Calculate Michigan’s per diem allowance for your business travel

Business travel expenses can quickly add up, and managing them effectively is important for keeping your company’s budget on track. In Michigan, where costs can vary significantly between urban centers and rural areas, understanding the state’s per diem rates is key to maintaining control.

These fixed rates let businesses pay employees fairly for hotel, meals, and other things they need. They also make it easier to report expenses and follow federal rules. With clear per diem guidelines, your business can prevent overspending and avoid potential disputes over travel expenses.

Michigan per diem calculator

Input the dates of your business travel, along with the location, county, and city, to calculate your per diem allowance.

Michigan per diem rates

If your destination city doesn't have a specific per diem rate, you'll use the standard federal rates: $110 for lodging and $68 per day for meals and incidentals. These rates, effective from October 2025 to September 2026, are set by the GSA.

For cities with higher costs, the GSA provides specific per diem rates to reflect local expenses. Below is a list of Michigan cities with their own per diem rates:

| County | Oct 2025 | Nov | Dec | Jan 2026 | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Default* | $110 | $110 | $110 | $110 | $110 | $110 | $110 | $110 | $110 | $110 | $110 | $110 |

| Emmet | $171 | $116 | $116 | $116 | $116 | $116 | $116 | $116 | $220 | $220 | $220 | $171 |

| Grand Traverse | $134 | $134 | $134 | $134 | $134 | $134 | $134 | $134 | $134 | $235 | $235 | $134 |

| Kent | $119 | $119 | $119 | $119 | $119 | $119 | $119 | $119 | $119 | $119 | $119 | $119 |

| Mackinac | $120 | $120 | $120 | $120 | $120 | $120 | $120 | $120 | $120 | $195 | $195 | $120 |

| Midland | $120 | $120 | $120 | $120 | $120 | $120 | $120 | $120 | $120 | $120 | $120 | $120 |

| Muskegon | $110 | $110 | $110 | $110 | $110 | $110 | $110 | $110 | $149 | $149 | $149 | $110 |

| Oakland | $116 | $116 | $116 | $116 | $116 | $116 | $116 | $116 | $116 | $116 | $116 | $116 |

| Ottawa | $116 | $116 | $116 | $116 | $116 | $116 | $116 | $157 | $157 | $157 | $157 | $116 |

| Van Buren | $110 | $110 | $110 | $110 | $110 | $110 | $110 | $110 | $142 | $142 | $142 | $110 |

| Washtenaw | $125 | $125 | $125 | $125 | $125 | $125 | $146 | $146 | $146 | $146 | $146 | $125 |

| Wayne | $152 | $152 | $152 | $152 | $152 | $152 | $152 | $152 | $152 | $152 | $152 | $152 |

| County | M&IE Rate |

|---|---|

| Default* | $68 |

| Emmet | $86 |

| Grand Traverse | $80 |

| Kent | $80 |

| Mackinac | $86 |

| Midland | $74 |

| Muskegon | $68 |

| Oakland | $80 |

| Ottawa | $74 |

| Van Buren | $68 |

| Washtenaw | $80 |

| Wayne | $74 |

Easily automate per diem rate controls and tracking

By staying up to date on Michigan's per diem rates, your business can ensure compliance with state and federal regulations, reducing the risk of costly errors. Clear per diem policies set expectations for your team, making travel expense management more efficient and transparent.

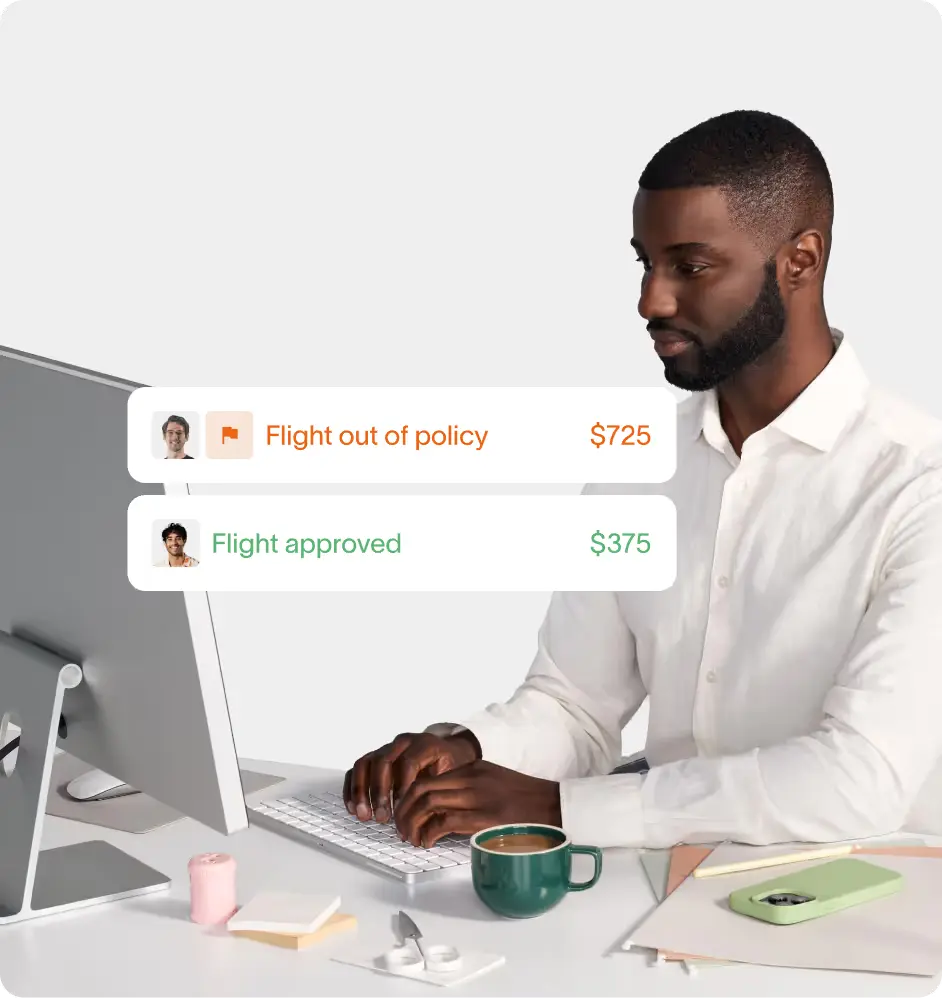

Ramp makes managing these expenses simple. From automating per diem calculations to streamlining employee expense claims, Ramp helps enforce spending policies and provides real-time insights into travel costs. Employees can track their allowances in real time, ensuring they stay within budget and fully understand their spending limits.

With features like GSA rate integration and customizable settings, Ramp enables precise, location-based per diem rates, keeping costs under control and maintaining compliance. Equip your business with the tools to efficiently manage travel expenses and optimize your corporate travel planning.

Simplify your business travel from booking to expense tracking with Ramp