How to apply for and get a business credit card

- Who can get a business credit card?

- What do you need to qualify for a business credit card?

- Business credit card application requirements

- How to apply for a business credit card

- How to choose the right business credit card for your company

- Traditional vs. modern business cards

- Why companies are choosing Ramp for business spending

- Get a Ramp Business Credit Card based on your business revenue

A business credit card can be one of the most useful tools for managing company spending — but knowing how to qualify and apply is just as important as choosing the right one. Whether you’re running a new startup or managing a growing team, understanding what issuers look for can help you secure a card that supports your company’s next stage of growth.

Most business credit card applications can be completed online in just a few minutes. You’ll typically need to provide your company details, financial information, and supporting documents like bank statements or tax returns.

Once approved, a business credit card helps you separate personal and business expenses, build credit and earn rewards on everyday purchases — giving your company more flexibility and access to better financing options as it grows.

Who can get a business credit card?

You don’t need to be a large company to qualify. If you earn money on your own — whether as a freelancer, consultant, or startup founder — you can usually apply with your Social Security number or Employer Identification Number. Issuers mainly review your personal credit and basic business details.

You may be eligible if you:

- Operate as a sole proprietor, LLC, or corporation

- Have freelance or self-employed income

- Can show consistent revenue or available cash flow

- Use a dedicated business bank account

Even early-stage businesses can qualify, especially with strong personal credit. This is a key difference between traditional and modern issuers: while some banks still rely heavily on credit scores, others—like Ramp—evaluate your company’s financial performance and available funds.

Why your business benefits from a credit card

Business credit cards provide structure, control, and growth opportunities that other payment methods simply can't offer, making them essential financial tools rather than just a convenience.

- Keep business and personal spending separate for cleaner books and easier tax prep

- Build business credit and unlock access to future financing

- Earn rewards on recurring purchases

- Use built-in spend controls and automation to save time and prevent errors

How do you know it's time to get a credit card for your business?

If you're regularly mixing personal and business expenses, spending hours on expense tracking, or finding yourself short on cash between client payments, it's probably time for a dedicated business card. Most businesses benefit from a separate card as soon as they start making regular purchases or have predictable revenue, even at early stages. The sooner you establish this financial foundation, the easier it becomes to manage growth when it happens.

What do you need to qualify for a business credit card?

To qualify for a business credit card, issuers look for signs that your company is active, stable, and capable of managing ongoing payments. You don’t need years of revenue history — but you do need to show you’re operating a legitimate business with predictable cash flow.

In most cases, you’ll need:

- A business name or legal entity, or your own name if you’re a sole proprietor

- A business bank account or evidence of self-employment income

- A tax identification number (EIN or SSN)

- Contact and ownership information for major stakeholders

- A strong personal credit score for traditional cards, or solid business financials for modern providers

Once you have these basics, you can start your application. The next section outlines what card issuers typically review and why those details matter.

Business credit card application requirements

Before you apply, it’s helpful to understand what lenders look for when evaluating a business credit card application. Most providers review both personal and business information to confirm who you are, verify your company, and gauge whether your business can handle new credit responsibly.

Each card issuer weighs these factors differently, but here’s what’s typically part of the process.

Business credit card application overview

| Category | What issuers look for | Why it matters |

|---|---|---|

| Personal information | Name, date of birth, Social Security number (or ITIN), contact details, and annual income | Confirms your identity and helps determine your ability to manage repayment responsibly |

| Business information | Legal business name and address, business structure (LLC, corporation, sole proprietorship), time in business, number of employees, and industry | Verifies your company’s legitimacy and gives issuers context about how your business operates |

| Financial details | Annual business revenue, average bank balance, and expected monthly spend | Shows your company’s financial stability and ability to support a credit line |

| Tax and legal documents | Employer Identification Number (EIN) or Social Security number, and occasionally recent bank statements or tax returns | Confirms compliance and provides proof of financial standing |

| Approval factors | Personal credit score, business history, and overall risk profile | Helps issuers decide credit limits, terms, and eligibility |

Your personal details

Most business credit cards still ask for some personal information, even when your company is incorporated. This is used to verify your identity and, in many cases, assess creditworthiness.

You’ll usually be asked to share:

- Basic identifying information, such as your name, date of birth, and Social Security number or Individual Taxpayer Identification Number.

- Contact information, including your address, phone number, and email.

- Annual income from all sources, not just your business. Issuers often consider this when setting initial spending limits.

While these details are standard, the level of personal involvement varies by provider. Traditional issuers often rely on personal credit and require a personal guarantee, meaning you’re personally responsible for repayment.

Modern cards like Ramp don’t require personal guarantees or credit checks. Approval is based on your business performance, not your personal score.

Your business details

Every business card application will also ask for key information about your company. This helps issuers understand how your business operates and ensures compliance with financial regulations.

You’ll typically need to include:

- Your legal business name and contact information. Sole proprietors can use their personal name and address if they don’t have a registered company.

- Business structure, such as LLC, corporation, partnership, or sole proprietorship.

- Time in business or the date you started operating.

- Number of employees, excluding yourself.

- Industry or business category, which helps the issuer classify risk levels.

- Tax identification number (EIN or SSN, depending on your structure).

- Business revenue and expenses or an estimate of how much you expect to spend each month. Even early-stage companies can apply, and many modern issuers focus on cash flow and account balances rather than long operating histories.

In some cases, issuers may request supporting documentation, like recent bank statements or tax returns, to confirm financial stability.

Does applying for a business credit card affect my personal credit?

It depends on the type of card. With most traditional cards, yes, it often involves a personal credit check and a personal guarantee, making you personally liable for the debt. This can temporarily lower your credit score. Modern cards don’t require a personal credit check or guarantee, helping you keep business and personal finances separate.

What matters most:

All of these details help card issuers understand how your business manages money. They want to see that you have a steady flow of funds, clear financial records, and a plan to meet monthly obligations.

If your company is still new, focus on what you can control: open a business bank account, keep consistent balances, and separate personal and business expenses early on. Those habits show stability and make it easier to qualify for financing later.

Modern providers take a broader view of financial health. Instead of relying on personal credit checks or guarantees, they assess factors like your company’s revenue trends and available cash flow. That’s the approach Ramp takes. Approval is based on your business performance, not your personal credit score.

How to apply for a business credit card

You can apply for a business credit card in just a few minutes, and you typically get the decision in less than a week. Here are the steps:

1. Gather the required information

When applying for a business credit card, you should gather the following items:

- Business bank account information, like routing number, account number, and recent statements

- Ownership information, including details for anyone who owns 25% or more of the business

- Government-issued ID for yourself and any other business owners

2. Submit the online application

Most business credit card applications can be completed in 15-30 minutes:

- Go to the card issuer's website

- Complete the online form with your business details

- Double-check all information for accuracy

- Submit your application

Make sure to fill out all sections completely to avoid unnecessary delays in processing.

3. Get approved and set up your account

After approval, you can immediately access your account features:

- Generate virtual cards for immediate use or team distribution

- Connect your accounting software for automatic expense sync

- Set spending limits and approval workflows for employees

- Configure receipt capture and categorization settings

Modern cards offer immediate virtual card access upon approval, while physical cards typically arrive within 7-10 business days.

How long does approval take?

Most business credit card applications are reviewed quickly. Many issuers make decisions within a few minutes, while others may take several business days if manual review is needed.

Traditional banks tend to take longer when personal credit checks or additional documentation are required. Modern providers often approve within a day — and some, like Ramp, can issue virtual cards immediately after approval.

4. Maximize your card's value

Once your account is active:

- Review your card's specific benefits and rewards structure

- Set up automatic payment aligned with your billing cycles

- Create expense policy best practices aligned with your business needs

- Take advantage of expense tracking features to monitor costs

Some cards help you identify cost-saving opportunities through vendor comparisons, subscription management, and contract renewal alerts. Focus on using these tools to optimize your spending rather than just earning rewards.

Discover Ramp's corporate card for modern finance

How to choose the right business credit card for your company

Choosing the best business credit card isn’t just about credit limits or travel perks. It’s about finding a card that fits the way your company actually spends. When Candid switched to Ramp, for example, their cashback earnings jumped from under 5% to 14%, saving more than $40,000 in a year. The right match between spending patterns and rewards can unlock serious value.

Here’s what to keep in mind:

Match your spending patterns

Start by reviewing your biggest expense categories from the past year. If your team travels often, prioritize cards with travel rewards or no foreign transaction fees. If your expenses are more evenly distributed, a flat-rate cashback card may give you more consistent returns.

Look beyond rewards

A high rewards rate doesn’t mean much if fees or friction eat into savings. Compare annual fees, interest charges, and expense management features side by side. Sometimes a simpler card with built-in automation offers more long-term value than a perk-heavy card that requires manual tracking.

Assess integration capabilities

Choose a card that connects directly to your accounting tools and allows you to set spending controls for employees. Automation, receipt capture, and category tagging can save your finance team hours each month and reduce the chance of manual errors.

Weigh employee card management

If multiple team members need access to company funds, prioritize cards that make it easy to issue and manage employee cards. Consider whether you’ll need to set individual spending limits, restrict purchases by merchant category, or generate virtual cards for one-time transactions.

Plan for growth

Look for flexibility as your business scales. Some issuers automatically adjust credit limits based on performance, while others require manual requests. If you’re growing fast, choose a card that evolves with your business rather than one you’ll outgrow in a year.

Once you’ve compared features and costs, it’s worth understanding how traditional and modern cards differ.

Traditional vs. modern business cards

Business credit cards have evolved from simple payment tools into financial management platforms. Traditional cards handle transactions and rewards. Modern cards turn those same payments into real-time data your finance team can use to control spend and close the books faster.

Traditional cards often mean manual uploads, delayed insights, and reactive management. You only spot overspending or duplicate charges after the fact. Modern cards integrate directly with your financial systems, automatically enforce spending policies, and capture receipts the moment a purchase happens — so your visibility and control are always up to date.

Here's how the two types of cards compare:

Feature | Traditional credit cards | Modern business cards |

|---|---|---|

Approval basis | Primarily based on personal credit score. | Based on company financials; minimal or no personal credit check |

Spending limits | Fixed credit limits determined by issuer. | Dynamic limits based on real-time company financial data |

Interest charges | Average APR around 24.28% as of May 2025 | Typically require full monthly payment; many offer no interest charges |

Rewards | Points or cash back on purchases (often focused on travel rewards, statement credits) | Savings through negotiated vendor discounts and spend analysis |

Expense management | Basic transaction reporting; often manual | Comprehensive software with approval workflows and real-time tracking |

Receipt tracking | Manual submission by cardholders | Automated capture through mobile apps and software integrations |

Accounting integration | Basic data export; manual entry into accounting systems | Real-time, two-way synchronization with accounting platforms |

Employee cards | Available with limited controls over spending | Customizable permissions, spending rules, and real-time controls. |

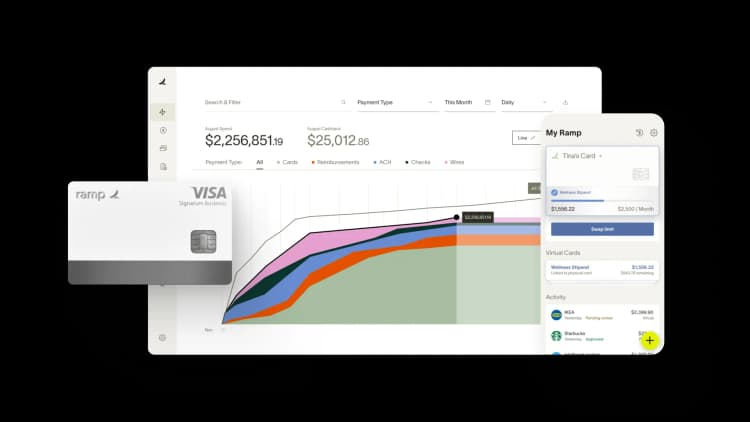

Why companies are choosing Ramp for business spending

Companies choose Ramp because it transforms credit cards into a finance automation platform that helps teams eliminate manual work, find savings, and close their books faster. Instead of just processing payments, Ramp brings expense management, accounting automation, and spend controls into one connected system.

Finance teams save hours each month through automated expense review, fraud detection, and real-time policy enforcement. Ramp’s AI reviews transactions instantly, flags policy issues before they become problems, and syncs approved expenses directly to accounting tools.

Companies like Marqeta and New Way Landscape have seen the impact firsthand:

- Marqeta cut corporate card admin time by 87%, freeing up hours each month for analysis instead of data entry.

- New Way Landscape, a fast-growing landscaping company, replaced a slow, manual card distribution process with flexible controls that made it easier to issue and manage employee cards in minutes.

Across thousands of customers, these time savings add up. Businesses using Ramp typically reduce wasteful spend by around 5% and reclaim hundreds of hours every year through automation.

Unlike traditional credit cards, Ramp evaluates your business based on its financial health rather than personal credit scores, making it accessible to companies whose fundamentals are stronger than the founder’s credit history.

Get a Ramp Business Credit Card based on your business revenue

The right business credit card should do more than process payments — it should give you visibility, control, and value as you grow.

Before you apply, consider your priorities. Do you need stronger expense tracking for your growing team? Want to maximize rewards on everyday purchases? Or are you looking to build credit for future financing? Some cards focus on one area, while others balance all three.

Ramp combines these advantages with features designed for modern finance teams — cashback on every purchase, real-time visibility into company spending, and automated expense management.

See if you're eligible for Ramp’s modern corporate business credit card.

FAQs

Small business credit cards are available to owners of businesses of all sizes and enterprises, including sole proprietors, freelancers, gig workers, and independent contractors.

It’s possible, but your options may be limited. Some issuers offer secured business credit cards, which require a refundable deposit and can help you rebuild your credit over time. Others evaluate your company’s financial performance instead of relying on personal credit scores. Modern providers like Ramp approve based on business metrics, making them accessible even if you have bad credit or limited credit history.

Look for cards that align with your LLC’s cash flow and everyday spending. Prioritize options that offer rewards on your most common expenses and support multiple employee cards with built-in spend controls. If your business is new, consider cards that evaluate company revenue or financial performance instead of personal credit — a helpful approach for startups and newer LLCs.

If denied, you'll receive a notice explaining the reasons, which often include insufficient revenue, poor credit history, or incomplete documentation. You can reapply after addressing these issues, typically waiting 30-90 days. Consider applying with a different issuer that has more flexible requirements, or look into modern cards that evaluate based on business financials rather than personal credit scores.

Revenue requirements vary widely by issuer. Traditional cards may require $50,000-$100,000 in annual revenue, while others accept businesses with as little as $10,000-$25,000 annually. Some modern card providers focus more on cash flow and bank balance rather than setting strict revenue minimums, making them accessible to newer or smaller businesses.

Most traditional business credit cards require a personal guarantee, making you personally liable for the debt and requiring a personal credit check. However, some modern business cards don't require personal guarantees, allowing you to keep business and personal finances completely separate while building business credit independently.

Don't miss these

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide.” ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn’t just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn’t exist in Zip. It’s made approvals much faster because decision-makers aren’t chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits

“More vendors are allowing for discounts now, because they’re seeing the quick payment. That started with Ramp—getting everyone paid on time. We’ll get a 1-2% discount for paying early. That doesn’t sound like a lot, but when you’re dealing with hundreds of millions of dollars, it does add up.”

James Hardy

CFO, SAM Construction Group