- What is accounts payable reconciliation?

- How to reconcile accounts payable along with key considerations

- Best practices for successful accounts payable reconciliation

- Is accounts payable reconciliation automation worth it?

- How Ramp Bill Pay speeds up AP reconciliation

- What makes Ramp Bill Pay worth it

Accounts payable reconciliation is meant to keep financial records accurate and prevent costly errors—but for many businesses, it’s a tedious, time-consuming process that eats up hours every month.

The good news is that with the right workflows and automation tools, businesses can eliminate errors, speed up month-end close, and gain real-time visibility into their payables.

Here’s a breakdown of how AP reconciliation works and best practices to streamline the process.

What is accounts payable reconciliation?

Accounts Payable Reconciliation

Accounts payable reconciliation is the process of ensuring that a company’s records of unpaid invoices match what vendors say is owed.

Accounts payable reconciliation is essentially a financial checkpoint that prevents errors, overpayments, and transactions from being missed. Without regular reconciliation, small discrepancies can snowball into larger financial issues.

Why reconciling accounts payable matters

A missed invoice might lead to late fees, while a duplicate payment could drain cash reserves. Inaccurate records also affect cash flow forecasting, accounts payable reporting, and tax compliance—making reconciliation a necessary step for businesses to stay in control of their finances.

Reconciling accounts payable also matters because it:

- Prevents overpayments and duplicate charges: Invoices can be mistakenly entered twice or processed under different references. Reconciliation ensures each payment aligns with a legitimate invoice.

- Avoids missed payments and penalties: Vendors expect timely payments. Failing to reconcile AP records can result in missed due dates, leading to late fees or strained vendor relationships.

- Identifies fraud and unauthorized transactions: Unexpected charges or altered invoice amounts can indicate accounts payable fraud. Reconciliation helps businesses detect and investigate unusual activity.

- Maintains financial accuracy: Discrepancies between internal records and vendor statements create reporting errors. Keeping AP records reconciled ensures financial statements reflect the true state of liabilities.

- Strengthens vendor relationships: Vendors rely on consistent payments. Accurate AP tracking helps businesses avoid disputes and negotiate better terms.

Without AP reconciliation, businesses risk cash flow mismanagement, reporting mistakes, and unnecessary costs.

How to reconcile accounts payable along with key considerations

While reconciliation follows a structured approach, businesses often run into challenges like missing payments, misapplied funds, or vendor-side errors. Addressing these issues requires a mix of detailed record-keeping, careful comparison, and proactive resolution.

Here’s how to effectively reconcile accounts payable in seven key steps.

Step 1: Gather internal accounts payable records

The process begins with verifying that your internal records are accurate before comparing them with vendor statements. This means reviewing the accounts payable ledger, outstanding invoices, and recorded payments to confirm that everything is properly entered.

Here’s what to check to ensure your AP records are complete:

- Outstanding invoices should be listed correctly, with accurate amounts and due dates

- Payments that have already been made should align with bank statements, including check numbers, ACH transfers, or wire payments

- The AP aging report should clearly show which invoices are due and whether any payments are overdue

Before moving forward, it’s important to catch and correct any internal inconsistencies. A common issue is duplicate invoices, which can lead to overstatements in payables.

Partial payments also create confusion—if a vendor has been paid in installments, the system may not clearly show what remains due. Additionally, invoices that are misclassified in the wrong expense category can lead to financial reporting errors.

To avoid these issues, a three-way matching process—comparing invoices, purchase orders, and receiving reports—can help confirm that payments match what was actually ordered and received. Fixing errors at this stage ensures a smoother reconciliation process later.

Step 2: Obtain and review vendor statements

Once internal records are confirmed, the next step is to obtain vendor statements, which provide an external reference for what the vendor believes is owed. These statements typically include a summary of outstanding invoices and any payments received.

To ensure an accurate comparison, check that vendor statements align with your AP records:

- Invoices listed on the vendor statement should match what has been recorded in your system

- Payments that have been made should appear as credited on the vendor’s side

- Any additional charges, discounts, or credits should be accounted for in both records

One challenge here is that not all vendors use the same statement format. Some provide detailed breakdowns listing every invoice, while others may only show a total balance due.

Timing differences can also cause confusion—if a payment was recently processed, it might not appear on the latest vendor statement yet. Additionally, vendors sometimes apply payments differently than expected, prioritizing older invoices instead of the ones you intended to pay.

If vendor records don’t align with your internal records, request a detailed invoice breakdown or a remittance confirmation from their end. For payments that haven’t been reflected, check whether the vendor has a processing delay or whether a bank transfer is still in transit.

Step 3: Match invoices and payments

With both internal records and vendor statements in hand, the next step is to compare them line by line. This ensures that every invoice, payment, and outstanding balance is accounted for correctly.

Here’s what to focus on when matching transactions:

- Invoice numbers, amounts, and due dates should be identical in both records

- Payments should be matched to the correct invoices to confirm they were applied as intended

- Additional fees, service charges, or adjustments should be verified to ensure they are valid

At this stage, mismatches often appear. If multiple invoices were paid in a single lump sum, vendors may have applied the payment differently than expected. Some invoices might be completely missing from your records, either because they were overlooked or because the vendor didn’t send them.

Even accounting software can create errors—some systems attempt to auto-match payments but may assign them to the wrong invoices.

If discrepancies are found, refer to remittance advice documents, which outline how payments were allocated. For missing invoices, confirm whether they were received but not yet entered or if they need to be requested from the vendor.

Step 4: Investigate and resolve discrepancies

Once mismatches are identified, it’s essential to determine their cause and take corrective action. Discrepancies can stem from errors on either side—an invoice might be missing from internal records, a payment may not have been applied correctly, or an incorrect amount might have been charged.

To resolve discrepancies efficiently:

- Missing payments should be traced by checking bank records and sending proof of payment to the vendor if necessary

- Overcharges or pricing errors should be compared against purchase orders and contracts to confirm the agreed-upon pricing

- Duplicate invoices or suspicious charges should be flagged and verified to prevent overpayment or fraud

A common issue at this stage is that vendors sometimes process payments late, meaning a payment that was sent may not yet appear in their system. If this happens, confirming the payment’s clearing date with the bank can clarify whether it’s a timing issue or an actual mistake.

A month of work done in minutes.

Handle 10x the invoices in half the time. Our standard tier is free.

Step 5: Communicate with vendors as needed

Not all reconciliation issues can be resolved internally—sometimes, vendor input is needed to clarify outstanding balances. If an invoice is missing, a payment isn’t reflected, or an unexpected fee appears, reaching out to the vendor is necessary.

When communicating with vendors, it’s best to:

- Be specific about discrepancies by referencing invoice numbers, dates, and amounts

- Provide documentation such as proof of payment or revised invoices to support corrections

- Confirm any updates on the vendor’s end and request an updated statement if necessary

Handling these discussions professionally helps prevent misunderstandings and keeps vendor relationships strong. In some cases, recurring reconciliation problems can be avoided by establishing a structured process with key vendors, such as agreeing on regular statement reviews or implementing standardized invoice submission methods.

Step 6: Adjust internal records

Once discrepancies are resolved, internal records need to be updated to reflect the final, accurate amounts owed. This step ensures that financial statements and cash flow reports remain correct.

Adjustments may include:

- Updating invoice statuses to reflect payments or corrections

- Applying missing credits or discounts issued by vendors

- Correcting any misclassified expenses to ensure accurate reporting

One potential challenge is that some accounting systems lock prior periods after financial close, preventing adjustments from being made. In these cases, corrections should be recorded as current-period adjustments, with clear documentation explaining the change.

Step 7: Final review and documentation

Before completing the reconciliation process, a final review helps confirm that all outstanding items have been addressed and that records are fully aligned. This step ensures long-term accuracy and prepares records for audits or financial reporting.

To finalize reconciliation:

- Verify that all balances match between internal records and vendor statements

- Ensure that all adjustments and corrections have been properly documented

- Retain reconciliation reports for future reference in case of audits or vendor disputes

Maintaining clear documentation of reconciliations provides a structured audit trail and prevents recurring errors. If automation tools are used, reconciliation reports should be regularly reviewed to ensure the system is flagging issues correctly.

Best practices for successful accounts payable reconciliation

Even small reconciliation errors can create major workflow disruptions—misapplied payments, duplicate invoices, or overlooked credits can all add up.

Here are some best practices for a smooth accounts payable reconciliation process:

- Automate invoice matching: Use AP automation to match invoices with purchase orders and receipts. This speeds up reconciliation, reduces errors, and flags discrepancies before they cause issues.

- Stick to a set reconciliation schedule: Monthly or biweekly reconciliation prevents small errors from turning into larger financial misstatements. The longer you wait, the harder discrepancies are to fix.

- Keep a strong audit trail: Document all billing discrepancies, resolutions, and vendor communications to track every adjustment. A clear record simplifies audits and helps resolve disputes faster.

- Standardize workflows: Define a step-by-step process for reconciliation so every team member follows the same structured approach. Consistency reduces errors and streamlines training for new employees.

- Verify invoices with three-way matching: Compare invoices with purchase orders and receiving reports to ensure accuracy. This prevents overpayments and improves billing management.

- Monitor outstanding payments: Avoid late fees and vendor disputes by tracking due dates and setting payment reminders. Using reliable payment management systems strengthens supplier relationships.

- Strengthen internal controls: Assign different team members to invoice approval and payment processing to prevent fraud. Regular internal reviews help identify process gaps and ensure compliance.

Is accounts payable reconciliation automation worth it?

Absolutely. AP automation streamlines the reconciliation process by eliminating manual data entry, reducing errors, and matching invoices with payments in real-time. Instead of spending hours on data gathering and corrections, your team can focus on higher-value tasks like financial planning and analysis.

Beyond time savings, automation improves financial accuracy and speeds up month-end close. Transactions are processed continuously, keeping records up to date and reducing last-minute reconciliation bottlenecks. This not only minimizes reporting delays but also strengthens overall cash flow management.

By shifting away from repetitive, error-prone processes, businesses gain better financial visibility, fewer disputes, and more efficient operations.

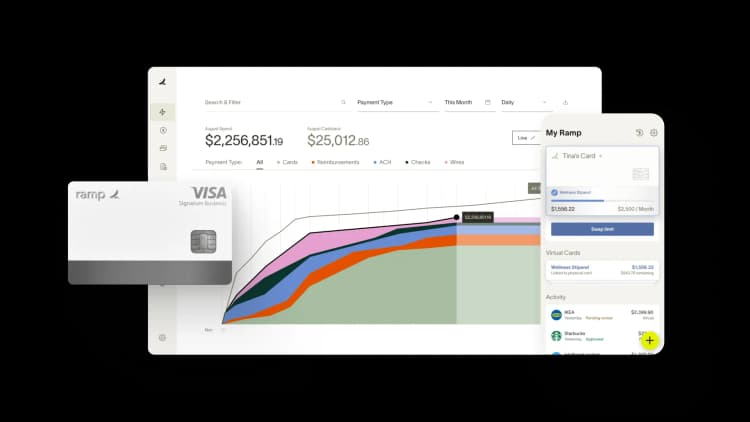

How Ramp Bill Pay speeds up AP reconciliation

Ramp Bill Pay is autonomous AP software built to replace manual busy work with touchless execution. Four specialized AI agents take over the heavy lifting—categorizing invoices based on your history, catching fraudulent payments mid-flight, drafting approval documentation, and pushing card payments straight to vendors. Your team steps away from the grind while OCR pulls invoice data at up to 99% accuracy and cycles through payments 2.4x faster than outdated platforms1.

Run Ramp Bill Pay standalone, or use it with Ramp's corporate cards, expense systems, and procurement workflows for end-to-end spend transparency. Companies that make the move see up to 95% better visibility into their financial processes2.

Features include but are not limited to:

- Reconciliation: Close books faster with automatic transaction matching

- Real-time ERP sync: Connect your vendor master data bidirectionally with 10 ERPs such as NetSuite, QuickBooks, Xero, Sage Intacct, and more for audit-ready books

- Auto-coding agent: Analyzes historical coding patterns and invoice details like product IDs, descriptions, and shipping addresses to map expenses to the correct GL codes

- GL coding: Map transactions to the correct accounts with AI-assisted recommendations

- Intelligent invoice capture: Extracts data across every line item with 99% OCR accuracy

- Automated PO matching: Verifies invoices against purchase orders with 2-way and 3-way matching to catch overbilling before payment

- Real-time invoice tracking: Monitor every invoice from receipt through payment

- Payment methods: Pay vendors via ACH, corporate card, check, or wire transfer

- Batch payments: Process multiple vendor payments in a single batch

- Roles and permissions: Enforce separation of duties with granular user controls

What makes Ramp Bill Pay worth it

Ramp Bill Pay redefines the AP experience: precise data, autonomous execution, touchless flow, and breakneck speed. Finance teams have left 2,100+ verified reviews on G2 with a 4.8-star consensus, consistently ranking it as one of the simplest AP platforms to roll out.

Ramp Bill Pay delivers full AP functionality right out of the box. But for teams looking to centralize bills, card spend, expenses, and procurement, they can tap into Ramp's connected spend management system that consolidates it all under one roof.

Jump in with Ramp's free tier that covers the AP essentials, or scale up to Ramp Plus for $15 per user per month to unlock more advanced features.

See what Ramp Bill Pay can do for you.

1. Based on Ramp’s customer survey collected in May’25

2. Based on Ramp's customer survey collected in May’25

Don't miss these

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits