CFO vs. controller: What’s the difference, and which does your business need?

- What is a CFO?

- What is a controller?

- What’s the difference between a CFO and a controller?

- CFO vs. controller salaries and costs

- What is a comptroller vs. controller?

- When to hire a CFO vs. controller

- Do you need a controller or CFO?

- Ramp: A finance leader's best friend

As your company moves beyond the early-stage startup phase, you need more than basic accounting. You need someone who can lead financial planning and analysis (FP&A) and has a deep understanding of your business model and cash flow.

But should you hire a chief financial officer (CFO) or bring on a financial controller? While these two financial leadership roles often collaborate closely, they serve distinct functions within your organization.

We highlight the basic responsibilities of a CFO vs. controller, explain when growing businesses typically hire them, compare their key differences, and help you decide which financial leader best fits your needs.

What is a CFO?

The chief financial officer of a company is a strategic leader responsible for overseeing all financial obligations, including financial forecasting, planning, and analysis. They're part of your company's senior management team and typically report to the CEO and board of directors.

CFOs also act as the chief financial spokesperson and often partner with the chief operating officer (COO) to identify business risks and opportunities. Together, they coordinate decision-making, address company needs, and chart the path for growth.

CFO responsibilities

While the CFO is the individual most accountable for your company’s financials, their role extends beyond simple oversight. CFOs review financial statements and analyze financial data to uncover opportunities for improvement. Their chief tasks include:

- Management of the finance function

- Advising the CEO

- Strategic FP&A and growth planning

- Fundraising and managing capital markets activity

A large part of their job involves anticipating business risks and taking proactive steps to mitigate them. In addition to driving long-term financial strategy, they also advise stakeholders on key business decisions and often take the lead in funding major initiatives.

CFO qualifications

Most CFOs hold advanced degrees in finance, accounting, or business, typically an MBA or a master’s in finance or economics. They also bring extensive experience in financial leadership, strategic planning, and capital management.

Certifications such as certified public accountant (CPA) or chartered financial analyst (CFA) can add credibility, especially in companies with complex compliance or reporting needs.

What is a controller?

A financial controller is a senior-level executive with a deep accounting background. They're responsible for overseeing all your business’s accounting activities and ensuring money flows in and out of your business smoothly and legally.

If you already have a CFO, the controller typically reports to them. If you have a smaller company without a CFO, the controller may report directly to the CEO and take on broader financial oversight. In either case, they manage key processes such as payroll, financial reporting, and building operational budgets.

Controller responsibilities

The controller's foremost duty is to ensure accurate financial accounting and reporting. As the head of the accounting department, they focus on company compliance and maintaining strong internal controls.

However, their role has expanded to match the pace of increasingly complex financial operations. Today’s controllers not only manage day-to-day accounting but also help steer your business’s financial health and integrity. Their scope now often includes:

- Accounting team management

- Financial processes and reporting

- Internal spend controls

- Cash and equity management

- Payroll and taxes

- Budgets and forecasting

Controller qualifications

Most controllers hold a bachelor’s or master’s degree in accounting or finance. Many are licensed CPAs, especially if your company requires audited financials or works with lenders and investors. They often have experience in public or corporate accounting and bring deep expertise in compliance, audit procedures, and financial reporting standards.

What’s the difference between a CFO and a controller?

Although there's quite a bit of overlap between the two roles, especially in smaller companies, the jobs become more distinct as your business gets larger. Here are the key ways they differ:

Scope of roles: Strategic vs. operational

- CFO: A CFO is your company’s financial strategist. They leverage past financial statements with current projections to make calculated business decisions and investments. They have one goal in mind: to drive your company forward.

- Controller: A controller is responsible for the accuracy of your company’s financial accounting and reporting. By optimizing accounting procedures and ensuring compliance, the controller helps improve profitability, particularly when it comes to tracking business expenses.

CFO's daily tasks

A CFO's day will typically include the following:

- Management: Overseeing strategic financial management, including accounting and other finance operations

- Transactions: Ensuring accurate payroll, accounts payable and receivable, and timely payments

- Financial strategy and forecasting: Making decisions to improve efficiency or fund strategic investments based on analysis of financial records

- Treasury: Managing your company’s capital position and determining the best options for investing money or handling debt and equity

- Reporting: Making sure financial reporting is accurate and timely to guide executive decision-making

Controller's daily tasks

Controllers are responsible for:

- Management: Supervising the accounting function overall

- Transactions: Ensuring payroll, payables, and receivables are accurate and on time

- Reporting: Controlling the general ledger, producing accurate financial reports, and addressing debt and tax issues

- Compliance: Creating policies to improve internal controls and ensuring your organization abides by them

CFO vs. controller salaries and costs

According to recent data from Salary.com, the annual base salary for CFOs in the United States ranges between $353,972 and $535,409, with a median annual salary of $436,142. That median salary goes up to $645,311 when bonuses are factored in.

For controllers, Salary.com reports annual base salaries between $213,916 and $315,280, with a median annual salary of $252,925 in the United States. When including bonuses, the median salary in the US is $317,550.

Several factors influence the level of compensation for your CFO or controller. Larger firms or public companies tend to pay significantly more, while startup or small business CFOs may accept more equity in lieu of high base pay. If your business is located in a financial hub such as New York, San Francisco, or Boston, higher salaries are likely needed to match the cost of living.

What is a comptroller vs. controller?

A comptroller and a controller both oversee financial management, but their roles differ based on the type of organization they serve.

Comptrollers work primarily in the public sector, such as government agencies or nonprofits, focusing on transparency, regulatory compliance, and public accountability. Controllers, on the other hand, are typically found in private companies. They oversee accounting, financial reporting, and internal controls, emphasizing profitability and operational efficiency.

Some organizations use the terms interchangeably, especially in government or institutional settings, even though the responsibilities can vary depending on the context.

When to hire a CFO vs. controller

Depending on your company’s financial size, specific needs, and future plans, you may need to hire a full-time CFO, a controller, or both.

Here are some specific signs to look out for when evaluating your financial leadership needs:

When to hire a CFO

Your business may hire a full-time, in-house CFO when it reaches around $50 million in annual revenue. If you have an investor-backed company or one with more sophisticated financial needs, you may bring on a CFO sooner, typically around the $30 million mark.

Hire a CFO for:

- Oversight of the finance team

- Financial strategy and guidance

- Reporting to stakeholders

- Fundraising

- Analyzing financial metrics

Driven Insights estimates that most businesses won’t need a CFO until annual revenue reaches at least $1 million. Even then, you may opt for a part-time or outsourced CFO to provide strategic oversight without the full-time cost.

When to hire a controller

Your business will benefit from a part-time controller when it reaches the $1 million revenue mark and needs to start producing audited statements for financial partners. By the time your business reaches $10 million in annual revenue, it’s common to have an in-house controller.

Hire a controller for:

- Bookkeeping supervision

- Improving financial reporting speed and accuracy

- Improving the month-end close

- Reducing errors, fraud, or security breaches

- CPA support

- Greater ownership over your company's accounting processes and financial system

If your business has between $1 million and $10 million in annual revenue, an in-house controller often wears multiple hats, acting as a quasi-CFO, bookkeeper, supervisor, and reporting lead. After passing the $10 million threshold, their focus shifts more toward financial reporting, maintaining internal controls, and leading the accounting function.

Do you need a controller or CFO?

If you're still unsure when to hire a controller vs. CFO, consider your current challenges. A controller is ideal if your priorities include tightening internal controls, improving financial reporting, or streamlining the month-end close. A CFO is the better fit if you're focused on strategic growth, fundraising, financial forecasting, or managing investor relationships.

Ask yourself:

- Do I need high-level financial strategy or better day-to-day accounting oversight?

- Are we preparing for fundraising or simply trying to close the books faster?

- Do we need help with forecasting and long-term planning, or accurate reporting and compliance?

Match your business challenges to the role best equipped to solve them. And remember, in some cases, hiring a fractional controller or CFO can give you the expertise you need without a full-time commitment.

Ramp: A finance leader's best friend

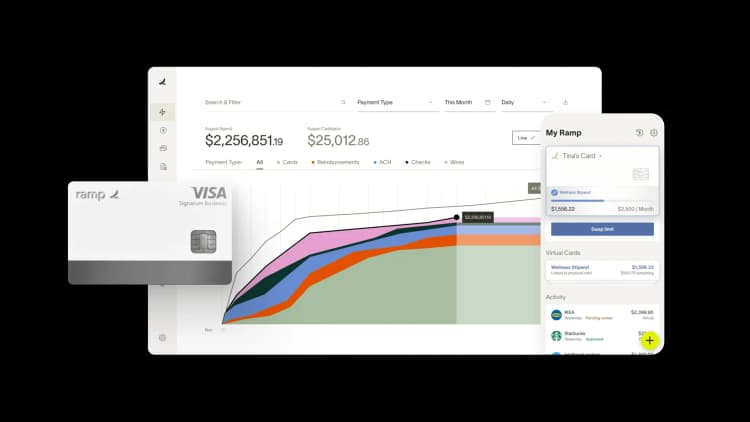

Whether you have a CFO, controller, or both, finance leaders need all the help they can get when managing and monitoring spend. That's where Ramp can help from day one.

Ramp is an all-in-one finance operations platform that gives your finance team real-time visibility and control. Our modern corporate cards come with built-in expense management software that enforces your spend policies automatically, automatically matches receipts with transactions, and reduces manual work.

Controllers benefit from faster closes and cleaner books, while CFOs get the insights they need to drive smarter, more strategic decisions. Ready to get started? Explore an interactive demo.

FAQs

Many controllers become CFOs, especially if they expand their skills beyond accounting to include strategic planning, fundraising, and financial leadership. The transition often depends on the size of your company and whether the controller has experience in cross-functional decision-making.

A fractional CFO works with your company on a part-time or contract basis, providing strategic financial oversight without the cost of a full-time executive. A full-time CFO is embedded in your business and handles ongoing responsibilities, while a fractional CFO is typically brought in to improve financial processes or support specific projects.

A controller primarily manages your company’s accounting operations, including financial reporting, internal controls, and compliance. A VP of finance focuses on broader financial strategy, such as setting financial goals, overseeing budgeting and forecasting, and guiding your company’s financial planning.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits