Vendor management systems: Best software options in 2025

- What is a vendor management system?

- Why do you need vendor management software?

- Key benefits and use cases of vendor management systems

- 14 best vendor management and procurement services

- How to choose a vendor management system

- Streamline vendor management with Ramp

External spend can make or break your bottom line. McKinsey & Company estimates it accounts for 50–80% of a company’s total costs. That’s a lot of money flowing to vendors and suppliers, and without the right systems, costs can spiral and contracts can get messy.

That’s where vendor management systems (VMS) come in. They help you track vendors, monitor performance, control spending, and streamline the entire post-procurement process. We break down what a vendor management system is, why it matters for businesses of all sizes, and the top software options to consider in 2025.

What is a vendor management system?

A vendor management system is software that automates and centralizes all vendor-related activities after the procurement process. These activities include documenting vendor details, collecting W-9s, and recording vendor data so stakeholders can easily discover it.

The purpose of a VMS is to create a single source of truth for vendor information, streamline workflows through automation, and improve oversight of contracts, performance, and spend.

While procurement software focuses on selecting and purchasing goods or services, and supplier management software often manages broader supply chain relationships, a VMS zeroes in on managing vendors after they’re onboarded, helping you keep costs in check and vendor relationships on track.

Vendor vs. supplier: What's the difference?

The terms vendor and supplier are often used interchangeably, but they have subtle differences.

- A supplier typically provides raw materials, components, or wholesale goods used in production or resale

- A vendor usually sells finished products or services directly to your business

In vendor management, this distinction matters because it shapes the type of contracts you manage and the metrics you track. It also highlights the risks you need to mitigate.

Why do you need vendor management software?

As your business grows, so does the number of tools your employees need to do their jobs effectively. A 2024 study from BetterCloud reported that the average company uses 112 SaaS applications. Managing a high volume of vendors manually is virtually impossible even for experienced finance teams, and this explosion in SaaS spending has surfaced two key challenges:

- No single source of truth: Finance teams often track and manage vendor information, contracts, and documents across fragmented data sources. This creates manual work and wasted time on admin.

- Overspending: SaaS companies are notorious for opaque pricing, making it difficult to know whether a quoted or renewal price is fair

You need a vendor management system that offers a comprehensive view of all vendor details and transactions. Here are some key ways a VMS can help your business run smoothly:

- Reduce risk: Store all vendor documentation, monitor compliance, and track performance to avoid costly mistakes or third-party failures

- Increase spend transparency: See exactly where your money goes, identify duplicate or wasteful spending, and negotiate better deals

- Speed up onboarding: Get new vendors set up faster with automated workflows and centralized approvals

- Stay compliant: Keep up with regulatory requirements and contract terms without drowning in paperwork

- Control shadow IT: Spot and stop unapproved software purchases before they drive up costs or create security risks

Key benefits and use cases of vendor management systems

A solid vendor management platform will help you audit and control who supplies your business. You can modify contracts based on actual needs, ensure vendor and supplier spending reflects the actual service your teams receive, and automate many vendor management workflows.

Improve vendor performance visibility

Your business may rely on contingent workers and external service providers for specialized skills you can’t get in-house. Without a centralized view, it’s difficult to monitor whether these vendors meet your expectations.

The best vendor management systems provide real-time analytics and dashboards for supplier performance management. You can see if project milestones are achieved, whether service quality meets standards, and if you’re releasing phased payments too soon. This transparency can help you make informed decisions about renewals and negotiations.

Reduce shadow IT and control costs

Shadow IT, or buying and using unauthorized technology, can quietly drive overspending, create IT inefficiencies, and introduce data risks.

A VMS centralizes vendor approvals, giving you visibility into all technology tools and suppliers across your organization. By combining vendor lists, contract owners, and spend analytics in one place, you can identify and eliminate unapproved or duplicate software purchases.

Streamline vendor payments

B2B payments are inherently more complex given the rise of international supplier bases, alternative payment methods, and cross-border regulations.

