Xero AP automation: A guide on how Xero AP functions work

- What is Xero accounts payable software?

- How does using Xero with AP automation tools work?

- How to integrate AP automation software with Xero

- What to do when you’re all set up

- Using Ramp AP software alongside Xero

- How integrating Ramp has helped businesses improve AP management

- Maximize your Xero software with Ramp AP automation

Managing accounts payable manually can be overwhelming, taking up valuable time and leaving room for costly errors. Xero’s accounting software includes AP features that help ease the burden by automating essential tasks like bill entry and payment reconciliation, giving small businesses a clearer path to staying organized and accurate.

At the same time, integrating Xero with third-party AP automation tools like Ramp can provide another layer of efficiency and control.

We’ll walk through how Xero’s accounts payable features work and show how combining it with software like Ramp can create a smooth AP experience for your business.

What is Xero accounts payable software?

While Xero includes accounts payable features, it’s primarily a cloud-based accounting software designed to help small businesses manage their finances, including billing, invoicing, and payment processes.

Within its broader functionality, Xero’s accounts payable tools simplify tasks like bill entry, approval tracking, and payment reconciliation, making it easier for businesses to save time and reduce errors.

For businesses requiring more advanced AP capabilities—such as OCR data extraction, custom workflows, or detailed invoice approvals—third-party AP automation tools can be used alongside Xero to fill these gaps.

But before exploring how these integrations work, let’s take a closer look at how Xero’s built-in functions can help optimize your accounts payable workflows:

- Bill capture: Upload bills directly from your email or desktop using Xero’s integrated tool, Hubdoc.

- Streamlined approvals: Assign roles and permissions to control who can create and approve bills, ensuring secure and accurate approvals.

- Duplicate detection: Xero flags duplicate bills automatically, helping prevent costly errors and potential fraud.

- Simplified payments: Schedule and pay multiple bills at once by exporting payment files from Xero to your bank.

- Automated reconciliation: Match payments to your bank transactions automatically, ensuring your records are always up-to-date.

How does using Xero with AP automation tools work?

Xero’s accounts payable capabilities can be enhanced through integrations. For instance, Xero's OCR capabailities are not natively built-in. They have to integrate with tools like Hubdoc, included in Xero subscription plans like Early, Growing, or Established, to allows users to capture and process data from bills and receipt.

But while Hubdoc simplifies document capture and organization, its focus is on digitizing financial records rather than full AP automation. For businesses requiring more robust automation, using Xero accounting software with third-party tools like Ramp provides additional features and capabilities to enhance efficiency and control.

Ramp offers advanced features such as OCR for accurate data extraction, invoice approval automation, customizable workflows, and real-time insights, creating a comprehensive AP automation experience.

This integration enables businesses to efficiently manage complex AP workflows by leveraging Ramp’s advanced capabilities, effectively complementing Xero’s accounting features. We’ll explore the full details of Ramp's AP tools shortly after reviewing best practices for setting up Xero software.

How to integrate AP automation software with Xero

To unlock additional AP automation capabilities with Xero, integrating with third-party tools is essential. These integrations bridge the gap by adding advanced features like workflow customization and invoice matching, allowing you to streamline your accounts payable processes effectively.

Though the steps may vary, here’s a general overview on how to get started:

- Choose the right third-party tool: Research approved AP automation solutions that work well with Xero to meet your specific business needs.

- Connect your Xero account: Log in to the third-party platform and follow its configurations, which typically includes connecting your Xero account securely via an API module.

- Map accounts and vendors: Use the integration’s setup tools to map expense categories, vendors, and account codes, ensuring a smooth transition between Xero and the automation software.

- Sync your data: Use the third-party tool to sync bills, invoices, and other AP-related data between Xero.

- Configure workflows: Set up approval hierarchies, routing rules, and automation triggers in the integrated tool to handle exceptions, recurring invoices, or other unique AP scenarios.

Configuring workflows allows you to create a process tailored to your business needs. Assign roles to team members, set approval thresholds, and establish rules for managing non-standard invoices with ease.

What to do when you’re all set up

Once you’ve configured your AP automation tool, your accounts payable process can become more efficient by following a few best practices. Here’s some to keep in mind:

- Bill management: Regularly audit uploaded bills for accuracy and ensure all necessary details are captured before approval to maintain clean financial records.

- Approval workflows: Customize workflows to align with your internal processes, such as routing high-value invoices to senior approvers, to keep operations smooth and compliant.

- Simplified payments: Schedule payments in advance to optimize cash flow and avoid late fees while regularly monitoring payment statuses to address any issues promptly.

- Cash flow visibility: Reconcile accounts daily to catch discrepancies early and ensure your records remain accurate and actionable.

With these capabilities in place, Xero serves as a foundational accounting tool for managing AP processes, especially when enhanced with advanced third-party automation tools.

Using Ramp AP software alongside Xero

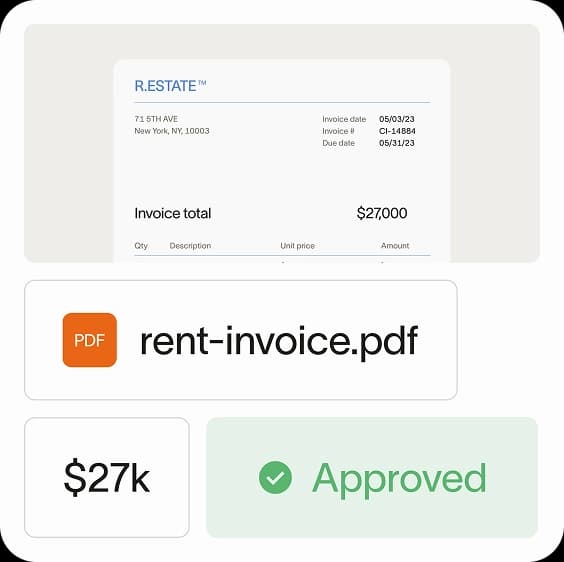

As we’ve touched on earlier, using Xero with Ramp's AP software helps address gaps in advanced workflows and AP efficiency.

Here’s what Ramp AP software offers when integrated with Xero:

- Data synchronization: Ramp pulls essential data from Xero, including your Chart of Accounts, Project Information, Contacts, and Tracking Categories, ensuring alignment between the two systems.

- Bill integration: Link a single bill to multiple card transactions with Xero, import bills from Xero into Ramp, and pay them using Ramp Bill Pay.

- International Bill Pay: Ramp supports international bill payments for Xero users, making it easier to manage global transactions efficiently.

- Vendor creation: When a new vendor is detected, Ramp allows you to create the vendor directly within Ramp. It will appear in Xero’s Contact column as “New:...” and sync to Xero upon creation.

Together, Ramp and Xero streamline complex workflows, reduce manual effort, and keep your focus on running your business, not chasing payments.

How integrating Ramp has helped businesses improve AP management

Ramp doesn’t have a formal AP automation case study with Xero (yet). However, our integrations with other leading ERPs and accounting platforms showcase the significant business impact you can expect when pairing Ramp with Xero.

Ramp and NetSuite integration: Precision Neuroscience’s experience

Precision Neuroscience, a med-tech company, had fragmented procurement and accounts payables process became unsustainable, requiring significant time spent on manual data entry across multiple platforms. This disjointed system led to frequent errors and inefficiencies, impacting both the finance team and other employees.

By integrating Ramp with NetSuite, Precision Neuroscience replaced its outdated setup with a single, automated platform for procurement and AP management. The new system eliminated unnecessary tools and provided the team with a centralized, easy-to-use solution.

For Precision Neuroscience, Ramp's seamless integration with their systems and advanced features resulted in:

- Significant time savings: Ramp’s OCR automated data entry for 20–30 POs weekly, freeing up time for higher-value tasks.

- Error reduction: Ramp flagged duplicate invoices automatically, preventing unnecessary approvals and wasted effort.

- Streamlined month-end close: Precision Neuroscience reduced month-end close from several days to just 1–2 days.

- 50% faster procurement process: Automatic AP approval flows enabled quicker purchase order (PO) submission and vendor communication.

"Ramp’s OCR has been so useful on the procurement side," said Brian Lautenbach, Financial Controller at Precision Neuroscience. "It automatically takes all the information from the quote and saves all the data entry that we would have otherwise had to type into a purchase order.”

Maximize your Xero software with Ramp AP automation

Pairing Xero with third-party AP tools like Ramp Bill Pay simplifies and optimizes accounts payable management. Xero accounting software provides essential tools for managing bills and payments, while Ramp adds advanced automation features designed to scale with your business.

Take control of your accounts payable. Learn more about Ramp and how it integrates with Xero.

Don't miss these

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits

“More vendors are allowing for discounts now, because they're seeing the quick payment. That started with Ramp—getting everyone paid on time. We'll get a 1-2% discount for paying early. That doesn't sound like a lot, but when you're dealing with hundreds of millions of dollars, it does add up.”

James Hardy

CFO, SAM Construction Group