The top 5 Rippling alternatives for expense management

- At a glance: Rippling alternatives compared

- The best overall Rippling alternative: Ramp

- Emburse Professional

- Paylocity

- Rho

- PayEm

- Choose the best Rippling alternative for expense management

Rippling is a human resources information system (HRIS) that combines HR, IT, payroll, and expense management solutions into a single platform. With an overall score of 4.8 out of 5 stars on the software review website G2, it’s a popular choice for small and mid-sized businesses looking for the convenience of an all-in-one solution.

But despite its efforts to consolidate so many tools into a single software, most customers still view Rippling primarily as an HR platform. If you need a solution with strong, comprehensive expense management capabilities, you may find Rippling lacking.

For example, some reviewers note that Rippling's workflow automation and advanced financial reporting features cost extra, while many competitors offer certain features for free.

So, who are Rippling competitors? In this article, we compare Rippling against other highly rated expense management software, including:

- Ramp

- Emburse Professional (formerly Emburse Certify)

- Paylocity

- Rho

- PayEm

We chose these as our favorites based on feedback from actual users, public reviews, and ratings shared on G2, coupled with our own research into each platform’s features. Read on to learn more about the five Rippling competitors we cover below.

At a glance: Rippling alternatives compared

| Platform | G2 rating | Market segment | Key features | Minimum cost |

|---|---|---|---|---|

| Ramp | 4.8 | Startups, small businesses, mid-market | Expense management, corporate cards, travel booking | $0; unlimited free tier |

| Navan | 4.7 | Mid-market | Travel booking, expense management | $0; free tier with seat and usage limits |

| Fyle | 4.6 | Mid-market | Expense management | $11.99 per user per month, billed annually |

| Paylocity | 4.5 | Mid-market | Procurement, expense management | N/A; all pricing is quote based |

| Emburse Professional | 4.5 | Mid-market, enterprise | Expense management | $3,000 per year |

| Coupa | 4.2 | Mid-market, enterprise | Procurement, expense management, invoice automation, payments | N/A; all pricing is quote based |

The best overall Rippling alternative: Ramp

Ramp is a complete finance operations platform that’s purpose-built to save businesses time and money. Our software combines expense management, corporate cards, travel booking, accounts payable (AP) automation, and procurement to help companies streamline their operations and make more informed financial decisions.

We have to admit that we’re a bit biased when it comes to how we view Rippling versus Ramp. Luckily, you don’t have to take our word for it: Ramp has a rating of 4.8 out of 5 stars on G2 based on more than 2,000 verified reviews. And in a head-to-head matchup, Ramp beats Rippling expense management in three out of seven rating categories and ties in two:

Key features

- All-in-one finance platform: Ramp consolidates data and workflows between accounts payable, travel and expense management, procurement, accounting, and more.

- Built-in travel booking: Unlike Rippling, Ramp offers a complete travel booking system out of the box. Ramp Travel automatically enforces your T&E policy and provides a huge inventory of flights and accommodations, thanks to our partnership with Priceline.

- Corporate cards you control: Select which spending categories are allowed or blocked on corporate cards across more than 40 categories—including SaaS, flights, taxi fares, and merchandise

- Real-time spend visibility and reporting: Gain comprehensive visibility into all your business expenses on a single, intuitive platform. Ramp offers granular financial reporting across departments and categories, and our AI even recommends new ways for you to save.

- Integrates with your tech stack: Ramp is designed to work with the tools you already use. We offer seamless integrations with leading accounting software, collaboration tools, and HRIS platforms, allowing you to sync employee data across systems.

Why customers choose Ramp vs. Rippling

- Process more bills with higher accuracy: Ramp uses AI to extract key details from invoices automatically and remembers how you code, streamlining your AP workflow

- Minimize the risk of fraud and errors: Ramp Bill Pay identifies duplicate invoices, three-way matches to purchase orders and receipts, and routes bills for approval based on your rules and requirements

- Consolidate all your payment methods in a single platform: Pay domestic and global vendors by check, card, ACH, or international wire—all from Ramp

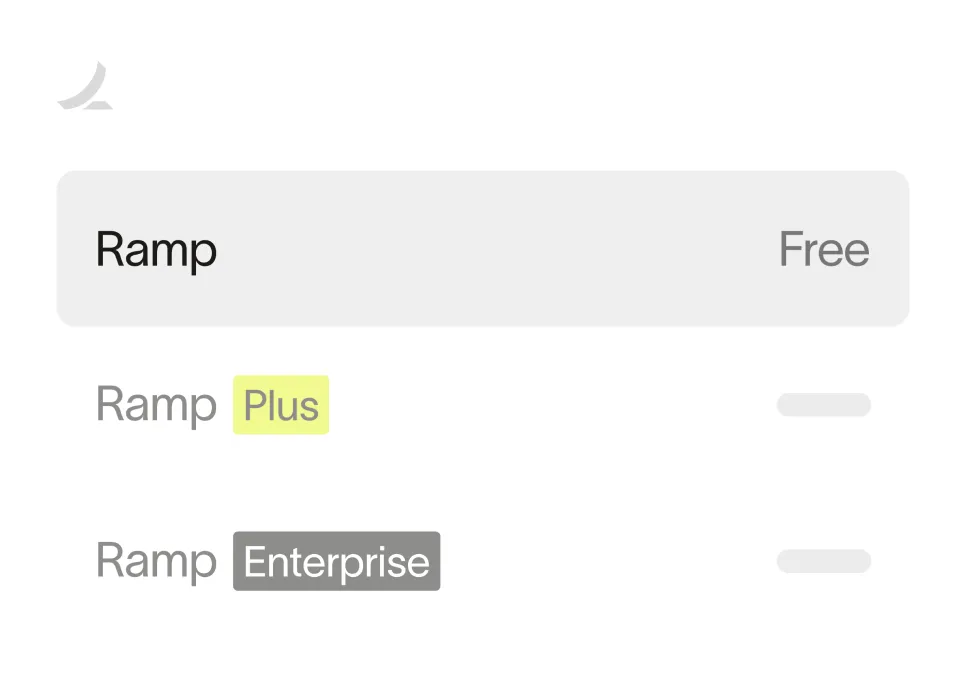

Pricing

You can use the majority of Ramp’s features for free, including expense management, travel booking, bill pay, and more. If you need additional control and customizations, you can upgrade to Ramp Plus for $15 per user per month. We also offer enterprise pricing on request—just reach out.

Ready to take control of your finances?

Learn about Ramp’s pricing plans and start saving today.

Emburse Professional

Emburse Professional (formerly known as Emburse Certify) is an expense management solution that combines travel booking and accounts payable, catering to mid-market and enterprise companies. As a Rippling alternative, Emburse Professional is rated lower at 4.5 out of 5 on G2, with Rippling coming out on top in all categories:

Key features

- Automated expense categories and policies for real-time spend management

- Travel booking platform that suggests the most economical itineraries by default

- Mobile app with receipt capture and reporting on the go

- Automatic matching of employee expenses to corporate card receipts

Why customers choose Emburse vs. Rippling

G2 reviewers appreciate the ease of use of Emburse Professional and how it helps streamline their expense management process, including receipt management.

Pricing

Emburse Professional doesn’t list any public pricing information on its site, so you’ll need to reach out for a quote. But on G2, it states their starting plan costs $3,000 per year.

Paylocity

Paylocity’s spend and expense management platform, which now incorporates what was formerly Airbase, offers procurement, accounts payable automation, and real-time expense visibility. According to G2, the platform currently holds an average rating of 4.5 out of 5 based on more than 4,600 verified reviews. Compared with Rippling, Paylocity performs strongly in categories such as ease of use, feature breadth, and integration support:

Key features

- Guided procurement workflows and vendor onboarding

- Integrated invoice capture, processing, and spend tracking

- Automated coding and real-time expense visibility

- Receipt upload with OCR and reconciliation tools

Why customers choose Paylocity vs. Rippling

Reviewers highlight Paylocity’s automation, spend visibility, and ability to centralize procurement and expense workflows. Many note that Paylocity’s unified approach reduces manual effort and dependency on multiple point solutions.

Pricing

Paylocity does not publicly list pricing for its spend and expense management module. Organizations should visit the Paylocity contact page to request a tailored quote.

Rho

Rho is a financial operations platform that offers business banking services as well as corporate credit cards, expense management, and bill pay. Rho has a strong 4.8 rating on G2, but it’s based on a small sample size of just over 100 reviews. It ties or outranks Rippling in six out of seven rating categories:

Key features

- Business checking and savings accounts with no fees for ACH payments or wire transfers

- Treasury management services that allow businesses to invest excess cash in treasury bills

- Custom spending limits and restrictions at the card level

- Option to add your logo to Rho’s physical business credit cards

Why customers choose Rho vs. Rippling

No customers mentioned Rippling in any G2 reviews. Overall, reviewers find Rho to be much easier to set up and administer, and they particularly appreciate Rho’s 24/7 customer support.

Pricing

Rho’s business banking accounts, corporate cards, and expense management platform are free to use. The company earns the bulk of its revenue from interchange fees.

PayEm

PayEm is an expense management platform that offers automated invoice processing, PO creation, and budgeting tools. It currently has a G2 score of 4.7 out of 5 stars based on around 175 reviews. PayEm beats Rippling in two rating categories and ties in one:

Key features

- Corporate cards with custom controls and spending limits, including category restrictions

- Generate purchase orders and process invoices from the same platform

- Bill pay automation with the option to schedule payments via card, ACH, wire, or check

- Built-in audit trail that tracks financial events like budget requests, purchase orders, and expense reimbursements

Why customers choose PayEm vs. Rippling

Reviewers rate PayEm’s expense management features more highly than Rippling’s, and they generally find PayEm to be a better business partner overall. Many customers highlight PayEm’s ease of use as a key feature.

Pricing

PayEm doesn’t publicize its pricing information, so you’ll need to reach out for a quote. The price depends on your business size and the number of users who will need access to the platform.

Choose the best Rippling alternative for expense management

When it comes to your expense management needs, it pays to pick a specialized solution. Ramp’s modern finance platform is purpose-built to save you time and money, helping you simplify every aspect of the expense management process.

Tens of thousands of businesses choose Ramp to streamline their financial workflows, boost efficiency, and grow their businesses.

Watch our demo video and learn why Ramp customers save an average of 5% a year.

Don't miss these

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits