- What is general loan amortization schedule template?

- How to create a loan amortization schedule?

- Simple interest loan amortization

- Common mistakes to avoid when using loan amortization schedules

- Take control of your loan strategy with amortization schedules

- Close your books faster with Ramp’s AI coding, syncing, and reconciling alongside you

Amortization refers to the process of gradually paying off a debt over a specified period through regular payments, covering both interest and a portion of the principal balance.

For loans, early payments largely cover interest due to the higher outstanding balance, but as time progresses, a larger portion goes towards the principal. This gradual shift helps reduce the total interest paid over the loan's life, making it a financially savvy approach to debt management.

A loan amortization schedule is invaluable if you are a borrower. It outlines each periodic payment on a loan, detailing the payment number, date, principal, interest, total payment, and remaining balance.

Examining this schedule gives you a comprehensive view of how each payment affects your loan balance. This structured breakdown is essential for effective financial planning and decision-making.

What is general loan amortization schedule template?

A general loan amortization schedule template is designed to handle a variety of loan types, making it a versatile tool for managing different financial obligations.

Get our free Excel Loan Amortization Schedule Template

This template can be used for mortgages, auto loans, personal loans, and more. Its flexibility allows users to input specific loan parameters, ensuring accurate calculations and projections.

Calculating interest and principal payments

One of the primary functions of an amortization schedule is to break down each payment into its principal and interest components, helping borrowers see how much of their payment is reducing the principal balance and how much is going towards interest. In Excel, the PMT function is used to calculate the periodic payment amount.

Excel Formula: =PMT(interest_rate / payments_per_year, total_payments, loan_amount)

To further separate each payment into principal and interest portions, the PPMT and IPMT functions are used, respectively. The PPMT function calculates the principal portion of each payment, while the IPMT function calculates the interest portion.

Components of a loan amortization schedule

A loan amortization schedule lays out a detailed picture of how your loan gets paid off over time.

- Loan amount: This is the total amount you borrow from a lender at the beginning of the loan. It forms the foundation for calculating your monthly payments. The larger the loan amount, the higher your payments will be unless you extend the term or get a lower interest rate. Throughout the life of the loan, this original amount (also known as the principal) gets paid down gradually until it's fully repaid.

- Interest rate: This is the percentage charged by the lender for borrowing the money. It’s typically expressed as an annual rate and is applied to the remaining loan balance. A higher interest rate increases your total repayment cost, since more of each monthly payment will go toward interest rather than reducing the principal. Your rate may be fixed—staying the same over time—or variable, meaning it can change.

- Loan term: This refers to the total length of time you have to repay the loan, which could be anywhere from a few months to several decades, depending on the type of loan. A longer term spreads out your payments, which can make them more affordable each month—but you'll likely pay more in interest over time. A shorter term means higher payments, but less interest paid overall.

- Monthly payment details: Each monthly payment is made up of two parts: principal and interest. At the beginning of the loan, a larger portion of your payment goes toward interest. Over time, as the balance gets smaller, more of each payment starts to go toward the principal. The amortization schedule shows this shift month by month, helping you see how each payment contributes to paying off the loan.

- Payment date: These are the dates on which each loan payment is due. The schedule lists them out, usually in monthly intervals, so you can plan ahead and avoid missing any deadlines. Staying on top of these dates is key to avoiding late fees, protecting your credit score, and staying in good standing with your lender.

- Remaining balance: After each payment is made, the amortization schedule updates to show your new remaining loan balance. This number reflects how much principal you still owe, excluding future interest. Watching this balance go down over time gives you a clear sense of your progress and helps you stay motivated as you move closer to paying off the loan completely.

How to create a loan amortization schedule?

Lenders typically generate a loan amortization schedule when the loan is issued, giving borrowers a clear view of how the debt will be repaid over time. But that initial schedule isn’t set in stone. Borrowers should revisit or recreate their amortization schedule anytime the loan terms change, like after a refinance, an interest rate adjustment, or when making extra payments.

Step 1: Start with the basics

Before anything else, gather the core details of your loan. You'll need the total loan amount, the annual interest rate, and the full length of the loan term. You also need to know how often you’ll be making payments—monthly is standard for most loans. These numbers are the foundation of your amortization schedule, and you can usually find them in your loan agreement or disclosure documents.

Step 2: Calculate your monthly payment

The monthly payment is what you'll pay each billing cycle, and it includes both principal and interest. To calculate it manually, you can use the amortization formula:

M = P [r ( 1 + r) ^ n] / [ ( 1 + r ) ^ n – 1]

In this formula, M is your monthly payment, P is the loan amount, r is the monthly interest rate (your annual rate divided by 12), and n is the total number of payments over the life of the loan.

If the formula seems too technical, you’re not alone. Many borrowers use Excel, Google Sheets, or online calculators to do the heavy lifting. These tools let you plug in your loan details and get an accurate monthly payment amount in seconds.

Step 3: Choose how you'll build the schedule

You can create your amortization schedule in a spreadsheet, through an online calculator, or using financial software. Spreadsheets like Excel and Google Sheets are flexible and allow you to customize the schedule for extra payments or changes in terms. Online calculators are faster but less customizable. Financial software like QuickBooks integrated with Ramp can automate this process entirely and integrate it into your broader financial operations.

Step 4: Build out the full schedule

Once you have your monthly payment, lay out each payment period in order—from the first month through the final one. For every row in the schedule, break down how much of that payment goes toward interest and how much goes toward principal. In the beginning, a larger portion will go toward interest.

Over time, more of your payment will reduce the loan principal. For each row, also include the payment date and the remaining balance after the payment is applied. The goal is to give yourself a full picture of how the loan balance declines with every payment.

Step 5: Use a loan amortization template

For a faster and easier option, download our free loan amortization schedule template. Enter your loan amount, interest rate, and term into the built-in calculator, and the schedule will generate automatically. This saves time and helps ensure accuracy, especially if you're not comfortable using formulas or starting from scratch.

Step 6: Keep it updated

An amortization schedule isn’t a one-and-done task. If you refinance, change your payment frequency, or make extra payments, update the schedule to reflect those changes. This ensures your projections remain accurate and helps you see the real impact of your financial decisions. Borrowers who track amortization closely are more likely to pay off their loans faster.

Simple interest loan amortization

Simple interest loans are straightforward, as interest is calculated only on the principal amount rather than on the accumulated amount like in compound interest loans. This simplifies the calculation and tracking process for borrowers.

In a simple interest loan amortization schedule, each payment includes a fixed interest amount plus a portion of the principal. The total interest paid over the loan term is determined upfront, providing clear visibility into the overall cost of the loan.

Daily interest accrual method

Simple interest loans often use a daily interest accrual method, which means interest is calculated daily based on the outstanding principal balance. This method can be particularly useful for short-term loans or loans where payments are not made on a regular monthly schedule.

Formula: Daily Interest = Principal Amount * (Annual Interest rate / 365)

This daily interest amount is then added up for the number of days in each payment period to determine the total interest for that period. The remaining amount of the payment goes towards reducing the principal balance.

Home mortgage loan amortization schedule

Home mortgage loans are often the largest financial commitments individuals make, and having a detailed amortization schedule is crucial for managing these long-term loans. A mortgage amortization schedule helps borrowers understand how their payments are divided between interest and principal over the life of the loan. This clarity is essential for budgeting and financial planning, especially when considering the impact of making extra payments.

Calculation of balances paid and owed

In a mortgage amortization schedule, each payment is divided into interest and principal components. Initially, a larger portion of the payment goes towards interest, with the principal portion gradually increasing over time. This is due to the nature of amortizing loans, where the interest is calculated on the remaining balance.

The formulas used in Excel for calculating these components are similar to those used for other loan types. The PMT function calculates the total payment amount, while the PPMT and IPMT functions determine the principal and interest portions, respectively.

Excel formula:

=PMT(annual_rate / 12, total_payments, loan_amount)

=PPMT(annual_rate / 12, payment_number, total_payments, loan_amount)

=IPMT(annual_rate / 12, payment_number, total_payments, loan_amount)

Distribution of payments and benefits of extra payments

Understanding the distribution of payments between interest and principal is crucial for mortgage borrowers.

- Early payments are mostly interest, while later payments primarily reduce the principal.

- Excel's amortization schedule can visually represent this distribution through charts or detailed tables, showing the impact of each payment on the overall loan balance.

- Making extra mortgage payments can significantly reduce the total interest paid and shorten the loan term.

- Extra payments directly reduce the principal balance, and Excel templates can accommodate these by recalculating the payment distribution and updated loan balance, highlighting the financial benefits and encouraging faster loan payoff.

Balloon payment loan amortization schedule

A balloon payment loan includes regular periodic payments with a significantly larger final payment, known as the balloon payment. This type of loan is typically used for short-term financing needs where lower monthly payments are desired initially, followed by a large payment at the end of the loan term. The regular monthly payments primarily cover interest and a portion of the principal, with the remaining principal due as the final balloon payment.

Monthly payment calculation

This formula calculates the fixed monthly payment amount based on the interest rate, total number of payments, and loan amount.

=PMT(rate, nper, pv, [fv], [type])

where

rate = loan interest rate

nper = total number of payments

pv = present value, or the principal amount

fv = future value

type = 0 or 1, indicating when payments are due

Balloon payment calculation

To find the balloon payment, you can use the FV (Future Value) function, which calculates the remaining balance after a series of payments.

=FV(rate, nper, pmt, [pv], [type])

where

rate = periodic or monthly interest rate

nper = total number of payments

pmt = monthly payments

pv = principal or loan amount

type = 0 or 1, indicating when payments are due

Next comes home equity loan amortization schedules, essential for tracking equity growth and remaining debt.

Home equity loan amortization schedule

Home equity loans allow homeowners to leverage their property's value as they build equity through mortgage payments. Equity is the difference between the home's current market value and the remaining mortgage balance.

An amortization schedule for a home equity loan helps track equity growth and remaining debt. As you pay down the principal, your equity financing increases, and any appreciation in the home's market value further boosts your equity.

Auto loan amortization schedule

Auto loans are a common way to finance vehicle purchases, and having an amortization schedule helps you understand your repayment structure. The total loan amount typically includes the vehicle's price, applicable taxes, fees, and adjustments for trade-ins, rebates, and down payments.

Factors such as trade-ins, rebates, and down payments significantly influence the total loan amount. Understanding these elements helps borrowers manage their auto loans more effectively and save on interest costs.

Summary of amortization table

By using basic arithmetic formulas such as SUM and division, you can extract key insights from your amortization schedule. These summaries include the total interest paid, total principal repaid, and remaining balance at the end of each period.

Total interest paid

=SUM(interest_payments_range)

Total principal repaid

=SUM(principal_payments_range)

Remaining balance

=initial_loan_amount - SUM(principal_payments_range)

Let’s talk about some of the main drawbacks you might face while dealing with amortization schedules.

Common mistakes to avoid when using loan amortization schedules

Use your loan amortization schedule effectively by avoiding common mistakes, managing your debt with more control, and making sound financial decisions. Here are some common pitfalls:

- Relying on a fixed-rate model for a variable-rate loan. Standard amortization schedules assume your interest rate stays the same over the life of the loan. If you have a variable-rate loan, this creates an inaccurate picture of future payments. Always adjust your schedule when interest rates change to reflect the true cost of the loan.

- Ignoring additional costs tied to the loan. Many loans include fees beyond principal and interest, like origination fees, insurance premiums, or penalties for late payments. If your schedule doesn’t include these expenses, you’re not seeing the full financial picture. Incorporate all known costs to plan effectively and avoid surprises.

- Failing to update the schedule after making extra payments. Making extra payments toward the principal can reduce your total interest and shorten the loan term. But if you don’t recalculate your schedule after those payments, your records won’t match your new payoff timeline. Always update your schedule to reflect changes and track progress accurately.

- Overlooking the benefits of early repayment. Paying off a loan early can lead to substantial interest savings. However, if your schedule doesn’t account for early payoff scenarios, you might miss opportunities to save or adjust your strategy. Build in flexibility to see how early payments affect the loan’s total cost and duration.

- Using Excel formulas incorrectly. Tools like Excel’s PMT, PPMT, and IPMT functions are powerful but easy to misuse. A wrong input or formula reference can throw off your entire schedule. Double-check your formulas, use consistent units for time and interest, and test with known values to ensure accuracy.

- Misunderstanding how payments are split. Every loan payment includes a portion for interest and a portion that reduces the principal. If you’re unclear on how this split works, you might misinterpret your progress or make poor financial choices. Make sure you understand how the schedule breaks down each payment and how those portions change over time.

- Neglecting to review and update regularly. If there is a shift in your income statement, you refinance, or make any change to your repayment plan, your amortization schedule should reflect it. Reviewing and updating it regularly helps you stay aligned with your financial goals and avoid falling off track.

A clear understanding of your loan's amortization schedule is crucial for effective financial planning. It helps you track payments, understand the principal and credit card interest portions, and manage your overall debt efficiently. Using tools like Excel or online calculators helps you maintain a detailed, accurate record of your loan repayments and make better financial decisions.

Take control of your loan strategy with amortization schedules

An Excel loan amortization schedule gives you control. By clearly mapping how your loan gets paid off month by month, you can plan ahead, make smarter decisions, and stay on top of your financial commitments.

Most borrowers don't fully understand how their loan payments break down. That gap can lead to missed opportunities, like paying off your loan early or reducing interest through extra payments.

With our free Excel loan amortization template, you don’t need to build anything from scratch. Just enter your loan details and instantly generate a clear, accurate schedule tailored to your terms.

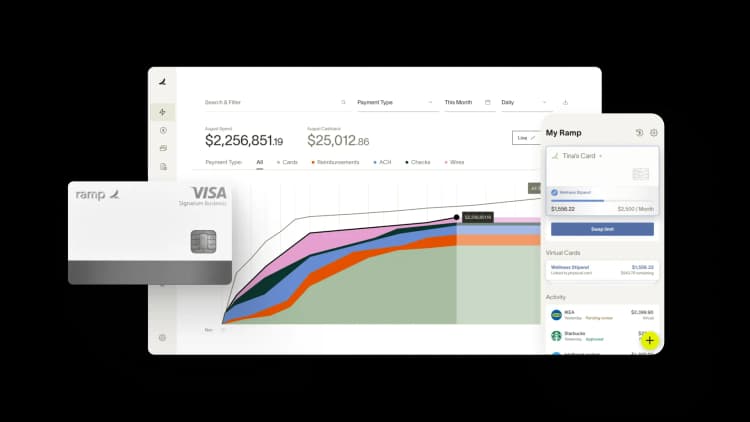

Close your books faster with Ramp’s AI coding, syncing, and reconciling alongside you

Month-end close is a stressful exercise for many companies, but it doesn’t have to be that way. Ramp’s AI-powered accounting tools handle everything from transaction coding to ERP sync, so teams close faster every month with fewer errors, less manual work, and full visibility.

Every transaction is coded in real time, reviewed automatically, and matched with receipts and approvals behind the scenes. Ramp flags what needs human attention and syncs routine, in-policy spend so teams can move fast and stay focused all month long. When it’s time to wrap, Ramp posts accruals, amortizes transactions, and reconciles with your accounting system so tie-out is smoother and books are audit-ready in record time.

Here’s what accounting looks like on Ramp:

- AI codes in real time: Ramp learns your accounting patterns and applies your feedback to code transactions across all required fields as they post

- Auto-sync routine spend: Ramp identifies in-policy transactions and syncs them to your ERP automatically, so review queues stay manageable, targeted, and focused

- Review with context: Ramp reviews all spend in the background and suggests an action for each transaction, so you know what’s ready for sync and what needs a closer look

- Automate accruals: Post (and reverse) accruals automatically when context is missing so all expenses land in the right period

- Tie out with confidence: Use Ramp’s reconciliation workspace to spot variances, surface missing entries, and ensure everything matches to the cent

Try an interactive demo to see how businesses close their books 3x faster with Ramp.

FAQs

A loan amortization schedule is a detailed table outlining each periodic payment on a loan, including the breakdown of principal and interest, payment dates, and the remaining balance after each payment.

Maintaining a loan amortization schedule is crucial for ensuring timely payments, avoiding penalties, understanding the true cost of the loan, and making informed decisions about extra payments to reduce interest costs.

You can create a loan amortization schedule in Excel by using functions such as PMT to calculate the total payment amount, PPMT to determine the principal portion of each payment, and IPMT to calculate the interest portion. Input the loan amount, interest rate, and term to generate the schedule.

You can include extra payments in your amortization schedule. By manually adjusting the schedule or using an advanced template that accommodates extra payments, you can see the impact of these payments on reducing the principal and shortening the loan term.

A simple interest loan calculates interest only on the principal amount, making the calculation straightforward. An amortizing loan divides each payment into interest and principal portions, with the interest calculated on the remaining balance, and requires a more detailed amortization schedule.

Standard amortization schedules assume static interest rates. If you have a variable interest rate loan, your payments can change over time. In such cases, you may need a more dynamic model or specialized software to account for interest rate fluctuations and accurately represent future payments.

Don't miss these

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits