- Why businesses are looking for Rho alternatives

- At a glance: Rho alternatives compared

- Ramp: The best overall Rho alternative

- Paylocity

- Rippling

- SAP Concur

- BILL Spend & Expense (formerly Divvy)

- A closer look at Ramp vs. Rho

- Why choose Ramp vs. Rho: A broader, more strategic approach to spend

- Ramp isn’t just a Rho alternative—it’s an upgrade

Rho offers finance teams a mix of corporate cards, bill pay, and banking functionality in a unified platform. But if your business needs more specialized automation, better integrations, or greater flexibility across expense management and accounts payable workflows, you might be looking for a Rho alternative.

If you're researching Rho competitors, we've pulled together a list of today's strongest alternatives:

- Ramp

- Paylocity

- Rippling

- SAP Concur

- BILL Spend & Expense (formerly Divvy)

Whether you’ve outgrown Rho’s native functionality, need more robust expense controls, or want deeper integration with your accounting systems, this guide breaks down the best Rho alternatives, each tailored to different business needs.

Why businesses are looking for Rho alternatives

Rho bills itself as an all-in-one solution that blends banking, corporate cards, bill pay, and expense tracking into a single platform. Many users appreciate its clean design, mobile experience, and responsive customer support.

However, as finance teams scale or require more specialized automation, several recurring pain points have led businesses to explore alternatives. To better understand why, we reviewed real user feedback on G2.

Limited customization and configurations

While Rho is easy to use, multiple users have noted that certain features, like reporting and integrations, offer limited customization—“especially when it comes to reporting or integration options,” according to a reviewer.

Finance teams that need granular control over how data is displayed, filtered, or routed into their accounting systems often find Rho’s options too rigid. This can become especially problematic for teams with complex entity structures or nuanced reporting requirements.

Cashback complications

Rho’s cashback program isn’t always straightforward. Cashback may depend on monthly spend minimums, category limitations, or interchange rates, and some industries may not qualify for full cashback rewards.

Bugs and interface quirks

While Rho’s design is generally praised, some teams experience occasional glitches, such as needing to refresh pages for updates to appear or encountering intermittent platform freezes. These small usability issues may seem minor in isolation, but they create friction for fast-paced teams that rely on responsiveness and reliability.

There are also constant changes to the user interface to contend with. Rho is still evolving, so its interface changes frequently. While many updates are ultimately beneficial, the evolving layout and feature set can lead to a learning curve or inconsistencies in how finance processes are carried out.

Integration gaps with ERP systems

Rho integrates with platforms like QuickBooks Online, but users have highlighted shortcomings in syncing receipts, expense data, and other transaction details into their broader ERP or accounting stack.

“It's not yet fully integrated into our ERP, so uploaded receipts don’t push through. I’d rather do this in Rho, but I still have to upload them in our clunky ERP,” says a user.

In some cases, users resort to duplicating work in their ERP systems because Rho doesn't fully push relevant documentation or transactions through. This undermines the benefits of automation and can slow down month-end close.

Workflow limitations

The platform can have limitations in day-to-day operational workflows. Examples include restrictions on the number of attachments per transaction, inability to edit submitted reimbursement requests, or a lack of advanced triggers for notifying users during error states, like missing requirements not triggering alerts.

“It is impossible to adjust reimbursement requests from either the submitter or approver end,” a reviewer notes, “so if someone makes a typo, they have to start over with a whole new request.”

No built-in procurement or vendor lifecycle tools

Unlike some alternatives, Rho doesn’t support intake-to-procure workflows, contract approvals, or vendor lifecycle management. Teams managing purchases and vendor relationships across departments often turn to tools like Ramp for these capabilities, which reduces the need for additional systems or spreadsheets.

Banking-first architecture can limit flexibility

Since Rho’s platform is tied closely to its business banking services, users often must shift banking relationships or routing setups to fully utilize the system. For companies that want to retain existing bank accounts or decouple their financial infrastructure from a single provider, this bundling can slow down processes.

At a glance: Rho alternatives compared

Not all Rho competitors target the same use cases. Some platforms, like Ramp, focus on the full range of finance operations, combining expense management with corporate cards, bill pay, procurement, and vendor management. Others, like SAP Concur, are more narrowly built around traditional T&E workflows or approval-heavy spend control.

We’ve rounded up a range of options so you can find the solution that best fits your company’s priorities today and scales with you over time.

Platform | Best for | Key features | Starting cost |

|---|---|---|---|

Ramp | Startups, small businesses, mid-market | Corporate cards, expense management automation, bill pay, procurement | Unlimited free tier |

Airbase | Mid-market and multi-entity orgs | Pre-approvals, global payments, bill pay, reimbursements, audit trails | Available on request |

Rippling | Teams using Rippling for HR/payroll | Unified expense + HR + IT, role-based permissions, modular software model | Custom pricing |

SAP Concur | Global enterprises with legacy ERPs | Travel & expense management, deep integrations, global compliance | Available on request |

BILL Spend & Expense | SMBs and finance-light teams | Virtual cards, team budgets, receipt capture | Free plan available |

Ramp: The best overall Rho alternative

Ramp is a best-in-class finance automation platform that consolidates corporate cards, expense management, travel booking, accounts payable, procurement, and treasury management into a single solution. It’s a powerful alternative to Rho for businesses that want deeper automation, tighter control, and scalability across their finance operations.

While Rho combines banking with spend management, Ramp offers a broader set of features for fast-growing businesses. It’s purpose-built for modern finance teams that want tighter control, faster workflows, and deeper visibility across all non-payroll spend.

Ramp’s corporate cards enforce policy at the point of sale, automatically blocking out-of-policy purchases and streamlining receipt collection. Transactions are categorized in real time and sync seamlessly with integrated accounting systems like NetSuite, QuickBooks, and Xero. Finance teams also benefit from AI-powered invoice matching, one-click bill pay, and procurement tools that handle requests, approvals, and vendor onboarding—all in one place.

For companies aiming to automate finance operations, reduce complexity, and scale efficiently, Ramp offers a more complete and forward-looking alternative to Rho.

Key features

- All-in-one platform that centralizes workflows and data across corporate cards, expense management, travel, accounts payable, procurement, treasury, and more

- AI-powered invoice matching enables one-click bill imports with 99% line-item accuracy

- Real-time tracking and automatic policy enforcement for corporate cards, reimbursements, and invoices

- Integrated corporate cards with preset spend controls to automatically block out-of-policy transactions

- Bills are auto-coded as liabilities and synced in real time with leading ERPs like NetSuite, QuickBooks, Sage Intacct, and Xero. Ramp also supports advanced features like multi-entity workflows, custom field mapping, and dynamic sync logic (something many users find missing in Rho’s more basic ERP integrations)

Serviceable markets

Ramp serves a wide range of customers, from early-stage startups to mid-market and enterprise organizations. It's especially popular in tech, SaaS, healthcare, education, nonprofits, and professional services.

Pricing

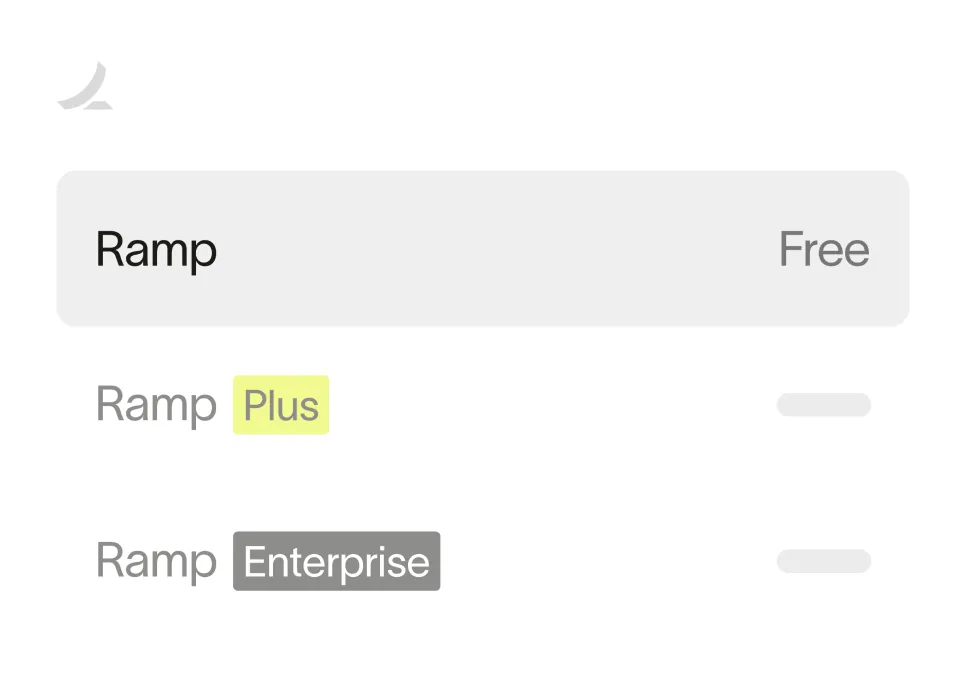

The majority of Ramp’s most powerful features are free to use, with no per-user fees. More specialized features like procurement, certain integrations, and advanced reporting and controls are available via Ramp Plus, which starts at $15 per user per month. Custom enterprise pricing is also an option for more tailored solutions.

Ready to take control of your finances?

Learn about Ramp’s pricing plans and start saving today.

Paylocity

Paylocity, which now includes the former Airbase product, offers a unified procure-to-pay experience as part of its broader HR and finance suite. It’s a strong Rho alternative for organizations that operate across multiple entities or require stricter spend governance.

Key features

- Pre-approval workflows and budget enforcement

- Virtual and physical corporate cards

- Invoice processing and bill payments

- Multi-currency, multi-entity support

- Audit trail for compliance and internal controls

Serviceable markets

Paylocity primarily serves mid-market and upper mid-market companies (50–1,000+ employees), especially those in tech, finance, legal, and consulting sectors with growing operational complexity.

Pricing

Paylocity doesn’t publish its pricing information, so you’ll need to request a quote.

Rippling

Rippling combines HR, IT, and finance in one platform. For companies already using Rippling for payroll, device management, or benefits, its spend management module offers a convenient Rho alternative that ties expenses to employee roles and permissions.

Key features

- Integrated corporate card and expense tracking

- Automatic categorization and mobile receipt upload

- Expense approval workflows tied to HR roles

- Syncs with Rippling's HR and IT stack

Serviceable markets

Rippling is best suited for growing companies (25–500 employees) that want unified control over people, devices, and expenses. It’s popular among startups and mid-sized companies that want to consolidate HR, IT, and finance management into a single platform. This can reduce complexity but risks long-term vendor lock-in and overall inflexibility.

Pricing

Rippling uses a modular pricing model. You’ll need to be on a base HR plan to access finance features. The final cost will vary by your employee count and the modules selected. All pricing is quote-based.

SAP Concur

SAP Concur is a longtime player in the travel and expense space, built for enterprises with global operations and complex compliance requirements. It's a Rho alternative for companies needing robust ERP connectivity and mature T&E workflows.

Key features

- Integrated travel booking and expense reporting

- Mobile receipt scanning with OCR

- ERP integrations (SAP, Oracle, NetSuite)

- Global compliance features: multi-currency, VAT, per diems

- Role-based approval flows and analytics

Serviceable markets

Concur is tailored for large enterprises and multinational corporations across sectors like pharma, manufacturing, logistics, and professional services.

Pricing

SAP Concur doesn’t publish its pricing information, so you’ll need to request a quote. However, due to implementation and configuration complexity, expect a higher total cost of ownership.

BILL Spend & Expense (formerly Divvy)

BILL Spend & Expense provides businesses with company cards and simple expense tracking. You can use it on its own or together with BILL AP/AR, its core paid product for accounts payable and receivable. It’s a lightweight Rho alternative for small businesses or teams that don’t want to switch banks but need better visibility into employee spend.

Key features

- Physical and virtual company cards with custom limits

- Real-time expense tracking and reporting

- Reimbursements and receipt matching

- Role-based permissions and approval flows

Serviceable markets

BILL Spend & Expense is ideal for SMBs (5–250 employees), particularly in industries like marketing, event planning, retail, and field services that need fast, user-friendly expense tools.

Pricing

BILL Spend & Expense is free to use, but its scope and feature set are more limited than those of other tools on our list. As your company grows, you’ll need to add a paid BILL AP/AR account to access other necessary features, like bill pay.

A closer look at Ramp vs. Rho

If you're comparing Ramp and Rho, the key differences come down to scope, automation, and flexibility. At first glance, Rho and Ramp both offer integrated corporate cards, bill pay, and expense tracking. But their underlying approaches and scalability differ significantly.

So, what’s the difference between Ramp and Rho? In short:

- Rho is best for companies seeking bundled banking and basic spend management under one roof

- Ramp is built for organizations ready to scale, automate, and consolidate financial operations, while maintaining existing banking relationships

Rho: Bundled banking and basic spend controls

Rho combines business banking with basic spend controls. It’s best for early-stage teams that want to manage bills and track expenses within a bundled checking and treasury platform.

What you'll get:

- Card-based spend tracking

- Manual accounts payable workflows

- Light policy controls (all tied to using Rho’s banking services)

- Basic ERP syncing

- Free pricing tier (requires funds kept in Rho’s banking environment)

Ramp: Built for scale and finance automation

Ramp, by contrast, is a finance automation platform purpose-built to scale with growing and complex finance teams. It centralizes expense management, bill payments, procurement, and real-time reporting—without requiring a switch from your current bank.

Automation and finance tools include:

- Automatic expense categorization, receipt matching, and policy enforcement

- Smart invoice ingestion, line-level matching, and custom approval workflows

- Dynamic spend controls and policy guardrails on corporate cards

- Advanced ERP integrations (NetSuite, QuickBooks, Xero)

- Built-in procurement tools for vendor intake and contract workflows

Why Ramp wins for growth

For businesses focused on optimizing operations, reducing overhead, and scaling finance workflows—not just banking—Ramp is often the more flexible and future-ready choice.

Why choose Ramp vs. Rho: A broader, more strategic approach to spend

More than a banking partner

Ramp doesn’t require users to change banks, making it easier to adopt without disrupting vendor payments or payroll. Its finance tools integrate flexibly into your existing stack—something Rho’s bundled structure doesn’t allow.

Automated workflows across expenses, AP, and procurement

Ramp unifies expense management, reimbursements, bill pay, and procurement in a single platform with AI-driven automation, significantly reducing manual oversight.

Better visibility and compliance

Ramp’s real-time reporting, custom spend limits, and policy-based controls give finance teams complete visibility across all spending, not just card activity. You can set controls by department, role, or vendor, and flag out-of-policy spend instantly.

More value for less

Ramp’s core platform is free and doesn’t charge per user at the base tier, offering strong value compared to many traditional T&E tools as your team grows. While Rho also offers a free model, Ramp includes more automation and controls out of the box.

Built for long-term scalability

As your company grows, you won’t need to bolt on new platforms. Ramp already supports complex workflows like procurement, vendor approvals, multi-entity accounting, and ERP-grade reporting—features Rho lacks.

Stronger treasury option

Both Ramp1 and Rho offer similar treasury yields for investment accounts, with Ramp edging out Rho at 4.33%2 vs. 4.30%. But Ramp goes one step further, offering 2.5%3 on your operating cash with a Ramp Business Account. That means you don’t need to shuffle funds between your bank and investment accounts to earn on your cash.

Both the Ramp Business Account and Ramp Investment Account are fully integrated into your company’s broader finance workflows. This makes it easier to manage liquidity, spend, and yield from a central place.

Save time and money

Ramp helps eliminate the hidden costs of legacy systems. Our research reveals that Ramp customers:

- Submit expense reports 85% faster, saving $435,000 a year in employee time

- Cut expense review time by 95%, freeing up $697,000 a year in labor costs

- Reduce out-of-policy spend by up to 8.8%, saving millions annually

Ramp isn’t just a Rho alternative—it’s an upgrade

While Rho is a solid starting point for teams looking for a modern banking and finance tool, growing companies often outpace its capabilities. If you’re looking to centralize your finance stack, automate processes, and gain granular visibility across spend, Ramp is the best Rho alternative on the market.

Learn how Ramp’s expense management automation software can help your finance team drive greater efficiency, enforce smarter spend policies, and modernize your operations at scale.

1. Ramp Business Corporation is a financial technology company and is not a bank. All bank services provided by First Internet Bank of Indiana, Member FDIC.

2. Before investing in a money market fund, carefully consider the fund's investment objectives, minimum investment requirements, risks, charges and expenses, as described in the applicable fund's prospectus. You may obtain a copy of the fund prospectus here. Yield rate is the current effective annualized 7-day rate for the Invesco Premier U.S. Government Money Portfolio fund (FUGXX), and is variable, fluctuates, and is only earned on cash invested into money market funds in the Ramp Investment Account. Market data provided by and copyright © 2026 Nasdaq, Inc. All rights reserved. Past performance is not indicative of future results. Investing in securities products involves risk of loss, including loss of principal. This is not an offer to buy or sell, or a solicitation of an offer to buy or sell, any security, and no buy or sell recommendation should be implied.

3. Get up to 2.5% in the form of annual cash rewards on eligible funds in your Ramp Business Account. Cash rewards are paid by Ramp Business Corporation and not by First Internet Bank of Indiana, Member FDIC. Cash rewards are subject to change. See the Business Account Addendum for more information.

FAQs

Rho is a finance platform that combines business banking, corporate cards, accounts payable, and treasury management in one interface.

The Rho corporate card is a charge card tied to your Rho business banking account. It offers basic spend controls and expense tracking and requires using Rho’s banking infrastructure. It does not allow revolving balances.

No, Ramp does not perform a personal credit check. Eligibility is based on business financials such as cash flow, revenue, and account balances.

Ramp focuses on automation and efficiency for scaling finance teams and strongly emphasizes expense management, procurement, and AP. Brex targets startups looking for an alternative to traditional corporate cards, while Divvy (now part of BILL) offers budgeting and spend management tools geared toward SMBs.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits