The 6 best Airbase alternatives for 2026 (a Paylocity company)

- Best overall Paylocity alternative: Ramp

- Stampli

- Navan (formerly TripActions)

- Mesh Payments

- PayEm

- Spendesk

- Pick the best-rated Paylocity alternative

Airbase’s spend management tools are now folded into Paylocity after the full acquisition and integration. According to G2, Paylocity currently holds an average rating of 4.5 out of 5 based on thousands of verified reviews.

While customers frequently praised Airbase for its ease of use and streamlined expense submission workflows, some users reported that the mobile app occasionally failed to properly categorize receipts, and others noted bugs or limitations in expense search functionality.

If you’re evaluating alternatives now that Airbase is part of Paylocity, this guide compares top tools against Paylocity across features, usability, and value.

- Ramp

- Stampli

- Navan

- Mesh Payments

- PayEm

- Spendesk

We chose these tools based on feedback from actual users, as well as the public reviews and ratings shared on G2. Coupled with our own research into each platform’s features, we narrowed our picks to the seven Paylocity alternatives below.

Best overall Paylocity alternative: Ramp

Ramp is a comprehensive finance operations platform designed to save companies time and money. Our software combines expense management, corporate cards, travel booking, bill pay automation, and AI-powered procurement to help businesses of all sizes streamline their workflows and make better financial decisions.

Yes, we may be a bit biased in how we view Ramp as a Paylocity competitor. But our customer reviews back us up. More than 2,000 verified users have rated Ramp 4.8 out of 5 stars on G2:

Key features

- Comprehensive finance platform: All-in-one platform that combines accounts payable (AP), corporate travel booking, expense management, and procurement with industry-leading corporate cards

- Fast, effective procurement: AI-powered procurement software automates the entire intake-to-pay workflow, helping your business complete the procurement process 8.5x faster

- AP automation out of the box: Ramp Bill Pay uses machine learning to help automate your AP workflow, from invoice receipt to approvals, payments, and three-way matching

- Real-time spend visibility and reporting: Full visibility into all your business spending on one unified platform. Ramp offers real-time financial reporting across departments and categories

- Industry-leading corporate cards: Unlimited physical and virtual corporate cards with built-in expense management features to help you save an average of 5% annually

- AI-powered savings insights: Uncover areas to reduce spend with intelligent recommendations based on millions of financial transactions

Why customers choose Ramp vs. Paylocity

One G2 reviewer shared their experience switching between expense management software, ultimately crowning Ramp the clear winner: “I've switched expense management systems twice (once from Brex to Paylocity, formerly Airbase, this time from Brex to Ramp) and have found Ramp to be best-of-breed for startups to mid-market.”

Overall, users find Ramp to be easier to use, set up, and administrate, citing its expense reporting automation as a particular highlight. Users are also more confident in Ramp’s ability to grow with them, with one reviewer highlighting its pace of innovation as a clear benefit over Paylocity (formerly Airbase):

"Before, month-end close took approximately 10 days. Now, it’s unbelievable—it takes 3–4 days. If we were to export transaction details, it’s really easy to pull a bunch of different metrics. I've had multiple compliments from people I barely even speak with just going out of their way to tell me how easy it is to use Ramp."

– Kay Coolican, Accounting Manager at Clearbit, on switching from Airbase to Ramp

Pricing

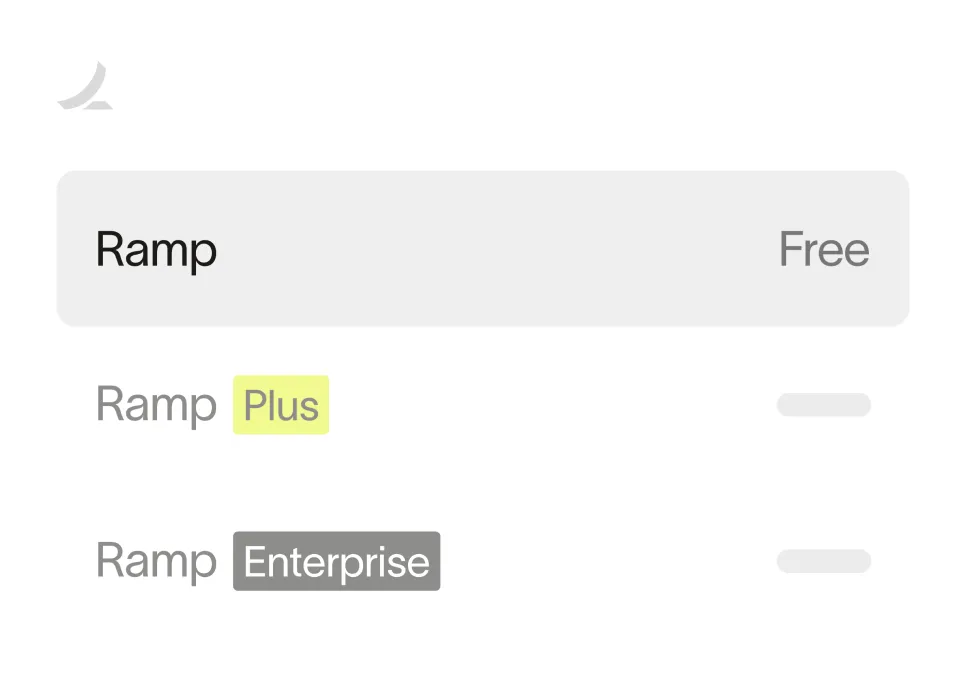

Ramp offers most of its powerful expense management features for free, including bill pay, spend visibility, and unlimited physical and virtual corporate cards. If you need greater control and advanced customizations, Ramp Plus costs $15 per user per month. Ramp also offers enterprise pricing on request—just reach out.

