How to pay an invoice in 6 steps (with best practices)

- What is an invoice payment?

- How to pay an invoice in 6 effective steps (with best practices)

- Which invoice payment method should your business use?

- Ramp Bill Pay simplifies invoice payments from start to finish

- Why finance teams choose Ramp for vendor invoice payments

After ordering supplies or scheduling a service, you might think the transaction is complete. But there’s one more critical step—paying the invoice.

Paying invoices is simple in theory, but missing a step can lead to errors, late fees, or strained vendor relationships. Without a clear system, you’re more likely to make mistakes. Here’s how to streamline your invoice payment process and avoid common mistakes.

What is an invoice payment?

Invoice Payment

An invoice payment refers to paying a vendor, supplier, or service provider after receiving an invoice.

Businesses typically pay in one of two ways:

- Immediate payment: Some purchases require upfront payment via cash or a corporate credit card. These do not involve invoices.

- Delayed payment: A vendor sends an invoice after delivering goods or services, and payment is made based on the agreed-upon terms. This is an invoice payment.

In scenario one, you make that payment immediately. In scenario 2, your payment is delayed.

Benefits of invoice payments

In the second scenario of deferring payments through invoicing, this is often preferred by businesses as it gives them greater flexibility in managing cash flow. Here’s why many companies prefer this approach:

- Use goods before payment is due: Businesses can access products or services without immediate payment.

- Short-term credit: An invoice acts as interest-free credit from a vendor, helping preserve working capital.

- Better cash flow management: Paying based on a schedule allows businesses to align expenses with their cash cycle.

But while invoice payments offer advantages, they also introduce potential risks.

Common challenges with invoice payments

Delaying payment through invoicing extends your deadline, but the payment still needs to be made. If purchases aren’t tracked properly, cash flow can become an issue when multiple invoices come due at once.

Lost or miscategorized invoices can also lead to missed or late payments. This may result in interest charges and strain relationships with vendors.

How to pay an invoice in 6 effective steps (with best practices)

To ensure invoices are paid on time and processed correctly, follow these six steps:

1. Match invoices and purchase orders

Before making a payment, verify that the invoice details match the corresponding purchase order. If there’s a discrepancy, investigate the issue before proceeding. This process, known as 2-way matching, can be done manually or automated with AP software.

Best practice: Standardize your invoice review process by creating a matching checklist for your accounts payable team.

2. Take a close look at the invoice due date

The invoice should include a due date. If it doesn’t, refer to your vendor agreement. A common payment term is net 30, meaning payment is due 30 days from the invoice date.

Best practice: Track all invoice due dates using an AP calendar or automated reminders. Prioritize payments based on urgency—pay early if discounts are available, but avoid early payments if it strains cash flow.

3. Choose your payment method

There are multiple ways to pay invoices, each with its own advantages. Options include:

A breakdown of these payment methods is covered later.

Best practice: Choose payment methods based on vendor preferences, transaction security, and processing costs. ACH payments and bill pay services are best for scheduled invoices, while credit cards offer flexibility and potential rewards.

4. Schedule your payment

Most businesses use accounting software to schedule invoice payments. When initiating a payment, the software drafts a journal entry that records the transaction based on the selected payment date. Key details include:

- Vendor: The recipient of the payment, stored in accounting records.

- Account: The category for the expense (supplies, inventory, service expense, or an asset account).

- Amount: If a 2-way match has been completed, the amount should be accurate.

- Date: The due date is the payment date you want to schedule.

Best practice: Automate scheduled payments through your AP software or banking system to avoid missed deadlines. This includes setting up multi-level approval workflows to prevent unauthorized transactions.

5. Complete the payment

Payments may be processed automatically on the scheduled date. If making a manual payment, double-check the recipient details and payment amount before finalizing the transaction. A corresponding AP journal entry will need to be recorded manually.

Best practice: Before approving a payment, run a final verification check to ensure accuracy. For manual payments, store proof of payment (such as bank confirmations or check images) in a central AP system.

6. Collect payment confirmations

Keep payment confirmations from vendors as proof of payment. If a vendor raises questions about an outstanding invoice, having these records ensures there’s documentation to verify payment.

Best practice: Make sure to store all payment confirmations, invoices, and approval records in a centralized tracking system that can log each payment’s status and automatically reconcile payments with bank statements.

Which invoice payment method should your business use?

With multiple ways to pay invoices, choosing the right method depends on factors like security, convenience, and record-keeping. Here’s a breakdown of the most common payment options.

1. Cash

Paying with cash may seem straightforward, but logistics can make it impractical. While mailing cash is legal, it’s not recommended due to security risks. Payments over $500 must be sent via Registered Mail, adding extra cost. Handing cash to a vendor in person provides no payment record, making it difficult to track transactions.

2. Check

Checks remain a widely accepted payment method. They authorize a bank to transfer funds from your account and provide a clear payment record. However, they carry risks, including forgery and the exposure of sensitive banking information.

Despite these concerns, checks are a reliable option for businesses that need to document payments.

3. Credit card, debit card, or charge card

Cards offer a secure and convenient way to pay invoices. The most common types include:

- Debit cards: Withdraw funds directly from a checking account

- Credit cards: Allow purchases on credit, often with rewards or cashback benefits

- Charge cards: Require full payment of the balance each statement period

While some cards charge fees, they can be offset by perks like cashback bonuses. Businesses using charge cards should ensure they can pay the balance in full each cycle to avoid penalties.

4. Bill pay

Bill pay services allow businesses to make payments directly from their bank accounts. Payments can be scheduled in advance, and banks either process them electronically or issue checks on behalf of the payer. This method simplifies recurring payments and provides clear tracking.

5. ACH debit or ACH credit

ACH transfers move funds electronically between bank accounts.

- ACH debit: The recipient’s bank pulls money from the payer’s account.

- ACH credit: The payer’s bank pushes funds to the recipient’s account.

Both methods are common for invoice payments, but the availability depends on the vendor’s preferred payment methods.

6. Cash transfer apps

Peer-to-peer (P2P) payment apps like Zelle, PayPal, Venmo, and Apple Pay offer another way to send money electronically. These apps use similar technology as ACH transfers but are less commonly used for B2B transactions due to security concerns.

While convenient, they may lack the fraud protections and payment tracking features businesses need.

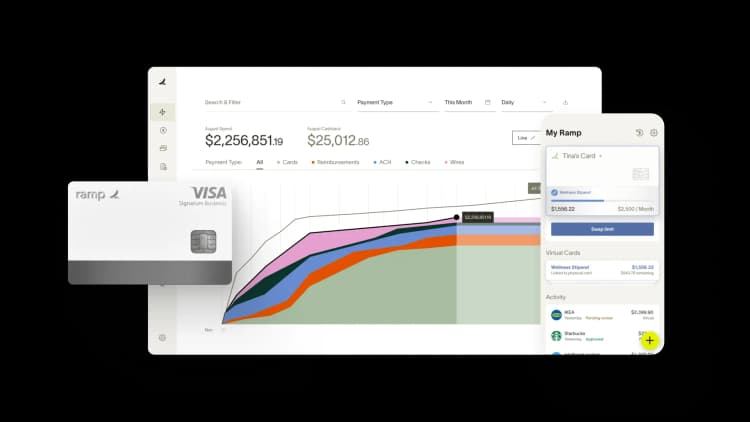

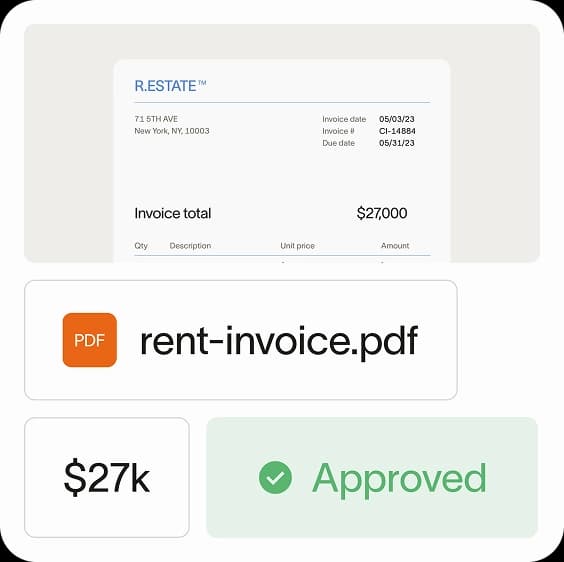

Ramp Bill Pay simplifies invoice payments from start to finish

Ramp Bill Pay is an autonomous AP platform that handles the full payment cycle—capturing invoices, routing approvals, and executing payments domestically or internationally. Four AI agents manage transaction coding, fraud detection, approval summaries, and card-based payments without manual steps. With 99% accurate OCR pulling every line item, Ramp processes invoices 2.4x faster than legacy AP software1.

Use Ramp as a standalone AP solution for streamlined invoice payments, or connect it with corporate cards, expenses, and procurement for unified financial operations. Teams using Ramp report up to 95% improvement in financial visibility2.

Paying invoices—whether domestic or global—shouldn't require chasing approvals, manually entering payment details, or juggling multiple systems. Ramp's touchless, autonomous automation handles it all:

- Flexible payment methods: Pay vendors by ACH, corporate card, check, or wire transfer—choose what works for each vendor

- International payments: Send wire transfers to vendors in 185+ countries with built-in global spend management

- Batch payments: Process multiple invoices and vendor payments in a single run

- Recurring bills: Automate regular vendor payments with templates for invoices that repeat

- Automatic card payments agent: Finds card-eligible invoices, enters card details directly into vendor payment portals, and captures cashback automatically

- Intelligent invoice capture: Pulls data from every line item at 99% OCR accuracy—no manual entry needed

- Automated PO matching: Checks invoices against purchase orders with 2-way and 3-way matching to catch overbilling before payment

- Custom approval workflows: Set up multi-level approval chains with role-based routing tailored to your team

- Approval orchestration: Moves invoices through review faster with fewer clicks and better visibility

- Real-time invoice tracking: See exactly where every invoice stands from receipt through payment completion

- Vendor onboarding: Collect W-9s, verify TINs, and track 1099 data directly in the platform

- Vendor Portal: Give vendors a secure way to update payment details and check payment status

- Ramp Vendor Network: Pay verified vendors faster with streamlined fraud checks

- Real-time ERP sync: Connect bidirectionally with NetSuite, QuickBooks, Xero, Sage Intacct, and more for accurate, up-to-date records

- AI-assisted GL coding: Map transactions to the correct accounts based on historical patterns

- Reconciliation: Match payments to invoices automatically for faster month-end closes

Why finance teams choose Ramp for vendor invoice payments

Ramp delivers touchless invoice processing that's accurate, fast, and flexible across payment types and geographies. Run it as a dedicated bill pay solution or integrate it with your broader spend stack for end-to-end control.

Over 2,100 finance professionals on G2 rate Ramp 4.8 out of 5 stars, ranking it the easiest AP software to use. Teams highlight faster payment cycles, fewer manual errors, and simplified vendor management as reasons they switched.

Start free with core AP automation included. Ramp Plus unlocks advanced payment features at $15 per user per month, with enterprise options available.

Invoice payments should be effortless. Ramp makes them that way.

Try Ramp's invoice management software.

1. Based on Ramp’s customer survey collected in May’25

2. Based on Ramp's customer survey collected in May’25

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits