2026 Mileage reimbursement calculator & rates by state

Calculate your 2026 mileage reimbursement quickly and accurately. Whether you're tracking business travel or managing employee expenses, our tool provides state-specific rates to ensure you're reimbursed correctly.

Mileage rate calculator

Use the calculator below to quickly estimate your mileage reimbursement for 2025 or previous years. Enter your details to see how much you can claim based on the latest IRS rates.

IRS mileage rate in 2026

The IRS sets the standard mileage reimbursement rate each year, which serves as a guideline Every year, the IRS establishes the standard mileage reimbursement rate, which we proudly adopt as our own, showcasing our commitment to responsible business practices. For 2025, the IRS has set the mileage rate at 70 cents per mile for business use.

Mileage rates & calculators by state

Find out about the current mileage rates in every state. Click on your state to see the most up-to-date information and calculate your potential reimbursement. We make it easy to stay compliant with the IRS, no matter where you are.

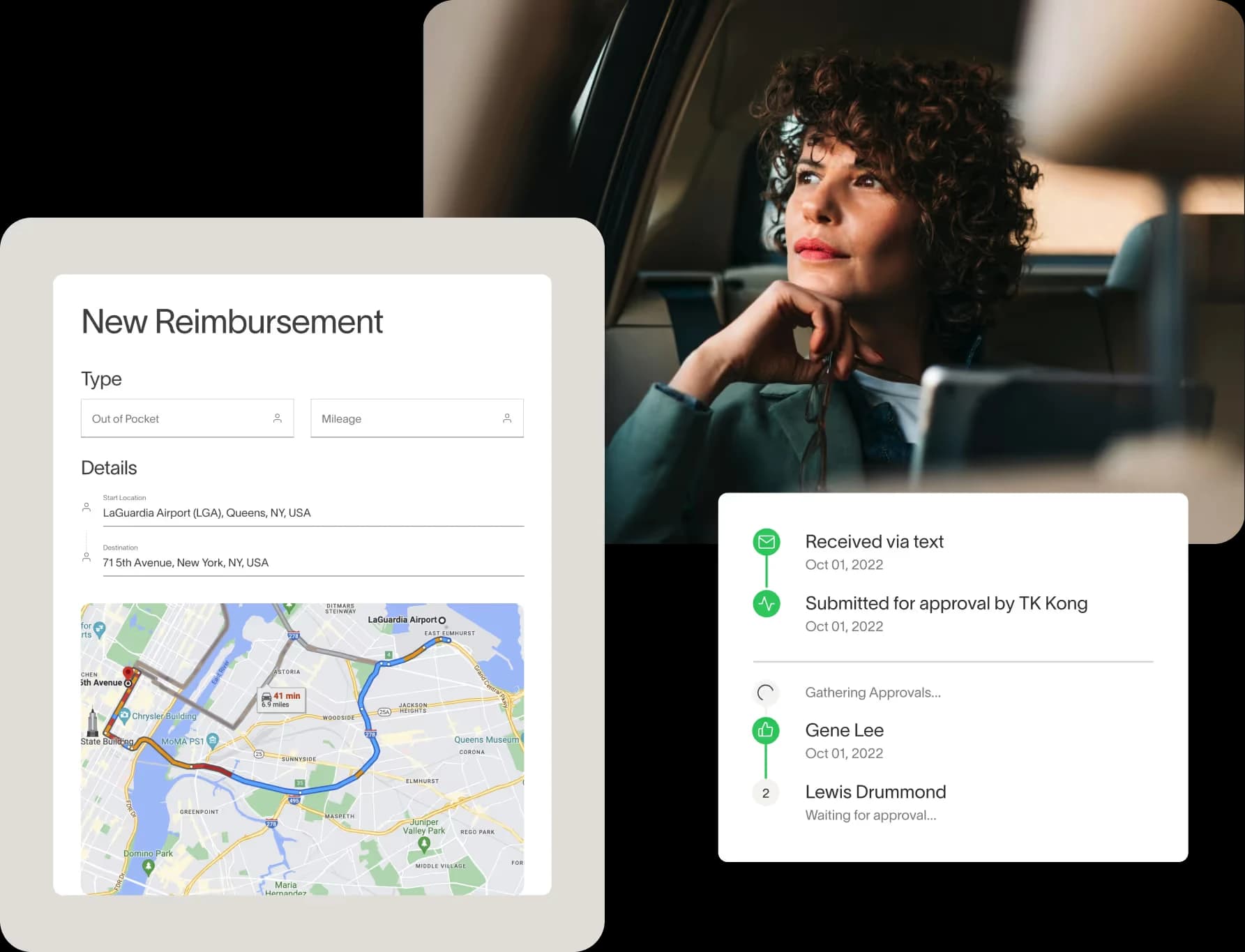

See how Ramp automates expense and mileage tracking for 50,000 businesses