Ready to take control of your finances?

Learn about Ramp’s pricing plans and start saving today.

Stampli

Stampli positions itself as the only finance automation platform centered on accounts payable, so it’s not surprising that it’s a popular choice for AP automation and invoice management. More than 1,800 user reviews have earned Stampli 4.6 out of 5 stars on G2. Its overall score is slightly higher than Paylocity’s, the two platforms match up competitively:

Key features

- Automate invoice capture, coding, and approvals

- Vendor management, including onboarding, information-sharing, and documentation

- Two-way and three-way PO matching, plus partial payments and line item adjustments

- Process and pay invoices across departments, offices, companies, or locations

- One-click access to invoice conversations and activities to support audits

Why customers choose Stampli vs. Paylocity

Customers frequently praise Stampli for its powerful accounts payable automation and invoice management features. Reviewers also highlight Stampli’s responsive and knowledgeable customer support. By contrast, some Paylocity users have noted occasional challenges with AP workflow complexity and support consistency following the Airbase integration.

Pricing

Stampli doesn’t publish its pricing information, so you’ll need to contact sales for a quote. Notably, subscriptions are charged monthly, with no option for an annual contract.

Navan (formerly TripActions)

Navan is a T&E management solution that offers two main products: Navan Travel, for corporate travel planning, and Navan Expense Management, which provides traditional expense management features like expense reporting and reimbursements. Formerly known as TripActions, Navan tops Paylocity's overall score with 4.7 out of 5 stars on G2:

Key features

- Integrates with any business credit card so you can keep your existing rewards program

- Automated expense reconciliation helps finance teams track and monitor spend

- Ability to spin up virtual cards tied to each travel itinerary

- Reimbursement support for employees across 45 countries and 25 currencies

- Navan Rewards encourage employees to book cost-effective travel itienraries

Why customers choose Navan vs. Paylocity

Reviewers consistently praise Navan’s travel booking capabilities as a core reason they select the platform. Paylocity does not include native travel booking features, but it supports integrations such as Perk to enable booking workflows.

Pricing

Navan is free for up to 5 users per month. Past that, the subscription costs $15 per user per month. Navan also offers enterprise pricing on request.

Mesh Payments

Mesh Payments is a travel and expense management platform that offers corporate cards, extensive integrations, and table-stakes features like expense reporting and reimbursements. It’s rated slightly higher than Paylocity with 4.6 out of 5 stars on G2 and holds its own in a head-to-head comparison:

Key features

- Multiple options for travel booking, including integration with your preferred travel management company (TMC)

- Virtual and physical corporate cards with customizable spend controls

- Integrates with any ERP or procurement system, enabling intake-to-pay automation

- Real-time spend reporting and insights

Why customers choose Mesh Payments vs. Paylocity

Mesh Payments is often favored for its intuitive administration and ease of use, especially in card and expense workflows. That said, in side-by-side comparisons, reviewers tend to prefer Paylocity’s approach to product updates and roadmap development.

Pricing

Mesh Payments has a free Pro plan that offers basic expense management functionality. The Premium plan starts at $10 per user per month and provides access to additional tools to help scale your spend management process. Custom pricing is available on request.

PayEm

PayEm is an end-to-end spend management platform for PO creation, invoice processing, budget control, and more. It tops Paylocity on G2 with 4.7 out of 5 stars, but that’s based on a fairly small sample size of reviews. In a head-to-head comparison, the tools match up well:

Key features

- Corporate cards with custom spend controls

- Accounts payable automation with multiple payment options, including card, ACH transfer, and international wire

- Generate purchase orders and process invoices from the same platform

- Budgeting solutions with real-time visibility into how spend is tracking against projections

Why customers choose PayEm vs. Paylocity

While PayEm reviewers do not appear to reference Paylocity, users frequently praise PayEm’s intuitive interface and administrative ease. Many also highlight the responsiveness of PayEm’s team and the platform’s role as a strong business partner.

Pricing

PayEm doesn’t share its pricing structure. You’ll need to contact them for a custom quote based on your business size and the number of users who need access to the platform.

Spendesk

Founded in 2016, Spendesk provides expense management, budgeting, and AP software alongside its corporate cards. With an overall G2 rating around 4.6, Spendesk remains a strong contender among Paylocity alternatives, even though Paylocity ranks comparably in many categories:

Key features

- Expense reporting automation and simple employee expense reimbursements

- Real-time spending dashboard that displays online and offline transactions

- Invoice automation and approval workflows for more control over invoicing lifecycles

- Single-use virtual cards plus dedicated virtual cards for recurring costs help eliminate the risk of expense fraud

Why customers choose Spendesk vs. Paylocity

Spendesk draws strong adoption among European companies and teams with EMEA operations. Many users appreciate its simplicity: reviewers mention it makes expense submission easy and helps eliminate manual processes. Several also note that Spendesk’s customer support and partnership orientation helped them scale.

Pricing

Spendesk offers three different plans, but you’ll have to schedule a demo to get a quote.

Pick the best-rated Paylocity alternative

With more than 2,000 5-star reviews on G2, Ramp is the #1 Paylocity alternative. Ramp’s comprehensive platform offers all the features modern finance teams need: expense management, travel booking, AP automation, procurement, cash flow visibility, and more.

Tens of thousands of companies use Ramp to improve their finance operations and grow their business. Watch a demo video and learn why Ramp customers save an average of 5% a year across all spending.

Don't miss these

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits