Accounts payable management simplified: 8 key strategies

- What is accounts payable management?

- 8 best practices to effectively manage accounts payable

- How to measure your AP management initiatives

- Why Ramp Bill Pay is the best way to manage AP

- Why Ramp Bill Pay is the right choice

Managing accounts payable isn’t just about paying bills—it’s about keeping your cash flow steady, building trust with vendors, and staying one step ahead of deadlines. But when invoices pile up and approvals lag, it can feel more like juggling than managing.

This guide breaks down smart strategies for simplifying accounts payable, so you can stay organized, avoid costly missteps, and focus on what matters most: running your business.

What is accounts payable management?

Accounts Payable Management

Accounts payable management is the practice of efficiently managing a business’s unpaid bills and vendor payments. It involves recording, approving, and paying invoices accurately and on time, while maintaining a clear view of cash flow and financial commitments.

Done well, AP management ensures timely and accurate payments—helping you avoid late fees and build stronger vendor relationships. It also gives you better visibility into your expenses, so you can make better financial decisions and create a smoother accounts payable process.

Why is AP management so important?

Accounts payable management is a strategic lever for building financial health. Staying ahead on payments lets you negotiate better vendor terms, like early payment discounts or extended deadlines, which can free up cash for other business priorities and improve working capital.

Poor AP management, on the other hand, can create a domino effect of problems. Late payments can trigger penalties, and disrupt supply chains. Over time, these issues can damage your reputation and limit future opportunities and even affect your balance sheet.

8 best practices to effectively manage accounts payable

Managing accounts payable efficiently requires more than just staying organized. These eight AP best practices break down not only what to do but how to do it, so you can take immediate action and see results.

1. Centralize invoice management

Scattered invoices are a recipe for chaos. Set up one dedicated system to handle all incoming invoices—whether that’s a shared email inbox or an AP platform designed to keep everything in one place.

If your invoices still come in on paper, digitize them immediately using a scanner or app. To make it even easier, consider going paperless and integrating accounting software to track all incoming invoices and their due dates, flag missing details, and send reminders. A single source of truth for your invoices eliminates the guesswork and reduces the risk of missed payments.

2. Establish clear payment terms

Work with your vendors to set payment terms that fit your cash flow needs—like net-30 or net-60—and ensure these agreements are documented. Whether you’re using a contract, a simple email, or an invoice tracking sheet, keep the terms accessible so your accounts payable department knows exactly when payments are due.

Clear agreements prevent misunderstandings and give you more control over your payment schedule.

3. Prioritize on-time payments

Late payments can cost you—both in fees and reputation. Start by organizing invoices by due date in a system that works for your team, like a calendar, spreadsheet, or dedicated AP tracker.

Set reminders for upcoming deadlines to keep payments on track. If AP approval process bottlenecks are an issue, create a process that assigns clear responsibilities to avoid delays. Even with a manual approach, timely payments ensure vendors can trust your payable system.

4. Take advantage of early payment discounts

Early payment discounts are a great way to save money, but they require cash flow planning. Review your vendor agreements to see which suppliers offer discounts.

For example, they might offer a 5% or 10% discount if you pay the invoice within 10 days of receipt. If cash flow allows, consider paying ahead of time to benefit from these savings. Over time, these discounts can add up, improving your bottom line and boosting short-term financial flexibility.

5. Monitor cash flow regularly

Keep a close eye on your cash flow to ensure you always have sufficient funds to cover your payables. Use dashboards or cash flow forecasting tools to identify gaps early.

This real-time visibility allows you to decide whether to delay payments, negotiate terms, or reallocate funds for larger expenses. A clear picture can help you forecast accounts payable and accounts receivable, ensuring you can confidently make early payments or investments without overextending.

A month of work done in minutes.

Handle 10x the invoices in half the time. Our standard tier is free.

6. Automate where it makes sense to

Automation is one of the most effective accounts payable management strategies. Start by identifying repetitive tasks in your current workflow, like data entry, invoice matching, or payment processing.

Then, use AP software that can handle these tasks for you. For instance, use tools that scan invoices and extract details automatically, route them to the right approvers, and trigger payments on approved invoices. Even partial AP automation can reduce manual processes and human error if you don’t need a full, robust setup.

7. Implement a three-way matching system

Three-way matching ensures accuracy by comparing purchase orders, invoices, and delivery receipts before payments are approved. Start by requiring vendors to include purchase order numbers on all invoices.

If discrepancies arise, flag them and resolve the issue before approving payment. For larger volumes of invoices, automation tools can help streamline this process.

For example, if an invoice lists a higher quantity than the delivery receipt, the system can hold it for review. This process reduces overpayments, catches accounts payable fraud, improves procurement oversight, and ensures you’re only paying for what you actually received.

8. Regularly review and reconcile accounts

Reconciliation isn’t glamorous, but it’s essential. At least once a month, compare your AP ledger to your bank statements to detect duplicate payments, outstanding balances, or fraud.

A simple checklist or spreadsheet can help you track this process. If your AP volume is high, integrating with an accounting system or software can make reconciliations faster by highlighting inconsistencies so you can address them immediately.

Keeping your accounts accurate not only ensures smooth operations but also helps you maintain strong internal controls during audits or end-of-year reporting.

How to measure your AP management initiatives

Once you make changes to your accounts payable process, you need to track results to ensure those changes are having the desired effect and your accounts payable management is on the right track. Here are four metrics to focus on:

- Days payable outstanding (DPO): DPO measures the average number of days it takes your business to pay suppliers. A high DPO might mean you're holding onto cash longer. But if it’s too high, you could damage supplier relationships. Aim for a balanced DPO that supports cash flow without risking delayed payments or missed discounts.

- Invoice processing time: Track how long it takes to process an invoice from receipt to payment. The faster your AP workflow, the more efficient your accounts payable process is. Shorter processing times reduce bottlenecks and help you avoid late payment fees.

- Payment accuracy: Monitoring the accuracy of your vendor payments helps ensure you’re not making duplicate payments, overpaying, or underpaying invoices. Automation can help reduce these errors, but it’s still important to regularly check this metric.

- Number of late payments: One of the clearest indicators of poor AP management is frequent late payments. A low number of missed payments shows you’re staying on top of your payables, avoiding late fees, and keeping vendors happy.

Leveraging an accounts payable management system that can run detailed reports helps you track these AP metrics over time and see where improvements happen—or where there’s still room to grow.

Regularly reviewing reports can help you spot trends, improve your processes, monitor AP ROI, and keep your AP system running smoothly. By measuring these key areas, you'll know if your efforts to manage accounts payable more effectively are truly paying off.

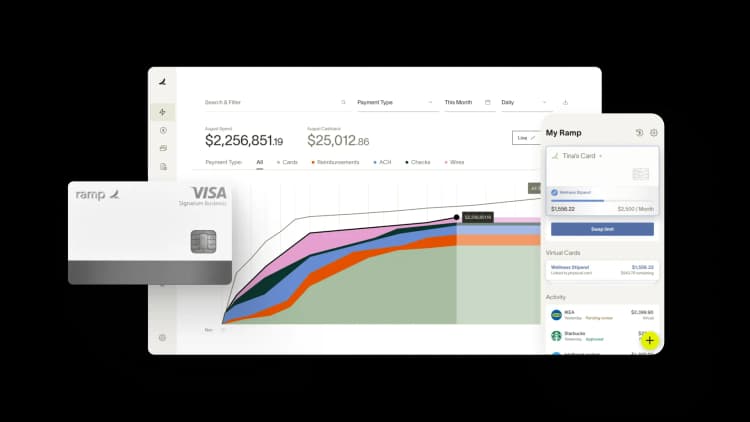

Why Ramp Bill Pay is the best way to manage AP

Ramp Bill Pay converts AP into a zero-touch workflow. Four AI agents work in tandem to code invoices, catch fraud, write approval summaries, and execute vendor payments—all to give your team touchless AP processing. Its OCR technology delivers 99% accuracy when pulling line-item details, while also processing invoices 2.4x faster than traditional systems1.

Run Ramp Bill Pay as your primary AP system, or tie it to Ramp’s business credit cards, expense management, and procurement tools for end-to-end spend control. Businesses consistently see 95% stronger visibility into their payables after going live with Ramp2.

Top Ramp features for AP management

- Custom approval workflows: Design multi-tier authorization paths that route invoices according to department, amount, or vendor category

- Approval orchestration: Eliminates redundant steps while delivering the context approvers need for informed decisions

- Roles and permissions: Control who views, modifies, and authorizes transactions through detailed access settings

- Real-time invoice tracking: See where every invoice stands from submission through final disbursement

- Automated PO matching: Compares invoices to purchase orders using two-way and three-way verification, catching discrepancies before you authorize disbursement

- Batch payments: Execute multiple vendor disbursements simultaneously rather than individually

- Recurring bills: Schedule automatic payment execution for subscription services and regular vendor invoices

- Ramp Vendor Network: Work with pre-authenticated suppliers who receive faster payment processing

- Vendor Portal: Let vendors securely update payment details, view payment status, and communicate with your AP team

- Bulk W-9 collection: Issue a single request to vendors for tax documentation and electronic signatures rather than following up individually

- AI-powered 1099 prep: Ramp automatically maps bill pay spend to 1099-NEC and 1099-MISC boxes with calculations done for you

- One-click IRS filing: File directly with the IRS and eligible states in minutes—no extra portals or logins

- Four AI agents: Automatically code invoices, scan for anomalies in billing patterns, compile approval summaries, and process card-eligible invoices directly through supplier payment portals

- Intelligent invoice capture: Reads and digitizes every field on incoming invoices with 99% accuracy

Why Ramp Bill Pay is the right choice

Ramp Bill Pay redefines what modern AP should look like: accurate, autonomous, touchless, and fast. Over 2,100 verified G2 reviews give Ramp a 4.8-star rating, and users consistently rank it as one of the easiest AP platforms to use. Finance leaders turn to Ramp to cut out busywork, prevent costly mistakes, and finish month-end close faster.

You don't have to use Ramp's other products to get value from Ramp Bill Pay—it's a complete AP solution on its own. But if your team is looking to manage bill payments, card spending, employee expenses, and procurement in one system, Ramp also provides a unified platform to make it happen. Set it up the way your business needs it.

Start off with Ramp's free plan for essential AP automation capabilities, or try Ramp Plus at $15 per user per month for more advanced features.

Modern AP shouldn't require constant oversight. Ramp Bill Pay fixes that.

1. Based on Ramp’s customer survey collected in May’25

2. Based on Ramp's customer survey collected in May’25

Don't miss these

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits