Efficient Strategies to Track Customer Payments and Enhance Cash Flow

- What is payment tracking?

- Key components of an effective payment tracking system

- Benefits of streamlining payment tracking processes

- How to implement a payment tracking system

- Best practices for effective payment tracking

- Save time and money with Ramp

When you run a business, keeping track of customer payments can feel overwhelming. You want to make sure every payment lands where it should, on time, without any hiccups. But let's face it, it's not always that simple. You've got invoices flying out, payments trickling in, and sometimes, things slip through the cracks. It’s not just about knowing who paid and who didn’t; it’s about maintaining a smooth cash flow and keeping your financial health in check.

What is payment tracking?

Payment tracking is the process of monitoring and managing customer payments to ensure timely and accurate receipt of funds.

Definition of payment tracking

Payment tracking involves keeping a close eye on incoming payments, matching them with the corresponding invoices, and updating records to reflect the current status of each transaction.

Importance of payment tracking for businesses

Maintains healthy cash flow: Keeping track of payments helps ensure that money flows into your business as expected. This steady inflow of funds is vital for covering expenses, paying employees, and investing in growth opportunities. For more insights on managing your cash flow, check out this cash flow management guide.

Identifies late or missed payments: By tracking payments, you can quickly identify any that are late or have been missed entirely. This allows you to take prompt action, such as sending reminders or following up with customers, to recover the funds.

Helps prevent bad debts: Regularly monitoring payments reduces the risk of bad debts. When you know who owes you money and for how long, you can address issues before they escalate into uncollectible debts.

Provides insights for financial forecasting: Accurate payment tracking offers valuable insights into your business’s financial health. It helps you predict future cash flows, plan for potential shortfalls, and make informed decisions about budgeting and investments.

Key components of an effective payment tracking system

You might be thinking, “This sounds great, but how do I actually make it happen?” Let’s dive into the essentials.

Centralized payment data

A centralized payment data system serves as the single source of truth for all payment information. This means all your payment records, invoices, and customer details are stored in one place. This setup eliminates the need to sift through multiple spreadsheets or systems to find payment information. It ensures that everyone in your organization has access to the same, up-to-date data, reducing the risk of errors and discrepancies. You can quickly check the status of any payment, see historical data, and generate reports without jumping between different platforms. Learn more about creating the ideal accounts payable process to streamline your operations.

Automated payment reminders

Automated payment reminders are a game-changer for maintaining timely payments. These reminders notify customers of upcoming due dates or overdue payments without manual intervention. You can set up these reminders to be sent at specific intervals, ensuring that customers receive timely notifications. This reduces the likelihood of missed payments and helps maintain a steady cash flow. Automated reminders also free up your team from the tedious task of following up on payments, allowing them to focus on more strategic activities.

Real-time payment status updates

Real-time payment status updates provide instant visibility into the status of your invoices. You can see which invoices are paid, pending, or late at any given moment. This real-time insight allows you to act quickly if a payment is overdue or if there are any discrepancies. It also helps in making informed decisions about your cash flow and financial planning. With real-time updates, you can avoid the lag time associated with manual tracking and ensure that your financial records are always current. Understanding the cash application process can further enhance your payment tracking efficiency.

Integration with accounting software

Integrating your payment tracking system with accounting software ensures a seamless flow of data between payment tracking and financial records. This integration eliminates the need for manual data entry, reducing the risk of errors and saving time. When a payment is received, it automatically updates your accounting software, ensuring that your financial records are always accurate. This seamless data flow also simplifies the reconciliation process, making it easier to match payments with invoices and keep your books balanced. Discover the payment management software benefits that can enhance your system integration.

Customizable reporting and analytics

Customizable reporting and analytics provide insights into payment trends, customer behavior, and cash flow. You can generate reports tailored to your specific needs, whether it's tracking overdue payments, analyzing payment patterns, or forecasting future cash flows. These insights help you understand your financial health better and make informed decisions. Customizable reports allow you to focus on the metrics that matter most to your business, providing a clear picture of your payment landscape. Analytics can also highlight areas for improvement, helping you optimize your payment processes and enhance overall efficiency. Improve your efficient invoice management with tailored reporting.

Benefits of streamlining payment tracking processes

Streamlining your payment tracking not only makes your life easier but also brings tangible benefits to your business.

Improved cash flow management

Faster payment collection: Streamlining your payment tracking processes speeds up the collection of payments. Automated reminders and real-time updates ensure that customers are aware of their due dates, reducing delays. This means you get your money faster, which keeps your cash flow healthy and allows you to reinvest in your business more quickly. Learn how to pay bills on time to maintain a healthy cash flow.

Reduced outstanding receivables: Efficient payment tracking helps you stay on top of outstanding invoices. With automated systems, you can quickly identify overdue payments and take action. This reduces the amount of money tied up in receivables, ensuring that more of your revenue is available for immediate use.

Enhanced customer relationships

Proactive communication: Streamlined payment tracking enables proactive communication with your customers. Automated reminders and notifications keep customers informed about their payment status, reducing the likelihood of misunderstandings. This proactive approach fosters trust and transparency, strengthening your relationship with your customers.

Timely issue resolution: When payment issues arise, a streamlined system allows you to address them promptly. Real-time updates and centralized data make it easier to identify and resolve disputes or discrepancies. Quick resolution of issues enhances customer satisfaction and maintains a positive business relationship.

Increased operational efficiency

Automated tasks and reminders: Automating payment tracking tasks reduces the burden on your team. Automated reminders, invoice generation, and payment matching free up time for your staff to focus on more strategic activities. This increases overall productivity and ensures that your team can handle a higher volume of transactions without additional effort.

Reduced manual effort and errors: Manual payment tracking is prone to errors and time-consuming. Streamlining the process with automation minimizes the risk of mistakes and reduces the need for manual data entry. This leads to more accurate records and fewer discrepancies, saving time and reducing frustration for your team.

Better financial visibility and forecasting

Real-time payment data: Access to real-time payment data provides a clear picture of your financial status at any given moment. You can see which invoices have been paid, which are pending, and which are overdue. This immediate visibility helps you make informed decisions about your cash flow and financial planning.

Informed decision-making: With accurate and up-to-date payment information, you can make better financial decisions. Customizable reports and analytics offer insights into payment trends and customer behavior. This data helps you forecast future cash flows, plan for potential shortfalls, and make strategic decisions to support your business growth.

How to implement a payment tracking system

Implementing a payment tracking system might seem daunting, but it's easier than you think. Here’s a step-by-step guide.

Assess current payment tracking processes

Start by evaluating your existing payment tracking methods. Identify where inefficiencies and pain points exist. Are payments frequently late? Do you spend too much time reconciling invoices? Pinpoint these issues to understand what needs improvement. This assessment will provide a clear picture of your current system's shortcomings and areas that require enhancement.

Define payment tracking goals and requirements

Next, set clear goals for your payment tracking system. Determine what you want to achieve. Are you aiming for faster payment collection? Do you need better visibility into payment statuses? Outline the specific capabilities your system should have. This step ensures that the solution you choose aligns with your business needs and objectives.

Evaluate and select a payment tracking solution

With your goals in mind, start evaluating different payment tracking solutions. Compare features, integrations, and costs. Look for systems that offer centralized data, automated reminders, real-time updates, and seamless integration with your accounting software. Consider user reviews and case studies to gauge the effectiveness of each option. Select a solution that meets your requirements and fits within your budget. Discover how to streamline invoice payments for better efficiency.

Set up and configure the system

Once you've chosen a payment tracking solution, proceed with the setup and configuration. Customize the settings to match your business processes. Automate as many tasks as possible, such as sending reminders and updating payment statuses. Ensure the system is configured to provide real-time updates and accurate reporting. This setup phase is crucial for ensuring the system operates smoothly and efficiently.

Train staff and communicate with customers

Finally, train your staff on how to use the new payment tracking system. Provide comprehensive training sessions and resources to ensure everyone understands how to navigate and utilize the system. Clear communication with your customers is also important. Inform them about any changes in the payment process and how it benefits them. This step ensures a smooth transition and encourages adoption by both your team and your customers.

Best practices for effective payment tracking

Effective payment tracking isn't just about the tools you use; it’s also about how you use them.

Establish clear payment terms and policies

Set clear payment terms and policies from the start. When you onboard a new customer, outline your payment expectations. Specify due dates, accepted payment methods, and any penalties for late payments. Clear communication prevents misunderstandings and sets the stage for timely payments. Make sure your terms are easy to understand and accessible to all customers. This transparency builds trust and encourages prompt payment.

Send timely and accurate invoices

Send invoices promptly and ensure they are accurate. Delays in billing can lead to delays in payment. Double-check all invoice details before sending them out. Include the correct amount, due date, and payment instructions. Accurate invoices reduce the likelihood of disputes and speed up the payment process. Use invoicing software to automate this process and minimize errors. Timely and precise billing keeps your cash flow steady and predictable. Explore different B2B payment methods to ensure your invoices are paid on time.

Offer multiple payment options

Provide multiple payment options to make it easy for customers to pay. Different customers prefer different methods—some may like paying by credit card, others by bank transfer, and some by digital wallets. Offering a variety of options increases the chances of receiving payments on time. It also enhances customer satisfaction by providing flexibility. Make sure all payment methods are secure and easy to use. This convenience encourages prompt payment and reduces friction in the payment process. Check out this ACH payments guide for more details on various payment options.

Monitor and follow up on late payments

Keep a close eye on late payments and follow up promptly. Use automated reminders to notify customers of upcoming or overdue payments. Personalized outreach can also be effective. A friendly reminder email or a quick phone call can prompt customers to settle their accounts. Address any issues or disputes quickly to avoid further delays. Consistent monitoring and follow-up ensure that late payments are addressed before they become a bigger problem.

Regularly review and optimize processes

Regularly review your payment tracking processes and look for areas to improve. Analyze your data to identify patterns and trends. Are there common reasons for late payments? Are certain customers consistently late? Use this information to refine your processes. Implement changes that can streamline payment tracking and improve efficiency. Continuous improvement based on data and feedback keeps your system effective and responsive to your business needs. Learn more about invoice tracking best practices to enhance your processes.

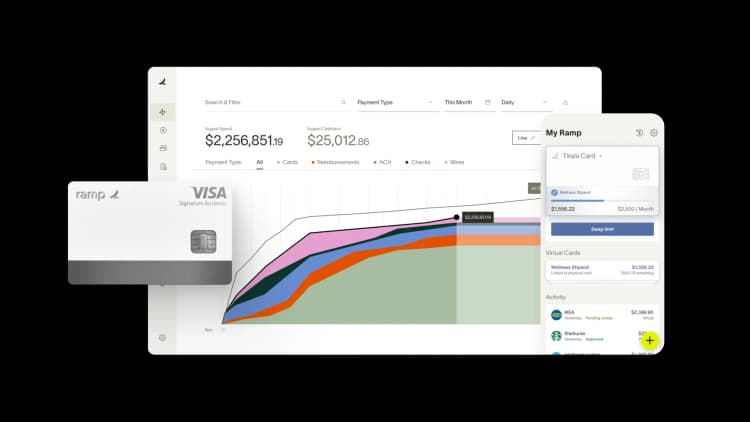

Save time and money with Ramp

Ready to streamline your payment tracking and enhance your cash flow? At Ramp, we offer integrated financial solutions that automate expense management, bill payments, and more. Visit Ramp Pricing to see how we can help you save time and money while modernizing your finance operations.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Compared to our previous vendor, Ramp gave us true transaction-level granularity, making it possible for me to audit thousands of transactions in record time.”

Lisa Norris

Director of Compliance & Privacy Officer, ABB Optical

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°