- At a glance: Fyle alternatives compared

- Best overall Fyle alternative: Ramp

- Rho

- PayEm

- Navan (formerly TripActions)

- Paylocity

- Mesh Payments

- Zoho Expense

- Why customers choose Zoho Expense vs. Fyle

- Pick the top-rated Fyle competitor

Fyle, now acquired by Sage, is a spend and expense management software for mid-sized businesses. It integrates directly with business credit cards you’re already using, so it’s a popular choice for accountants and business owners. Thanks to that and its other helpful functionality, Fyle earns a solid rating of 4.6 out of 5 stars on the software review website G2.

Even with a relatively high rating, Fyle has its drawbacks. Reviewers mention that it isn’t particularly easy or intuitive to use, with a noticeable learning curve for new users. Others highlight issues with receipt management, manual entry, and uploads not always meeting their expectations.

With that in mind, and with Fyle now part of Sage, it’s worth exploring other solutions that may be a better fit for your business. That’s why we’ve compiled a list of strong Fyle alternatives—some that earn equally high reviews on G2 and others that stand out for different strengths, features, or usability.

- Ramp

- Rho

- PayEm

- Navan

- Paylocity

- Mesh Payments

- Zoho Expense

We compiled this list after conducting a deep analysis of real user reviews on G2. That analysis, paired with our own research on each tool’s features and pricing models, informed our rankings here.

At a glance: Fyle alternatives compared

| Platform | G2 rating | Market segment | Key features | Minimum cost |

|---|---|---|---|---|

| Ramp | 4.8 | Startups, small businesses, mid-market | Expense management, corporate cards, travel booking | $0; unlimited free tier |

| Navan | 4.7 | Mid-market | Travel booking, expense management | $0; free tier with seat and usage limits |

| Paylocity | 4.5 | Mid-market | Procurement, expense management | N/A; all pricing is quote based |

| Emburse Professional | 4.5 | Mid-market, enterprise | Expense management | $3,000 per year |

| Coupa | 4.2 | Mid-market, enterprise | Procurement, expense management, invoice automation, payments | N/A; all pricing is quote based |

| Zoho Expense | 4.2 | Small businesses, mid-market | Expense management, travel booking | $3 per active user per month; free plan available |

| Fyle | 4.6 | Mid-market | Expense management | $11.99 per user per month, billed annually |

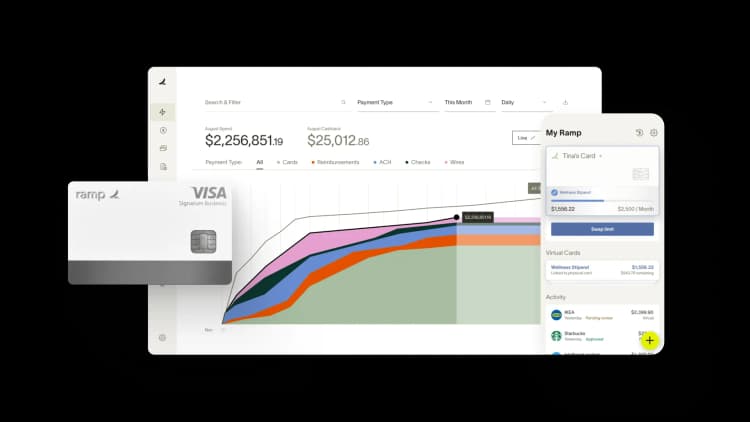

Best overall Fyle alternative: Ramp

No matter how you slice it, Ramp’s all-in-one expense management platform is the top Fyle alternative on our list.

Clearly, we’re biased. But don’t just take our word for it. With a G2 score of 4.8 out of 5 stars and more than 2,000 reviews (including 1,800 5-star reviews), Ramp outperforms Fyle in a measurable way. In a direct comparison, Ramp beats Fyle in six of G2’s rating categories, tying in the final category:

What’s more, while businesses need to pay $11.99 per user per month just to access Fyle’s basic expense management features, you get those same features (and more) for free with Ramp. Talk about a win-win.

Key features

- Automated expense reports: Submit expenses through Ramp’s mobile app, SMS, and other integrations to automatically generate expense reports.

- Comprehensive expense management: Manage every facet of company spend, including employee reimbursements, mileage reimbursements, travel booking, vendor management, and even procurement—all from one platform.

- Corporate cards you control: Issue as many physical and virtual corporate cards as your business needs, while setting custom controls and spend limits at the card, individual, or department level to keep spending in check.

- AI-powered accounts payable: Reduce manual data entry and the costly errors it can cause, strengthen controls, and stay on top of all your company’s bills with Ramp Bill Pay and accounting automation.

Why customers choose Ramp vs. Fyle

Ramp’s platform is incredibly easy to set up and use, making it popular for many small and mid-sized businesses that value usability. G2 reviewers have more confidence in Ramp’s product roadmap and believe that Ramp meets their needs better than Fyle. Ramp’s virtual cards, receipt management, and expense management also come up as major positives for the company.

“Everything is on auto-pilot. You just buy something with your card and then respond to the text requesting a picture of the receipt and a description—you don't have to save your receipts, scan them later, get way behind on reimbursements and dread doing them or any of that.”

– Richard, CFO (small business)

Pricing

You can access the majority of Ramp’s most powerful features—unlimited corporate cards, spending controls, automated expense management, vendor management, AP automation, and more—free of charge.

If you need additional control, customizable workflows, advanced ERP integrations, international capabilities, and procurement management, you can get those functions for just $15 per user per month with Ramp Plus. Ramp also offers enterprise pricing—just reach out for a quote.

Ready to take control of your finances?

Learn about Ramp’s pricing plans and start saving today.

Rho

Rho is a financial operations platform built around banking services, like business checking accounts, business savings accounts, corporate credit cards, and treasury management. The platform also offers expense management, AP automation, and travel management features. Rho currently scores 4.8 out of 5 stars on G2 based on a small sample size of just over 100 reviews. It outranks Fyle in all of G2’s rating categories:

Key features

- Business checking and savings accounts with $0 ACH and wire transfer fees and up to $75 million in FDIC deposit insurance

- Treasury management services that allow businesses to put excess cash to work by investing in treasury bills, currently earning up to 5% APY

- Expense management capabilities that give businesses the power to set spending rules, digitally capture receipts, and automate expense reports and approvals

Why customers choose Rho vs. Fyle

On average, G2 reviewers find Rho to be easier to set up, administer, and operate than Fyle. They also share that Rho provides better customer support and a clearer product direction than Fyle.

Pricing

Rho currently doesn’t charge any fees to access its platform, instead relying on interchange fees to make money. This means the company’s checking and savings accounts, corporate cards, AP, and expense management features are free.

PayEm

PayEm is a relative newcomer to the expense management market, with features like invoice processing, purchase order creation, and budgeting options. PayEm currently has a G2 score of 4.7 out of 5 stars based on around 150 customer reviews. The company either beats or ties Fyle in most of G2’s rating categories:

Key features

- Corporate cards with custom spending limits, approved categories, and usage dates to facilitate employee spend

- Automated invoice processing that pulls necessary information from a digital scan, removing the need for manual processing

- A built-in audit trail that keeps track of financial events like funding requests, purchase orders, and reimbursements

Why customers choose PayEm vs. Fyle

While G2 reviewers believe that both PayEm and Fyle meet their business requirements, they say that PayEm provides better product support and is easier to use. Positive reviews also mention the company’s virtual cards and receipt management features.

Pricing

PayEm doesn’t publicize its pricing model, so you’ll have to reach out for a quote. Pricing depends on the size of your business and the number of employees that need access to the platform.

Navan (formerly TripActions)

Navan offers a popular travel management product specifically designed for booking and managing business travel that’s also used for general spend management. Navan tops Fyle with a G2 rating of 4.7 out of 5 stars and beats Fyle in all but two of G2’s rating criteria:

Key features

- Link your existing business credit card to the platform so you can keep your existing rewards program

- International reimbursements in 45 countries and 25 currencies for businesses with a global workforce

- In-platform travel booking, including hotels, airfare, rental cars, and more

Why customers choose Navan vs. Fyle

G2 reviewers indicate that Navan provides better customer support than Fyle. Users enjoy that the platform is easy to use and that reimbursements are quick and easy.

Pricing

Navan is free for the first 5 users in companies up to 300 employees. Enterprise pricing is available for larger businesses.

Paylocity

Paylocity’s spend and expense management platform — now integrating what was formerly Airbase — offers a unified procure-to-pay experience built into its HR/finance ecosystem. According to G2, Paylocity currently holds an average rating of 4.5 out of 5 based on more than 5,000 verified reviews. It performs strongly in categories like ease of use, integration, and support when compared with other spend management platforms including Fyle:

Key features

- Guided procurement workflows with customizable a

- Invoice capture, processing, and payment automation

- Real-time expense tracking and spend visibility

- Receipt upload with OCR and reconciliation tools

Why customers choose Paylocity vs. Fyle

Reviewers frequently highlight Paylocity’s unified approach, combining procurement, accounts payable, and expense workflows into one platform. Many mention stronger automation, tighter spend controls, and deeper integration across finance and HR systems as advantages over Fyle.

Pricing

Paylocity does not publish public pricing for its spend and expense management module. Organizations interested in exploring pricing can contact the Paylocity sales team.

Mesh Payments

Mesh Payments is a spend management platform that offers a range of business solutions, from travel management to expense management, vendor management, procurement, and more. The company ties with Fyle, with 4.6 out of 5 stars on G2 based on more than 1,000 reviews. In G2’s rating criteria, Mesh Payments beats Fyle in two and ties in four others:

Key features

- SaaS spend management that helps businesses identify opportunities to save—for example, by consolidating subscriptions

- Unlimited virtual spending cards with custom expiration dates, spending limits, and vendor locks

- Extensive integrations with popular accounting, HRIS, SSO, banking, and other software

Why customers choose Mesh Payments vs. Fyle

G2 reviewers seem more enthusiastic about Mesh Payments’ product roadmap than Fyle’s. They also report that Mesh Payments is easy to set up and administer. Users specifically mention the platform’s card management, receipt management, and virtual cards as strengths.

Pricing

Mesh Payments offers a free tier with basic expense management functionality and a Premium subscription for $10 per user per month. Enterprise pricing is available upon request.

Zoho Expense

Zoho Expense is an expense management solution designed for small and mid-sized businesses that want affordability without sacrificing essential functionality. The platform holds a G2 score of 4.5 out of 5 stars, putting it close to Fyle. Head-to-head, Fyle often scores higher on receipt management and integrations, while Zoho earns praise for its ease of use and value for money.

Key features

- Automated expense reporting with receipt scanning and OCR

- Multi-currency support and mileage tracking for business travel

- Integration with other Zoho applications like Zoho Books and Zoho CRM

Why customers choose Zoho Expense vs. Fyle

Zoho Expense users appreciate its intuitive interface, affordability, and smooth integration with other Zoho apps. Many small business owners highlight how easy it is to onboard employees and manage expenses without a steep learning curve. For companies already invested in the Zoho ecosystem, Zoho Expense offers a seamless extension of their existing workflows.

Pricing

Zoho Expense offers three main tiers: Free, Standard at $3/user/month, and Premium at $5/user/month. You’ll need to contact them for enterprise pricing. All plans include a 14-day free trial, making it easy for businesses to test before committing.

Pick the top-rated Fyle competitor

When it comes to your finances, it pays to pick the top-rated solution. Ramp’s all-in-one finance platform is powerful, intuitive, reasonably priced, and backed by more than 2,000 5-star reviews.

Whether you’re looking for corporate cards, expense management, AP automation, travel booking, financial reporting, or more, Ramp’s got you covered. That’s what makes Ramp stand out in the field, and it’s why we think Ramp is the #1 Fyle alternative.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits