Calculate Georgia’s per diem allowance for your business travel

If your employees are frequently traveling for business, managing expenses can quickly become a daunting task. Per diem rates simplify this process by providing standard reimbursement amounts for lodging, meals, and incidentals. This ensures your team is fairly compensated while helping you, as a business, control costs effectively.

When it comes to Georgia, travel expenses can vary and understanding the rates is important for your business. Clear per diem guidelines not only simplify expense reporting but also ensure you're in compliance with federal regulations.

Georgia per diem calculator

Enter the dates of the business travel, along with the destination details, including the city and county, to calculate your per diem allowance.

Understanding per diem rates in Georgia

For many locations in Georgia without specific per diem rates, the standard federal rates apply: $110 for lodging and $68 per day for meals and incidentals. These rates are set by the General Services Administration (GSA) and are effective from October 2025 to September 2026.

However, for certain cities in Georgia, such as Atlanta, the GSA provides fixed per diem amounts tailored to local costs. Here's a handy chart detailing the specific per diem rates for these destinations:

| County | Oct 2025 | Nov | Dec | Jan 2026 | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Default* | $110 | $110 | $110 | $110 | $110 | $110 | $110 | $110 | $110 | $110 | $110 | $110 |

| Chatham | $147 | $147 | $147 | $147 | $147 | $176 | $176 | $147 | $147 | $147 | $147 | $147 |

| Clarke | $136 | $136 | $136 | $136 | $136 | $136 | $136 | $136 | $136 | $136 | $136 | $136 |

| Cobb | $126 | $126 | $126 | $126 | $126 | $126 | $126 | $126 | $126 | $126 | $126 | $126 |

| DeKalb | $182 | $182 | $182 | $197 | $197 | $197 | $182 | $182 | $182 | $182 | $182 | $182 |

| Fulton | $182 | $182 | $182 | $197 | $197 | $197 | $182 | $182 | $182 | $182 | $182 | $182 |

| Glynn | $172 | $172 | $172 | $172 | $172 | $223 | $223 | $223 | $223 | $223 | $172 | $172 |

| Richmond | $125 | $125 | $125 | $125 | $125 | $125 | $125 | $110 | $110 | $125 | $125 | $125 |

| County | M&IE Rate |

|---|---|

| Default* | $68 |

| Chatham | $80 |

| Clarke | $74 |

| Cobb | $74 |

| DeKalb | $86 |

| Fulton | $86 |

| Glynn | $86 |

| Richmond | $74 |

Effortlessly manage business travel, from booking to tracking

Knowing Georgia’s per diem rates is key to staying compliant with state and federal guidelines, reducing the risk of non-compliance. Clear per diem practices provide transparent travel expense guidelines, preventing misunderstandings.

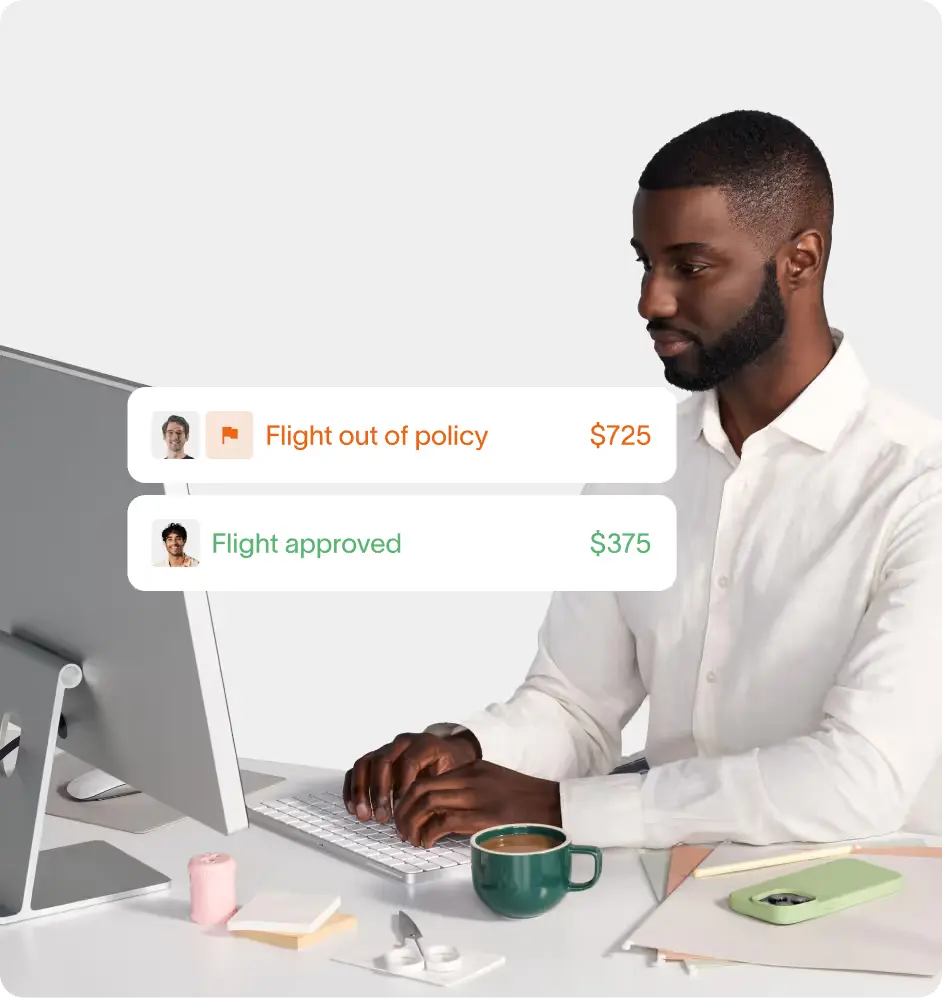

At Ramp, we offer integrated expense management solutions that automate reporting, enforce policies, and provide real-time spending insights. This simplifies expense management, ensures compliance with per diem rates, and saves time and money.

Ramp goes further by offering accurate, location-based per diem rates, keeping expenses under control and compliance in check. Employees can easily track their allowances, helping them stay within budget. With features like GSA rate integration and custom multipliers, Ramp makes per diem management simple for both administrators and employees.

Simplify your business travel from booking to expense tracking with Ramp