Revenue recognition journal entries under ASC 606

- What is revenue recognition?

- What is ASC 606?

- The 5-step revenue recognition model

- Common journal entries for revenue recognition

- How to record revenue recognition journal entries under ASC 606

- Common mistakes and best practices

- How to improve revenue recognition processes

- Close your books faster with Ramp’s AI coding, syncing, and reconciling alongside you

To book a revenue recognition journal entry under ASC 606, you start by recording payments as deferred revenue on the balance sheet. As your business meets performance obligations, you reduce deferred revenue and record the earned amount in the revenue account.

Using ASC 606 has completely changed how businesses handle revenue recognition, providing a consistent framework across industries. This standard’s five-step process ensures all revenue is recognized accurately, while also aligning with GAAP and IFRS 15 compliance requirements. Getting these entries wrong can lead to misstated financials, audit issues, and regulatory risks.

What is revenue recognition?

Revenue recognition is an accounting principle that requires businesses to record revenue in the period it is earned, not when cash is received. It’s essential for producing accurate financial statements and staying compliant with standards like ASC 606 and IFRS 15.

What is ASC 606?

ASC 606 is the accounting standard that governs how companies recognize revenue from customer contracts. It replaces industry-specific guidance with a universal five-step model to ensure consistency and transparency across financial reporting.

The 5-step revenue recognition model

ASC 606 is built on a five-step revenue recognition process that outlines how your business should account for revenue and structure its journal entries:

- Identify the contract: Confirm that a contract exists and understand the contract terms

- Identify performance obligations: Define the goods or services your business has committed to delivering. Each obligation must be distinct and clearly separable in the agreement with the customer.

- Determine the transaction price: Establish the total amount the customer will pay, including any variable considerations like discounts or rebates

- Allocate the transaction price: Assign the transaction price to each performance obligation based on its standalone value. This ensures revenue aligns with the selling price of individual components.

- Recognize revenue as obligations are satisfied: Reduce deferred revenue and record earned revenue when goods or services are delivered, either at a point in time or over time

Common journal entries for revenue recognition

Recording journal entries under ASC 606 means accounting for revenue systematically based on performance obligations and the accrual basis of accounting.

Recording deferred revenue for upfront payments

When a customer pays upfront, record the cash received as a debit to cash and a credit to deferred revenue. For example, in a SaaS subscription model, a customer paying $1,200 for an annual subscription would book the full amount as deferred revenue at the time of payment.

Each month, reduce deferred revenue by $100 and recognize $100 as revenue.

Recognizing revenue as obligations are fulfilled

Revenue is recognized as performance obligations are satisfied, either at a point in time or over time. For instance, a construction company using the completion method records revenue progressively as milestones are reached.

This ensures revenue reflects the work completed and aligns with the accrual basis of accounting, which matches income and expenses to the period they occur, not when cash is exchanged.

Examples of industry-specific applications

Revenue recognition looks different depending on the type of business. Here’s a quick recap of how ASC 606 applies in common industries:

- SaaS: Revenue recognized monthly for subscriptions, even if paid upfront

- Construction: Revenue recorded progressively based on milestones or percentage of completion

- Retail: Revenue recognized at sale, with adjustments for returns or rebates

How to record revenue recognition journal entries under ASC 606

Recording revenue under ASC 606 revolves around tracking transactions from the moment payment is received (or earned) to the point when performance obligations are fulfilled.

Deferred revenue journal entry example

When a customer makes a payment, the business cannot recognize the revenue immediately. Instead, it must record the payment as deferred revenue (a liability) on the balance sheet. Deferred revenue represents the company’s obligation to deliver goods or services, which are only recognized as revenue once performance obligations are satisfied.

Example: A SaaS company sells a one-year subscription for $1,200, paid up front.

At the time of payment:

- Debit cash $1,200

- Credit deferred revenue $1,200

Each month, as service is delivered:

- Debit deferred revenue $100

- Credit revenue $100

By the end of the subscription term, the full $1,200 has been recognized as revenue in line with service delivery.

Create a revenue recognition schedule.

To streamline your revenue recognition process, create a revenue recognition schedule at the start of each contract to map out when and how much revenue you'll recognize each period. This helps prevent recognition errors and simplifies your month-end closing process.

Accrued revenue journal entry example

Accrued revenue occurs when goods or services have been delivered but payment has not yet been received. This ensures revenue is recognized in the correct accounting period, even if cash comes later. On the balance sheet, accrued revenue is recorded as an asset until payment is received.

Example: A consulting firm completes $10,000 of work in December but invoices the client in January.

At year-end (to recognize earned revenue):

- Debit accounts receivable (or accrued revenue) $10,000

- Credit revenue $10,000

When payment is received in January:

- Debit cash $10,000

- Credit accounts receivable (or accrued revenue) $10,000

This approach ensures that the December financial statements accurately reflect the revenue earned, consistent with ASC 606’s revenue recognition principle.

Contracts with bundled elements

Some contracts include bundled products and services (for example, software plus support). Under ASC 606, your business must allocate the transaction price to each performance obligation based on its standalone selling price. Revenue is then recognized separately as each obligation is satisfied.

Example: A software company sells a $9,000 license and $3,000 of support services as a bundle for $10,000.

Allocation:

- License = $7,500 (9,000 / 12,000 * 10,000)

- Support = $2,500 (3,000 / 12,000 * 10,000)

Journal entries would look like this:

At payment:

- Debit cash $10,000

- Credit deferred revenue $10,000

When the license is delivered:

- Debit deferred revenue $7,500

- Credit revenue $7,500

As support services are provided monthly:

- Debit deferred revenue $208.33

- Credit revenue $208.33

This ensures revenue recognition aligns with the delivery of each distinct element, keeping reporting compliant with ASC 606 and IFRS 15.

Common mistakes and best practices

Even with ASC 606’s clear framework, there’s always potential for errors in revenue recognition journal entries. Such mistakes can distort financial statements, create compliance issues under ASC 606 and IFRS 15, and increase the risk of audit findings.

Timing errors

Recognizing revenue in the wrong period, either too early (before performance obligations are met) or too late (after they should have been recorded), is one of the most common mistakes. Timing errors often occur with variable consideration, such as performance bonuses, discounts, or penalties, where the exact revenue amount is uncertain.

Your business may apply revenue recognition rules inconsistently or fail to update estimates when contract terms change. To avoid this, establish clear policies for identifying when obligations are satisfied and use historical data or probability-weighted outcomes to estimate variable consideration.

Misclassification of revenue

Another frequent error is confusing accrued revenue with deferred revenue. Misclassifying the two can cause the wrong accounts to be debited or credited, leading to inaccurate financial reporting.

Similar terminology and complex contracts make it easy for teams to misapply the rules. You can combat this by training staff on the difference between accrued and deferred revenue and using standardized journal entry templates. Automated accounting software can also flag inconsistencies before they lead to misstated balances.

Audit trail and documentation

Weak documentation is a recurring issue in revenue recognition. During audits, incomplete records, poorly supported estimates, and incorrect allocation of variable consideration often lead to findings.

Maintaining clear contracts, performance obligations, and journal entries, supported by automated accounting software, helps reduce errors and simplify compliance.

How to improve revenue recognition processes

Adopting best practices for revenue recognition ensures compliance with ASC 606 and supports more accurate, reliable financial reporting. These strategies help your business address common challenges and stay aligned with core accounting standards:

- Use automated accounting software: Automated tools can help streamline tasks such as tracking performance obligations, calculating variable consideration, and generating journal entries. These systems reduce errors, save time, and provide detailed documentation to ensure complete compliance during audits.

- Collaborate with a CPA: A certified public accountant (CPA) can interpret ASC 606, tailor solutions to your operations, and identify where policy adjustments may improve reporting accuracy

- Ensure consistency under ASC 606: Keep clear documentation of contracts, performance obligations, and any other considerations to support accurate and compliant reporting

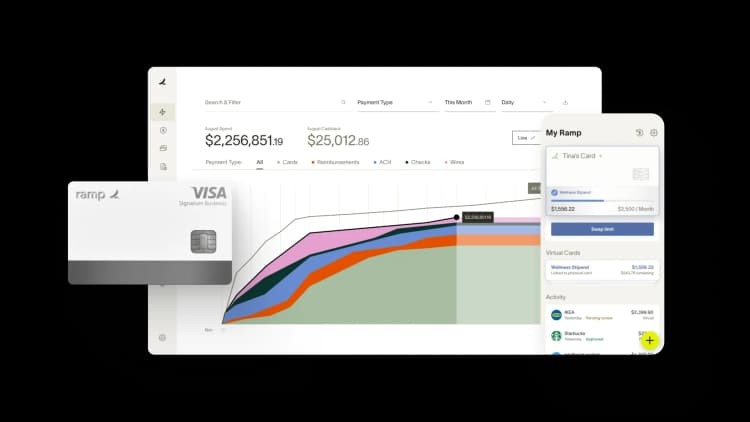

Close your books faster with Ramp’s AI coding, syncing, and reconciling alongside you

Month-end close is a stressful exercise for many companies, but it doesn’t have to be that way. Ramp’s AI-powered accounting tools handle everything from transaction coding to ERP sync, so teams close faster every month with fewer errors, less manual work, and full visibility.

Every transaction is coded in real time, reviewed automatically, and matched with receipts and approvals behind the scenes. Ramp flags what needs human attention and syncs routine, in-policy spend so teams can move fast and stay focused all month long. When it’s time to wrap, Ramp posts accruals, amortizes transactions, and reconciles with your accounting system so tie-out is smoother and books are audit-ready in record time.

Here’s what accounting looks like on Ramp:

- AI codes in real time: Ramp learns your accounting patterns and applies your feedback to code transactions across all required fields as they post

- Auto-sync routine spend: Ramp identifies in-policy transactions and syncs them to your ERP automatically, so review queues stay manageable, targeted, and focused

- Review with context: Ramp reviews all spend in the background and suggests an action for each transaction, so you know what’s ready for sync and what needs a closer look

- Automate accruals: Post (and reverse) accruals automatically when context is missing so all expenses land in the right period

- Tie out with confidence: Use Ramp’s reconciliation workspace to spot variances, surface missing entries, and ensure everything matches to the cent

Try an interactive demo to see how businesses close their books 3x faster with Ramp.

FAQs

Yes. Under accrual accounting, you recognize revenue as soon as you deliver goods or services, even if you haven’t issued an invoice yet. This approach keeps revenue matched to the correct accounting period.

No. Unearned revenue (or deferred revenue) is a liability for payments received before you deliver services. Accrued revenue is an asset for revenue you’ve earned but haven’t billed or collected yet.

Yes. Many ERP systems, especially those that integrate with automation platforms like Ramp, can handle the full accounting cycle. They record transactions, generate journal entries, and sync financial data in real time.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits