What are ePayables? How it works, benefits, and fees

- What are ePayables, and how do they work?

- The relationship between ePayables and accounts payable

- ePayables and associated fees

- ePayables vs. ACH payments

- The benefits and challenges of ePayables

- Streamline your AP workflow with ePayables and Ramp

Smooth, secure, automated payments are no longer a nice-to-have. Your suppliers expect them.

Fortunately, ePayables can transform how your business handles accounts payable, replacing outdated processes like check payments and ACH with faster, more efficient workflows.

Let’s dive into how ePayables simplify payments, why they’re a smarter alternative to traditional methods, and how they can streamline your AP process.

What are ePayables, and how do they work?

ePayables use virtual cards and are designed to replace outdated payment methods like paper checks. Think of these virtual cards as digital credit cards built for business-to-business (B2B) payments.

The ePayables process uses an electronic file your AP team sends to your bank to credit your vendors’ virtual cards with your payments.

Like a standard commercial card, each ePayable virtual card has a:

- Unique 16-digit card number

- Expiration date

- Card verification code (CVC)

The unique virtual card number like commercial cards have is one of the benefits of ePayables. A key difference is that ePayable cards don’t exist physically. The entire process is electronic, making ePayables ideal for secure online transactions and over-the-phone payments.

How the ePayables process works in 6 steps

To clarify how ePayables work, let’s break down the process step by step:

- Assign a virtual card during supplier enrollment: A purchasing authority assigns a unique virtual card number to each supplier

- Invoice submission: The supplier sends an invoice to the buyer as usual

- Invoice review and approval: The AP department reviews the invoice and submits it for approval

- Card funding: Once the invoice is approved, your AP team sends an electronic file to your bank outlining payment details. The supplier’s virtual card is then funded with the exact payment amount. This is typically done in bulk payments to multiple suppliers.

- Payment notification: The supplier receives a notification that their virtual card is ready for use. Payment information (including remittance advice) is emailed to the supplier’s preferred contacts.

- Payment processing: The supplier processes the payment by charging the exact invoice amount to the virtual card. The transaction is reflected in the buyer’s credit card account, confirming the payment is complete.

ePayables streamline your payment system by automating invoice processes, cutting down on manual workflows, and reducing errors.

The relationship between ePayables and accounts payable

ePayables and accounts payable (AP) work together to simplify payments and improve efficiency. With an ePayables program, your business can automate workflows, reduce errors, and better control cash flow.

Here’s how they work together:

- Invoice approval triggers funding: After a supplier submits an invoice, your AP team reviews and approves it. Once it’s approved, your AP team sends an electronic file to your bank outlining payment details, including which vendor cards need funds and how much.

- Real-time payment tracking: ePayables provide greater visibility into cash flow for your AP team. Every transaction connects with a virtual card, so tracking and reconciling payments in real time is easy.

- Streamlined vendor payments: By automating much of the manual work associated with traditional payment methods, ePayables reduce processing time and eliminate errors like duplicate payments or incorrect amounts

Examples of ePayables

Let’s look at a simple example of how an ePayables solution works when a supplier provides a company with $5,000 worth of office supplies:

- The supplier sends an invoice to the company for $5,000

- The AP team reviews and approves the invoice, verifying that the goods have been received

- An electronic file is sent to the company’s bank, instructing them to fund the supplier’s ePayable card with $5,000

- The bank processes the request and funds the virtual card

- The supplier receives an email notification with payment details and charges the card for $5,000

- The AP system records the transaction and ensures the invoice is fully reconciled

ePayables and associated fees

ePayables are processed like card payments and are subject to standard merchant pricing. Depending on the card network, method used (swiped vs. keyed in), and payment terms, typical processing fees range from around 1.3% to 3.5%.

The convenience and benefits of ePayables are often worth the cost to your vendors, making them a go-to choice for modern payment workflows.

ePayables vs. ACH payments

ePayables and ACH payments are both electronic payment methods offering paperless payment solutions. They do share similarities, but let’s look at where their processes and features differ.

Processing method

- ACH payments: Funds move between bank accounts in large batches via the Automated Clearing House network. Transfers occur at set times, and businesses rely on the ACH system for processing.

- ePayables: Payments are processed using the credit card system. Each vendor is assigned a unique virtual card number, and funds are distributed individually.

Flexibility

- ACH payments: Transfers are less flexible because they’re processed in bulk. Adjustments or cancellations are limited once the batch is sent.

- ePayables: Offer greater autonomy. Companies can tailor payments to individual vendors, and tracking is more precise.

Speed

- ACH payments: Payments take 1–3 business days, depending on the bank’s processing schedule.

- ePayables: Payments are often immediate, as they use the credit card network.

Control

- ACH payments: Businesses have less visibility and control over individual transactions once submitted.

- ePayables: Each vendor’s payment is linked to a unique card, making it easier to manage and reconcile payments.

The benefits and challenges of ePayables

From streamlining AP workflows to improving cash flow management, ePayables can transform how your business handles payments. Of course, no AP system is without its challenges. Understanding the pros and cons can help you ensure you’re using ePayables in the best way possible for your business.

5 key benefits of ePayables

- Faster payments: The credit card system processes payments instantly or within hours, while traditional methods like checks or ACH payments may take days

- Detailed reporting: Real-time tracking links every transaction, improving cash flow visibility and making accounts payable reconciliation easier for your AP team

- Better cash flow management: Your team can schedule payments strategically to optimize your working capital

- Simplified administration: Automation removes manual processes, reduces errors, and lets your accounts payable team focus on higher-value tasks

- Lower costs: Your company saves on printing, postage, and other administrative expenses by eliminating paper checks and manual processing

5 main challenges of ePayables

- Merchant fees: Vendors incur transaction fees ranging from around 1.3% to 3.5%, which may deter some from accepting ePayables

- Vendor onboarding: Enrolling vendors into the ePayables system requires collecting contact information and explaining the process

- Limited vendor adoption: Some suppliers may prefer other payment methods, such as ACH payment or checks, due to familiarity

- Dependency on technology: BecauseePayables rely on digital infrastructure, technical glitches or system outages can disrupt payments

- Learning curve: Both your accounts payable team and your vendors may need training to fully understand and use the ePayables system effectively

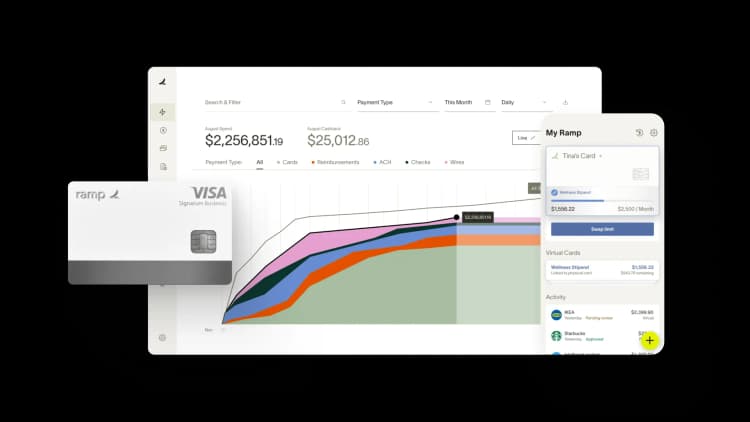

Streamline your AP workflow with ePayables and Ramp

Integrating ePayables into your AP workflow allows you to automate routine tasks like recurring bills, batch payments, and vendor onboarding so your team has more time to focus on strategic initiatives.

With Ramp Bill Pay, you can take your AP efficiency to the next level:

- Unified payments platform: Manage all domestic and global vendor payments in one place

- AI-powered automation: Eliminate manual data entry and invoice processing with AI that automates payments

- Custom approval flows: Tailor smart approval workflows to match your unique business needs, ensuring control and compliance at every step

Ready to handle 10x the invoices with the same headcount?Ramp makes it possible.

ePayables use virtual cards and are designed to replace outdated payment methods like paper checks. Here's how they differ from ACH & their relationship with AP

Don't miss these

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Compared to our previous vendor, Ramp gave us true transaction-level granularity, making it possible for me to audit thousands of transactions in record time.”

Lisa Norris

Director of Compliance & Privacy Officer, ABB Optical

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°