards) that define how data is exchanged and authenticated

- Materials and construction: Most cards are made of polyvinyl chloride (PVC), but polycarbonate, acrylonitrile butadiene styrene (ABS), or polyethylene terephthalate (PET) composites also come into play for added durability. Standard sizes match a credit card (85.60 x 53.98 mm) or SIM card (25 x 15 mm).

Contact chips

Contact smart cards have a visible metallic chip on the card surface. The chip’s contact pads align with the reader’s connectors to exchange power and data when inserted into a reader. These are common in credit and debit cards, SIM cards, and government-issued IDs, where secure, direct communication is required.

Contactless technology

Contactless smart cards use radio frequency technology to communicate with a reader without physical contact. An embedded antenna coil inside the card transmits data when powered by the reader’s electromagnetic field. This technology is behind tap-to-pay cards, public transit passes, and building access badges.

NFC vs. RFID

Both near field communication and radio frequency identification enable wireless communication between cards and readers, but they differ in range and application:

- RFID can operate over several centimeters to meters and is commonly used in access control, inventory tracking, and transportation passes

- NFC works at a much shorter range, usually a few centimeters, and is designed for secure, two-way communication, making it ideal for mobile payments, ID verification, and digital ticketing

Embedded microprocessors

Some smart cards include a microprocessor in addition to memory. This allows the card to process and store data, enabling advanced functions such as encryption, secure authentication, and on-card application processing.

Microprocessor cards can handle complex data such as business credit scores or digital certificates, while simpler memory cards store static information for uses such as prepaid balances or SIM authentication.

Types of smart cards

Smart cards differ by data read/write capabilities, chip type, and chip capabilities. There are various types of smart cards, as detailed below.

Contact vs. contactless cards

These two major types of smart cards have different properties and uses. Electrical connectors connect a contact smart card to the card reader that transmits data. The card's gold-plated covering holds the electronic cardholder certificate.

You can use contactless smart cards just by tapping them on the card reader. They use RFID or NFC technology and transmit data seamlessly.

Hybrid cards

Hybrid cards are more technologically advanced than other types of smart cards. They’re embedded with memory and microprocessor chips. The proximity chip allows physical access to restricted places, while the contact smart card chip verifies sign-in details.

Dual-interface smart cards

Dual-interface smart cards can be used in both contactless and contact payments. These cards typically work with Europay, Mastercard, and Visa (EMV) readers but also contain NFC chips to transfer information. Most bank cards are dual-interface cards.

Microprocessors

These cards contain an IC microchip with a microprocessor and memory. They can be contactless or require contact to transfer data. Microprocessor cards contain sophisticated architecture, such as Java and .NET, to power their functions.

Memory cards

Memory cards serve as a temporary smart card; you can’t edit or change the data after programming them. The cards store data without a microprocessor and rely solely on non-volatile memory. You’ll usually find them in SIM cards and prepaid cards.

These cards feature basic security, including data encryption and access control, making them ideal for storing personal information and transaction records. Because of their low memory capacity, they’re usually disposable, similar to a prepaid money card.

What's the difference between memory chips vs. microprocessors?

Memory chips are essentially data storage units with limited functionality. In contrast, microprocessor cards contain a microprocessor and memory, allowing them to process and store complex data. While memory chips offer basic security features, microprocessor cards can provide more advanced security due to their processing capabilities.

Smart card security features

Security is central to smart card technology. Unlike magnetic stripe cards, smart cards contain integrated circuits that can encrypt, process, and authenticate sensitive information, making them far harder to clone or compromise.

Encryption capabilities

Smart cards use encryption to protect stored and transmitted data. Many can perform on-card cryptographic operations, such as generating secure keys or verifying credentials, without exposing sensitive information.

Regulatory compliance

Most smart cards meet global standards such as EMV for payments, Payment Card Industry Data Security Standard (PCI DSS) for cardholder data protection, and International Organization for Standardization (ISO) or International Electrotechnical Commission (IEC) specifications for interoperability and security across systems.

Tamper-resistance

Smart cards use tamper-resistant materials and secure microcontrollers to deter physical and digital attacks. Many can erase stored data if after unauthorized access.

Authentication protocols

Smart cards support multi-factor authentication and can store digital certificates, one-time passwords, or cryptographic keys. Common methods include challenge-response and secure PIN verification.

Pros and cons of smart cards

Smart cards offer several advantages, but a few disadvantages to consider, as well:

Benefits of smart cards

- Security: Smart cards hold more authentication and account data than magnetic stripe cards, making them more secure. Unlike magnetic stripe cards, smart cards resist electronic interference and magnetic fields.

- Large and impenetrable memory: Smart cards provide tamper-resistant memory ideal for storing confidential data

- Prevent fraud: Smart cards reduce fraud and theft by securely storing sensitive data. Malicious actors can’t easily replicate or read smart card data.

Disadvantages of smart cards

- Weak durability: The chip embedded in a plastic or paper card can bend, causing damage. People often carry cards in wallets or pockets, which increases the risk of damage due to pressure.

- Possible risk of hacking: Smart cards aren’t theft-proof. Hardware hacking is possible with physical access to the card.

- High cost and weak compatibility: Most smart cards and card readers are relatively expensive. Moreover, several smart cards use patented software that’s incompatible with certain smart card readers.

The history of smart cards

The smart card, in its first iteration, was invented in 1959. German engineers integrated the electronic chip with plastic in the late 1960s. Here’s a brief timeline of smart card development since then:

- 1974: Roland Moreno patented the memory card; Bull, SGS-THOMSON, and Schlumberger advanced development

- 1977: Michel Ugon created the first microprocessor-based card with local memory

- 1970s–1980s: First commercial uses included prepaid telephone cards in Europe and banking cards in France

- 1991: First SIM card sold to Finnish wireless network operators

- 1994: EMV standard introduced, enabling global payment card interoperability

- 1995: First SIM cards launched commercially

- 1999: First national eID card launched in Finland

- 2003: Micro-SIM launched; chip and PIN cards rolled out in the U.K.

- 2005: First International Civil Aviation Organization (ICAO) compliant electronic passport issued

- 2006: Large-scale rollouts of smart cards begin in Asia, Europe, and the U.S.

- 2012: Nano-SIM introduced

- 2018: First biometric contactless payment card and eSIM launched

- 2019: First 5G SIM launched

- 2021: First voice payment card launched

- 2023: First Global System for Mobile Communications Association (GSMA) certified iSIM

Early use in banking and government

Smart cards entered the banking sector in France in 1974, offering a more secure payment method than magnetic stripe cards. They spread across France by 1988 and internationally by the late 1990s. Government adoption followed with national eID programs and biometric passports, setting the stage for today’s digital identity systems.

SIM cards, IDs, and passports

The first SIM card connected just 300 devices in Finland; today, billions of devices use SIM technology. Finland’s 1999 electronic ID program evolved into multifunction national ID cards capable of storing digital signatures and health data. Norway’s biometric passports, launched in 2005, met ICAO and EU security standards, influencing modern e-passport design worldwide.

Smart card trends and the future

The combined SIM card and smart card market is projected to grow by $29.6 billion by 2033, driven by the rise of digital national IDs and expanded SIM card adoption.

COVID-19 accelerated demand for smart cards as organizations sought secure, contactless solutions. The rollout of technologies such as 5G, LTE, eSIM, and M2M further fuels adoption, particularly for private communication and secure authentication.

Focusing on smart cards alone, the global market had a value of about $14.23 billion in 2022, and predictions say it will grow at a compound annual growth rate (CAGR) of 5.7% through 2030.

Today, smart cards have become a major payment channel, offering an alternative to methods such as ACH and EDI payments.

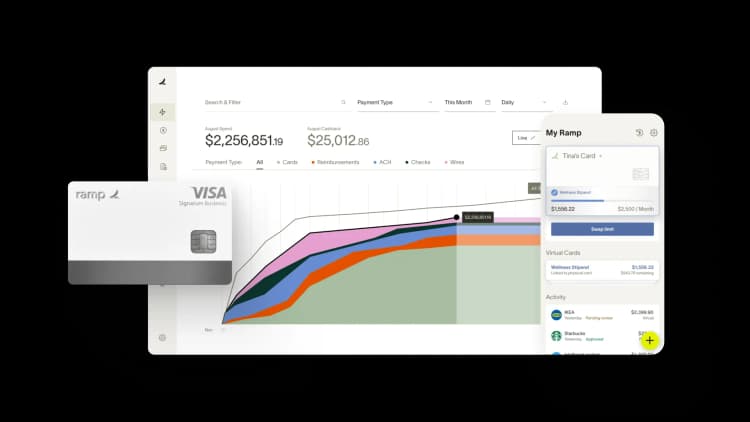

Simplify business spending with the Ramp Business Credit Card

Smart card technology has transformed how we pay and manage transactions, and Ramp takes those benefits even further for businesses.

The Ramp Business Credit Card combines the security, convenience, and advanced controls of a modern smart card with powerful spend management tools. From preset vendor and category limits to automatic policy enforcement, our business credit card helps prevent out-of-policy purchases before they happen while giving you real-time visibility into every transaction.

There's no personal guarantee or credit check to apply, and you can get approved in under 48 hours. You'll also earn cashback on spending and get access to over $350,000 in exclusive partner rewards and discounts.

Try an interactive demo and see why Ramp customers save an average of 5% a year across all spending.

FAQs

Common examples include credit and debit cards with EMV chips, SIM cards used in mobile phones, government-issued ID cards, transit passes, and building access badges. These cards store and process data securely for payments, identification, and access control.

A smart card is a type of card embedded with a microchip that can store and process data, while a credit card is a payment tool that allows you to borrow funds from an issuer. Many modern credit cards are smart cards because they use EMV chips for secure transactions, but not all smart cards are credit cards.

Keep your smart card in a protective RFID-blocking sleeve or wallet to prevent unauthorized wireless scanning. Avoid sharing your PIN or card details, and monitor your accounts regularly for suspicious activity.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits