The complete guide to full cycle accounts payable

- What is full cycle accounts payable?

- How full cycle accounts payable fits into procure-to-pay

- Understanding cycle time in AP

- The end-to-end full cycle accounts payable process

- Full cycle AP vs traditional AP: What’s the difference?

- Common challenges in accounts payable

- How AP automation software enhances the AP process

- The future of full cycle AP: Machine learning and AI

- Why Ramp Bill Pay is the best way to automate your entire AP cycle

- Why Ramp Bill Pay stands out

Full cycle accounts payable (AP) isn’t just a buzzword—it’s essential for a smooth procure-to-pay (P2P) process. Spanning from the moment your business decides to purchase a product or service to settling the vendor’s invoice, full cycle AP keeps operations efficient and cash flow smart.

With so many guides on accounts payable floating around, let’s cut through the noise. We’ll dive into how full cycle AP weaves together procure-to-pay, procurement, and accounting—terms that sound alike but pack their own unique punch in keeping your business running seamlessly.

What is full cycle accounts payable?

Full cycle accounts payable covers the entire journey of managing your organization’s payables—from receiving supplier invoices to processing payments and reconciling accounts. It’s called a “full cycle” because it wraps up where it starts: with an invoice that’s paid and accurately logged in your financial system.

Here’s why it matters:

- Accurate financial records: Stay on top of expenses and liabilities with precision.

- Timely vendor payments: Keep supplier relationships strong with payments made on schedule.

- Better cash flow management: Optimize cash flow through efficient payment scheduling and control.

Think of it as the engine that keeps your payables smooth, your vendors happy, and your cash flow smart.

How full cycle accounts payable fits into procure-to-pay

To truly understand full cycle accounts payable, it’s crucial to see how it connects to the larger procure-to-pay system. Full cycle AP doesn’t operate in a vacuum—it’s a vital part of the P2P workflow, ensuring smooth coordination between procurement and payment.

What is procure-to-pay (P2P)?

Full cycle accounts payable and procure-to-pay are closely linked but distinct processes within a company’s financial operations.

The P2P process covers the entire lifecycle of purchasing and payment—from identifying a need to final reconciliation. It’s made up of two main stages:

- Procurement: Focuses on sourcing, ordering, and receiving goods or services.

- Full cycle accounts payable: Handles everything from invoice processing to payment and reconciliation.

In short, full cycle AP represents just one part of the broader P2P process, which bridges purchasing activities and financial transactions seamlessly.

What is upstream and downstream in full cycle AP?

While procurement and AP (that we just mentioned) focus on specific departments and actions, there is something called the upstream-downstream framework—a fancy way of showing how decisions in one stage can ripple through and impact the next. It’s less about who’s doing what and more about how their processes influence overall efficiency:

- Upstream: This is all about the procurement phase—strategic sourcing, vendor selection, contract negotiation, and managing risks before any purchase happens.

- Downstream: This kicks in post-purchase, covering the full accounts payable cycle, from receiving goods or services to verifying invoices, processing payments, and reconciling transactions.

Understanding this difference won’t make or break your knowledge of full cycle AP’s place in P2P, but it’s the kind of insight that helps you see the bigger picture—and trust us, that’s worth knowing. Let’s break it down further in a typical P2P workflow.

Steps in the P2P process

Here’s a breakdown of where each subprocess starts and ends, showing how full cycle AP fits into the bigger picture:

Step | Stage | Description |

|---|---|---|

1 | Procurement | Identify the need: Determine what goods or services are required. |

2 | Procurement | Select a vendor: Choose a supplier based on factors like pricing, quality, and terms. |

3 | Procurement | Create a PO: Outline the details of the order. |

4 | Procurement | Receive goods or services: Upon delivery, verify that the items meet the PO's specifications. |

Procurement stage ends – full cycle AP begins | ||

5 | Full cycle AP | Receive the invoice: Vendor sends a bill for the delivered goods or services. |

6 | Full cycle AP | Invoice verification (3-way match): Cross-check and validate the invoice with the PO and delivery receipt. |

7 | Full cycle AP | Approval process: Route the invoice for approval to confirm it’s valid and ready for payment. |

8 | Full cycle AP | Process the payment: Schedule and execute the payment. |

9 | Full cycle AP | Record and reconcile: Log the payment and reconcile it with bank statements to ensure accuracy. |

Essentially, procurement starts the P2P process, and full cycle AP completes it.

By pinpointing where full cycle AP fits within P2P, businesses can refine both procurement and payment workflows. This alignment reduces errors, enhances efficiency, and ensures a cohesive, end-to-end process that drives operational success.

Understanding cycle time in AP

Cycle time in accounts payable tracks how long it takes to process a single transaction—from receiving an invoice to completing payment. It’s a key measure of efficiency across the accounts payable workflow, covering each step in the process. The shorter the cycle time, the smoother the process—helping maintain cash flow, avoiding late fees and late payments, and building stronger vendor relationships.

Cycle time also reveals how well upstream (procurement) and downstream (AP) processes are aligned. For example, a well-run procurement stage with accurate purchase orders and clearly negotiated terms can significantly speed up cycle times in the AP stage, ensuring a seamless workflow from start to finish.

Cycle time in invoice processing

Invoice cycle time zeroes in on how efficiently individual invoices are handled—from the moment they’re received to when they’re approved for payment processing. It covers key activities like data entry, 3-way matching, and routing invoices through AP approvals. Long invoice cycle times often highlight bottlenecks like manual processes, human errors, or approval delays.

Let’s break down what a typical full cycle AP process looks like from start to finish.

The end-to-end full cycle accounts payable process

Here’s a full look into the end-to-end full cycle AP process:

- Creating a purchase requisition: The company identifies needs and submits a formal request detailing required items or services.

- Review and validation of the requisition: Authorized personnel ensure the request aligns with budget and priorities.

- Selecting a vendor and issuing a PO: The procurement team chooses a vendor and creates a purchase order specifying terms, quantities, and pricing.

- Receiving goods or services: Goods are inspected for quality and logged into the system for tracking and reconciling accounts payable.

- Three-way matching: The PO, receipt, and invoice are cross-checked for consistency before payment approval.

- Invoice approval and coding: Verified invoices are assigned to the right accounts and routed for final approval.

- Processing payments: Approved invoices are paid on schedule using payment methods like ACH or checks to optimize cash flow.

- Recording and reconciling transactions: Payments are logged, and accounts are reconciled to ensure accuracy and resolve discrepancies.

- Maintaining records and vendor relationships: Transaction records are securely stored for compliance, and timely payments build trust with vendors, improving terms.

The importance of 3-way matching in full cycle AP

Three-way matching is the unsung hero of full cycle AP—a control mechanism that safeguards against overpayments and fraud by cross-referencing the purchase order (PO), receiving report, and invoice.

It ensures consistency in quantity, price, and specifications, approving only valid payments while minimizing costly errors and strengthening vendor trust.

Manual 3-way matching is slow and error-prone, but AP automation tools like NetSuite streamline the process. These tools automatically compare documents, flag discrepancies, and improve accuracy—saving time and freeing AP teams to focus on bigger priorities.

With automation, 3-way matching isn’t just faster—it becomes a seamless, dependable system that elevates your entire AP process.

Full cycle AP vs traditional AP: What’s the difference?

The key difference between full-cycle accounts payable and traditional AP comes down to scope, integration, and the strategic value they deliver. Here’s the gist:

Criteria | Full-cycle AP | Traditional AP |

|---|---|---|

Scope | Covers the entire P2P process—from procurement to payment. | Focuses solely on invoice processing and payment. |

Integration | Seamlessly connects procurement and payment workflows. | Limited integration with procurement. |

Approach | Proactive, strategic, and efficiency-driven. | Reactive and task-based. |

Strategic involvement | Drives cash flow optimization, vendor management, and cost control. | Primarily operational, with limited strategic value. |

Technology usage | Leverages automation and AI for end-to-end efficiency. | Relies on manual or semi-automated processes. |

Which is better?

Full-cycle AP is built for modern businesses that value efficiency, cost savings, and alignment with broader goals. It elevates AP from a back-office task to a value-driving process. Traditional AP, on the other hand, is simpler and works for smaller businesses with fewer transactions. But as businesses grow, shifting to full-cycle AP is essential for reaching your AP goals, while also staying scalable and competitive.

Common challenges in accounts payable

Like anything in life, managing AP comes with its own set of challenges. Typical challenges for manual AP include time-consuming manual data entry, inefficiencies in approval workflows, and longer processing times.

These are typical challenges, but here are the big ones you’ll face when tackling full-cycle AP that may hurt your financial health when not considered:

Fraud

Fraud in AP—from duplicate payments to fake vendor schemes—can cost companies big. The solution? Strong payment internal controls, segregated duties, and regular audits of your financial statements. Advanced AP or invoice management software adds an extra layer of protection with automated fraud detection and digital audit trails.

Case in point: In 2021, a multinational company faced a $62 million SEC penalty for manipulating supplier contracts and inflating financial metrics. This underscores the importance of robust AP practices to safeguard your financial integrity.

Vendor management and efficiency

Vendor and invoice management often flies under the radar, but it’s a cornerstone of AP. Building strong relationships fosters trust, unlocks better terms, and improves overall efficiency. Tools like vendor portals simplify interactions, allowing vendors to check payment statuses, resolve issues, and handle electronic invoicing—all without unnecessary back-and-forth.

How AP automation software enhances the AP process

Automation is revolutionizing AP, turning headaches into streamlined workflows. From managing POs to automating invoice processing, tools like Ramp, cut down manual tasks, sync invoice data, integrate with ERP systems and accounting software, and provide real-time insights.

With accounts payable automation handling the grunt work, your accounts payable department can shift focus to high-value priorities like managing cash flow and driving smarter financial decisions. It’s not just faster—it’s AP with strategy baked in.

The future of full cycle AP: Machine learning and AI

AI and Machine Learning (ML) are pushing full-cycle AP into the future, bringing intelligence and automation to the forefront:

- Procurement transformation: AI optimizes sourcing and purchasing by predicting needs, managing inventory, and recommending buying times. It also evaluates vendor performance and identifies risks, making supply chains stronger and smarter.

- AP advancements: AI automates the invoice approval process and payments, flags unusual patterns to prevent fraud, and continuously learns to improve efficiency.

- Future innovations: AI-driven tools will offer real-time cash management insights, optimize payment strategies, and even introduce intelligent chatbots to streamline vendor communication. ML will enhance contract management, ensuring compliance and securing better terms.

AI and ML are turning AP into a strategic powerhouse—delivering unmatched efficiency, accuracy, and agility in today’s data-driven world.

Why Ramp Bill Pay is the best way to automate your entire AP cycle

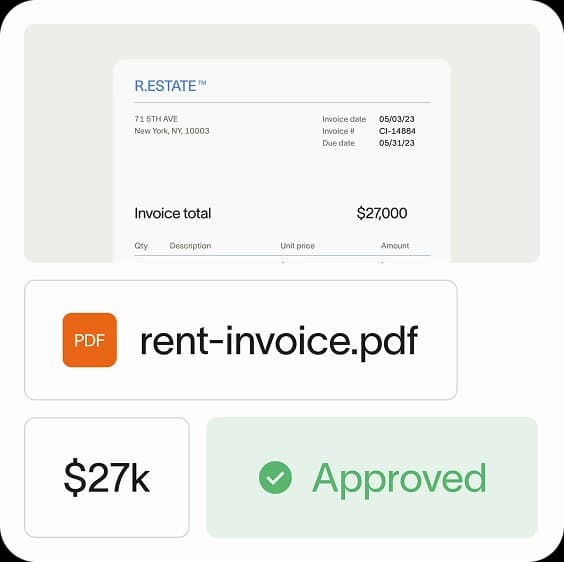

Ramp Bill Pay functions as autonomous AP software, running on four AI agents that manage invoice coding, fraud detection, approval summaries, and card payments—making your AP process touchless. With 99% OCR accuracy and automatic line-item capture, invoices move through 2.4x faster than legacy AP platforms1.

Use Ramp Bill Pay as your core AP system, or connect it with corporate cards, expense management, and procurement for unified spend visibility. Up to 95% of companies report better control over payables after switching to Ramp2.

Top AP features

- Intelligent invoice capture: Reads and extracts invoice details at the line-item level with exceptional accuracy

- Automated PO matching: Compares incoming bills against your purchase orders using two- and three-way reconciliation to flag billing errors before funds leave your account

- Four AI agents: Automatically code invoices, scan for fraudulent invoices, build detailed approval summaries, and push card transactions through vendor portals

- Real-time invoice tracking: Follow each invoice’s journey from submission to final disbursement

- Custom approval workflows: Configure layered approval chains that route invoices based on roles, departments, and your organizational structure

- Roles and permissions: Set precise access controls to ensure proper segregation of duties across your AP team

- Vendor onboarding: Request tax forms, validate identification numbers, and organize 1099 documentation within the system

- Ramp Vendor Network: Connect with pre-authenticated suppliers who receive expedited payment processing

- Vendor Portal: Give suppliers a secure channel to update banking information, monitor payment timing, and reach your AP staff

- AI-powered 1099 prep: Ramp automatically maps bill pay spend to 1099-NEC and 1099-MISC boxes with calculations done for you

- Bulk W-9 collection: Request all W-9s and e-consent at once instead of chasing vendors with one-off emails

- Payment methods: Disburse funds via ACH transfer, company card, printed check, or wire

- Real-time ERP sync: Maintain two-way synchronization of vendor records with leading accounting systems like NetSuite, QuickBooks, Xero, Sage Intacct, and others to keep your books audit-ready

- Batch payments: Execute dozens of vendor payments simultaneously instead of processing them individually

- Recurring bills: Configure automatic payment execution for subscription services and regular invoices

Why Ramp Bill Pay stands out

Ramp Bill Pay works as a standalone AP system, but it can also unify your entire finance stack. If you want to manage bill payments alongside card spending, expenses, and procurement, Ramp can also pull everything into one view.

No matter how you use it, Ramp Bill Pay processes AP with accuracy and automation that traditional systems can't keep up with. The proof is in the numbers: Over 2,100 verified G2 reviews give Ramp a 4.8-star rating, with Ramp consistently ranking as one of the easiest AP platforms to use on G2. Finance leaders turn to Ramp to eliminate tedious manual processes, catch mistakes before they impact the business, and shorten their close cycles.

Ramp's free plan covers essential AP automation, and Ramp Plus provides advanced capabilities for $15 per user per month.

AP should be touchless. With Ramp Bill Pay, it is. Try Ramp Bill Pay.

1. Based on Ramp’s customer survey collected in May’25

2. Based on Ramp's customer survey collected in May’25

Don't miss these

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits