Picking AP software is hard: Here are 10 must-know tips

- Why choosing the right AP automation software is so difficult

- 10 specific tips for choosing AP software that actually fits your business

- What 'best' looks like depends on your business

- How Ramp Bill Pay simplifies AP—by delivering on these 10 tips

- Why choose Ramp Bill Pay?

The accounts payable (AP) software market has grown quickly in recent years, offering finance teams a long list of tools to evaluate. But with such variety—different features, pricing models, and levels of complexity—it can be difficult to figure out what really matters for your team. Many guides offer similar checklists, but few focus on what will actually help your business choose the right solution.

We share 10 practical tips for picking the best AP automation software based on your team’s workflow, goals, and challenges—not just what’s trending or feature-heavy.

Why choosing the right AP automation software is so difficult

There’s no shortage of AP tools promising to streamline payments or eliminate paperwork. But finding the right solution is more complicated than it seems—because every business approaches accounts payable differently.

- Small teams often need help getting out of spreadsheets and email-based approvals, but don’t have the time or IT support to implement complex systems

- Mid-market companies are usually focused on scale: routing invoices efficiently, handling growing vendor lists, and avoiding costly errors as volume increases

- Large enterprise teams are balancing multi-entity structures, strict compliance, and deep ERP integrations—while trying not to slow down operations

Plenty of recommendations boil down to the same thing: automate, integrate, customize. But that advice alone isn’t useful without context.

The real challenge is knowing what your team needs on day one, and being able to filter out what doesn’t apply. That’s where this discussion begins—by helping you break down your process, identify where the friction is, and pick software that supports the way you already work (with room to grow).

10 specific tips for choosing AP software that actually fits your business

Before we begin, here’s a quick preview of the 10 areas this guide will cover—so you know what to expect before diving in:

- Start with your process map to understand your actual AP flow

- Prioritize tools with strong ERP and system integrations

- Make sure duplicate payment detection comes standard

- Look for multi-currency support if you work with global vendors

- Choose software with customizable AP approval workflows

- Consider built-in procurement features for end-to-end visibility

- Evaluate reporting and analytics for smarter decisions

- Pick a platform that can scale with your business

- Verify security controls and compliance readiness

- Think about ROI beyond the subscription cost

Now let’s take a closer look at each tip to help you pick the right AP automation software for your team.

1. Start with your process map: Know your AP landscape

Before implementing AP software, map out how your accounts payable process works today. That includes how invoices come in, how approvals are routed, and what steps happen before a payment is released. This exercise makes it easier to spot bottlenecks, inconsistencies, or manual tasks that the right AP automation tool could solve.

Think about the types of invoices you process. For example, if your team handles mostly purchase order-based invoices, you’ll need strong three-way matching. If you work more with non-PO invoices, look for software that supports flexible routing and account coding.

This step creates a clear framework for your evaluation. Rather than getting distracted by broad feature lists, you can focus on tools that solve the right problems.

2. Prioritize ERP and system integration for seamless operations

One of the biggest signs you’ve picked the right solution is how well it integrates with the tools you already use. AP tools with two-way ERP syncs ensures that vendor records, GL codes, and payment data stay consistent across systems—without manual duplication.

A well-integrated platform reduces reconciliation issues, improves reporting accuracy, and keeps your team from switching between systems to chase down information. This is especially useful as invoice volumes grow or as your approval chains get more complex.

When evaluating tools, don’t stop at ERP. Look for platforms that connect with procurement tools, payment processors, and your general ledger. The best AP automation software supports a connected finance stack, not a siloed one.

3. Choose tools that detect duplicate payments

The inability to detect duplicate payments is a real financial risk. They lead to unnecessary spend, messy accounting cleanups, and strained vendor relationships. For growing teams, manual checks just aren’t scalable.

The best AP automation platforms use built-in logic to catch potential duplicates by scanning for overlaps in invoice numbers, vendors, dates, and amounts. These alerts prevent errors before funds go out the door—and they should come standard, not as a paid add-on.

As your volume increases, having strong duplicate detection helps your team stay confident in their process and reduce time spent on corrections.

4. Ensure multi-currency support for global vendors

If your vendor base includes international suppliers—or if you’re planning to expand—multi-currency support is a must. Without it, your team could be stuck doing manual conversions, tracking exchange rates separately, or chasing down errors after the fact.

Look for tools that automatically handle exchange rate updates, let you pay vendors in their local currency, and stay compliant with regional tax and payment regulations. Beyond processing, strong multi-currency features also help with consolidated reporting and give you better visibility into your global cash position.

Good AP software should scale with your geography, not slow it down.

5. Customize your AP approval workflows to match real life

AP approval chains don’t always follow a neat structure. Sometimes it depends on vendor type, department, invoice size, or who’s out of office. That’s why choosing the right AP automation software often comes down to how easily you can set up and adjust approval workflows.

Look for tools that let you build custom rules without needing IT support. Things like mobile approvals, role-based access, and automated reminders help keep things moving—especially when decision-makers are busy or traveling.

The goal is to mirror your actual decision-making process, not force your team to fit into someone else’s template. Software that adapts to your workflow is much more likely to deliver long-term value.

Are you a small business?

Check out our recommendations for small business AP software.

6. Look for built-in procurement features to improve visibility

When procurement and accounts payable live in separate systems, it's easy to lose track of spending. You might approve purchases without realizing they’ve already exceeded the budget, or miss a step when reconciling an invoice with a purchase order.

That’s why choosing the right AP automation software often includes a discussion around embedded procurement features. A unified system improves visibility by connecting the full procure-to-pay process, from purchase request to final payment. This helps reduce accounts payable discrepancies and improves budget discipline.

Look for platforms that offer native procurement tools—not just integrations. Purpose-built features tend to provide better data consistency and a smoother experience for your team.

7. Choose tools with strong analytics and reporting

Accounts payable software shouldn’t just move invoices from one step to another. It should help you understand what’s happening with your spending.

The best AP tools include dashboards and reports that show key metrics like vendor performance, invoice cycle times, and spending by department. Strong reporting makes it easier to spot patterns, flag bottlenecks, and plan more strategically.

Some platforms go further, offering predictive analytics or benchmarking to help you optimize payment timing and working capital. These features tie your AP operations into bigger finance goals—like improving cash forecasting or reducing Days Payable Outstanding (DPO).

8. Pick a platform that scales as you grow

What works for a 10-person team might fall short once your business doubles in size. Choosing the best AP automation software means thinking not just about today’s needs, but tomorrow’s as well.

Scalable platforms handle increasing invoice volumes, more complex approval chains, and multiple entities without slowing you down. Look for solutions that are cloud-based, regularly updated, and have clear product roadmaps. That shows a commitment to long-term value, not just quick wins.

Cloud-native systems also offer practical benefits like uptime reliability, no-downtime updates, and resource flexibility during peak periods.

9. Make sure it checks the boxes on security and compliance

Any tool handling your payables should meet strict standards for data protection, access control, and auditability. This isn’t just an IT concern—it’s a must-have for finance teams operating in regulated industries or under strict accounts payable internal controls.

When you're picking the right AP software, ask vendors about:

- Encryption standards

- Role-based access permissions

- Audit logs that track every user action

- Compliance with frameworks like SOC 2, GDPR, and Sarbanes-Oxley

A trustworthy provider will have third-party certifications, clear security documentation, and transparent answers during your evaluation process.

10. Think beyond price when evaluating ROI

Sticker price is only part of the story. To understand the real cost savings of accounts payable automation, consider implementation time, training needs, ongoing support, and how much internal effort will be required to manage the system.

On the other side of the equation, think about time saved, error reduction, and potential gains from early payment discounts. Often, a platform with a slightly higher monthly cost can pay for itself through better automation and stronger controls.

Look for pricing models that match your business. Usage-based pricing can make sense if your invoice volume fluctuates, while flat fees may work better if you need predictability. Thinking beyond price will help you truly evaluate the ROI of the AP software you'll choose.

Companies are reducing invoice processing time by 50% or more with automation. See the results in these AP automation case studies.

What 'best' looks like depends on your business

There's no universal "best" AP automation solution—only the right match for your specific business needs. What works for a multinational with hundreds of entities won’t necessarily work for a startup building its first finance stack. That’s why picking the best solution starts with understanding your workflow, team structure, and goals.

This decision should be a discussion across teams:

- Finance can define approval logic and risk controls

- Ops teams understand where bottlenecks happen

- IT can speak to integrations and data syncs

- Procurement can weigh in on vendor management

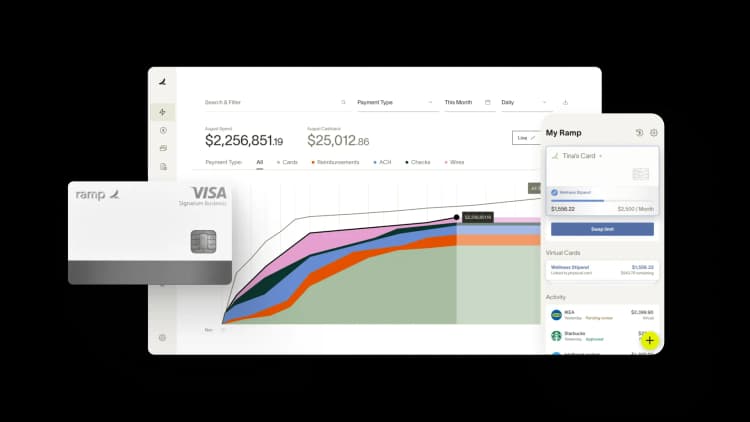

How Ramp Bill Pay simplifies AP—by delivering on these 10 tips

If you’ve made it through the tips, you’ve likely noticed a common theme: the best AP automation software is the one that fits your actual workflow, scales with your team, and removes friction without adding complexity. Ramp Bill Pay was built with those exact goals in mind.

Ramp Bill Pay is an autonomous AP automation platform, powered by four AI agents that handle invoice coding, fraud detection, approval summaries, and card-based payments without manual intervention. With 99% accurate OCR and intelligent line-item capture, Ramp delivers touchless invoice processing that's 2.4x faster than legacy AP software1.

Whether you need a standalone AP solution or a unified platform that connects bill pay with corporate cards, expenses, and procurement, Ramp Bill Pay adapts to how your business operates. Up to 95% of businesses report improved visibility into their payables after using Ramp2.

Ramp Bill Pay features

AI & Automation

- Four AI agents: Automatically code transactions using historical patterns, detect fraud before payments go out, generate approval summaries with vendor history and pricing analysis, and complete card-eligible payments directly in vendor portals

- Intelligent invoice capture: Extracts data across every line item with 99% OCR accuracy

- Automated PO matching: Verifies invoices against purchase orders with 2-way and 3-way matching to catch overbilling before payment

Workflows & Approvals

- Custom approval workflows: Build multi-level approval chains with role-based routing tailored to your org structure

- Approval orchestration: Reduces clicks, improves visibility, and accelerates processing across reviewers

- Roles and permissions: Enforce separation of duties with granular user controls

- Real-time invoice tracking: Monitor every invoice from receipt through payment

Payments

- Payment methods: Pay vendors via ACH, corporate card, check, or wire transfer

- International payments: Send wires to 185+ countries with global spend management support

- Batch payments: Process multiple vendor payments in a single batch

- Recurring bills: Automate regular payments with recurring bill templates

- Amortization templates: Spread prepaid expenses across periods for accurate accounting

Vendor Management

- Vendor onboarding: Collect W-9s, match TINs, and track 1099 data directly in the platform

- Ramp Vendor Network: Access verified vendors who skip additional fraud checks for faster payments

- Vendor Portal: Let vendors securely update payment details, view payment status, and communicate with your AP team

Tax & Compliance

- Bulk W-9 collection: Request all W-9s and e-consent at once instead of chasing vendors with one-off emails

- AI-powered 1099 prep: Ramp automatically maps bill pay spend to 1099-NEC and 1099-MISC boxes with calculations done for you

- One-click IRS filing: File directly with the IRS and eligible states in minutes—no extra portals or logins

Accounting & ERP

- Real-time ERP sync: Connect your vendor master data bidirectionally with 10 ERPs such as NetSuite, QuickBooks, Xero, Sage Intacct, and more for audit-ready books

- GL coding: Map transactions to the correct accounts with AI-assisted recommendations

- Reconciliation: Close books faster with automatic transaction matching

Why choose Ramp Bill Pay?

You can use Ramp Bill Pay as a standalone AP platform—you don't need to bundle it with anything else to get full functionality. But if you do want unified visibility across bill pay, corporate cards, expenses, and procurement, Ramp can connect everything all in one place. Choose the setup that fits how your team actually works.

Ramp Bill Pay sets a new standard for touchless, accurate, and fast AP processing. And don’t just take our word for it. Ramp ranks among the most user-friendly AP platforms on G2, backed by over 2,100 verified reviews and a 4.8 out of 5 star rating. Finance teams choose Ramp to eliminate manual work, catch errors before they become problems, and close books faster.

Getting started is easy: Ramp's free tier includes core AP automation, with advanced features available on Ramp Plus for $15 per user per month.

AP should be easy. Now it is. Try Ramp Bill Pay.

1. Based on Ramp’s customer survey collected in May’25

2. Based on Ramp's customer survey collected in May’25

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits