- What is a startup budget?

- Benefits of creating a startup budget

- How to determine your startup's budget size

- Step-by-step guide to creating a startup budget

- Best practices for managing your startup budget

- Common challenges in startup budgeting and how to overcome them

- Track startup spending in real-time to prevent cash surprises

You’ve got a fantastic idea for a startup and you're eager to get going. But before you dive in, you need to make sure your finances are in order. This means creating a solid startup budget.

A well-planned budget can be the difference between your startup thriving or just surviving. It helps you understand where your money is going and ensures you have enough to cover all your bases.

So, how do you go about building a startup budget? Let’s break it down step by step.

What is a startup budget?

A startup budget is a financial plan that outlines the projected expenses and revenues for a new business. It serves as a roadmap for how to allocate resources, manage cash flow, and make informed financial decisions. For startups, budgeting is particularly important because it helps avoid financial pitfalls and ensures that the business can sustain itself until it becomes profitable.

Budgeting for startups involves estimating initial costs, ongoing expenses, and potential revenue streams. This includes everything from office rent and employee salaries to marketing expenses and product development costs. By having a clear picture of these financial elements, startups can plan for the future, set realistic goals, and attract potential investors. For a deeper dive into the basics, check out this guide on understanding business finance.

Benefits of creating a startup budget

You might be wondering, why is a startup budget so crucial? Well, think of it as your financial GPS, guiding you on your entrepreneurial journey and helping you avoid any costly detours.

Financial planning and control

Creating a startup budget allows you to allocate resources efficiently. Knowing where every dollar goes helps you avoid overspending and ensures that funds are available for critical areas like product development and marketing. Efficient resource allocation keeps your operations running smoothly and supports your growth objectives.

Managing cash flow is another key benefit. A detailed budget helps you track incoming and outgoing funds, preventing cash shortages that can disrupt your business. With a clear picture of your cash flow, you can plan for expenses and make sure you have enough liquidity to cover day-to-day operations.

Informed decision-making becomes easier with a well-structured budget. You can compare actual performance against your budget to see how well you’re sticking to your financial plan. This insight helps you make adjustments as needed and guides your strategic decisions, ensuring that you stay on track to meet your goals.

Risk mitigation

Worried about unexpected costs throwing a wrench in your plans? A startup budget helps you identify potential financial risks. By outlining all your expenses and revenue streams, you can spot areas where you might face financial challenges. This foresight allows you to take proactive measures to mitigate these risks before they become critical issues. For more insights, explore these financial tips for small businesses.

Setting aside contingency funds is another important aspect of risk mitigation. Unexpected costs can arise at any time, and having a financial cushion ensures that you can handle these surprises without derailing your business. A contingency fund acts as a safety net, giving you peace of mind and financial stability.

Planning for various scenarios is also crucial. A comprehensive budget allows you to model different financial situations, such as changes in market conditions or unexpected expenses. This planning helps you prepare for the worst while aiming for the best, ensuring that your startup can adapt to changing circumstances.

Investor confidence and funding

Securing funding can be one of the biggest hurdles for a startup. A well-prepared budget shows potential investors that you have a clear grasp of your financial needs and projections. This understanding builds trust and makes investors more likely to support your business.

A detailed budget outlines your path to profitability and shows that you have a realistic plan for achieving your financial goals. This assurance can make investors more confident in your ability to succeed.

Supporting fundraising efforts becomes easier with a solid budget. Investors want to see that you have a clear financial plan and that you’re prepared for the challenges ahead. A well-structured budget can be a powerful tool in your fundraising toolkit, helping you secure the capital you need to grow.

Performance measurement and management

Keeping track of your startup’s progress is essential. A startup budget provides a baseline against which you can measure your actual financial results. This comparison helps you see how well you’re performing and identify areas for improvement.

By comparing your budgeted expenses to your actual spending, you can see where you might be able to cut costs or improve efficiency. This assessment helps you make strategic adjustments that can enhance your overall performance.

When you have a detailed financial plan, you can see how changes in one area of your business might impact your overall financial health. This insight allows you to make informed decisions and adjust your strategy as needed to stay on track.

How to determine your startup's budget size

Figuring out how much money you need can feel overwhelming, but breaking it down into manageable steps can make the process smoother.

Factors to consider

Determining the size of your startup budget involves several key factors. First, consider industry and market conditions. Different industries have varying cost structures and revenue potentials. For example, a tech startup may require significant upfront investment in research and development, while a service-based business might have lower initial costs but higher ongoing operational expenses. Understanding the economic landscape and competitive environment helps you gauge how much capital you need to get started and sustain operations.

Next, evaluate your growth stage and objectives. Early-stage startups often focus on product development and market entry, which can involve substantial costs in areas like marketing and hiring. In contrast, more mature startups might allocate more budget towards scaling operations and expanding market reach. Clearly defining your short-term and long-term goals will guide you in prioritizing expenditures and setting realistic financial targets.

Available funding and resources also play a significant role. Assess your current financial resources, including personal savings, investments, and any external funding from investors or loans. This assessment helps you understand your financial limits and plan accordingly. If you have limited funds, you may need to adopt a more conservative budgeting approach, focusing on essential expenses and deferring non-critical investments until you secure additional funding.

Common budgeting approaches

Several budgeting approaches can help you determine the size of your startup budget. The percentage of revenue method involves allocating a fixed percentage of your projected revenue to different budget categories. This approach ensures that your spending aligns with your income, helping you maintain financial stability. For instance, you might allocate 10% of your revenue to marketing, 20% to product development, and so on.

Zero-based budgeting requires you to build your budget from scratch for each period, justifying every expense. This method encourages careful scrutiny of costs and helps eliminate unnecessary expenditures. It’s particularly useful for startups with fluctuating expenses or those looking to optimize their spending.

Goal-oriented budgeting focuses on allocating funds to achieve specific business objectives. For example, if your goal is to launch a new product, you might allocate a significant portion of your budget to research and development, marketing, and production. This approach ensures that your spending directly supports your strategic goals.

Lean budgeting emphasizes minimizing expenses and maximizing efficiency. This approach is ideal for startups operating with limited resources. It involves prioritizing essential costs and finding cost-effective solutions to achieve your objectives. Lean budgeting helps you stretch your funds further and maintain financial flexibility. If you're considering bootstrapping, learn more about startup bootstrapping.

Contingency planning involves setting aside a portion of your budget for unexpected expenses. This approach ensures that you have a financial cushion to handle unforeseen challenges, such as market shifts or operational disruptions. A common practice is to allocate 5-10% of your total budget to a contingency fund, providing a safety net for your startup.

Step-by-step guide to creating a startup budget

Ready to get your hands dirty? Let's walk through the steps to build your startup budget.

1. Assess your financial situation

Start by gathering all your financial statements. This includes balance sheets, income statements, and cash flow statements. These documents provide a snapshot of your current financial health and are the foundation for your budget. For more detailed guidance, check out this article on accounting for startups.

Next, analyze your revenue and expenses. Look at your income sources and categorize your expenses into fixed and variable costs. Fixed costs remain constant regardless of your business activity, such as rent and salaries. Variable costs fluctuate with your business volume, like raw materials and shipping.

Determine your break-even point. This is the point where your revenue equals your expenses, and you start making a profit. Knowing your break-even point helps you understand how much you need to sell to cover your costs and start generating profit.

2. Set clear business goals and objectives

Align your goals with your startup vision. Your budget should reflect your long-term vision and strategic objectives. This alignment ensures that your financial planning supports your overall business direction. For legal and financial planning, consider what goes into a startup founders' agreement.

Use the SMART goal framework. SMART stands for Specific, Measurable, Achievable, Relevant, and Time-bound. Setting SMART goals helps you create clear and actionable objectives. For example, instead of aiming to "increase sales," set a goal to "increase sales by 20% in the next quarter."

Balance short-term and long-term targets. Short-term goals keep you focused on immediate priorities, while long-term goals guide your strategic planning. Ensure your budget allocates resources to both, maintaining a balance that supports sustainable growth.

3. Research costs and revenue channels

Identify all potential expenses. List every cost you might incur, from office supplies to marketing campaigns. This comprehensive list ensures you don’t overlook any expenses that could impact your budget.

Analyze the cost-benefit of each expense. Evaluate the return on investment for every cost. For example, if you’re considering a marketing campaign, estimate the potential increase in sales and compare it to the campaign's cost. This analysis helps you prioritize spending on activities that offer the highest returns.

Examine pricing strategies and sales channels. Research your competitors' pricing and determine the best strategy for your products or services. Analyze different sales channels, such as online platforms, retail stores, or direct sales, to understand their costs and benefits. This examination helps you choose the most effective ways to reach your customers and maximize revenue. For startups with inventory, managing cash flow is crucial; learn more about managing cash flow.

4. Allocate budget to business activities

Prioritize based on objectives. Allocate funds to activities that directly support your business goals. For example, if your goal is to expand your market reach, prioritize spending on marketing and sales efforts.

Balance departmental needs. Ensure each department receives adequate funding to operate efficiently. This includes allocating resources to essential functions like product development, marketing, operations, and customer service. Balancing these needs ensures your business runs smoothly and supports overall growth.

Invest in growth opportunities. Allocate a portion of your budget to initiatives that drive growth, such as new product development, market expansion, or technology upgrades. Investing in these opportunities helps you stay competitive and achieve long-term success.

5. Plan for contingencies and unexpected costs

Assess potential risks. Identify risks that could impact your financial stability, such as market fluctuations, supply chain disruptions, or regulatory changes. Understanding these risks helps you prepare for potential challenges.

Establish a contingency fund. Set aside a portion of your budget for unexpected expenses. A common practice is to allocate 5-10% of your total budget to this fund. This financial cushion ensures you can handle surprises without jeopardizing your business operations.

Develop an emergency response plan. Outline steps to take in case of financial emergencies. This plan should include cost-cutting measures, alternative funding sources, and strategies to maintain operations during crises. Having a plan in place helps you respond quickly and effectively to unforeseen challenges. For more guidance, read about surviving economic downturns.

Best practices for managing your startup budget

Managing a startup budget isn’t just about creating it; it’s about maintaining and adjusting it as you go along.

Regular monitoring and review

Regularly tracking your actual performance against your budget helps you stay on top of your financial health. This practice involves comparing your projected expenses and revenues with the actual figures. Doing this consistently allows you to spot any discrepancies early and address them promptly. For more insights, learn how to jumpstart your SMB finance function.

Identifying variances and making adjustments is a key part of this process. When you notice that certain expenses are higher than expected or revenue is lower, you can investigate the reasons behind these variances. This insight enables you to make necessary adjustments, such as cutting costs or reallocating resources, to stay aligned with your financial goals. Discover more about improving budget variance.

Conducting monthly or quarterly reviews provides a structured approach to monitoring your budget. These regular check-ins help you maintain financial discipline and ensure that your budget remains relevant and accurate. During these reviews, assess your financial performance, update your projections, and refine your budget as needed. For actionable steps, explore the priorities for the first 100 days.

Leverage financial management tools

Utilizing budgeting software simplifies the process of managing your startup budget. These tools offer features that streamline budgeting tasks, making it easier to create, update, and monitor your budget. Look for software that suits your business needs and integrates well with your existing systems. Check out the finance tech stack for your business.

Automating expense tracking reduces the manual effort involved in recording and categorizing expenses. Automation ensures accuracy and saves time, allowing you to focus on more strategic tasks. With automated tracking, you can easily monitor spending patterns and identify areas where you can cut costs or optimize spending.

Generating real-time financial reports provides instant insights into your financial status. These reports help you make informed decisions quickly, as they reflect the most current data. Real-time reporting also enhances transparency, making it easier to communicate your financial position to stakeholders.

Maintain transparency and stakeholder involvement

Keeping team members informed about the budget fosters a culture of financial responsibility. When everyone understands the financial goals and constraints, they are more likely to make decisions that align with the budget. Regular updates and open communication ensure that all team members are on the same page.

Sharing budget insights with investors builds trust and confidence. Investors want to see that you have a clear financial plan and are managing your resources effectively. Providing regular updates on your budget performance demonstrates transparency and helps maintain investor support. To make informed decisions, consider leveraging strategic finance.

Seeking feedback and input from stakeholders can provide valuable perspectives. Team members and investors may have insights or suggestions that can improve your budgeting process. Encouraging open dialogue ensures that you consider different viewpoints and make well-rounded decisions.

Adopt a flexible and adaptive approach

Adjusting your budget as your business evolves is necessary for staying relevant. As your startup grows and market conditions change, your financial needs and priorities will shift. Regularly revisiting and updating your budget ensures that it reflects your current situation and future goals.

Responding to changes in the market helps you stay agile. Economic fluctuations, industry trends, and competitive dynamics can impact your financial performance. Being prepared to adjust your budget in response to these changes helps you navigate uncertainties and seize opportunities.

Embracing agile budgeting practices allows for greater flexibility. Agile budgeting involves setting short-term financial goals and regularly reviewing and adjusting them. This approach helps you stay adaptable and responsive, ensuring that your budget supports your strategic objectives in a dynamic environment. Learn more about driving high growth with limited data.

Common challenges in startup budgeting and how to overcome them

Every startup faces hurdles, but knowing what to expect can help you navigate these challenges more effectively.

Underestimating expenses

One common challenge in startup budgeting is underestimating expenses. Startups often overlook hidden costs or fail to account for all necessary expenditures. This can lead to financial shortfalls and disrupt operations. To avoid this, create a comprehensive list of all potential expenses, including one-time costs like equipment purchases and ongoing costs like utilities and salaries. Regularly review and update this list to ensure accuracy. Use historical data and industry benchmarks to estimate costs more precisely. Some of the best startup business credit cards can also help you identify hidden costs.

Overestimating revenue projections

Overestimating revenue projections is another pitfall. Startups may have optimistic expectations about sales and market penetration, leading to inflated revenue forecasts. This can result in overspending and cash flow issues. To mitigate this, base your revenue projections on realistic assumptions and market research. Consider different scenarios, including conservative estimates, to prepare for potential shortfalls. Regularly compare actual revenue against projections and adjust your budget accordingly.

Lack of financial expertise

Many startups struggle with budgeting due to a lack of financial expertise. Founders may not have a background in finance, making it challenging to create and manage a budget effectively. To overcome this, seek advice from financial professionals or consider hiring a part-time CFO. Utilize financial management tools and software to simplify budgeting tasks. Educate yourself and your team on basic financial principles to improve overall financial literacy.

Unexpected market shifts

Unexpected market shifts can also pose challenges. Economic downturns, changes in consumer behavior, or new competitors can impact your financial performance. To navigate these uncertainties, stay informed about market trends and be prepared to pivot your strategy. Maintain a flexible budget that allows for adjustments in response to market changes. Establish a contingency fund to cover unexpected expenses and ensure business continuity.

Managing cash flow

Managing cash flow is crucial for startup survival. Inconsistent cash flow can lead to difficulties in meeting financial obligations and sustaining operations. To improve cash flow management, monitor your cash flow regularly and forecast future cash needs. Implement strategies to accelerate receivables, such as offering discounts for early payments. Control your payables by negotiating favorable terms with suppliers. Maintain a cash reserve to handle fluctuations and ensure you can cover essential expenses.

Track startup spending in real-time to prevent cash surprises

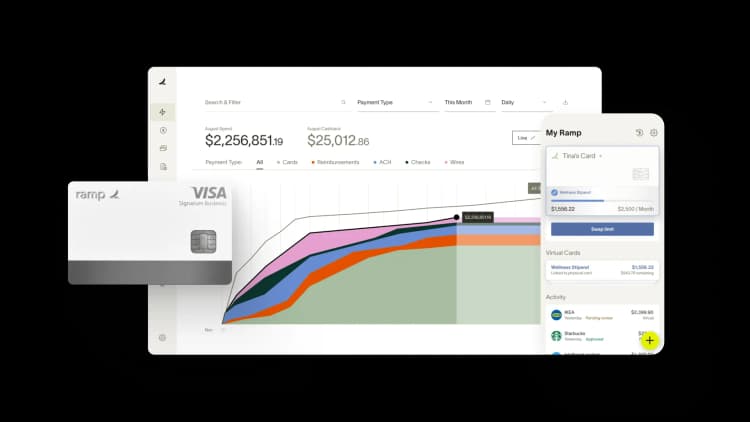

Building a startup budget is one thing—keeping it from derailing is another. Without real-time visibility into where money's going, you're left guessing until bank statements arrive, often too late to course-correct before cash runs dry.

Ramp Budgets gives you continuous insight into spending across every category, department, and vendor so you can spot potential shortfalls before they happen. Instead of reconciling expenses at month-end, you'll see exactly how much runway remains at any moment.

Here's how Ramp helps startups maintain budget discipline:

- Monitor spending as it happens: Track expenses across cards, reimbursements, and accounts payable in real time, including upcoming committed spend that hasn't hit your books yet

- Set threshold alerts: Configure notifications when spending approaches budget limits so you can intervene before teams overspend

- Include budget owners in approvals: Route expense requests through department heads who can see the projected impact on their budget before approving

- Organize by any dimension: Create budgets by department, project, vendor, or custom fields to match how your startup actually operates

- Roll up hierarchically: Nest team budgets within department budgets to track spending at multiple levels without losing granular detail

When every dollar counts, waiting until month-end to discover you've overspent isn't an option. Real-time budget tracking lets you make adjustments while you still have time to protect your runway.

Schedule a demo to see how Ramp helps startups maintain budget visibility and prevent cash shortfalls.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits