Does Xero have OCR? How it works, costs, and integrations

- What is Xero OCR?

- How does Xero OCR work?

- How much does Hubdoc through Xero cost?

- What are the benefits of invoice capture?

- How to choose the right invoice capture tool to use with Xero

- How Ramp Bill Pay provides advanced OCR and AP features

- Why the right OCR solution makes all the difference

Xero doesn’t have a built-in OCR solution, but it does provide automated data capture through Hubdoc. For businesses using Hubdoc as a part of their Xero subscription, it’s a convenient tool for basic invoice automation.

For companies with higher invoice volumes, complex approval workflows, or the need for PO matching, the option to integrate with other third-party AP automation solutions is also available.

Let’s break down how Xero OCR (via Hubdoc) works and explore integrations for businesses needing additional invoice capture capabilities.

What is Xero OCR?

Xero OCR refers to Xero’s document data capture capabilities, primarily powered by Hubdoc, a tool included with Xero business subscriptions.

While Xero itself does not have a built-in OCR tool, Hubdoc extracts key details from bills, receipts, and bank statements. Businesses can upload documents via email, mobile app, or scan, allowing Hubdoc to automatically pull vendor names, invoice numbers, amounts, and due dates to create draft transactions in Xero.

How does Xero OCR work?

Xero OCR, powered by Hubdoc, automates document processing and reduces manual data entry through the following key capabilities:

- Automated document capture: Users can email, scan, or upload bills and receipts, and Hubdoc extracts key details.

- Data recognition: OCR extracts vendor names, invoice numbers, amounts, and due dates, reducing the need for manual entry.

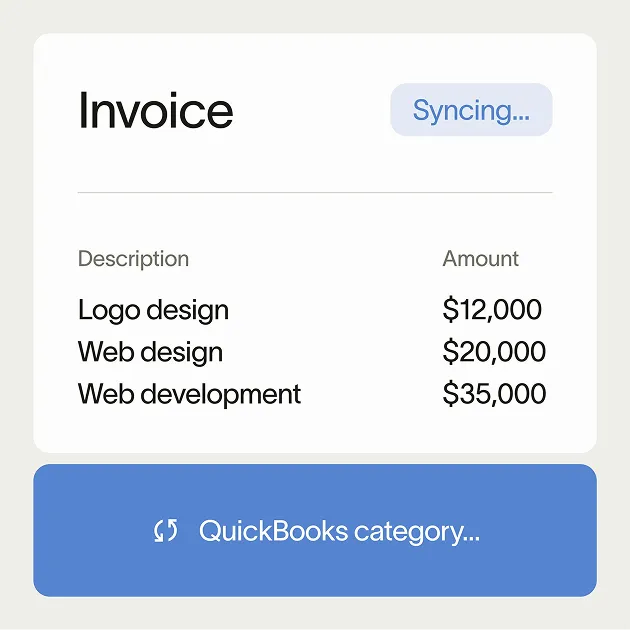

- Xero integration: Extracted data is used to create draft invoices, bills, and transactions within Xero.

- Bank statement extraction: Hubdoc can convert PDF bank statements into CSV files, making it easier to import transaction data.

- Cloud-based document storage: All uploaded files are stored in Hubdoc, searchable and accessible from anywhere.

How much does Hubdoc through Xero cost?

To use Xero OCR, businesses must have an active Xero subscription with Hubdoc included. Hubdoc is included with Xero’s Business Edition plans. However, businesses using Xero Partner Edition may need to purchase Hubdoc separately, since it’s not bundled with their subscription.

Since Xero follows a tiered pricing model, the cost of accessing Hubdoc depends on the chosen Xero plan. Pricing details for Xero plans can be found on Xero’s official website.

Tip: If your company needs automation features beyond OCR, start by looking at the best AP software built for small businesses.

What are the benefits of invoice capture?

Invoice capture and OCR provides several advantages for businesses looking to simplify invoice processing:

- Reduces manual workload: Automating data extraction minimizes time spent on manual entry, allowing AP teams to focus on reviewing and approving invoices.

- Speeds up invoice processing: By eliminating the need to enter invoice details manually, OCR helps businesses process supplier bills faster.

- Improves financial accuracy: OCR reduces human input errors, ensuring that key invoice details (like amounts and due dates) are captured correctly.

- Improves cash flow control: Faster invoice approvals and automated workflows help businesses manage payments more predictably, reducing late invoice fees and optimizing cash flow.

How to choose the right invoice capture tool to use with Xero

When evaluating invoice capture tools for the first time, the key is finding a solution that reduces manual work, improves AP efficiency, and integrates seamlessly with your existing workflows. The right software should streamline invoice processing, minimize errors, and support your business as it scales.

Here are five critical factors to consider when selecting an invoice capture solution:

1. Smart invoice processing and automation

The best invoice automation software eliminates repetitive data entry by using AI-powered OCR to extract key details like vendor names, invoice numbers, and amounts with high accuracy. Advanced solutions continuously improve through machine learning, reducing the need for manual corrections over time.

Look for a tool that supports:

- Automated matching with purchase orders to minimize discrepancies

- Smart learning capabilities that recognize recurring vendor invoices

- Multiple invoice formats, including PDFs, email attachments, and scanned documents

2. Seamless integration with accounting software

If you're using an ERP or accounting platform, your invoice capture solution should integrate without adding unnecessary steps. The ideal tool should:

- Sync invoice data automatically, eliminating manual transfers

- Support automated GL coding and approval workflows to speed up reconciliation

- Offer two- and three-way matching to verify invoice accuracy

- Prevent duplicate entries and misclassifications during data sync

3. Flexible approval workflows and vendor collaboration

A rigid payment workflow process can slow down invoice processing. The system should adapt to your organization’s approval structure while making vendor interactions more efficient.

Consider:

- Automated approval workflows that route invoices to the right approvers

- Role-based permissions to assign approvals based on invoice amount, department, or vendor

- Vendor self-service options to reduce back-and-forth communication by allowing vendors to submit and track invoices independently

4. Security, compliance, and fraud prevention

Because invoices involve financial transactions, strong security and compliance features are essential. A reliable invoice capture tool should:

- Maintain a detailed audit trail of invoice actions for transparency

- Detect duplicate payments and potential fraud before payments are processed

- Ensure tax compliance to help businesses meet regulatory requirements

5. Scalability, pricing, and ease of use

The right invoice capture solution should meet your current needs while scaling with your business as it grows. Key considerations include:

- Pricing model: Is it based on invoice volume, users, or a flat-rate subscription?

- Scalability: Can it handle higher invoice volumes efficiently without excessive costs?

- User experience: Does it have an intuitive interface that minimizes training time?

By prioritizing automation, integration, approval flexibility, security, and scalability, businesses can choose an invoice capture solution that enhances efficiency without adding complexity to their AP processes.

How Ramp Bill Pay provides advanced OCR and AP features

Before choosing an invoice capture solution, it’s important to evaluate whether it meets your business’s needs—especially if you rely on Xero for accounting. With Ramp Bill Pay, Ramp's AP automation software, OCR and other invoice automation features are supported:

Consideration | Supported by Ramp? | Details |

|---|---|---|

Invoice capture and automation | Yes | AI-powered OCR extracts invoice data. Supports PDFs, emails, and scanned invoices. Auto-matches POs. |

ERP/accounting integration | Direct for supported ERPs, UCSV for others | Provides direct integrations with select ERPs. For non-supported systems, including Xero, transactions can be synced via Universal CSV (UCSV) export. |

Approval flexibility | Yes | Customizable approval workflows with automated routing. Vendors can submit invoices through a self-service portal. |

Compliance and security | Yes | Real-time audit trails, fraud detection, and tax compliance (1099s, VAT, GST). |

Low costs with scalability | Yes | Offers a free standard tier, scales with business growth, and features an intuitive interface. |

Why the right OCR solution makes all the difference

An effective OCR solution should integrate smoothly with your AP workflows, reduce inefficiencies, and scale with your business.

That’s why more than 7,000 businesses trust Ramp to accelerate invoice processing and reduce errors. But don’t take it from us—Alejandro, CFO at Roof Squad, after adopting Ramp Bill Pay, said:

“The way bill pay works now is super easy. That was such a tedious process before. Now it’s just a couple clicks away, saving us about 10 hours a week, and reducing the number of errors we make.”

Investing in a flexible, high-performing accounts payable system with invoice scanning and OCR leads to faster approvals, fewer manual corrections, and a more efficient AP process.

Start processing invoices faster with Ramp's integration with Xero.

Don't miss these

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits