6 most important business loan requirements in 2023: SBA, bank, and private loans

- What should I look for in a loan?

- SBA loan vs. conventional bank loans vs. private loans

- 6 small business loan requirements

- Checklist: what do you need to get a business loan?

- What to do after you secure a loan

- How to qualify for a business loan with no money

- Alternative forms of funding for small businesses

- Make the most of existing funding with Ramp

All businesses need money to run successfully. One way to secure these funds is to apply for a business loan. However, it takes more than just an application to qualify for funding.

In this article, we’ll explain the difference between conventional bank loans, private loans, and small business government-backed loans. We’ll also go over what to look for in a loan, important newbusiness loan requirements, as well as some alternative financing options for small businesses.

What should I look for in a loan?

Before picking a loan, you need to figure out what your business needs are. Set clear goals before starting your loan research to guide your search. To find out what you should look for in a loan, consider these questions:

- How much money do you need?

- How much interest are you comfortable with? (Is the interest fixed or variable?)

- What is your current credit score? (both personal and business)

- What is the length of the loan?

- How long would it take for you to pay it back?

- What are the repayment terms of the loan? Can you afford this in your budget?

- How much collateral will you need to put up to qualify for the loan?

SBA loan vs. conventional bank loans vs. private loans

The three most popular forms of funding for small businesses are SBA loans, conventional bank loans, and private loans. Let’s explore each and find out what sets them apart.

What is an SBA loan?

An SBA loan is a small business loan partially backed by the U.S. Small Business Administration. The SBA doesn’t give out loans directly. Instead, the loans come from participating lenders, typically banks, who follow guidelines set by the SBA. Since the SBA partially backs the loans, they lessen the risk to the lender. Even if you can’t pay back the loan, the SBA will cover the portion loaned to you.

Loans from the SBA can range anywhere from $500 to $5.5 million. Each loan comes with its own rules and guidelines about how it needs to be repaid. While the SBA's partial backing makes it possible for small businesses to access great loans, it comes with stricter requirements. The application process is thorough and restrictive, so keep this in mind if you choose to go this route.

Good fit for: Newer small business owners who haven’t established a strong credit history yet.

Small business loan requirements

Although these loans are difficult to qualify for, you can begin the process if you meet these minimum requirements for a business loan:

- Must be a for-profit business

- Have a business history of two years or more

- Have good personal credit (score of 690 or more)

- Sufficient annual revenue and cash flow

What is a conventional bank loan?

A conventional bank loan is a loan offered by banks, credit unions, and other popular financial institutions. Lenders provide you with funding, and as the borrower, you’re expected to pay it back within a fixed term. Unlike SBA loans, conventional bank loans are not backed by the government.

Since the bank takes on 100% of the loan, conventional bank loans will often turn down lenders with bad credit.

Good fit for: Businesses who’ve been operating for many years and have a strong credit history, and have good relationships with financial institutions.

Requirements for conventional bank loan

To get a conventional bank loan, businesses need to meet these requirements:

- Show that you can pay back the loan

- Have good business and personal credit

- Show a business plan that details your financial projections

- Have a low debt-to-income ratio

Private loans

Business loans from private lenders are also known as private business loans. They’re issued from non-banking lenders like venture capitalists, online lenders, or angel investors. These loans are easier to qualify for than SBA or conventional bank loans, but they depend on the lender's specific requirements.

Private lender financing can include:

- Short-term loans

- Invoice factoring

- Investor loans

- Merchant cash advances

Requirements for private loans

Unlike traditional lenders, requirements for private lenders depend on the type of lender you choose. For example, with a merchant cash advance, they may give immediate funding in return for a portion of future sales. With investor loans, private lenders provide funding and expect a percentage of future profits. Check the requirements of your private lender if you choose to go this route.

Good fit for: Businesses who are looking for flexibility in repayment terms.

6 small business loan requirements

If you’ve decided that a small business loan is the best choice for your business, you need to familiarize yourself with the requirements. Here are six requirements for successfully getting a small business loan.

1. Credit

Although the SBA or private lenders may not state a credit score minimum, it’s best to have good credit. A personal score above 690 is considered good credit.

You should also have a strong business credit score. The scores range from 0 to 100, and you'll want to keep your credit score above 75.

If you’re a startup trying to build up your business credit score, here are a few tips on how to establish business credit in your early days:

- Incorporate and register your business

- Open a separate business bank account

- Build credit with vendors and suppliers who report to credit reporting agencies

- Pay bills on time

- Check credit score/reports regularly

- Get a business credit card

- Keep old credit accounts open to continue building credit

2. Revenue

Revenue gives lenders an inside look at the health of your business. They want to see what kind of cash your business has and the net profit of your business.

Since your net profit margin measures the profitability of your business, you should prepare this for your loan application. This number can also reveal what changes you need to make in your business and if you’re currently managing cash flow properly.

To calculate your net profit margin, divide your net income by revenue.

These numbers are typically found on your company income statements. If your net profit margin is low, improve it before attempting to apply for a loan.

3. Debt-to-income ratio (DTI)

Lenders will look at the debt-to-income ratio of your business. They want to determine the amount of your monthly debt and compare it to your monthly gross income.

Calculate your debt to income ratio by dividing your total monthly expenses, including loan payments, by your gross monthly income.

If you have a high debt-to-income ratio, you’ll struggle to qualify for a loan. The maximum debt to income ratio allowed depends on the lender. However, lenders generally feel uneasy about giving loans to businesses with large amounts of existing debt.

Lenders will ask to see a balance sheet and your debt-to-income ratio. A balance sheet is a financial statement that states your business's assets, liabilities, and equity. This document helps you decide whether you can afford to increase spending for growth.

Remember that not all debt is viewed in the same light. For example, commercial real estate debt and traditional lines of credit aren’t viewed the same by lenders.

4. Collateral

Collateral is any asset that a lender will accept as a possible source of repayment. If you fail to pay back your loan, the bank or lender can seize these items. Collateral could be equipment, real estate, cars, or even invoices.

The assets mentioned on your balance sheet can serve as collateral. You can separate them into two types: liquid and non-liquid assets.

You can quickly convert liquid assets into cash while keeping their market value. These include:

- Cash

- Checking/savings accounts

- Investments (stocks, bonds, mutual funds, money market funds, etc)

Non-liquid assets are difficult to convert into cash. They also tend to depreciate over time and must be sold and transferred in ownership to access their cash value.

Examples of non-liquid assets include:

- Real estate

- Land

- Equipment

- Art

- Collectibles

- Jewelry

Most lenders will require you to put up some form of collateral. Some lenders will allow you to access funding without collateral, which we’ll discuss later.

5. Business plan

Your business plan plays a major role in convincing a lender to give you funding. A good business plan should show that your business has the potential to grow and that you’ve managed it well so far.

Include these points in your business plan:

- Your company name and description

- Explain your product or service

- Discuss your business goals

- Market analysis

- Past and future projections

- Organizational structure

- Marketing plans

Your business plan is your chance to showcase your business. Include everything about your business that sets it apart from the competition. Include an executive summary that will sell the potential of your business.

6. Up-to-date documentation

Prepare as many financial statements for your loan application as possible. Show past and projected numbers, and ensure they align with your business plan.

Applicants should turn in these documents when applying for a loan:

- Income statements

- Bank statements

- Profit and loss (P&L) statement

- Projected financial statements (one year)

- Business licenses (certificates if applicable)

- Business plan (financial projections)

- Signed personal and business federal tax returns

- Business overview and history

- Business lease

Depending on your lender, they may require more documents, but it’s good to have these on hand. If you’re applying for a business loan to buy an existing business, you’ll need additional documentation:

- Up-to-date balance sheet and P&L statement for this business

- Two years federal income tax returns for the business

- Bill of sale/terms of sale

- Asking price with inventory, machinery, fixtures, furniture

Even if you’re applying for a loan from a conventional bank or private lender, it’s good to prepare these documents.

Checklist: what do you need to get a business loan?

In summary, before you can begin filling out a business loan application, here are the steps you need to take.

✅ Get pre-qualified for the loan: To see if you meet small business loan requirements, you’ll need a credit score above 690, have been in business for a minimum of 1-2 years, and reach the minimum annual revenue for the loan you want.

✅ Decide what kind of loan you need: What kind of loan do you need? Are you hoping to get an SBA loan, a conventional bank loan, or funding from a private lender?

✅ Write up a business plan: Write up a business plan that you’re running a reputable business with a positive financial future.

✅ Check credit scores: You can get a free personal credit report every three months from the three major consumer credit reporting companies: Equifax, Experian, and TransUnion. You can use Experian, Equifax, and Dun & Bradstreet to get a business credit report. You can request your credit report online, over the phone, or by mail.

✅ Collect financial statements: Collect all business bank statements required by your lender.

✅ Decide if you have collateral: Do you have collateral for a loan? If not, explore loan options that don’t require collateral.

What to do after you secure a loan

Take action after your loan approval. Once you’ve secured your loan, you should start the repayment process. This will help you continue building the credit of your business. Implement these practices:

- Set up your repayment schedule: Your lender may have specified a repayment after securing your loan. Set up a schedule to automatically pay your loan weekly, bi-weekly, or monthly to avoid missing payments.

- Protect your credit score: Taking out a loan often affects the borrower's credit score. Make regular payments on your business loan to build up your business's credit score.

- Refinance your loan: After repaying a portion of your loan, consider loan refinancing. You might be eligible for another loan with better terms and interest rates.

How to qualify for a business loan with no money

Businesses that are low on funds struggle to get business loans. Many lenders require small businesses to have capital before qualifying for a loan to get more money. You may need to get a business loan with no money down if:

- You’re waiting for clients to pay you: Many businesses work on a retainer, or contract, basis. You might be waiting for weeks after you deliver your services to get paid.

- Lack of resources makes it difficult to scale your business: You need money to grow your business and to grow your business, you need money. A business loan will help you meet the new business needs that seem to pop up daily.

- You mixed your personal and business funds: It’s not good to mix personal and business funds, but it happens. You may need a business loan to separate your funds and get a fresh financial start.

Some options for business loans with no money down are:

- Equipment financing: Equipment financing is excellent for businesses that need to purchase expensive equipment. An equipment financing company will offer to cover all or most of your equipment's cost. They use the equipment they finance as collateral if you fail to pay back the money.

- A business line of credit: A business line of credit is used similar to a credit card. Instead of access to a lump sum of money at once, you use your line of credit as you need it. Once you use your line of credit, you make payments on the amount you’ve borrowed with interest. As you borrow money, you pay down the balance. Your amount of available funds reload, and you can take out funding again.

- Invoice financing: Invoice financing is best for companies with long client billing cycles. You receive funding by selling unpaid invoices to your lender. The invoices serve as your collateral.

- Term Loans: Term loans allow you to borrow large amounts of money with only collateral through a personal guarantee. If you use the funding to purchase equipment or real estate, your lender can use that as collateral.

However, there are some risks to no-money-down financing:

- High interest rates: Borrowers are hit with higher interest rates during the repayment period.

- Expensive fees: These loan options often include expensive fees for borrowers to pay upfront.

Alternative forms of funding for small businesses

If you can’t qualify for a business loan yet, look into alternative funding options for your small business.

Ramp’s underwriting process

Underwriting is risk assessment. This process determines whether or not a business is eligible for a loan and works to mitigate the risk lenders face. Many new businesses fail the traditional business loan underwriting process because of a lack of financial history. They’re deemed too high of a risk for traditional loans.

Ramp’s commerce sales-based underwriting helps businesses access higher limits than traditional corporate cards. First, we connect with commerce platforms, web stores, and marketplaces in the industry, like Stripe and Shopify. Then, we use the commerce sales data from these platforms to underwrite business credit limits. Small businesses only need a year of sales history on commerce platforms to qualify.

This process empowers businesses to speed up their growth while accessing the funding they need.

Equity funding

Equity funding is taking money from an investor for an equity stake in your company. The amount of the equity awarded depends on the value of your company and the amount they invested. Equity funding can come from these sources:

- Crowdfunding

- Angel investors

- Venture capital firms

Debt funding

Debt funding is borrowing money from a lender and promising to repay it with interest in the future.

A popular form of debt funding is peer-to-peer lending. Several online lender sites engage in peer to peer lending.

Investors come together and pool money to invest in your business and provide business loans. Getting approval on these sites is easy, although terms and interest rates can be high.

Financial planning and analysis

At times, your business may have the funds you need to grow. You just aren’t getting the most use out of them. Connecting with a financial planning and analysis FP&A team will improve the financial health of your business. They examine your financial data and create an improved financial management strategy.

Make the most of existing funding with Ramp

As you can see, qualifying for a business loan involves thought and preparation. It takes the right documentation and good financial planning. If you do this, you can get business loan eligibility and get the necessary working capital. Your business will flourish, and you’ll gain access to new opportunities. However, getting the funding isn’t enough. You need to know how to make the most of it. To help, we created a SBA loan calculator tool to help you find the best payment terms for your business.

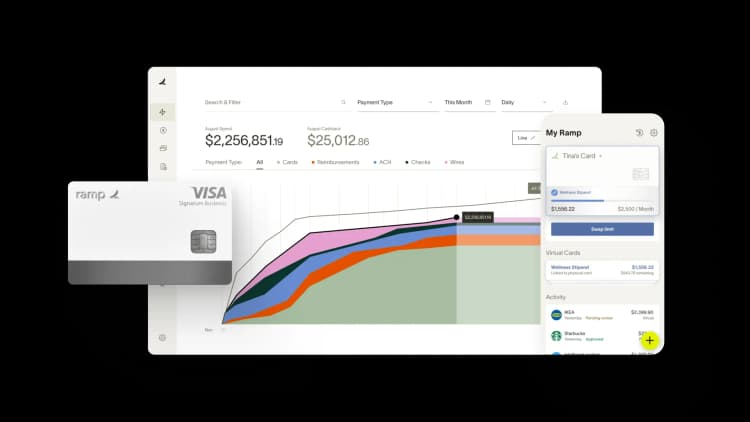

Ramp is the best way for businesses to get real-time insights into how they spend money. Ramp’s corporate cards give you an efficient way to track employee spending.

FAQs

Business credit scores range from 0 to 100, with 100 being the best possible score. Most small business lenders consider anything above 75 a good credit score. If you don’t have a business credit score yet, you’ll need a solid personal credit score to get a loan.

A business loan gives you the working capital to invest in your business. Use your business loan to cover everyday expenses, purchase new equipment, expand your inventory, cover startup costs, or even buy an existing business.

No, Ramp offers corporate cards. Many businesses that learn to control their finances realize they don’t need to borrow money. If you need a loan, you can use Ramp to get the most out of your money through tracked spending, automated reimbursement, and third-party integration.

Don't miss these

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide.” ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn’t just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn’t exist in Zip. It’s made approvals much faster because decision-makers aren’t chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits

“More vendors are allowing for discounts now, because they’re seeing the quick payment. That started with Ramp—getting everyone paid on time. We’ll get a 1-2% discount for paying early. That doesn’t sound like a lot, but when you’re dealing with hundreds of millions of dollars, it does add up.”

James Hardy

CFO, SAM Construction Group