The best business credit cards for healthcare practices

- The importance of business credit cards for healthcare practices

- Evaluating business credit card features

- Strategies for maximizing healthcare business credit card rewards

- Top business credit cards for healthcare providers

- Integrating your credit card into your financial workflow

- How Ramp helps medical practices and suppliers spend more time on patient care

- Modernize your healthcare business credit card program

Business credit cards give healthcare providers and medical practices a dedicated way to manage expenses and streamline purchasing. These cards typically come with higher credit limits, specialized expense tracking tools, and rewards programs tailored to business spending.

A good business credit card helps you manage your practice’s finances better. You can consolidate all your vendor payments onto one platform instead of juggling multiple payment methods. These cards also help you build business credit separate from your personal credit score, which matters when you need financing later on.

When you face high supply costs or delayed insurance payments, business credit cards give you the flexibility to manage your cash flow. Plus, you can earn rewards on your regular business spending.

The importance of business credit cards for healthcare practices

Healthcare practices deal with financial challenges that most businesses don't face. You likely manage payments from multiple sources—private insurance, government programs, and individual patients—each with different reimbursement rates and timelines.

Business credit cards help here by giving medical practices and suppliers a strategic tool to manage their finances and operate more efficiently:

- Managing cash flow: Healthcare practices often deal with uneven cash flow due to insurance payment cycles and seasonal demand. Business credit cards give you a rotating line of credit to help bridge those gaps, giving you flexibility when you need to stock up for busy periods or when insurance payments are delayed.

- Building business credit: Responsible use of a business credit card over time helps you build business credit, which can help you get better terms on loans or lines of credit. If you ever need equipment loans, facility expansions, or other financing down the line, a strong credit history is a must.

- Streamlining expense management: The best business credit cards offer built-in expense management software that can automatically track, categorize, and reconcile your expenses. These tools not only simplify budgeting and reporting, but also support compliance and cost-efficiency in a highly regulated and cost-sensitive industry.

Business credit cards also tend to offer rewards structures specifically designed to benefit your practice. For example, a card that offers elevated rewards at office supply stores can be useful for stocking up on necessary supplies for your lab. Additionally, a card that offers points for travel can be useful for attending conferences or lectures.

Evaluating business credit card features

The right card for your medical practice should support your financial health and help you comply with regulations. Key features to consider include:

Expense tracking and documentation

The best business credit cards for healthcare practices should offer integrated expense tracking and categorization tools. This software automatically sorts your transactions by department, vendor, or service line, giving you clear visibility into where your money goes. This real-time visibility helps you monitor cash flow and make more informed financial decisions.

Look for software that also automatically categorizes expenses. Automated expense categorization saves hours of manual reconciliation each month, freeing your staff to focus on patient care and giving you audit-ready documentation when tax season comes.

Integration with accounting software

A card that integrates with your accounting software reduces the need for manual data entry, which minimizes errors and saves staff valuable time. Integrated systems simplify monthly reconciliation and quickly generate accurate financial reports.

This is especially important in healthcare, where clear financial records support compliance, audits, and insurance documentation. As your practice grows, having a scalable, automated system becomes critical. Integration ensures the financial side of your business keeps pace with clinical operations, allowing you to stay focused on patient care.

Perks and rewards structure

Look at rewards and cashback programs based on how your practice spends money. Review your highest spending categories and narrow your search to cards that give you elevated cashback rewards or points multipliers in those areas. If your practice spends a lot on office supplies, for example, look for cards with bonus points in those categories.

Other factors: Fees, interest rates, and credit limits

Interest rates and fees directly affect your bottom line, especially if you sometimes carry balances during cash flow gaps. A card with a $95 annual fee might still be worth it if its rewards structure gives you more than $95 in benefits each year. If you pay in full each month, focus on rewards over APR. If you need payment flexibility, look at introductory APR offers.

Credit limits and spending flexibility matter, too. Make sure the initial credit line can handle your largest expected business expenses. Check if the issuer has a good track record of increasing credit limits for responsible cardholders. Some cards offer flexible payment options for large purchases, which helps when investing in new medical technology or facility upgrades.

Strategies for maximizing healthcare business credit card rewards

Using reward points strategically can improve your medical practice's bottom line. You can:

- Use points for travel to medical conferences, continuing education, or visits to suppliers

- Transfer points to airline and hotel partners for better value than statement credits

- Save points throughout the year to fund team-building events or staff training workshops

Timing large purchases with introductory offers helps you get more from necessary expenses. When planning major equipment upgrades or renovations, consider applying for a card with a big sign-up bonus or 0% APR promotion.

For example, buying $10,000 in new diagnostic equipment during a 0% APR period lets you spread payments over several months without interest, improving your cash flow and potentially earning a welcome bonus worth additional points or cashback.

Many business cards offer perks beyond the main rewards program. Look for cards that provide discounts or partner rewards on business services relevant to healthcare, like practice management software, telehealth services, or shipping for medical supplies.

Top business credit cards for healthcare providers

The right business credit card is a major asset for medical providers and suppliers. We collected three top picks based on the criteria discussed above:

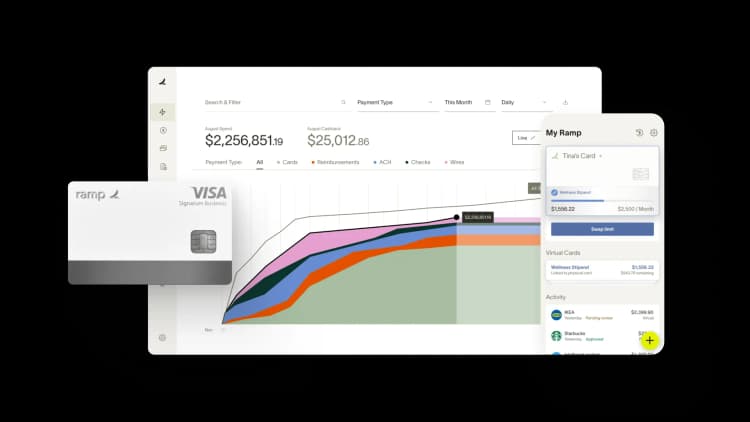

1. Ramp Business Credit Card

The Ramp Business Credit Card is the best overall card for healthcare practices and medical suppliers. Ramp provides financial management tools that help you track expenses, control budgets, stay compliant, and get real-time reports on your practice’s spending.

Ramp is specifically designed to save healthcare companies time and money. It offers cashback on purchases and up to $350,000 in partner rewards, perks, and discounts for common vendors like UPS and Amazon Business. This all adds up to an average savings of 5% a year across all spending.

Benefits include:

- Credit limits higher than traditional business credit cards, up to $100,000 or more for some businesses

- Built-in expense management features, including automated receipt collection and expense reporting

- Integrations with popular accounting software and ERPs like QuickBooks, Xero, and NetSuite, reducing manual reconciliation and expense categorization

- Unlimited free physical and virtual employee cards with customizable spend limits at the card, department, vendor, and category levels

- No annual fee or foreign transaction fees, especially useful for practices or suppliers with an international supplier base

2. American Express Business Gold Card

The American Express Business Gold Card offers a flexible rewards structure tailored to healthcare practices with diverse spending needs. It earns Membership Rewards points at an accelerated rate, providing 4x points in the two categories where your practice spends the most each billing cycle, from a list of eligible categories.

Benefits include:

- 4x points on eligible purchases in specific categories

- 3x points on flights and pre-paid hotels booked through Amex Travel

- Flexible points system with numerous redemption options

- No international transaction fees

- $240 flexible business credit for purchases at select business vendors

However, the card comes with a hefty $375 annual fee. Additionally, the 4x rewards rate is capped at $150,000 in combined purchases each calendar year, which may affect medical suppliers or practices with high annual spending needs.

3. Capital One Spark Cash Plus

The Capital One Spark Cash Plus card offers medical practices and suppliers a flexible spending limit—you’re not restricted by a fixed credit line, letting you make purchases as needed. You can earn 2% cashback on all business purchases, with no caps or limits, and an additional 5% back on hotel and rental car bookings through Capital One Travel.

Benefits include:

- Unlimited 2% cashback rewards on all purchases

- No preset spending limit

- No foreign transaction fees

- $150 statement credit to offset annual fee if you hit a minimum spending threshold

- Offers virtual card numbers

The Spark Cash Plus is a good choice if you want straightforward cashback rewards, but you may miss out on the points and other benefits you’d get with a more tailored rewards structure. The card also requires full balance payments each month, so it’s not a great choice if you plan to occasionally carry a balance.

Integrating your credit card into your financial workflow

Your business credit card should fit seamlessly into your practice's financial management system. Proper integration boosts financial visibility and reduces administrative work.

Here's how to get started:

- Develop a rollout plan: If you plan to distribute credit cards for your employees, you’ll need to establish clear protocols for card usage, receipt submission, and expense approval. Train all cardholders on proper documentation requirements, emphasizing the importance of detailed records for healthcare compliance.

- Designate expense categories for card use: Put all medical supplies and equipment purchases on the card for easier tracking and to generate rewards. Set up recurring payments (utilities, software, memberships) on the card for consistent documentation.

- Align card usage with your budget: Set spending limits that match your monthly or quarterly allocations. Create category-specific thresholds to avoid overspending, and implement approval workflows for purchases above certain amounts.

- Connect your card to accounting and practice management software: Most systems offer direct integration, automatically importing transactions. Configure expense categories in your software to match your card statements for easy reconciliation, and set up regular sync schedules to keep records current.

- Review card usage and benefits regularly: Ongoing management is key to getting the most out of your practice’s credit card. Review monthly statements to verify transactions and spot unusual patterns, assess your rewards accumulation and redemption strategy quarterly, and evaluate your card's features annually to ensure it still meets your needs.

How Ramp helps medical practices and suppliers spend more time on patient care

Surgical Affiliates Management Group (SAMGI), a healthcare organization providing surgical care and leadership, faced a common challenge: time-consuming manual processes for credit card and expense management.

Corporate Controller Kathleen Cole recalls the growing pains of using traditional bank cards with rigid, outdated systems. "Many employees avoided the corporate cards because it was easier to use personal credit cards and submit expense reports," she explains.

The manual expense system not only added workload but also increased fraud risk, with duplicate expense submissions being a concern. As SAMGI rapidly expanded, adding over 200 employees in a few years, the administrative burden became overwhelming. "Every moment spent managing cards took attention away from our primary mission: supporting providers and improving patient care," Kathleen says.

SAMGI partnered with Ramp to modernize their business credit card program and streamline operations. With Ramp's virtual cards, SAMGI could assign cards directly to individuals with built-in budgets and merchant restrictions. Transactions were pre-coded, making them easy to use and manage. "It has been a game-changer," says Kathleen. "We transitioned to Ramp without a hitch—our vendors didn't even notice."

Since adopting Ramp, SAMGI has seen enthusiastic employee adoption, reduced fraud risk, and a simplified review process. Employees can simply snap a photo of receipts, add notes, and submit via mobile. For the accounting team, Ramp's automated coding and receipt-matching save significant time. "Now, our accounting specialist can rely on Ramp's green check mark system, eliminating the need to manually verify every line item," Kathleen explains.

Ultimately, the efficiencies gained through Ramp allow SAMGI to focus more on delivering exceptional patient care. By automating manual card and expense processes, healthcare organizations like SAMGI can redirect their energy toward supporting providers and fulfilling their core mission. Ramp's spend management platform eliminates the distractions of outdated financial workflows, empowering healthcare teams to prioritize what matters most.

Modernize your healthcare business credit card program

The Ramp Business Credit Card can instantly modernize your practice’s spending, improving efficiency at every step of the purchasing process.

Unlimited physical and virtual cards help you drastically reduce or even eliminate employee expense reimbursements, and automated expense tracking and categorization help you make better financial decisions, save time on reconciliation, and stay compliant.

Take charge of your practice’s finances, reduce manual effort, and spend more time focusing on patient care. Try an interactive demo and see why Ramp cardholders save an average of 5% a year across all spending.

Don't miss these

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Compared to our previous vendor, Ramp gave us true transaction-level granularity, making it possible for me to audit thousands of transactions in record time.”

Lisa Norris

Director of Compliance & Privacy Officer, ABB Optical

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°