A VMS that integrates with or complements your financial management software can streamline payment processes and track transactions more efficiently. This is valuable in cloud-based vendor management environments where finance teams work across different regions.

Automatically track vendor spend

Keeping track of spending across all your vendors becomes more challenging as your business scales. Finance teams have the unenviable task of staying on top of this growth to track spending. This is why good vendor management software can prove so useful.

Structured vendor management lets finance teams see:

- How much money you spend on individual vendors and in total

- Accurate explanations of the goods or services you pay for

- How you make these payments, whether by card, bank, or wire transfer

- Which vendors get paid the most often and at what intervals

A strong VMS helps you monitor vendor spending so you can quickly spot trends and use those insights for more effective vendor negotiations.

Enhance compliance and risk management

If a vendor makes a mistake, your business often absorbs the regulatory, reputational, or customer impact. Manual processes make it hard to ensure compliance and mitigate risk.

A VMS supports vendor risk management by helping you store and track all required documents, such as financial and tax forms, licenses, certificates, and insurance, alongside ongoing performance data. For example, the Office of the Comptroller of the Currency requires banks to know who their vendors are and actively manage any third-party risks.

That means monitoring:

- The strengths of individual controls

- Compliance with laws and service level agreements

- Performance metrics and other contractual terms

Manage contingent workforce

Overseeing a contingent workforce, including freelancers, contractors, and service providers, can be challenging without centralized oversight.

With contingent workforce management features, a VMS helps you track performance, costs, and deliverables for non-permanent staff alongside regular vendors. That way, your business only pays for work that delivers measurable value.

14 best vendor management and procurement services

Choosing the right vendor management system comes down to your budget, workflow needs, and industry. Here’s a curated list of VMS examples and procurement platforms:

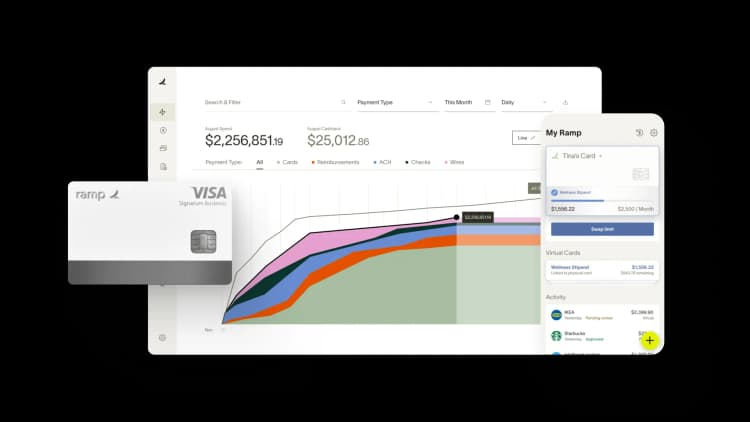

1. Ramp

Ramp’s vendor management software simplifies and centralizes procurement with a seamless approval process, saving your finance team time and holding internal project managers accountable. We identify and collect all vendors and contract owners in one place, notify you when the next payment is due, and track how much you’ve ever spent with each vendor.

When it's time to renew with a vendor, Ramp Intelligence lets you see how much other businesses pay for the same software product. We leverage data from thousands of transactions and offer transparency into competitive pricing, enabling better negotiations and smarter purchasing decisions.

Plus, our software fully integrates with the Ramp Business Credit Card, so you can save an average of 5% across all spending and receive automatic notifications about cost-saving opportunities.

Best for: Businesses of all sizes seeking integrated spend management, procurement automation, and cost savings

2. Precoro

Precoro promises to provide cost-effective and easy-to-use procurement solutions to help your company reduce administrative headaches, lower costs, and increase productivity. Precoro’s features include purchase requests, approval workflows, budget management, and inventory.

Best for: Small to mid-sized businesses looking for an affordable, easy-to-implement procurement solution

3. SAP Fieldglass

SAP Fieldglass is a cloud-based VMS that can help your organization find, engage, manage, and pay external workforces. SAP was named a Leader in Gartner’s Magic Quadrant for Procure-to-Pay Suites in 2021.

Best for: Large enterprises managing large volumes of contingent labor and service providers

4. SAP Ariba

SAP Ariba is a cloud-based procurement and supply chain management solution. Its vendor management capabilities focus on improving collaboration between buyers and suppliers. Ariba’s supplier performance management and sourcing solutions are particularly useful if your business requires advanced supplier data integration and reporting features.

Best for: Enterprises seeking a robust, globally recognized procurement platform with deep supplier collaboration tools

5. Gatekeeper

Gatekeeper describes itself as “an all-in-one vendor lifecycle management platform” built on vendor management automation, artificial intelligence, and vendor-facing features.

Gatekeeper provides an employee portal for internal users to request new vendors and compliance reviews, along with a vendor portal for managing tasks such as non-disclosure agreements (NDAs) and information security reviews.

Best for: Organizations that need AI-powered vendor lifecycle management with strong self-service portals for employees and vendors

6. Beeline

Beeline specializes in managing contingent workforces and external talent. It provides detailed analytics and reporting tools to track supplier performance, mitigate risk, and improve efficiency. Its platform also integrates with leading HR and procurement systems, making it easier to manage talent data in one place.

Best for: Enterprises managing large-scale contract labor programs who need granular workforce cost tracking

7. Venminder

Venminder describes itself as a recognized leader in third-party risk management. It helps your business organize, track, and report findings throughout the vendor management lifecycle.

Best for: Highly regulated industries, such as banking, healthcare, and insurance, that require robust third-party risk management

8. Oracle Procurement Cloud

Oracle’s solution helps your business manage suppliers, contracts, and procurement in a unified platform. With a focus on automation and transparency, Oracle’s procurement solution offers tools for supplier performance evaluation and risk management.

Best for: Mid-to-large enterprises looking for a scalable, cloud-based procurement platform with seamless Oracle ecosystem integration

9. Workday VNDLY

VNDLY is a comprehensive vendor management system tailored for managing contingent labor and contractors. Vndly can help your business gain better control over its supplier relationships, improving cost visibility and operational efficiency.

Best for: Enterprises seeking a Workday-integrated solution for managing contingent labor and procurement in one platform

10. JAGGAER

JAGGAER is a supplier management platform that also includes vendor management features. Widely used by organizations looking to streamline their supplier collaboration, JAGGAER helps your business optimize supplier selection, negotiate better terms, and manage performance.

Best for: Large enterprises and institutions with complex, global supply chains needing advanced sourcing and analytics

11. Zycus

Zycus offers an all-in-one supplier management platform with vendor management capabilities. It’s especially helpful if your business is in manufacturing or other industries with complex supply chains. Zycus lets you track and improve vendor relationships, ensuring that suppliers meet agreed-upon quality standards and delivery timelines.

Best for: Manufacturing and supply chain-heavy industries seeking AI-driven sourcing, contract, and supplier performance management

12. SynerTrade

SynerTrade is a digital supplier relationship management platform that integrates vendor management capabilities. SynerTrade’s supplier relationship management tools enable better collaboration and transparency with vendors, helping your company improve supply chain efficiency.

Best for: Mid-to-large enterprises seeking customizable procurement and vendor management solutions

13. Coupa

Coupa’s procurement management platform includes a range of tools for supplier relationship management. Its real-time analytics help your business monitor vendor performance and optimize spending. Coupa also lets you prioritize cost control and visibility into supplier performance.

Best for: Mid-to-large enterprises seeking a cloud-based solution with strong integration capabilities across finance, procurement, and expense management systems

14. Ivalua

Ivalua offers end-to-end procurement solutions with integrated vendor management features. It provides your business with detailed insights into its supplier base, while its analytics tools let you track supplier performance and ensure compliance.

Best for: Large enterprises that need a highly configurable, cloud-based solution capable of managing complex global supply chains

How to choose a vendor management system

Selecting the right vendor management system means weighing functionality, scalability, and cost against your organization’s specific needs. Below are the top factors to guide your decision:

Budget and pricing models

Look for a pricing model that aligns with your budget and factor in any costs for implementation, integrations, or premium features. A cost-effective platform should still offer the automation and visibility you need without overpaying for unused capabilities.

Integration with existing systems

A good VMS should connect seamlessly with your enterprise resource planning (ERP), accounting, procurement, and corporate card systems. For example, integration with your corporate card allows you to:

- Set preapproved spending limits to enforce expense policies automatically

- Limit or block spending on certain vendors or categories

- Apply weekly, monthly, or quarterly spend caps

Centralized procurement and approval

Procurement can become unwieldy if it’s not bound by a formal process that finance teams and department heads can quickly and easily follow. Look for a VMS that helps you centralize and simplify requests and approval processes in minutes, not weeks.

Automated and real-time vendor expense tracking

A VMS should help your business incentivize savings and value-for-money across the organization, whether that’s external consultant spend, SaaS subscriptions, or legal services. Look for a VMS that enables you to:

- Apply category-level spending controls to prevent unapproved purchases before they escalate

- Save time with accounting integrations and accurate expense coding, making it easier to identify high-value vendors and flag those underperforming against agreed deliverables

Auto-categorize vendors

It’s difficult to control costs if you don’t know exactly who your vendors are or what they provide. A good VMS will categorize vendors by service type and results, helping you spot duplicate services, uncover wasteful spend, and proactively manage vendor relationships.

Block certain vendor spend with preset rules

A VMS should integrate with your corporate card, allowing you to set preapproved spending limits that automatically enforce your company’s expense policies and monitor supplier and vendor spending. Look out for the ability to set weekly, monthly, and quarterly spend limits, too.

For example, Ramp lets you issue vendor-specific virtual cards to control spending at the category level, blocking spending on certain marketing activities or capping insurance outlay. You can limit or block spending on individual vendors, too.

Streamline vendor management with Ramp

Managing vendors at scale can quickly become overwhelming. Ramp’s vendor management software centralizes all your vendor data and spend in one searchable platform, automatically tracking every transaction so you can filter, analyze, and uncover cost-saving opportunities.

Our software offers custom fields that let you capture the details that matter most to your business, while renewal reminders at 60 and 30 days help you avoid surprise contract renewals.

Price Intelligence benchmarks your software costs against millions of real transactions, instantly showing whether you’re paying too much. Upload a contract and see how your price compares, right down to the cost per user across multiple SKUs, so you can negotiate with confidence.

Ready to get started? Try an interactive demo to see how Ramp's VMS can help improve your vendor management operations.

FAQs

A VMS provides tools and processes to ensure vendor compliance with legal and regulatory requirements. It tracks vendor performance, manages contracts efficiently, and identifies potential risks associated with vendor relationships. This centralized approach allows organizations to mitigate risks by maintaining transparency and control.

A VMS can help prevent shadow IT by providing visibility into all the technology and tools across your organization. It allows you to track and manage vendor relationships, flagging unauthorized technology solutions and helping you avoid security and compliance issues.

VMS focuses on overseeing vendors after they’ve been onboarded, including tracking performance, managing contracts, and controlling spend. Procurement software, on the other hand, is primarily used for sourcing, evaluating, and purchasing goods or services.

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide.” ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn’t just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn’t exist in Zip. It’s made approvals much faster because decision-makers aren’t chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits

“More vendors are allowing for discounts now, because they’re seeing the quick payment. That started with Ramp—getting everyone paid on time. We’ll get a 1-2% discount for paying early. That doesn’t sound like a lot, but when you’re dealing with hundreds of millions of dollars, it does add up.”

James Hardy

CFO, SAM Construction Group