8 best Emburse Professional (formerly Certify) alternatives in 2026

- At a glance: Emburse Professional competitors compared

- Best overall Emburse Professional alternative: Ramp

- Rho

- Navan (formerly TripActions)

- Sage Expense Management (formerly Fyle)

- Perk (formerly TravelPerk)

- Expensify

- FreshBooks

- SAP Concur

- Why Ramp is the best Emburse Professional alternative

- Pick the top-rated Emburse competitor

Emburse Professional, formerly known as Emburse Certify, is an expense management solution for small to mid-sized companies with moderately complex expense management needs. It’s fairly popular, sporting a score of 4.5 out of 5 stars on the software review website G2—a solid score with room for improvement.

While many reviewers say Emburse Professional is easy to use, they also point to several areas where the software falls short, specifically receipt management, manual entry, and error management. Many reviewers also note upload issues and other inaccuracies as areas of improvement.

Depending on the size of your organization, subscriptions start at $250 a month (or $3,000 annually) to access all of Emburse Professional’s functionality—a hefty price considering there are cheaper alternatives with better reviews.

If you’re looking for an Emburse Professional alternative, here are some highly rated competitors to look into:

- Ramp

- Rho

- Navan (formerly TripActions)

- Sage Expense Management (formerly Fyle)

- Perk (formerly TravelPerk)

- Expensify

- FreshBooks

- SAP Concur

To compile this list, we looked at alternatives that ranked at least as highly as Emburse Professional on the software review website G2. Those reviews, paired with our own research into each tool and its feature set, form the basis of our rankings.

At a glance: Emburse Professional competitors compared

Platform | G2 Rating | Market Segment | Key Features | Minimum Cost |

|---|---|---|---|---|

Ramp | 4.8 | Startups | Expense management | $0 – Unlimited free tier |

Rho | 4.8 | Small businesses | Business checking/savings | Free |

Navan (formerly TripActions) | 4.7 | Mid-market | Expense management | Free tier |

Fyle | 4.6 | Mid-market | Expense management | Growth ($11.99 per user per month) |

TravelPerk | 4.6 | Mid-market | Expense management | Starter (Free, up to 5 bookings/month) |

Expensify | 4.5 | Small businesses | Expense management | $0-$36/month depending on your plan |

Freshbooks | 4.5 | Small businesses | Invoicing | Lite ($7.60 per month) |

SAP Concur | 4 | Enterprise | Expense management | N/A – All pricing is quote-based |

Best overall Emburse Professional alternative: Ramp

Ramp’s all-in-one platform is our choice for the best Emburse Professional alternative. Yes, we’re a bit biased, but you don’t have to take our word for it: More than 2,000 reviewers on G2 have given Ramp a rating of 4.8 out of 5 stars.

In a head-to-head matchup, Ramp beats Emburse Professional handily in all seven of G2’s rating categories:

On top of that, Ramp was recognized by G2 as a category leader in Summer 2024—a designation awarded to products that achieve the greatest positive movement year over year.

Key features

- Automated expense management: AI-powered expense management lets you automate as much or as little of your process as you want, from expense reporting and approvals to reimbursements, financial reporting, and more

- Comprehensive feature set: In addition to expense management, Ramp offers corporate cards, employee reimbursement, procurement, accounts payable automation, vendor management, reporting capabilities, and more to help make your finance team a model of efficiency

- Granular spend management: Ramp’s corporate cards let you set spending controls at the card, employee, vendor, or category level. Pre-build budgets and enforce spend limits that reduce the risk of out-of-policy spending.

- Modern design: Ramp was designed to be highly intuitive and easy to use, leading to faster implementation, easier training, and increased adoption rates among your employees

Why customers choose Ramp vs. Emburse Professional

Nearly 1,000 G2 reviewers highlight Ramp’s ease of use as a major benefit. Ramp’s receipt management, virtual cards, and easy expense submission also come up as positives across reviews. Users also note that Ramp is easier to set up and quicker to implement than other options, enabling smoother onboarding and a faster time to value (TTV).

“Ramp cards are extremely easy to set up and use, with a great selection of reporting filters and flexibility. The hierarchy in authorizations is great, and the ability to submit receipts on the spot or have them auto-submitted through Gmail or Amazon is fantastic, as is the ability to code them into the general ledger on the spot.

– Mark T., Finance Manager (mid-market)

Pricing

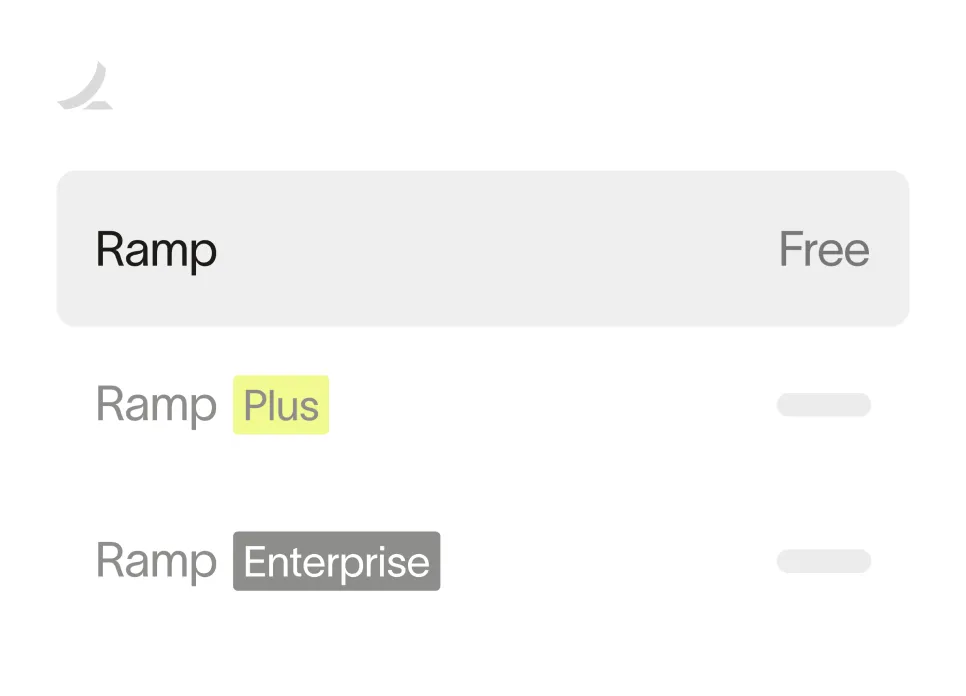

The majority of Ramp’s most powerful expense management features are totally free to use. This includes unlimited physical and virtual corporate cards, automated expense management, vendor management, accounting software integrations, and more.

For just $15 per user per month, you can unlock even more customization and control with Ramp Plus, giving you access to customizable workflows, procurement automation, advanced ERP automation, and more. Enterprise pricing is available, too—just reach out.

Ready to take control of your finances?

Learn about Ramp’s pricing plans and start saving today.

Rho

Rho is a financial operations platform that offers business banking and treasury services, plus expense management and accounts payable. The company has a G2 score of 4.8 stars based on a small sample size of just over 100 reviews. It outranks Emburse Professional’s score of 4.5 straight-up and in each of G2’s seven rating criteria:

Key features

- Expense management that lets you set spending rules, file expenses in real time, and enforce your expense policy automatically

- Business checking and savings accounts you can use for bill pay, global payment processing, and general treasury management

- Corporate cards that allow you to set merchant restrictions, spending limits, and custom approval processes

Why customers choose Rho vs. Emburse Professional

G2 users point to Rho’s ease of setup and ease of use as major positives, specifically calling out the software’s easy uploads and receipt management capabilities.

Pricing

Currently, Rho’s business banking, savings accounts, corporate cards, and expense management platform are free to use. The company earns the bulk of its revenue from interchange fees.

Navan (formerly TripActions)

Navan, formerly known as TripActions, is a travel management platform for booking and managing corporate travel expenses. Navan has a G2 score of 4.7 out of 5 stars and beats Emburse Professional in all seven of the criteria G2 measures:

Key features

- Online booking that lets you choose from a variety of travel options directly within the app

- Travel management that allows you to establish and enforce spend limits and other policies

- Automated expense management that categorizes and reconciles purchases as they’re incurred

Why customers choose Navan vs. Emburse Professional

Navan users on G2 tout the platform’s simple travel booking process and overall ease of use compared to Emburse Professional. Other positives include quick reimbursements and Navan’s general level of convenience.

Pricing

Navan’s expense management features are free for companies with up to 300 employees, but beyond that, Navan doesn’t publicly advertise its subscription costs. Enterprise pricing is available for larger businesses, though you’ll have to request a quote from Navan’s sales team.

Sage Expense Management (formerly Fyle)

Sage Expense Management, formerly known as Fyle, is an expense management platform with the stated goal of helping accountants streamline reporting processes without issuing new credit cards. It scores 4.6 out of 5 stars on G2 based on more than 1,500 customer reviews. Sage is rated higher than Emburse Professional in all of G2’s scoring categories:

Key features

- Simple receipt management that allows your employees to submit receipts via email, text, Slack message, and more

- Automatic expense categorization and submission powered by OCR technology reduces the need for expense reports

- Mileage tracking that integrates with Google Maps, replacing mileage logs and making mileage reimbursements easier

Why customers choose Sage Expense Management vs. Emburse Professional

G2 users like Sage’s easy receipt uploads and expense tracking capabilities, as well as the fact that it allows for relatively quick reimbursements. Compared to Emburse Professional, many users say that Sage is easier to set up and administer.

Pricing

Sage offers multiple pricing packages. The cheapest option, at $11.99 per user per month, is the Growth subscription, which provides access to Sage’s basic expense management functions.

Sage’s Business subscription costs $14.99 per user per month and provides additional functionality, including direct integration with Visa, Mastercard, and American Express, as well as ACH reimbursements and more. You can save some money on subscription costs if you choose annual billing.

Perk (formerly TravelPerk)

Perk is a travel management platform for booking and managing business trips and related expenses. Perk has 4.6 out of 5 stars on G2 based on more than 1,500 reviews and beats Emburse Professional in all but one rating category:

Key features

- Consolidated receipts so that all expenses related to a business trip are included on a single invoice for easy processing and recordkeeping

- Automated travel policies that allow you to customize spending limits by category (lodging, airfare, rental cars, and more)

- Value-added tax (VAT) calculator that tracks any foreign taxes you’ve paid, which you can deduct come tax season

Why customers choose Perk vs. Emburse Professional

Perk reviewers on G2 note the platform’s easy travel booking as the number one benefit of using the software. They also applaud the company’s customer service and general customer experience as positives.

Pricing

Perk offers three subscription options, with more expensive packages offering more comprehensive functionality:

- Starter: Free for the first 5 bookings each month, then 5% per booking

- Premium: $99 per month

- Pro: $299 per month

Expensify

Expensify is a popular spend management platform that offers a number of solutions for small businesses, including employee reimbursements and expense management. The company ties Emburse Professional’s score of 4.5 out of 5 on G2 based on more than 5,000 reviews.

Compared head to head on G2’s rating categories, the results are mixed. Expensify beats Emburse Professional in three categories, while Emburse Professional comes out on top in the remaining four:

Key features

- Physical and virtual corporate cards with individual spending limits

- Expense management that allows you to scan and track receipts, categorize purchases, and reimburse employees for out-of-pocket spend

- Invoicing and bill pay capabilities that make it easier to send and request payment

Why customers choose Expensify vs. Emburse Professional

In a head-to-head matchup, Expensify user reviews indicate the software is more intuitive and better at meeting business requirements than Emburse Professional. They specifically call out Expensify’s easy expense submissions and upload, as well as its general simplicity.

Pricing

Expensify reports that it can cost as much as $36 per user per month. However, your rate will vary based on your plan, your number of monthly users, whether you use Expensify’s corporate card, and how much you spend each month on your Expensify card. It’s best to check out Expensify’s billing support page for the full rundown of how pricing works.

FreshBooks

FreshBooks is an online accounting platform with a heavy emphasis on invoicing. The company ties Emburse Professional with a G2 score of 4.5 out of 5 stars. It does, however, beat Emburse Professional in five of G2’s rating criteria:

Key features

- Invoice generator that you can customize with your logo, messaging, and overall brand identity

- Online payments that make it easier to facilitate payment directly from within the invoices you send your customers

- Expense management with built-in receipt tracking and digital mileage log for employee reimbursements

Why customers choose FreshBooks vs. Emburse Professional

As an invoice-focused accounting software, it’s only natural that many user reviews on G2 commend FreshBooks’s invoicing and invoice management capabilities. Users also rate FreshBooks’s ease of use and customer support highly.

Pricing

FreshBooks offers three standard pricing plans:

- The Lite plan costs $8.40 per month and offers limited invoicing functionality

- Plus costs $15.20 per month and includes additional invoice capacity

- Premium costs $26 per month, with unlimited invoicing

You can save on subscription costs by choosing annual billing, and FreshBooks also runs frequent promotions like reduced pricing for the first six months.

SAP Concur

SAP Concur is one of the most widely used travel and expense management platforms out there, which is why we included it in this list despite its relatively low G2 score of just 4 out of 5 stars. This is the one competitor on this list that Emburse Professional clearly beats, leading SAP Concur in all seven of G2’s rating criteria:

Key features

- Digital receipt management and automatic expense categorization helps streamline expense reporting

- Advanced integrations that allow for travel booking, trip notifications, and broader itinerary management

- Ability to automatically audit expense reports to monitor for expense fraud and compliance

Why customers choose SAP Concur vs. Emburse Professional

Many of SAP Concur’s G2 reviewers state they believe the software makes them more efficient, especially when it comes to expense management and tracking. That being said, many reviewers also note that a poor user interface and unintuitive design hold the software back.

Pricing

SAP Concur’s pricing is pretty opaque. To get an accurate sense of the cost, you’ll need to request a quote.

Why Ramp is the best Emburse Professional alternative

For finance teams, managing employee expenses can be a time-consuming, error-prone process full of manual work and piecemeal solutions. Collecting paper receipts, reviewing expense reports line by line, and manually inputting data into accounting systems takes valuable time away from more strategic priorities.

Ramp's AI-powered expense management software automates the most painful parts of the process. Ramp lets you issue unlimited physical and virtual corporate cards that make it easy for employees to pay for work-related purchases. Transactions are automatically captured and categorized, with key details like merchant name, date, and amount populated instantly.

Built-in receipt matching uses OCR technology to pair receipts with their corresponding transactions, eliminating the need for manual data entry. You can even configure rule-based expense policies that automatically flag non-compliant purchases for review.

This automation doesn't just save time; it also provides real-time visibility and control over company spend. With Ramp, every card swipe and online purchase flows into intuitive dashboards that let you see category- and department-level spend at a glance.

Automatic accounting sync means approved expenses flow seamlessly into your general ledger, ensuring your books are always audit-ready. And if you do need to dig into the details, powerful search tools let you find specific transactions in seconds rather than hours of scrolling.

By streamlining the most tedious aspects of expense management, Ramp frees up your team to focus on what matters most: keeping budgets on track, spotting savings opportunities, and driving the business forward.

Pick the top-rated Emburse competitor

Reviewers rank Ramp’s all-in-one expense management software as the #1 Emburse Professional alternative for a reason: It makes expense management easy, straightforward, and convenient.

Ramp’s modern finance platform combines expense management with integrated corporate cards, travel booking, AP automation, procurement, cash flow visibility, and AI-powered recommendations that all add up to save customers an average of 5% a year across all spending.

Don't miss these

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits