How to use inventory financing to improve your cash flow

- What is inventory financing?

- Which businesses benefit most from inventory financing?

- How does inventory financing work?

- Types of inventory financing

- Pros and cons of inventory financing

- Can I get a loan on inventory?

- How do you apply for inventory financing?

- Alternatives to inventory financing

Do you need cash to meet growing inventory demand? Inventory financing can help your business prepare for seasonal rushes, expand product lines, and normalize cash flows. In this inventory financing guide, you’ll learn how to turn your existing inventory into a line of credit for your growing business.

What is inventory financing?

Inventory financing is an asset-based small business loan or line of credit that uses inventory as collateral. Your lender will offer a loan amount based on a percentage of your inventory value. If you default on the loan, they’ll seize and sell your remaining inventory to recover their losses.

Which businesses benefit most from inventory financing?

Companies that keep large quantities of inventory on hand will benefit the most from inventory financing. Some examples of such businesses include:

- Retailers: General and specialty retailers need inventory to do business, so they can use inventory financing to keep shelves stocked even when cash reserves are short.

- Wholesalers: Wholesalers keep expansive warehouse inventories, and they can leverage them to raise cash.

- Vehicle dealerships: Dealerships face huge inventory costs when purchasing vehicles that their cash flow may not cover. They can use inventory financing to stock new vehicles while waiting for old ones to sell.

- Seasonal businesses: Some businesses face high demand during certain seasons but sell less the rest of the year. They can use inventory financing to even out their cash flow and stock up to prepare for seasonal rushes.

How does inventory financing work?

Lenders loan your company money based on your current or near-future inventory value, using that inventory as collateral. You can then purchase more inventory and pay the lender back with the money you make selling it.

For example, let’s say your business needs to buy $500,000 of new inventory to meet increased customer demand, but paying cash would push your working capital too low. You can apply for inventory financing, receive 80% of that inventory value, or $400,000, from a lender, to buy inventory without disrupting your cash flow.

Types of inventory financing

You have two types of inventory financing to choose from: an inventory loan and an inventory line of credit. Both use inventory as collateral but have different implications for your ongoing finances.

Inventory loan

Inventory loans are business loans based on your inventory value. You get a set amount of money upfront to buy new inventory. Then you make monthly payments over a fixed repayment term until you repay the loan amount. You can only get more funding by taking out another loan.

Inventory line of credit (LOC)

You can only use an inventory loan once, but with an inventory line of credit, you get money on an ongoing, as-needed basis. A lender approves your business for a credit limit based on your inventory value. You can borrow money against your LOC and pay it back as many times as you need, provided you don't exceed your credit limit.

Pros and cons of inventory financing

Inventory financing comes with benefits and drawbacks.

✅ Pro: Meet consumer demand quickly

Sometimes your current cash flows won't match customer demand. When that happens, you can use inventory funding to acquire capital and purchase additional inventory.

✅ Pro: Simple collateral terms

Traditional business loans often require you to use a combination of real estate, inventory, and other assets as collateral. Inventory financing only uses your inventory, so there are fewer assets at stake.

✅ Pro: Credit score is less important

Inventory financing lenders care about your sales history and inventory value, not your credit score, which makes this funding option more accessible to businesses with a limited credit history.

✅ Pro: Works well with any size business

This financing option isn’t just for large businesses. With inventory loans, small to medium businesses can also raise the capital they need to buy new inventory and grow.

⚠️ Con: Tough approvals

To qualify for inventory financing, you need to prove that you have experience and a profitable track record in your field. If your business is less than a year old, you may want to apply for personal or private financing instead, as qualifying for inventory financing may prove difficult.

⚠️ Con: High interest rates

Banks offer the lowest rates on inventory financing, ranging from 3-6%, but even these rates are higher than those for traditional business loans, and other lenders charge more. Inventory financing specialists typically charge between 8-20%, and online lenders' rates range from 5% to an astounding 99%. So, if your credit score is high, you may be better off opting for a traditional loan.

⚠️ Con: High loan minimums

Since setup costs for inventory financing are high, some lenders have significant minimum loan requirements, potentially as much as $500,000.

⚠️ Con: Additional costs

Applying for inventory financing comes with added costs, such as loan application fees, inventory appraisal fees, early repayment penalties, and late fees.

Can I get a loan on inventory?

Want to apply for an inventory loan? First, you need to find out if you qualify. Your business must meet the following criteria to be approved for financing.

In business for a year

Your business should be at least a year old, and the longer you’ve been in business, the higher your approval odds will be since you can show a more comprehensive sales history. New businesses rarely get approved due to their limited sales records.

Sell physical products

Lenders use your inventory as collateral for these loans, so you won’t qualify if you don’t sell physical products.

Profitable sales history

Lenders look at your past inventory and financial records to determine whether your business is profitable and whether you can repay the loan with future sales. So, when you submit your loan application, you need to include a detailed summary of your sales history that outlines your inventory turnover, profits, and sales projections.

Detailed inventory system

You need to prove to lenders that you have systems in place to sell the inventory you plan to purchase. They’ll want to see documentation on your business’s marketing plan, payment capture systems, sales outlets, and inventory projections.

How do you apply for inventory financing?

The application process for inventory financing is simple, and you can ensure it goes smoothly by following the steps below.

1. Check your eligibility and determine the loan amount your business needs

Before applying, make sure you meet the eligibility criteria for inventory financing. Lenders differ in their exact criteria for approval, but all of them look at factors like your inventory value and sales history.

Once you’ve verified your business’s eligibility, you can use financial forecasting tools to estimate your future capital needs and choose the right loan amount for your business.

2. Evaluate potential lenders

Banks, online lenders, and specialized firms all offer inventory financing, and each lender has different benefits. As you evaluate which lender is right for you, consider the following:

- Banks offer lower interest rates, but they have stricter eligibility criteria.

- Online lenders have the most lenient criteria of these options. However, the fewer requirements you fulfill, the higher your interest rates will be.

- You can get customized financing terms from specialized firms, but they may not be willing to lend you the full amount you need.

3. Gather your documents

To apply for financing, you need to provide lenders with detailed financial documentation about your business. At a minimum, these documents should include:

- Inventory lists with turnover, loss, and damage rates

- Accounting statements, such as income statements, cash flow statements, and balance sheets

- Gross margin breakdowns

- Projected inventory needs

- Financial projects

- Sales forecasts

- Business bank account statements

- Business tax returns

4. Apply and review your offers

After you apply, lenders will conduct field audits of your inventory and facilities. They’ll offer you loan terms based on the outcome of the audits and all other documentation you submit to them. You can compare terms between different lenders to determine which option is best for your business, then sign with that lender.

Alternatives to inventory financing

Inventory financing won’t be the perfect fit for every business. Here are some other financing options you can explore.

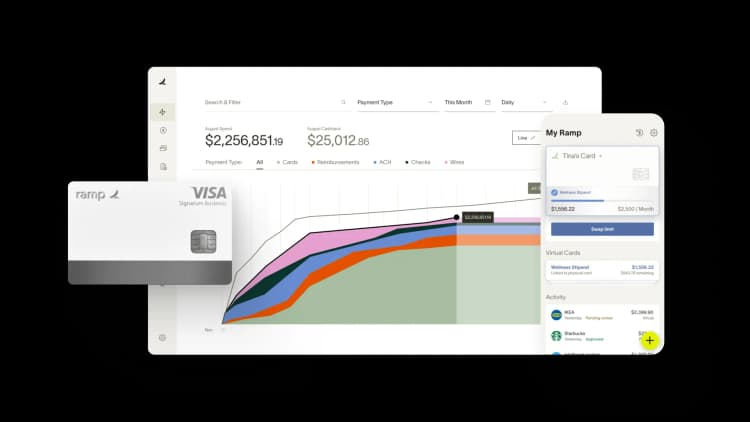

Corporate cards

Modern corporate card providers like Ramp offer commerce sales-based underwriting that allow you to access higher credit limits than traditional cards. If your business uses popular commerce platforms such as Stripe, Shopify and Amazon Business, you can see if you quality for higher credit limits and deploy more capital toward inventory.

Government loans

Depending where you do business, you can look into government business loans and other financing options, which often have better terms and lower interest rates than private lenders offer. In the United States, for example, the Small Business Administration (SBA) offers low-interest loans to qualifying businesses.

Personal loans

Interest rates on personal loans tend to be lower than on business loans, so they’re a great funding option if the loan amount you need is smaller, and you’re sure you can repay it on time. You can apply for one through your bank or an online lender.

Venture capital

Do you need significant financial backing? Then you can approach a venture capital (VC) firm or private investor about funding your business. If your company sells a SaaS product, VC firms are a great financing option, since they typically invest in technology-driven businesses. If not, private investors help back companies in any sector.

Merchant cash advance

The approval process for a merchant cash advance is quick, and you’ll have immediate access to the funds. But you’ll be borrowing against your business’s future earnings at an incredibly high interest rate, so you should only apply if you need cash immediately and can pay the advance back quickly.

Invoice factoring

With invoice factoring, or similarly accounts receivable financing, you can “sell” the value of uncollected invoices to a factoring company at a discount. The company pays you cash and assumes the risk of those uncollected invoices.

Invoice factoring (also not to mix it up with invoice financing) is a great financing choice for companies with long customer credit cycles. You may have to wait out a lengthy approval period, though, and the qualification criteria are similar to those for inventory financing.

Combining different forms of financing

You can also combine different financing options to suit your business needs. For example, using an inventory line of credit alongside a merchant cash advance gives you the flexibility to cover short-term business expenses but still address your long-term capital needs.

FAQs

If your business depends heavily on selling inventory to finance future purchases and faces seasonal demand, inventory financing might be your best choice. If you're unsure of collection times and have a strong credit history, traditional business loans or private investment might be better options.

Inventory is an asset, and for retailers it can be one of their more valuable assets. Retailers typically try to limit the amount of working capital tied up in inventory since, despite inventory usually being considered a liquid asset, it isn’t as liquid as cash and can also depreciate if retained too long. However, inventory financing enables companies to borrow against the value of their inventory.

With inventory financing, you can apply for a loan less than or equal to the full value of your inventory, on which, if approved, you could get up to 80% of the value as a loan. However, the loan amount is determined during the audit and assessment process. Once your business’s creditworthiness has been established, the lender will disclose the amount or percentage you are viable for.

Don't miss these

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide.” ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn’t just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn’t exist in Zip. It’s made approvals much faster because decision-makers aren’t chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits

“More vendors are allowing for discounts now, because they’re seeing the quick payment. That started with Ramp—getting everyone paid on time. We’ll get a 1-2% discount for paying early. That doesn’t sound like a lot, but when you’re dealing with hundreds of millions of dollars, it does add up.”

James Hardy

CFO, SAM Construction Group