- 6 expense management case studies and success stories

- Construction One

- Zola

- WayUp

- Liquid Measurement Systems (LMS)

- Betterment

- Crossbeam

- How Ramp makes expense management effortless

Traditional expense management—built on manual submissions, spreadsheets, and disconnected systems—slows down reimbursements, frustrates employees, and leaves finance teams with little control over company spending.

Modern platforms streamline the process by automating expense capture, enforcing policies in real time, and giving finance teams complete visibility into spend as it happens. The result is faster reconciliation, fewer errors, and more time to focus on strategic initiatives.

6 expense management case studies and success stories

The case studies below highlight real-world examples of companies that transformed their expense workflows with Ramp. Each organization faced unique challenges—ranging from manual submissions and delayed reimbursements to lack of visibility and difficulty enforcing policies—until they streamlined their processes with Ramp’s expense management software.

Here’s how they achieved faster reimbursements, stronger policy compliance, and clearer visibility into spending—all while saving time, reducing errors, and cutting costs.

Construction One

Company | Size & Industry | Description | Pain Point |

|---|---|---|---|

Construction One | Mid-size Construction & Engineering | A national construction management and general contracting company operating across all 50 states. | Lack of visibility and insight into spend. Manual, inefficient system that created excessive administrative work and slowed reconciliation. |

Challenges

Construction One’s expense management system was highly manual and paperwork-heavy. Employees had to upload receipts, manually code expenses for projects and categories, and re-enter details into individual Google Docs. The finance team then consolidated 75 different spreadsheets into one large report each month—a process that required around 40 hours.

Key challenges included:

- Manual submissions and redundant data entry created errors and delays.

- Fragmented spreadsheets made expense tracking inefficient.

- Limited visibility into company-wide spend hindered policy enforcement.

- Reconciling expenses consumed 40 hours each month.

Solution

Construction One implemented Ramp’s expense management platform to automate and streamline its workflows. With custom coding rules, automatic reminders, and built-in policy controls, Ramp simplified expense tracking and freed up valuable finance time.

- Automated coding and real-time reminders reduced manual input.

- Simplified receipt tracking and categorization improved accuracy.

- Spend controls blocked out-of-policy categories like flights and hotels for employees receiving per diems.

- Cashback rewards added measurable financial benefits.

Results

With Ramp, Construction One cut reconciliation time by 75%—from 40 hours to just 10 hours per month. Finance gained greater visibility into employee spending, while employees benefited from easier submissions and fewer administrative headaches.

- 75% faster reconciliation, saving 30+ hours each month.

- Greater visibility and tighter controls over expense categories.

- Reduced errors and a smoother employee experience.

- Higher cashback rewards compared to their legacy system.

“The whole process is much easier. We don’t have to worry about that reconciliation process—we just capture everything in real-time.” — Chris Moberger, Controller, Construction One

Zola

Company | Size & Industry | Description | Pain Point |

|---|---|---|---|

Zola | Mid-size Consumer Services | An online wedding registry, planner, and retailer that has grown into a one-stop destination for wedding planning and retail. | Manual AP processes created long invoice processing times, slow approvals, and delays in month-end close. |

Challenges

Zola’s finance team relied on a legacy, manual expense management system built around spreadsheets, credit card tracking, and chasing down receipts. This cumbersome process consumed hours of finance’s time each month and provided little visibility into spend.

Key challenges included:

- Heavy reliance on spreadsheets and manual expense reporting that slowed month-end close.

- Lack of visibility into spend and limited ability to control corporate cards.

- Cumbersome employee onboarding and training on outdated systems.

- Security concerns around virtual card distribution and receipt tracking.

Zola’s lean finance team, tasked with doing more with less, needed an expense management platform that could leverage automation and AI to improve efficiency, visibility, and control.

Solution

Zola partnered with Ramp to automate and simplify its expense management workflows. The team implemented custom coding, real-time controls, and seamless integrations to reduce manual oversight and improve security.

- Automated expense coding and reporting cut down repetitive manual tasks.

- Virtual card issuance became more secure and easier to manage.

- Real-time Slack alerts improved visibility and helped flag unusual charges instantly.

- Employee onboarding was simplified with Ramp’s intuitive platform, eliminating the need for training sessions.

- Integrations with accounting software streamlined reconciliation and reporting.

Results

With Ramp, Zola dramatically improved its expense management processes, freeing up time and enhancing financial oversight. Month-end close was reduced by nearly 50%, and employees gained a faster, more secure system for submitting expenses.

- 6 hours/month saved on expense coding and reporting.

- 3 hours/month saved on expense report processing.

- Month-end close reduced from 20–25 days to 12–13 days.

- Improved security with greater control over virtual card usage.

- Enhanced audit readiness with receipts and memos stored for every charge.

“We’re trying to get into a good rhythm of closing the books within 10–12 days, and Ramp has been a huge, huge lifesaver and time saver for us.” — Joe Horn, VP Controller, Zola

WayUp

Company | Size & Industry | Description | Pain Point |

|---|---|---|---|

WayUp | Mid-size Software & Technology | A job search platform connecting early career candidates with employers, serving thousands of students and companies nationwide. | Manual, inefficient expense management processes that wasted time, limited visibility, and created reporting challenges. |

Challenges

WayUp’s expense reporting process was inefficient and unreliable. Employees submitted reports months late, finance spent hours chasing receipts, and leadership had little visibility into spend. Even after manually reviewing each expense, the finance team couldn’t ensure accuracy.

Key challenges included:

- Expense reports submitted late, delaying financial reporting.

- Manual reconciliation consumed hours of staff time each month.

- Lack of real-time visibility into employee spend hindered decision-making.

- Minimal oversight and automation led to inaccuracies and inefficiencies.

Solution

WayUp adopted Ramp to automate its expense management workflows and provide real-time spend visibility. Ramp was rolled out in under a day, enabling the finance team to establish controls, set up rules for vendors and categories, and streamline reconciliation.

- Automated expense reconciliation reduced manual review time.

- Real-time visibility allowed leadership to track budgets as spend occurred.

- Vendor- and category-based rules automated spend management for employees.

- Employees gained an easier, faster process for submitting expenses.

Results

With Ramp, WayUp saved significant time, improved reporting accuracy, and strengthened financial oversight. Staff Accountant Jose Ramon-Batista cut expense report review time from six hours to less than one hour per month. Overall, Ramp’s automations saved the company 85 hours per month in expense management processes.

- 85 hours/month saved through automation.

- Expense review cut from 6+ hours to under 1 hour for finance staff.

- Real-time visibility into budgets empowered better decision-making.

- Stronger financial controls created accountability and improved employee behavior.

“I love how much control and freedom Ramp gives us.” — Jose Ramon-Batista, Staff Accountant, WayUp

Liquid Measurement Systems (LMS)

Company | Size & Industry | Description | Pain Point |

|---|---|---|---|

Liquid Measurement Systems (LMS) | SMB, Mid-Size Aerospace & Defense | Vermont-based manufacturer of fuel probes, indicators, and aircraft components, serving aerospace and defense OEMs for over 30 years. | Fraud concerns, poor user experience, and excessive manual work slowed expense reporting and month-end close. |

Challenges

Before adopting Ramp, Liquid Measurement Systems relied on an outdated corporate spend program with weak customer service and inefficient tools. Employees couldn’t submit receipts on mobile devices, forcing manual uploads and delays. Finance staff spent hours helping employees manage receipts, while fraud and security issues created additional headaches.

Key challenges included:

- No mobile functionality for uploading receipts, frustrating employees.

- Frequent fraudulent charges and weak controls with the legacy provider.

- Poor customer support and slow issue resolution.

- Excessive manual follow-up—employees photocopied receipts, while finance spent 5+ hours each month chasing them down.

Solution

LMS selected Ramp as its new expense management platform after evaluating several options. Onboarding was fast and intuitive, with policies, codes, and accounts imported in just days. Ramp’s ease of use allowed employees to submit receipts directly from their phones, while finance gained automated controls, security features, and built-in training support.

- Mobile-first receipt capture empowered employees to manage their own expenses.

- Automated policies and coding reduced finance’s manual workload.

- Virtual business cards enhanced security and reduced fraud exposure.

- Ramp’s intuitive UX, training academy, and AI support simplified onboarding.

Results

With Ramp, LMS streamlined expense management, improved security, and saved valuable time for both employees and finance. Employees now submit receipts and code expenses in real time, while finance no longer spends hours chasing paperwork.

- 5 hours/month saved on manual follow-up by accounting staff.

- 5–15 hours/month saved for employees through mobile-first receipt capture.

- Month-end close completed 1 day faster, with minimal accounting intervention required.

- Improved security with virtual/physical card pairing to prevent fraud.

- Higher employee satisfaction and smoother processes across the company.

“Because people can do their own receipts so easily and code in real-time, our accountant has minimal work to do at the end of the month.” — Sarah Paxman-Bean, Director of Finance & IT, Liquid Measurement Systems

Betterment

Company | Size & Industry | Description | Pain Point |

|---|---|---|---|

Betterment | Mid-Size Fintech & Financial Services | A fast-growing fintech company offering digital financial advisory services to individuals and businesses through an easy-to-use platform. | Fraud concerns, poor user experience, and excessive manual work slowed expense reporting and month-end close. |

Challenges

Betterment’s finance team struggled to manage spend across five subsidiaries using a legacy expense management platform. Coding rules regularly broke when moving transactions between entities, forcing the team to code purchases manually—wasting nearly a full day each week. Reimbursement delays frustrated employees, some of whom waited weeks for approval due to confusing workflows and poor system usability.

Key challenges included:

- Manual coding for subsidiary transactions created hours of extra work.

- Expense reimbursements were slow and inconsistent, often taking weeks.

- Limited system visibility led to duplicate vendor spend and inefficiencies.

- Legacy processes complicated financial close, requiring accruals for pending expense reimbursements.

Solution

Betterment turned to Ramp to automate its expense management processes and improve multi-entity visibility. With prepaid corporate cards, NetSuite integration, and customizable rules, Ramp provided both control and efficiency.

- Prepaid cards shifted spending away from out-of-pocket reimbursements.

- Coding rules saved directly to cards eliminated manual data entry.

- Seamless NetSuite integration improved reporting and accelerated financial close.

- Real-time spend visibility helped identify and eliminate redundant vendor charges.

- Custom card controls allowed teams like marketing to access funds with strict usage limits.

Results

By implementing Ramp, Betterment reduced manual work, improved reporting accuracy, and enhanced the employee experience. Finance gained real-time insights across subsidiaries, while employees benefited from faster reimbursements and easier expense tracking.

- 1–2 hours/week saved by finance on spend reviews.

- 4–5 hours/week saved on receipt tracking and uploads.

- 50% faster reimbursements with prepaid cards and automated workflows.

- Cleaner reporting through real-time NetSuite syncing.

- Improved employee satisfaction with faster access to funds and easier expense submissions.

“With Ramp, we can save rules directly to the card. Transactions from any of our monthly vendors come in already coded, so that’s been a huge time saver.” — Marianne Hawes, Senior Accountant, Betterment

Crossbeam

Company | Size & Industry | Description | Pain Point |

|---|---|---|---|

Crossbeam | SMB Software & Technolog | A leading ecosystem-led growth platform used by over 14,000 companies to drive sales through partnerships. | Manual, time-consuming vendor selection and invoice review processes that lacked visibility into fair pricing. |

Challenges

Crossbeam’s finance team struggled with opaque vendor pricing and inefficient expense-related workflows. Each time they evaluated new software vendors, VP of Finance Matt Dougherty had to spend hours searching forums, online communities, and peer networks for pricing benchmarks. Even then, data points were scarce, often outdated, and left the team uncertain about whether they were overpaying.

Key challenges included:

- Manual, error-prone process for reviewing vendor pricing and contracts.

- Hours wasted each week on online searches and peer outreach.

- Lack of confidence in whether negotiated software prices were competitive.

- Limited visibility into cost per seat and SKU-level spend.

Solution

Crossbeam expanded its use of Ramp—already embedded across spend management, cards, and Bill Pay—by adopting Ramp’s Price Intelligence tool. With AI-powered contract analysis and benchmarking against millions of Ramp transactions, Price Intelligence gave the team instant clarity on software pricing and negotiation leverage.

- Automated vendor price benchmarking within a 5% variance of fair market.

- SKU- and seat-level visibility to evaluate contracts with precision.

- Integration with existing Ramp spend data for complete visibility.

- Time savings from eliminating manual pricing research and outreach.

Results

With Ramp Price Intelligence, Crossbeam saved both time and money while improving confidence in vendor negotiations. The finance team reduced manual work by hours each week and avoided overpaying on major contracts, realizing immediate savings.

- $10K+ saved on a single vendor contract.

- 42.8% reduction in cost per seat.

- 8 hours/week saved by eliminating manual research.

- Increased negotiation confidence with accurate market benchmarks.

- Peace of mind knowing spend is aligned with fair pricing.

“Right now, I text a group of colleagues and search online—but being able to know within a 5% variance that we are solid on pricing? That gives me peace of mind.” — Matt Dougherty, VP of Finance, Crossbeam

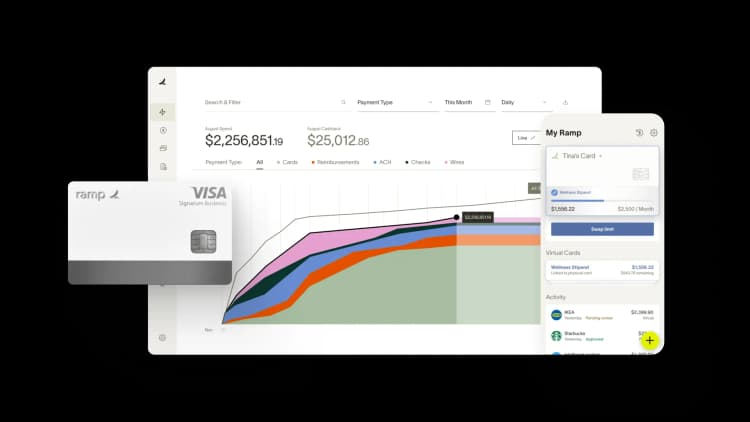

How Ramp makes expense management effortless

Ramp’s AI-powered expense management platform replaces manual submissions, spreadsheets, and disconnected tools with one automated system. Finance teams gain real-time visibility into spend, employees capture receipts instantly, and built-in policies keep compliance seamless.

By automating coding, receipt capture, ERP syncing, and reimbursements, Ramp eliminates the common headaches of chasing receipts, correcting errors, and reconciling scattered data.

Ramp consistently ranks as one of the easiest expense management softwares to use based on G2 reviews (as of August 19, 2025), with an average rating of 4.8/5 stars from 2,000+ reviews. Finance leaders across industries trust Ramp to accelerate reimbursements, reduce errors, and give their teams real-time control over spend.

The common pitfalls slowing down expense management

Most companies face familiar pain points with expenses:

- Chasing receipts and reimbursements after the fact

- Reconciling scattered spreadsheets and late submissions

- Fixing errors from manual coding and data entry

- Limited visibility into who is spending, on what, and against which budget

Ramp solves these with:

- Real-time receipt capture via text, email, or mobile upload

- AI-powered coding and categorization to the right GL accounts

- Policy controls to enforce limits and block out-of-policy charges

- Seamless ERP integrations (NetSuite, QuickBooks, Xero, Sage Intacct)

- Corporate and virtual cards with real-time spend data

- Faster reimbursements through automated expense workflows and ACH

- Slack and email alerts for unusual or out-of-policy charges

Why choose Ramp for expense management?

Ramp is redefining expense management with automation, intelligent controls, and real-time visibility. The platform helps finance teams cut manual work, close books faster, and maintain tighter control—while giving employees an intuitive experience.

From small businesses to global enterprises, Ramp adapts to fit any workflow. Teams that switch consistently report major time savings, clearer visibility, and greater confidence in every transaction.

Get started with Ramp today and experience what modern expense management should feel like.

Don't miss these

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits