The 5 best Rydoo alternatives and competitors in 2026

- Why businesses are looking for Rydoo alternatives

- At a glance: Rydoo alternatives compared

- Best overall Rydoo alternative: Ramp

- Navan (formerly TripActions)

- Zoho Expense

- Expensify

- SAP Concur

- A closer look at Ramp vs. Rydoo

- Why choose Ramp vs. Rydoo: A more strategic approach to spend management

- Ramp isn’t just a Rydoo alternative—it’s an upgrade

Rydoo is a well-rated platform for tracking employee expenses, particularly for organizations with heavy travel needs. With a 4.4-star rating on G2 from over 700 reviews, it’s a strong choice for teams focused on traditional travel and expense (T&E) management. But if your business needs more—like real-time expense controls, accounts payable automation, or broader spend management—you may be looking for an alternative.

This comparison looks at how Rydoo stacks up against other top-rated expense management solutions, spanning both travel-focused platforms and broader expense tools. There are several strong Rydoo alternatives in the expense management space, including Ramp, Navan, Zoho Expense, Expensify, and SAP Concur. Each platform brings a unique mix of features that makes them suitable for different business sizes and priorities.

Whether you're outgrowing Rydoo, frustrated with its limited integrations, or simply exploring more modern tools, this guide compares the top Rydoo competitors based on real G2 ratings, user reviews, and feature sets.

Why businesses are looking for Rydoo alternatives

While Rydoo remains a popular expense management platform, particularly among teams looking for real-time mobile expensing, some businesses are starting to research Rydoo alternatives due to concerns around customization, integration limitations, sync delays, and rising costs.

Rydoo reviews on G2 highlight a mix of praise and frustration that sheds light on why some companies are exploring other options:

1. Sync delays and offline limitations

Many users appreciate Rydoo’s mobile app for its ease of use, but also report that syncing issues can cause bottlenecks. Reviewers mention problems with syncing receipts while offline or delays in submitting expenses when connectivity is poor. These interruptions create friction, especially for frequent travelers and remote teams who rely on seamless mobile functionality.

2. Limited customization and complexity in admin setup

While Rydoo supports automated approval flows, some reviewers note that customizing these workflows isn’t always intuitive. Admin users have flagged that the platform can be rigid when configuring categories, approval chains, and entity structures. One reviewer noted that “the categorization, group, and entity are too complicated and difficult to configure,” which can be a roadblock for teams with nuanced accounting requirements.

3. Integration pain points

Although Rydoo boasts integrations with major ERPs and tools like SAP, Oracle, and QuickBooks, several mid-market and enterprise reviewers describe these integrations as “limited” or “clunky.” Issues with delayed transaction syncing and difficulties importing vendor data or receipts are commonly cited issues.

4. Feature gaps for power users

For basic expensing, Rydoo performs well. But users looking for advanced reporting, bulk upload capabilities, or granular financial insights have noted some limitations. For example, some users report that reports can’t be easily customized to specific business needs, while others wish the system offered a more transparent approval process or better dashboard UX.

At a glance: Rydoo alternatives compared

Not all Rydoo competitors serve the same niche. Some tools, like Navan and Concur, are purpose-built for travel and expense management. Others, like Ramp, offer a more holistic approach, combining expense management with corporate cards, bill pay, and instantaneous controls.

We’ve included a mix of options so you can choose the right solution based on your current (and future) needs.

Platform | G2 rating | Market segment | Key features | Minimum cost |

|---|---|---|---|---|

Ramp | 4.8 | Startups, small businesses, mid-market | Expense management, Corporate cards, Travel booking | $0 – Unlimited free tier |

Navan | 4.7 | Mid-market, enterprise | Travel booking, Expense management, Virtual cards | $0 – Free tier with seat and usage limits |

Zoho Expense | 4.5 | Small businesses, mid-market | Expense management, Receipt scanning, Policy enforcement | $0 – Free tier for up to 3 users, with usage limits |

Expensify | 4.5 | Small businesses, Mid-market | Expense reporting, Corporate cards, Invoicing | $0 – Free plan available (limited features) |

SAP Concur | 4.0 | Mid-market, enterprise | Travel and expense management, Integrations, Policy compliance | ~$9 per user/month (varies by plan) |

Best overall Rydoo alternative: Ramp

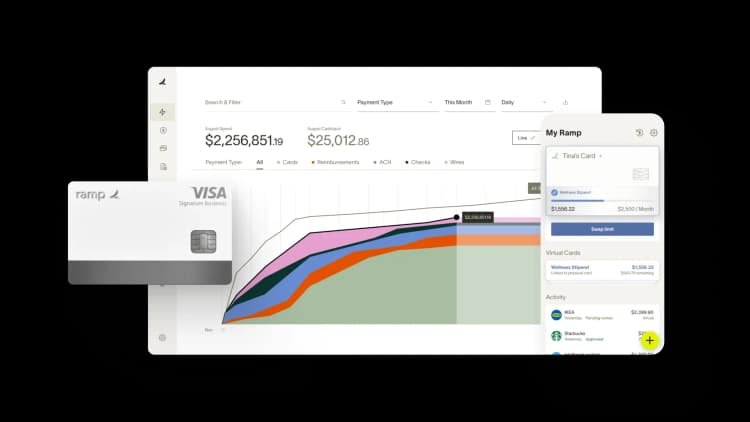

Ramp is more than a Rydoo alternative; it’s a broader solution built for modern finance teams.

While Rydoo focuses narrowly on travel and expense tracking, Ramp consolidates corporate cards, travel booking, AP automation, reimbursements, procurement, and real-time spend insights into a single platform. That’s why it consistently ranks as the top alternative for finance leaders looking to automate processes, reduce manual overhead, and future-proof their finance stack.

With Ramp, companies can issue corporate cards that enforce spend policies automatically, eliminating out-of-policy purchases and streamlining receipt collection. Its expense management features categorize transactions in real time and sync directly with accounting platforms and ERPs like NetSuite, QuickBooks, and Xero.

Teams also benefit from AP automation that simplifies invoice intake, approval, and payment, alongside procurement tools that manage purchase requests, vendor onboarding, and contract workflows. All of this is backed by powerful reporting and analytics tools that give finance teams the insights they need to make fast, strategic decisions.

For organizations looking to consolidate tools, reduce software costs, and automate financial workflows from end to end, Ramp offers a more scalable and complete alternative to Rydoo.

Key features

- Unified platform that consolidates workflows and data across expense management, corporate travel booking, AP, procurement, and more

- Seamless one-step bill import with AI-powered invoice matching, delivering 99% accuracy at the line-item level

- Real-time expense tracking and automated policy enforcement across cards, reimbursements, and invoices

- Integrated corporate cards with dynamic spend controls to block out-of-policy purchases before they happen

- Smart auto-coding of bills as liabilities, with robust integrations to ERP and HRIS systems such as NetSuite and QuickBooks

Why customers choose Ramp vs. Rydoo

Ramp holds a near-perfect 4.8-star rating on G2, with over 2,000 verified reviews from finance leaders, operations teams, and business owners. Customers consistently cite Ramp’s ease of use, automation capabilities, and all-in-one functionality as key reasons for switching from point solutions like Rydoo.

Unlike Rydoo, which focuses primarily on expense tracking, Ramp brings together corporate cards, expense management, bill pay, and procurement into a single, integrated platform. This centralized approach gives finance teams real-time visibility into spend, streamlines month-end close, and eliminates the need to juggle multiple tools.

Ramp also builds policy enforcement and spend controls into every transaction. Users can set dynamic limits, automate approvals, and receive instant alerts—features that reviewers say reduce manual oversight and increase policy adherence across departments. As one CFO wrote, “Ramp has revolutionized our business processes… We’ve cut our monthly time spent on expense management from 40 hours to 8.”

Another key differentiator is Ramp’s pricing model. Unlike Rydoo, Ramp’s entry-level plan doesn’t charge per user, making it cost-effective to scale finance automation across your organization. One small business controller put it simply: “For employees, it brings everyone onto a single user experience instead of working with many apps for AP, cards, reimbursements, and travel.”

Serviceable markets

Ramp serves a broad range of industries, including high-growth startups, mid-market companies, and enterprises across sectors like healthcare, education, professional services, and retail. From SaaS firms and nonprofits to real estate developers and e-commerce brands, over 50,000 businesses use Ramp to streamline spend, automate accounts payable, and gain real-time visibility.

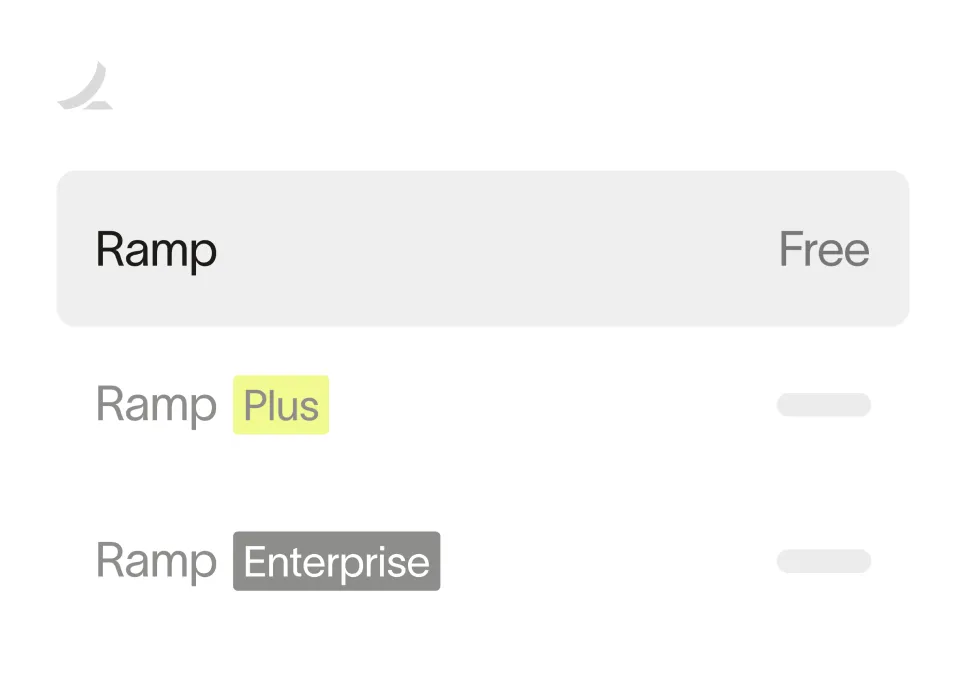

Pricing

Ramp’s free plan offers unlimited access to core features that help you control spend, automate payments, and close your books faster. For finance teams with more advanced needs, Ramp Plus is available at $15 per user per month. Custom Enterprise plans are also available.

Ready to take control of your finances?

Learn about Ramp’s pricing plans and start saving today.

Navan (formerly TripActions)

Navan offers integrated travel booking and expense tracking designed to streamline T&E workflows and reduce friction for finance teams. It’s ideal for teams that prioritize travel management and want a more intuitive, automated alternative to Rydoo.

Key features

- Customizable spend controls to automatically block out-of-policy purchases

- Automated expense reconciliation triggered at the point of sale

- Ability to link your existing business credit cards so you can maintain your current banking relationships and rewards

- Global reimbursement support across 45 countries and 25 currencies

Why customers choose Navan vs. Rydoo

Navan holds a 4.7-star rating from more than 8,000 reviews on G2, with users praising its intuitive design, fast reimbursements, and all-in-one travel and expense platform. While Rydoo focuses primarily on expense reporting, Navan combines travel booking, expense capture, and automated reconciliation in a single, unified experience.

Navan is a smart choice over Rydoo for companies that want to prioritize features like:

- Integrated travel booking and expense capture

- Auto-reconciliation at point-of-sale

- Multi-currency reimbursement support

In short, for international flexibility, Navan is a strong alternative to Rydoo.

Serviceable markets

Navan serves mid-market and enterprise companies with frequent travel needs, particularly in industries like technology, consulting, healthcare, and education. It’s well-suited for organizations with global teams.

Pricing

Navan provides a free plan for teams of up to 5 users. For enterprise plans, you’ll need to contact Navan’s sales team directly.

Zoho Expense

If your team needs a lightweight, budget-friendly alternative to Rydoo, Zoho Expense is a solid option. It’s part of the larger Zoho ecosystem, so it may be especially appealing if you’re already using other Zoho tools in your fintech stack.

Key features

- Mobile receipt capture with automatic expense creation

- Mileage tracking and per diem automation

- Customizable approval workflows

- Integrations with Zoho Books, QuickBooks, and Xero

- Global support for multi-currency reimbursements and compliance across 150+ countries

Why customers choose Zoho Expense vs. Rydoo

Zoho Expense earns a 4.5-star rating on G2 from over 1,400 reviews, with users praising its intuitive interface, automation features, and tight integration with Zoho’s broader suite of finance tools. It offers a more customizable and end-to-end solution for T&E management, particularly for small and mid-sized businesses looking for flexibility and value.

Teams choose Zoho Expense over Rydoo for its simple, user-friendly design that supports fast mobile receipt capture and auto-scanning. Its built-in mileage tracking, per diem automation, and real-time policy enforcement make it easy for businesses to stay compliant without micromanaging every transaction.

Serviceable markets

Zoho Expense is built for growing businesses that need a flexible, budget-friendly way to manage travel and expense workflows without overhauling existing systems. It’s a strong fit for finance teams in global SMBs and startups.

Pricing

Zoho Expense offers a limited free tier for up to 3 users. Its Standard plan starts at $3 per user per month, and its Premium plan starts at $5 per user per month, billed annually. Custom pricing is available on request.

Expensify

Expensify is a long-standing player in the expense management space. It offers automated receipt capture, employee reimbursements, and a business credit card, though many users feel it’s beginning to show its age compared to newer tools. Some companies and finance leaders move away from Expensify due to limited customization and a more manual approach to policy enforcement compared to platforms like Ramp.

Key features

- SmartScan OCR for fast, automated receipt capture

- Expensify Card with real-time expense syncing

- Mobile-first interface

- Free plan with next-day reimbursement

- Built-in chat for communication between employees and finance team

Why customers choose Expensify vs. Rydoo

Similar to Rydoo’s differences from Ramp, Rydoo places a stronger emphasis on travel integration, whereas Expensify leans more toward general expense automation and reimbursements.

With over 5,000 reviews and a 4.5-star rating on G2, Expensify is frequently praised for its intelligent receipt capture. Users also value Expensify’s clean, mobile-friendly interface, automatic expense syncing through the Expensify Card, and real-time tracking for both out-of-pocket and corporate card purchases.

Serviceable markets

Expensify primarily serves small to mid-sized businesses across industries like tech, professional services, nonprofits, and startups that need a lightweight, user-friendly way to manage expenses, reimbursements, and approvals. It’s also well-suited for distributed or remote teams who rely on mobile-first tools.

Pricing

Expensify offers a free plan for individuals through its New Expensify tier. For teams, the Collect plan starts at $5 per user per month. Businesses that need advanced controls and integrations can upgrade to the Control plan, which starts at $9 per user per month with Expensify Card usage, or up to $36 per user if billed month-to-month without it.

SAP Concur

SAP Concur is a legacy solution known for deep integrations with enterprise systems. It’s a reliable alternative to Rydoo for large organizations already embedded in the SAP ecosystem, especially those needing travel and expense management.

Key features

- Automated expense capture using OCR and mobile receipt scanning

- Built-in travel booking integration

- Real-time visibility across global teams

- Integrations with ERPs like SAP, Oracle, and NetSuite

- Global compliance support, including multi-currency, VAT, and per diem handling

Why customers choose SAP Concur vs. Rydoo

Enterprise teams often choose Concur over Rydoo for its deep functionality, global scalability, and proven track record in managing both travel and expense operations. With over 6,000 reviews on G2 and a 4.0-star rating, SAP Concur is praised for offering a comprehensive tool for T&E workflow management.

Unlike Rydoo, which emphasizes ease of use for growing companies with simpler travel needs, Concur stands out for its enterprise-grade features, particularly its integration with SAP and Oracle systems, built-in travel booking tools, and end-to-end compliance support.

Serviceable markets

SAP Concur primarily serves large enterprises and multinational organizations that require comprehensive travel and expense management with deep ERP integrations and global compliance capabilities.

Pricing

You’ll need to contact SAP Concur for a custom quote.

A closer look at Ramp vs. Rydoo

If you’ve been researching Rydoo alternatives, you might notice that Ramp doesn’t always appear on those lists. This is largely due to category definitions, not capability. If you're looking specifically for Rydoo alternatives (centralized travel and expense workflows), Ramp often gets left off because its platform spans broader finance operations.

Rydoo is designed as a travel and expense (T&E) management tool, purpose-built for companies that need to:

- Capture receipts and upload them manually or via mobile app

- Route expense reports for approval

- Handle employee travel bookings and related reimbursements

- Centralize invoicing for business trips

It’s a solid fit for organizations where travel is the main driver of employee expenses, and where expense tracking is still largely manual.

Ramp and Rydoo are used for related but distinct purposes. Ramp, by contrast, is in a different league. It’s a corporate card and spend management platform that automates—and elevates—everything Rydoo handles, while going far beyond traditional T&E.

With Ramp, you get:

- Corporate cards with built-in spend controls (no separate card program needed)

- Automated expense reporting with AI-powered receipt matching and policy enforcement

- Integrated accounts payable and bill payments, so you can manage reimbursements and vendor invoices from one platform

- Real-time insights and custom approval workflows that eliminate the need for end-of-month catch-up

While Rydoo focuses narrowly on travel and expense workflows, Ramp delivers a broader, more modern approach to spend management. So while Ramp may not appear on every Rydoo comparison list, it should.

For companies ready to automate manual processes and consolidate their finance stack, Ramp is a more scalable, intelligent, and cost-effective alternative that deserves serious consideration.

Why choose Ramp vs. Rydoo: A more strategic approach to spend management

Control and visibility over all spend, not just travel

Rydoo is great for travel-heavy teams. But what about SaaS subscriptions, one-off vendor payments, office supply purchases, or departmental budgets?

Ramp gives finance teams real-time visibility across every dollar spent, not just employee travel. You can:

- Set granular spend controls by employee, vendor, or category

- Get instant alerts on non-compliant activity

- Automate monthly close workflows with pre-categorized data, which is crucial for travel and expense reimbursement

Unified spend platform

Ramp consolidates what might otherwise require multiple tools—a T&E platform, a corporate card program, and an AP system—into one automated hub.

While Rydoo is effective for capturing receipts and managing travel-related expenses, Ramp offers a comprehensive platform that covers:

- Corporate cards (physical and virtual) with built-in controls

- Automated expense reporting with receipt matching

- Bill pay automation

- Vendor management and contract tracking

- Reimbursements

- Integrations with accounting tools like QuickBooks, NetSuite, Xero, and Sage

This means Ramp consolidates what might otherwise require varied logins and tools.

Intelligent automation reduces reconciliation errors, eliminates repetitive tasks, and accelerates month-end close

Ramp auto-collects and matches receipts via email and SMS, flags policy violations in real time, and syncs transactions directly with your general ledger, minimizing time spent on expense reconciliation.

This automation means less time chasing receipts and fixing data entry issues—something even modern T&E tools like Rydoo may still require manually or via limited integrations.

You won’t outgrow Ramp

Rydoo is tailored for T&E. As your company grows, you’ll likely need:

- AP automation

- Spend analytics

- Procurement workflows

- Departmental budgeting

With Ramp, you get these already built in, allowing your finance stack to scale with you, without bolting on additional tools or stitching together disjointed systems.

Stronger ROI and cost efficiency

Ramp is free to use and monetized through interchange. Companies using Ramp have cut spend by 5% on average, saved hundreds of hours per year in manual work, and closed their books 86% faster.

Rydoo, by contrast, may incur per-seat fees, and doesn't offer the same return on efficiency or scale.

Ramp isn’t just a Rydoo alternative—it’s an upgrade

If your goal is to streamline all non-payroll spend, improve policy compliance, and reduce manual overhead, Ramp offers far more value than a narrow T&E solution. Even if travel is part of your needs, Ramp’s broader financial infrastructure makes it a wiser investment for finance teams ready to modernize spend control and drive operational efficiency.

Discover how Ramp’s expense management solutions can help your finance team drive greater efficiency, enforce smarter spend policies, and modernize your operations at scale.

FAQs

It depends on the scope of your spending. If travel is your company’s primary expense category, a dedicated T&E tool like Rydoo may be enough. But if you also manage other expenses like SaaS subscriptions or department budgets, a broader platform like Ramp can help you consolidate tools and gain better visibility into your non-payroll spend.

If you’re looking to minimize tool sprawl and automate finance workflows end-to-end, an all-in-one platform like Ramp can streamline operations and reduce costs. However, if your needs are narrowly focused on travel, a best-of-breed T&E tool like Rydoo may suffice.

Rydoo is a travel and expense management solution designed to help teams capture receipts, book business travel, and manage reimbursements. It’s particularly useful for travel-heavy organizations looking to centralize expense approvals and trip-related invoicing.

According to industry research, manually processing a single expense report can cost companies anywhere from $35 to over $50, especially when factoring in time spent on submission errors, approvals, and reconciliation. Automated tools like Ramp significantly reduce these costs by eliminating manual entry and streamlining review workflows.

The biggest sources of inefficiency often stem from manual processes like chasing receipts, delayed approvals, and policy violations. Tools like Ramp solve this with real-time controls, automated receipt capture, and seamless integrations, helping finance teams avoid errors and close books faster.

Legacy systems often rely on after-the-fact review, meaning out-of-policy spend is caught too late. Platforms like Ramp embed policy enforcement into every transaction, including flagging issues in real time and reducing the risk of noncompliance, overspending, and audit complications.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits