Who's eligible for the Chase Ink Business Preferred sign-up bonus?

- What is the 90k offer for Ink Business Preferred?

- Who is eligible for the Chase Ink Business Preferred sign-up bonus?

- Additional Chase Ink Business Preferred card details

- Is the Ink Business Preferred worth it?

- Alternative business credit cards to consider

- Ramp: A modern alternative for business spending

The Chase Ink Business Preferred Credit Card is a popular business credit card that earns straightforward rewards on business and travel purchases. But it also offers a significant sign-up bonus for new cardholders.

Before you apply, it’s important to understand who qualifies for this bonus and why some applicants, even with strong credit, may be turned down. We walk you through how the Chase Ink Business Preferred sign-up bonus works, explain Chase’s eligibility rules, and help you determine whether the card is a good fit for your business.

What is the 90k offer for Ink Business Preferred?

The Chase Ink Business Preferred currently offers a 90,000-point sign-up bonus when you spend $8,000 on purchases in the first 3 months after account opening. That’s roughly $2,667 in spending per month for 3 months. This threshold is fairly attainable for many small businesses through routine spending such as supplies, travel, and software subscriptions.

Who is eligible for the Chase Ink Business Preferred sign-up bonus?

Small business owners, sole proprietors, and authorized representatives of larger businesses with qualifying credit profiles and business credentials are eligible for the Chase Ink Business Preferred bonus. This includes a wide range of business types, such as freelancers, consultants, online sellers, LLCs, partnerships, and startups.

Chase evaluates overall business finances, personal credit history, and your relationship with the bank when determining card approval and sign-up bonus eligibility. For the best chance of approval, you’ll need a good to excellent personal credit score, or a FICO Score of 670 and up.

Who isn't eligible?

Current Chase Ink Business Preferred cardholders and those who have received a sign-up bonus for this specific card in the past 24 months are typically ineligible for another bonus.

Beyond the published criteria, Chase may apply additional unpublished requirements to determine Chase Ink Business Preferred bonus eligibility, including factors such as the frequency of recent applications, your credit utilization ratio, and your business's perceived stability.

You should also be aware of Chase’s 5/24 rule, which may affect your ability to qualify for a Chase Ink sign-up bonus.

Chase's 5/24 rule explained

The Chase 5/24 rule is an unofficial guideline stating that if you've opened five or more personal credit cards from any issuer within the past 24 months, Chase may decline your application for a new card, including the Ink Business Preferred. This guideline aims to limit customers from opening multiple cards in a short timeframe, primarily to collect sign-up bonuses.

Important details about the 5/24 rule include:

- The count includes personal cards from all issuers, not just Chase

- Most business credit cards from other issuers don't count toward your 5/24 total

- Authorized user accounts may count toward your total

- The 24-month period is calculated on a rolling basis

To determine your 5/24 status, simply review your credit reports and count your personal credit card accounts opened in the past 24 months.

Additional Chase Ink Business Preferred card details

Beyond the sign-up bonus, the Ink Business Preferred offers a strong mix of rewards, flexible redemption options, and valuable perks for business owners. Here’s a closer look at how the card works day to day:

Rewards structure

The Ink Business Preferred features a tiered rewards structure that particularly benefits businesses with significant spending in specific categories:

- 3x points on the first $150,000 spent in combined purchases in the following categories each account anniversary year:

- Travel expenses, including airfare, hotels, rental cars, and train tickets

- Shipping purchases, including courier services and freight

- Internet, cable, and phone services, including cellular phone, landline, internet, and cable TV services

- Advertising purchases with social media sites and search engines, including Facebook, Instagram, Google, and Bing ads

- Unlimited 1x points on all other purchases

If a significant portion of your business’s spending falls within these categories, the Ink Business Preferred is worth considering. If your business spending is higher or less targeted, consider options with higher or no spending caps and alternative reward structures.

Redeeming Chase Ultimate Rewards points

You can redeem Chase Ultimate Rewards points earned with the Ink Business Preferred in several ways:

- Book travel through Chase Travel

- Transfer points at a 1:1 value to one of Chase’s 14 airline and hotel partners

- Redeem for cashback as a statement credit or direct deposit

- Pay with points for products in the Apple Ultimate Rewards Store

- Redeem for gift cards from over 150 brands

Note that points transferred to Chase's airline and hotel partners—including United, Southwest, Hyatt, and Marriott—can yield returns exceeding 2 cents per point, making it one of the most valuable redemption options. Standard redemptions yield around 1 cent per point.

Rates and fees

The Chase Ink Business Preferred charges a $95 annual fee, making it a mid-tier business rewards card. Factor this recurring cost into the overall value proposition of the card. Additional rates and fees worth mentioning include:

- APR: 20.24%–26.24% variable

- Foreign transaction fees: None

- Late payment fee: $40

- Balance transfer fee: $5 or 5% of the amount of each transfer, whichever is greater

- Cash advance fee: $15 or 5% of the amount of each transaction, whichever is greater

Key benefits

The Ink Business Preferred offers several benefits beyond its rewards points, most notably its cell phone protection benefit. When you pay your cell phone bill with the card, you receive up to $1,000 per claim in protection against damage or theft, with a maximum of three claims per year and a $100 deductible per claim.

If you’re looking to offer your staff access to credit, the Ink Business Preferred also offers free employee cards and the ability to set individual spending limits. Better yet, their eligible purchases will factor into your rewards balance.

The Ink Business Preferred also provides travel insurance benefits such as trip cancellation and interruption insurance, roadside assistance, and rental car coverage. You’ll also receive purchase protection and extended warranty coverage on eligible warranties of 3 years or less.

Is the Ink Business Preferred worth it?

The Ink Business Preferred is a great fit for business owners who spend heavily in its bonus categories, such as travel, shipping, internet and phone services, and online advertising. If your business can meet the $8,000 minimum spend in the first 3 months, the 90,000-point welcome offer alone offers significant value.

It’s also well-suited for entrepreneurs who want flexibility in how they redeem rewards. Whether you prefer to book travel through Chase’s portal, transfer points to airline and hotel partners, or use them for cashback or gift cards, this card gives you multiple ways to maximize value.

However, the Ink Business Preferred may not be ideal if you can’t meet the initial spending requirement, prefer a no-annual-fee business card, or don’t spend much in the 3x bonus categories. In those cases, a simpler business credit card with flat-rate rewards or lower upfront costs might be a better fit.

Alternative business credit cards to consider

The Chase Ink Business Preferred offers strong value for the right business, but it’s not the only option out there. Here are three additional options with solid welcome bonus offers and lower (or no) annual fees:

Capital One Spark 2% Cash

For a limited time, earn a $1,500 cash bonus when you spend $15,000 in the first 3 months from account opening. This business credit card earns cashback and offers a $0 intro annual fee for your first year ($95 per year after). On top of its unlimited 2% cashback on all purchases, you also earn an unlimited 5% back on hotels and rental cars booked through Capital One Travel.

U.S. Bank Triple Cash Rewards Visa Business Credit Card

This no-annual-fee U.S. Bank business credit card offers a $500 cashback welcome bonus when you spend $4,500 within 150 days from account opening. It features a similar earning structure to the Ink Business Preferred (albeit in the form of cashback vs. points) with 3% back at gas and EV charging stations, office supply stores, cell phone service providers, and restaurants.

Ink Business Unlimited Credit Card

If you’re partial to Chase credit cards and you're looking for a no-annual-fee option with a solid welcome bonus, consider the Ink Business Unlimited. Earn a $750 cashback bonus after spending $6,000 on purchases in the first 3 months, plus 1.5% cashback on all purchases. The card technically earns Chase Ultimate Rewards points that can be pooled with your other cards.

Ramp: A modern alternative for business spending

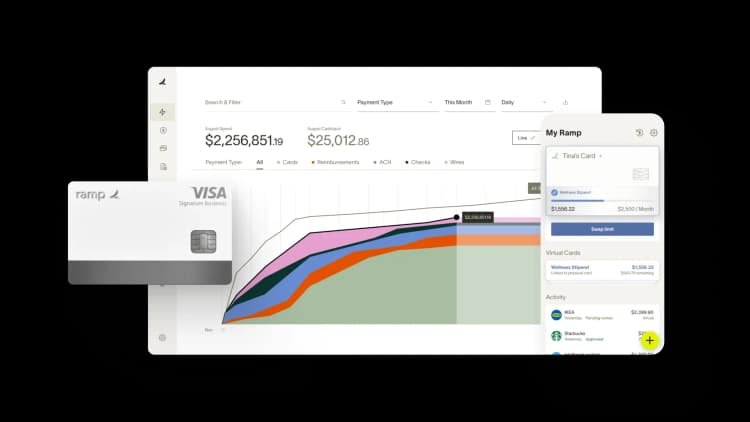

Unlike traditional business credit cards that primarily focus on rewards points, Ramp's integrated platform simplifies your entire financial workflow, from business credit cards and bill payments to accounting automation and reporting.

The Ramp Business Credit Card can save your business an average of 5% across all spending through a combination of automated expense policy enforcement, real-time spending controls, and AI-powered insights. Our card’s cashback rewards on purchases offer straightforward value without the complexity of category restrictions or redemption options.

Plus, there’s no personal credit check or personal guarantee required for approval. Issue unlimited physical and virtual employee credit cards, set spending rules for specific vendors and categories, and get access to over $350,000 in partner offers from brands such as QuickBooks, Indeed, and UPS.

Ready to get started? Explore a free interactive product tour.

The information provided in this article has not been officially confirmed by Chase and is subject to change.

FAQs

The Chase Ink Business Preferred has a $95 annual fee, with no foreign transaction fees and no additional costs for employee cards. The fee isn’t waived for the first year, and you’ll see it on your first statement. But if you can utilize the card's bonus categories and benefits, the value received typically outweighs this cost.

The Chase Ink Business Preferred doesn’t offer airport lounge access as part of its benefits package. If you’re looking for lounge access, consider premium travel cards such as the Chase Sapphire Reserve for Business or the Business Platinum Card from American Express.

Chase does not publish specific credit limit ranges for the Ink Business Preferred. Credit limits are determined based on business revenue, personal income, credit history, and your existing relationship with Chase. Initial credit limits typically range from $5,000 to over $25,000 for qualified applicants.

Applying for a Chase Ink business card at a branch may give you access to special in-branch offers or targeted sign-up bonuses that aren’t always available online. You may also benefit from speaking directly with a banker, who can help you determine eligibility and strengthen your application based on your business relationship with Chase.

Don't miss these

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits