AI in payments: How AI transforms transactions

- What is AI in payments?

- Current applications of AI in payments

- What are the benefits of AI in payments?

- Compliance and regulatory automation

- Implementation challenges and considerations

- AI in payments by business type

- Future trends and outlook of AI in payments

- Getting started with AI in payments

- How REVA Air Ambulance cut invoice processing time with Ramp's AI

- Streamline payments with Ramp's AI-driven AP automation

Managing payments manually is time-consuming and prone to errors. But when you match invoices automatically, process payments quickly, and flag fraud before it becomes a problem, your business benefits. That’s the power of AI in payments.

Payment processors, financial institutions, and businesses across every industry are grappling with mounting pressure to approve more transactions more quickly while blocking sophisticated fraudsters who continue to evolve their tactics.

AI-powered payment solutions directly tackle these challenges by analyzing vast amounts of data in real time to help you make smarter decisions that boost approval rates while significantly reducing fraud losses.

What is AI in payments?

AI in payments uses technology like machine learning (ML) to analyze vast amounts of transaction data and instantly decide how to process payments and spot fraud. These systems make decisions within milliseconds of a payment attempt, determining whether to approve or decline the transaction and which processing route will work best.

Whether you’re handling large volumes of payment data or juggling vendor approvals, AI simplifies complex processes and improves security. For finance teams, AI offers a clear opportunity to reduce manual work across accounts payable and receivable. With the right frameworks in place, AI can:

- Automate routine tasks: AI takes over invoice processing, payment reconciliation, and transaction approvals, freeing your team from repetitive data entry and allowing them to focus on higher-value analysis and strategic planning

- Detect and prevent fraudulent activity: Advanced algorithms continuously monitor transaction patterns across large datasets, flagging unusual activities and suspicious behaviors before they become costly problems for your business

- Improve accuracy and reduce payment failures: ML models validate payment information more precisely than manual processes, catching errors early and significantly reducing declined transactions that create delays and frustration

- Accelerate cash flow management: AI predicts payment timing patterns and identifies which customers are likely to pay late, helping you proactively manage working capital and make better decisions about credit terms

- Generate intelligent financial insights: By analyzing spending patterns and vendor relationships, AI surfaces actionable recommendations about contract negotiations, bulk purchasing opportunities, and budget optimization

- Simplify regulatory compliance: Automated systems respond to changing regulations across different jurisdictions and flag transactions that require special attention, reducing compliance risks while maintaining detailed audit trails

From invoice processing to providing real-time cash flow visibility, AI tools help finance teams work more efficiently. As of 2024, more than 70% of finance leaders actively use AI in their operations, according to PYMNTS. As AI technology continues to advance, that number will only grow.

Technologies that enable AI in payments

AI in payments relies on several key technologies working together to make your financial operations faster and more accurate than traditional manual processes.

- Machine learning models that improve over time: These are computer programs that learn from your company's payment history to improve vendor invoice management. The more payments they handle, the smarter they become at understanding your approval workflows and catching unusual invoices that might need extra review.

- Neural networks for pattern recognition: Think of these as digital assistants that can spot patterns in your vendor relationships and payment habits. They learn to recognize legitimate invoices versus suspicious ones and can flag duplicate bills or unusual payment requests that don't match your normal business patterns.

- Predictive analytics for forecasting payment behaviors: These analyze your past vendor payments to help you plan ahead. They can predict upcoming cash flow needs, identify the best times to pay invoices for early payment discounts, and alert you to potential payment delays before they happen, helping you manage your business finances more effectively.

- Generative AI for content creation and insights: This can automatically write payment summaries, generate vendor correspondence, and create financial reports. It’s a smart writing assistant that can draft emails to suppliers about payment terms, produce executive dashboards to explain spending trends, and even suggest responses to vendor inquiries.

With these capabilities, you can transform your payment operations from time-consuming manual processes into efficient, AI payment processing systems that save money, reduce errors, and free up time for strategic planning.

Traditional vs. AI-powered payment processing

Traditional payment processing relies on static, rule-based systems and manual reviews to catch fraud. This approach often generates high false positive rates, blocking legitimate transactions while missing sophisticated fraud attempts. Human reviewers can only process limited volumes, creating bottlenecks during peak periods.

AI-powered workflows learn from transaction patterns in real-time, adapting to new threats. Let’s say fraudsters start using stolen cards at gas stations between 2:00 AM and 4:00 AM in specific ZIP codes. A rule-based system would miss this pattern until you manually programmed it. AI would detect the anomaly within hours, automatically adjusting risk scores for similar transactions.

The contrast is striking: Traditional systems react slowly to known patterns, while AI proactively identifies emerging threats. This shift from reactive rules to predictive intelligence means fewer declined legitimate purchases, faster transaction approvals, and better fraud detection rates, all without increasing manual oversight.

Current applications of AI in payments

From automated invoice processing to fraud detection to personalized financial insights, AI transforms payment handling. These systems work behind the scenes, making your transactions faster, smarter, and more secure.

Here are just a few ways you can apply AI to payments:

Invoice management and payment processing

AI automates invoice workflows by matching invoices to purchase orders (POs) and receipts. With optical character recognition (OCR), AI extracts data directly from invoices, streamlining data entry and reducing errors. It can also predict payment timelines, flag inconsistencies, and recommend corrections.

Beyond basic automation, AI brings intelligence to vendor relationship management. The technology learns your payment preferences and patterns, automatically routing invoices through the right approval chains based on amount, vendor type, or department.

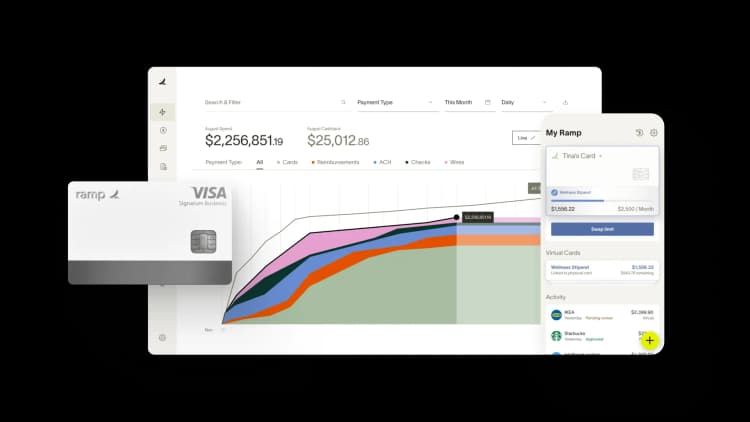

Modern AP automation software like Ramp uses AI to automate invoice approvals, monitor spend, and sync with accounting systems. As a result, finance teams can close their books faster and optimize cash flow.

Fraud detection and risk management

AI strengthens fraud prevention by scanning transactions in real time and flagging transactions that are out of the ordinary. AI algorithms can spot anomalies such as unusual spending patterns, location mismatches, or repeated login attempts.

The technology goes deeper by analyzing behavioral patterns unique to your business. AI builds profiles of normal vendor relationships, typical invoice amounts, and regular payment schedules. When something deviates, such as a large payment to a new supplier or an invoice from a vendor you haven't worked with recently, the system raises alerts for manual review before processing.

Some fintech providers use AI to block high-risk transactions or prompt extra authentication automatically. Over time, ML models adapt to new patterns, improving their ability to catch evolving threats with greater precision.

Personalization and customer experience

AI tailors payment experiences to customers by analyzing past behavior and transaction history. Rather than treating every customer the same, it adjusts the journey based on real-time insights.

For example, AI can:

- Recommend and update a buyer’s preferred payment method

- Offer one-click checkout to returning users

- Suggest tailored financing options, such as buy-now-pay-later plans

- Deploy chatbots for payment inquiries or automated dispute resolution

Brands also use predictive models to anticipate what customers need next, such as identifying the best time to charge a credit card or triggering a rewards offer when it’s most likely to convert.

Forecasting

AI takes the guesswork out of cash flow management by analyzing your payment patterns, seasonal trends, and vendor behavior to predict future financial needs. These predictive models examine everything from historical invoice volumes to supplier payment cycles, helping finance teams anticipate when money will flow in and out of the business.

AI is particularly valuable for companies with complex payment schedules or seasonal fluctuations. It can forecast which customers are likely to pay early, on time, or late based on their past behavior and external factors such as industry trends or economic conditions. This allows businesses to make better decisions about everything from working capital management to vendor negotiations.

Advanced forecasting models also help with budget planning by predicting spending patterns across different departments or categories. When AI spots trends, it can alert finance teams to adjust budgets before problems arise. Some platforms even recommend optimal payment timing to maximize cash flow benefits while maintaining good vendor relationships.

Process optimization

AI continuously analyzes payment workflows to identify bottlenecks, redundancies, and opportunities for improvement. The technology tracks how long each step takes, where approvals get stuck, and which processes eat up the most time.

ML algorithms spot patterns that humans might miss, such as certain types of invoices that consistently require manual intervention or approval routes that cause delays. AI can then recommend workflow adjustments, suggest automated alternatives, or flag processes that could benefit from restructuring.

The optimization extends beyond individual transactions to entire payment operations. AI examines vendor performance, payment method efficiency, and team productivity to recommend changes that reduce processing time and costs.

What are the benefits of AI in payments?

The advantages of using AI in payments go beyond speed. They span accuracy, cost savings, and customer satisfaction, among other benefits:

- Increased efficiency: When you automate repetitive tasks such as invoice processing and payment reconciliation, your team has more time to complete strategic tasks. AI highlights process bottlenecks and supports better pricing, cash flow, and resource planning decisions.

- Enhanced security: AI can monitor and actively protect your payments. In fact, according to Statista, over 80% of senior payment professionals say fraud detection and prevention is the top use case for AI in the payments industry. AI can catch invoice discrepancies that might slip past manual checks by analyzing transaction patterns in real time.

- Improved customer experience: AI personalizes payment experiences by learning customer preferences. Platforms such as Stripe use AI to recommend preferred payment methods or offer one-click checkout for returning customers.

- Revenue optimization: Machine-learning algorithms identify upselling opportunities and optimize pricing strategies based on customer behavior patterns. By analyzing payment data, these systems can predict which customers are most likely to make additional purchases and recommend the best timing for promotional offers.

- Cost reduction: Automated payment processing eliminates the need for manual invoice handling and reduces staffing costs for routine transactions. Smart routing technology finds the most cost-effective payment channels, while error detection prevents costly mistakes that would otherwise require manual intervention to resolve.

- Scalability: AI-powered payment platforms can handle massive transaction volumes during peak periods without requiring additional infrastructure investments. Whether processing hundreds or millions of payments, these systems automatically adapt to demand fluctuations while maintaining consistent performance across global markets.

These benefits create a powerful cycle: Enhanced security builds customer trust, leading to higher transaction volumes and revenue growth. This increased revenue funds further AI investments, improving efficiency and reducing costs. Lower costs enable competitive pricing, attracting more customers and reinforcing the entire cycle of continuous improvement.

Compliance and regulatory automation

Keeping up with financial regulations can feel overwhelming, especially when rules change frequently and penalties for non-compliance are severe. AI takes much of this burden off your shoulders by automating the complex world of regulatory compliance.

Anti-money laundering (AML) protection

AI monitors transactions for suspicious patterns that might indicate money laundering. Instead of relying on manual reviews that can miss subtle red flags, machine learning algorithms analyze transaction histories, amounts, and frequencies to flag potentially problematic activities in real time.

Know Your Customer (KYC) verification

Customer identity verification is faster and more thorough with AI. It can cross-reference multiple databases, verify documents, and assess risk levels for new customers. This reduces onboarding time from days to minutes while maintaining strict identity verification standards for KYC and KYB.

Regulatory updates

Financial regulations change constantly, and staying current requires significant resources. AI systems automatically incorporate new regulatory requirements into compliance checks, updating screening criteria and reporting formats as rules evolve. This means your payment processes stay compliant without manual intervention or lengthy update cycles.

Audit trail creation

AI generates detailed compliance records automatically, creating comprehensive audit trails that satisfy regulatory requirements. When auditors or regulators request documentation, you have complete, organized records ready for review.

Implementation challenges and considerations

Despite AI's clear benefits in payments, businesses face several practical hurdles when implementing these systems. Here are some of the key challenges and how to address them effectively.

- Data quality requirements: AI models work best with clean, complete transaction data, but you may struggle with inconsistent information scattered across different systems. Invest in data cleaning tools and create standardized processes so your AI can deliver reliable results.

- Ensuring regulatory compliance: Payment AI must meet strict requirements such as PCI DSS for card data security, HIPAA and GDPR for privacy, and emerging AI-specific regulations. A 2024 Cohesity survey found that 86% of U.S. consumers are concerned AI will make securing their data more challenging. Maintain detailed documentation of how AI makes decisions and implement processes that can demonstrate compliance during audits.

- Integration complexity: Legacy systems may not communicate well with modern AI platforms, and you may work with multiple payment processors that each have different technical requirements. Many companies find success using API-based solutions or middleware that acts as a bridge between old and new systems.

- Cost considerations: Beyond the initial software investment, budget for ongoing model training, data storage, and technical support. Smaller companies might see ROI within 6–12 months, while larger enterprises often plan for 18–24 month timelines. A phased approach helps control costs by starting small and expanding based on proven results.

- Human oversight needs: Even advanced AI requires human review for high-value transactions or unusual patterns. Compliance frameworks often mandate that humans can override AI decisions and explain why specific actions were taken. This means training staff to work alongside AI tools and maintaining clear escalation procedures.

- Model bias and fairness: AI systems can inadvertently discriminate against certain customer groups if not properly monitored. Regular testing helps identify when models might unfairly flag legitimate transactions from specific demographics or regions. You need ongoing processes to review AI decisions and adjust algorithms when bias appears.

The good news is you can tackle these challenges through pilot projects that start small and prove value before full deployment. Consider partnering with AI vendors who handle much of the technical complexity and provide built-in compliance features, allowing your team to focus on business outcomes rather than implementation details.

AI in payments by business type

Different businesses face unique payment challenges, and AI adapts to solve them. AI in payments by industry varies significantly based on transaction patterns, fraud risks, and customer expectations in each sector.

E-commerce and online retail

AI helps online stores convert more browsers into buyers by personalizing the checkout experience. Smart algorithms recommend the best payment methods for each customer based on their location, device, and past purchases. When someone abandons their cart, AI analyzes the reasons and suggests improvements such as offering installment plans or different currencies.

Buy-now-pay-later decisions happen instantly using AI that evaluates creditworthiness in real time. This reduces checkout friction and prevents customers from leaving due to slow approval processes. You may see higher conversion rates and increases in average order values when AI optimizes your payment flows.

B2B and enterprise payments

B2B payments often involve mountains of paperwork that AI can handle automatically. Invoice processing speeds up when AI extracts key information and matches invoices to POs without human review. Payment predictions help you know which customers will pay on time and which might need reminders.

AI also verifies new vendors by checking business registrations, financial records, and compliance status across multiple databases. Cash flow optimization gets smarter, too. AI recommends the best times to make payments based on available funds and upcoming income, helping you maintain healthy cash positions while taking advantage of early payment discounts.

Subscriptions and recurring payments

Subscription businesses lose customers when credit cards expire or payments fail for technical reasons. AI prevents this churn by automatically updating payment information and retrying failed payments at optimal times. Smart retry logic considers factors such as time zones and past payment patterns to maximize success rates.

AI spots customers who might cancel before they actually do by analyzing payment delays, support tickets, and usage patterns. This early warning allows you to offer personalized incentives or address concerns proactively. After implementing AI-powered retention strategies, you may see a reduction in churn rate and improvements in customer lifetime value.

Future trends and outlook of AI in payments

As we look ahead, AI's role in digital payments is set to expand dramatically. From voice-activated transactions to hyper-personalized financial experiences, the future promises exciting innovations that will further simplify how we pay and get paid.

Advanced fraud detection

AI’s ability to identify and block fraudulent activity is only getting sharper. Financial institutions are developing faster, more accurate detection models that learn from every transaction.

Voice-activated payments

Thanks to natural language processing and chatbots, users can now approve payments with simple voice commands. Whether it’s reordering supplies or approving vendor invoices, voice-activated payments offer a hands-free, frictionless experience. And adoption is growing fast. Global voice payment is set to reach $164 billion in 2025.

Real-time payments (RTP)

AI is accelerating the rollout of real-time payments by ensuring fast and secure transactions. ACI Worldwide predicts RTP networks will handle 575 billion transactions annually by 2028, nearly 27% of all electronic payments worldwide.

Digital identity verification

AI is powering advanced digital identity systems that rely on biometrics, behavioral patterns, and predictive models. As AI continues to evolve, its integration into electronic payments will likely lead to more secure, efficient, and personalized financial transactions, shaping the future of commerce.

Getting started with AI in payments

Before diving into AI in payment processing, take a close look at how your payments work right now. Check your authorization rates, see where transactions get declined, and figure out how much fraud costs you. Save these numbers so you can compare them later and see if AI actually helps.

Choose specific goals for your AI project. Maybe you want to approve 5% more legitimate transactions or cut fraud losses in half. Use SMART goals: Specific, Measurable, Achievable, Relevant, and Time-bound. Having clear targets helps you know whether your AI investment pays off.

Here are the implementation steps:

- Data preparation: Your AI is only as good as the data you feed it. Look at your transaction records and clean up any messy information. Set up rules for how data is collected and stored. Since you're dealing with payment information, make sure everything meets PCI compliance standards. This step takes time but sets you up for success.

- Vendor evaluation: Not all AI payment solutions are created equal. Compare what different vendors offer and see how well they work with your current setup. Ask for case studies from businesses like yours. Create a simple scorecard to rate each option objectively. It makes choosing much easier.

- Pilot approach: Don't try to do everything at once. Pick one area where AI can help, such as catching AP fraud. Run a small test for 3–6 months and track the results carefully. If it works well and saves money, then expand to other areas. Set clear metrics for your pilot and watch them closely.

- Team preparation: Your staff needs to know how to work with AI tools. Train them on the new systems and create clear processes for when humans should step in to review AI decisions. Build escalation procedures so everyone knows what to do when something unusual happens.

- Performance monitoring: Set up dashboards that show how your AI is performing. Track the same metrics you measured at the start to see improvements. Schedule regular check-ins, whether weekly or monthly, to review results and make adjustments.

Plan for 2–3 months to get your first AI system running, then 6–12 months to see the full benefits. Add extra time for data prep and connecting everything to your existing systems, as these steps often take longer than expected.

The key is starting small and building on what works. Don't try to overhaul your entire payment system at once. Test one AI application, prove it works, then gradually add more. This approach reduces risk and helps you learn what works best for your business along the way.

How REVA Air Ambulance cut invoice processing time with Ramp's AI

REVA Air Ambulance was drowning in manual invoice processing that took 15-20 minutes per bill and delayed their month-end close by nearly 3 weeks. Each invoice required tedious data entry and manual routing to approvers, creating payment delays and vendor relationship issues.

The company deployed Ramp's AI-powered accounts payable solution to automate the entire workflow. The AI extracts key details from invoices and categorizes expenses automatically, while smart approval workflows route bills to the right stakeholders instantly. Everything syncs seamlessly with their Sage Intacct system in real time.

The results were dramatic: Invoice processing time dropped by over 80%, from 15–20 minutes down to under 3 minutes per invoice. Month-end close accelerated by 2 full weeks, now finishing early in the month instead of taking nearly 3 weeks.

"There's never been an issue with payment. It's 100% perfection. With Ramp, we reconcile every couple of days. By the fourth or fifth of the month, Ramp is reconciled and closed," said Seth Miller, Controller at REVA.

Ramp's AI automation freed REVA's finance team from tedious manual work, giving them better control over vendor payments and improved financial visibility for more strategic operations.

Streamline payments with Ramp's AI-driven AP automation

Ramp's AI-driven finance automation platform uses advanced machine learning algorithms to analyze spending patterns, automatically categorize transactions, and flag anomalies in real time. This intelligent oversight not only aids in fraud prevention but also provides enhanced visibility into your company's financial health.

Ramp's key features include:

- AI-powered invoice capture: Extracts invoice details instantly with OCR, suggests GL codes, and reduces manual errors for audit-ready records

- Automated invoice processing: Captures and codes detailed invoices and line items with precision, reducing manual input and associated errors

- Record every detail: Understands invoice context to auto-fill bill records, including line items and descriptions, streamlining exception handling

For finance teams, this means less time reconciling statements and more time focusing on strategic initiatives. For executives, it means clearer insights into spending trends and opportunities for operational efficiency.

Learn how Ramp's finance automation platform can help your business eliminate manual data entry, automate invoice matching, and proactively flag exceptions.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits