- How Ramp Bill Pay handles the full AP workflow

- Key AP features for small businesses

- What Ramp Bill Pay costs (and what's included for free)

- What small businesses are actually saving with Ramp Bill Pay

- Get started with Ramp Bill Pay

For small businesses, accounts payable can quietly become one of the most resource-draining parts of finance. When you're down to one or two people handling everything from vendor payments to month-end close, invoices pile up fast. It's easy for processing to fall behind when the same person is also managing payroll, fielding customer questions, or putting out operational fires.

This is where AP automation helps. Ramp Bill Pay handles the repetitive parts: it processes invoices as they come in, routes them to the right people for approval, and schedules payments based on your cash flow. You're not chasing down approvals or manually entering payment details.

This guide walks through how small businesses actually use Ramp Bill Pay to save time on invoice processing, keep tighter control over spending, and avoid late payment fees. You'll see what the process looks like and where it makes the biggest difference.

How Ramp Bill Pay handles the full AP workflow

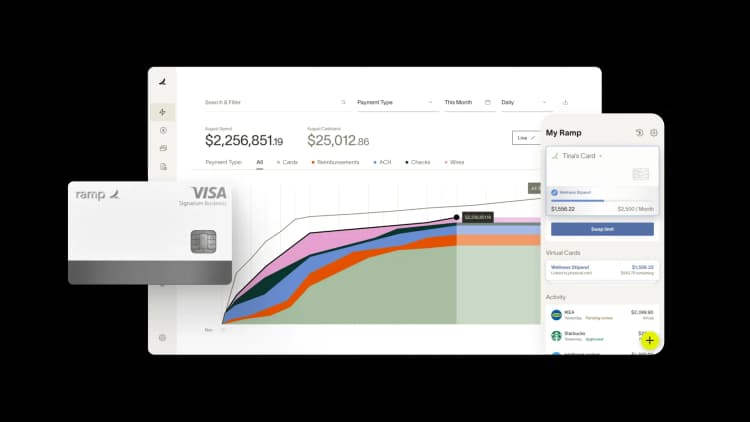

Ramp Bill Pay brings automation without complexity, with an intuitive interface designed so that small business owners can use it with ease.

If you're running AP for a small team, you're probably juggling invoices from email, paper, and your accounting system, all while trying to get approvals and make payments on time. Ramp Bill Pay handles this entire workflow in one place, so you don't need dedicated AP staff or custom integrations to make it work.

Here's how the workflow comes together:

- Invoice capture. You can send invoices from multiple sources (email forwarding, direct uploads, CSV import, or accounting system syncs). Ramp Bill Pay automatically extracts vendor name, invoice number, due date, and line items using OCR

- Approval routing. Based on your rules, Ramp sends invoices to the right team members for review. Approvers can see the full invoice, vendor history, and any attached documentation from their phone or desktop

- Payment scheduling. Once approved, you can schedule payments via ACH, check, card, or wire. Pay immediately or set a future date to manage cash flow

- Accounting sync. All payments and related details sync directly with your accounting software, reducing manual reconciliation and ensuring clean financial records

Key AP features for small businesses

Small businesses face specific AP challenges: your team is stretched thin, every cash flow decision matters, and you need control without hiring more people. Here's a breakdown of features that top-rated AP software for small businesses should address.

Invoice capture and data extraction

Right now, someone on your team is probably typing invoice details into your system by hand. That takes time and creates errors: wrong amounts, duplicate entries, mismatched vendor names.

Ramp scans invoices and pulls out the key details automatically. The system learns from corrections, so it gets more accurate the more you use it. Most teams cut their invoice processing time in half.

Set up approval workflows that match how your team works

Set up approval rules that match how your business actually works. Route by department, vendor, amount, or whatever makes sense for you.

Approvers receive alerts on their phone and can review from anywhere. No more chasing people down or waiting for someone to get back from vacation.

Choose when payments go out

Instead of paying bills the moment they arrive, you choose when payments go out. Schedule by due date, vendor terms, or your current cash position.

Ramp also flags early payment discounts and shows you what they're worth, so you can decide if the savings are worth the earlier cash outflow.

Keep all your vendor information in one place

When vendor information lives in email threads and filing cabinets, you're constantly hunting for W-9s or double-checking bank details.

Each vendor gets a profile in Ramp with payment details, W-9s, and 1099 documentation. Send vendors to Ramp's Vendor Network to upload their own tax and banking information. You get clean records, fewer errors, and full visibility into vendor spend.

Sync everything with your accounting system

Ramp connects directly with 200+ systems, including QuickBooks Online, Xero, Sage Intacct, NetSuite, and Acumatica.

Once a payment is made, all the data flows into your accounting system: vendor bills, reimbursements, transactions, accounting fields, everything. This eliminates double entry and keeps your books accurate all month. When it's time to close, you're already most of the way there.

AI agents for accounts payable

Ramp is also introducing AI agents for AP—autonomous systems built into Ramp that go beyond workflow automation. These agents understand invoice context and take action on behalf of your team. They code line items based on historical data, flag potential fraud, suggest the appropriate approver, and submit card payments when applicable.

Ramp customers can enable or join the waitlist for AP Agents in the Early Access tab. Auto-coding and approval recommendations are only available to Ramp Plus customers.

What Ramp Bill Pay costs (and what's included for free)

Ramp's platform starts with a free tier. Small businesses get access to core AP automation and spend management features without paying for a subscription.

The free plan combines AP, corporate cards, and spend controls in one system. It includes:

- Unlimited physical and virtual cards

- Card issuing controls and spend limits

- Expense policy enforcement and employee rewards

- Integrations with QuickBooks Online and Xero

- And much more

For accounts payable, the free tier specifically includes:

- Invoice capture with AI-powered OCR

- Bill payments by check, ACH, card, and wire

- Advanced exports

- Vendor onboarding and tax management

- Ability to create bills using CSV uploads

- Mobile bill approvals

- Approval rules and routing

Ramp also offers two paid tiers: Ramp Plus and Ramp Enterprise.

Ramp Plus starts at $15 per user per month, with additional platform fees based on team size. It includes everything in the free plan, plus more advanced AP capabilities like batch payments, payment release approvals, and support for two- and three-way matching. These features become useful when you're processing higher invoice volumes or need tighter controls. Ramp Enterprise unlocks even more advanced features.

If you start on the free tier and grow, you won't need to switch platforms. You can add users, handle more invoices, and build more complex approval workflows as your needs change. Pricing stays predictable, so you know what to expect as you scale up.

For a complete list of available features across all tiers, visit Ramp Pricing.

What small businesses are actually saving with Ramp Bill Pay

Many small businesses that have adopted Ramp Bill Pay have already saved time and money. Some have reduced invoice processing times by up to 50% and processed bills twice as fast. Here are a few customer stories from small businesses using Ramp:

1. How Dragonfly Pond Works scaled AP and simplified bill payments with Ramp

As Dragonfly Pond Works expanded, its bill pay process couldn’t keep up. The company had outgrown its bank-based scheduling tool, which lacked flexibility, vendor visibility, and control at scale. Payments were hard to track, and managing timing across growing responsibilities became increasingly manual.

Ramp Bill Pay gave the team a more scalable and reliable way to handle payments. Rather than batching payments through a limited banking portal, Dragonfly’s staff accountant now enters invoices into Ramp, selects the vendor, and schedules payments via ACH or check within the platform.

“Before Ramp, we had a bill pay scheduling function through our bank. The solution worked well, but we simply outgrew the system. We wanted to find ways to improve our process, optimize our days payable outstanding, and allow visibility for our vendors on payments,” says Austin Mcilwain, CFO at Dragonfly Pond Works.

“We also wanted a more scalable way to pay vendors via ACH. Our staff accountant enters all the information through Ramp Bill Pay and can easily schedule, whether via ACH or a check, in a way that we weren’t able to before.”

Since implementing Ramp, Dragonfly has cut a full week off its month-end close. With automated payment scheduling, real-time visibility, and a platform built to scale, the finance team now spends less time chasing down due dates—and more time planning ahead.

2. Crossings Community Church: How Ramp helped process bills 2x faster

Crossings Community Church had AP and procurement processes that were highly manual and time-consuming. The finance team had to cut hundreds of checks each week, as their previous system, Concur, did not support automated check payments. This resulted in significant time spent on processing, printing, and mailing physical checks.

Additionally, limited visibility into invoice approvals, vendor documentation, and purchase order workflows made it difficult to track spending and manage procurement efficiently. The manual nature of reporting also meant that budget reports were frequently outdated and inaccurate.

Crossings Community Church implemented Ramp Bill Pay to fully automate its check payments, invoice approvals, and AP workflows. Ramp’s system eliminated the need for manual check processing, allowing the finance team to issue vendor payments digitally with just a few clicks.

By automating invoice approvals and purchase order workflows, the finance team gained greater control over procurement while reducing delays in vendor payments. Ramp also provided real-time visibility into spending, ensuring more accurate budget forecasting and financial planning.

With Ramp Bill Pay, Crossings Community Church transformed its AP and procurement workflows, eliminating manual inefficiencies and significantly improving financial oversight.

- 2x faster bill processing time: Automated invoice approvals and check payments eliminated delays in vendor payments.

- More accurate financial reporting: Real-time budget insights improved cash flow forecasting and procurement planning.

- Significant time savings for finance teams: Automating AP processes allowed the finance team to focus on higher-value projects.

“Thanks to Ramp, I can review questions about specific invoices, and it'll probably take me a matter of hours as opposed to weeks. ” — Mandy Mobley, Finance Invoice & Expense Coordinator, Crossings Community Church

By automating AP with Ramp Bill Pay, Crossings Community Church eliminated check payment inefficiencies, improved vendor relationships, and freed up finance teams to focus on strategic financial planning instead of administrative tasks.

3. How the Hospital Association of Oregon used Ramp to reduce invoice processing times

When Jason Hershey became VP of Finance and Accounting at the Hospital Association of Oregon, he inherited strong processes—but outdated, manual systems. Invoices were emailed as attachments, approvals came through scattered replies, and check runs required printing, stamping, and mailing. Nothing was connected to their accounting system, which meant hand-keying each entry twice and constantly double-checking for errors.

To reduce their invoice processing time, Jason turned to Ramp. With Ramp Bill Pay, his team could upload invoices directly into the platform, route them automatically for approval, and issue payments—without waiting for a weekly batch or re-entering data into their accounting system. Department heads gained visibility into what they were approving and everything stayed in sync.

“Doing it the old way probably took a good 10 hours per AP batch,” Jason says. “Now it just takes a couple of minutes between getting an invoice entered, approved, and processed.”

With Ramp, invoice approvals happen as they come in, not once a week. That’s helped the team move faster, reduce email back-and-forth, and speed up month-end close by as much as five days.

“Ramp is such a valuable time-saver,” Jason says. “Especially in an environment where you’re maybe a small or one-person finance shop. You can feel a little bit more comfortable that the system is going to help you do those things you’re worried about—and it handles those things well.”

The Hospital Association of Oregon’s story shows how automating AP with Ramp doesn’t just save time—it creates space for lean finance teams to work smarter, stay audit-ready, and move their organizations forward with confidence.

Get started with Ramp Bill Pay

AP software can help—especially if you're processing more than a handful of bills each month. With Ramp Bill Pay, invoices get captured automatically, approvals happen in Slack or email, and everything syncs to your accounting system. You'll know exactly what's been paid and what's still pending.

If you're ready to stop chasing down invoices, try Ramp Bill Pay.

*Same-day ACH payments and International payments may incur a fee unless you are using a Ramp Business Account. Ramp Bill Pay is available on our free plan with no software or transaction fees. Note that certain ERP integrations require a Ramp Plus account, which includes a monthly fee.

FAQs

Ramp Bill Pay is Ramp’s name for its accounts payable software—a modern AP automation system that helps finance teams manage invoices, streamline approvals, and make vendor payments all in one place. It automates manual AP tasks, syncs directly with accounting systems like NetSuite, QuickBooks, and Sage Intacct, and gives businesses real-time visibility and control over spend.

Learn how your team can simplify and automate AP on our official Ramp Bill Pay page.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits