Business line of credit vs. business credit card: which should you choose?

- How does a business line of credit work?

- Pros and cons of business lines of credit

- How does a business credit card work?

- Pros and cons of business credit cards

- Business line of credit vs. business credit card: Which is best for your business?

- The Ramp advantage: A smarter way to pay and control spend

As a business owner, having access to financing is important for managing cash flow, taking advantage of growth opportunities, and covering unexpected business expenses. Two popular funding options that can help meet these needs are business lines of credit and business credit cards.

While they share some similarities, there are important differences to understand when deciding which one is the better choice for your company. In this article, we'll take an in-depth look at how business lines of credit and business credit cards work, the pros and cons of each, and offer guidance on when to use one over the other.

How does a business line of credit work?

A business line of credit provides your company with a predetermined amount of capital that you can draw from as needed. It operates similarly to a credit card in that you have a credit limit, but with a line of credit, you typically draw funds as cash deposited into your business bank account.

While credit cards are primarily used for direct purchases, a line of credit offers more flexibility in how you access and use the funds. The credit line comes with a maximum limit, and you only pay interest on the amount you've borrowed. As you repay the borrowed funds, your available credit is replenished, allowing for revolving access to capital.

The cash from your line of credit can be used for any legitimate business purpose, with no restrictions on what types of expenses you can cover. When you need funds, you can take out just the amount required, whether that's $500 to cover a minor purchase or $50,000 to make a larger investment. You control when and how much to borrow.

Key features include:

Feature | Business line of credit |

|---|---|

Access to Funds | Via company checking account, credit card, or mobile app |

Draw Period | Limited time to access funds (e.g., several years) |

Interest | Charged only on borrowed amount |

APR Range | Approximately 8% to 60% or higher, depending on lender and borrower creditworthiness |

Secured vs. unsecured business line of credit

Most business lines of credit are secured by collateral, though unsecured options exist for established businesses with strong credit profiles. Unsecured lines of credit do not require specific collateral, especially for lower borrowing amounts. However, approval for these unsecured lines often depends heavily on the owner's personal creditworthiness and may require a personal guarantee or a blanket lien on business assets.

Secured lines of credit, on the other hand, require collateral but generally offer lower interest rates due to reduced risk for the lender. These secured options may be easier to obtain for businesses with less established credit histories. The choice between secured and unsecured lines of credit depends on your business's financial situation, available assets, and risk tolerance.

Pros and cons of business lines of credit

Pros:

- Only pay interest on funds borrowed, not the full credit line

- Withdraw exact amount needed, when you need it

- No limitations on what you can use the funds for

- Quick access to cash for any business purpose

- Helps manage cash flow fluctuations

Cons:

- Generally don't offer rewards or cashback programs, unlike business credit cards

- May have annual maintenance fees

- Some lenders require specific collateral for larger lines

- Newer businesses may not qualify or receive smaller limits

- Interest rates are often variable and can increase over time

How does a business credit card work?

A business credit card functions as a revolving line of credit, allowing your company to borrow funds up to a defined limit for business expenses. When you use the card to make a purchase, you're essentially borrowing money from the card issuer, which you'll need to pay back later.

At the end of each billing cycle (usually monthly), you'll receive a statement detailing your transactions, the total amount owed, the minimum payment due, and the payment deadline. You have the option to either pay the balance in full or make a partial payment, as long as you meet the minimum amount due. If you pay the full balance within the grace period (typically between 21 to 25 days), you typically won't incur any interest charges. However, if you carry a balance from one month to the next, you'll be charged interest on the unpaid portion.

The interest rate on a business credit card is often higher than that of a traditional business loan or line of credit. The exact rate depends on factors such as your business credit score, the card issuer, and market conditions. Some cards like Ramp offer introductory 0% APR periods, which can provide short-term financing without interest charges.

Key features include:

Feature | Business credit card |

|---|---|

Access to Funds | Immediate via card purchases or cash advances |

Usage Period | Ongoing, as long as the account remains in good standing |

APR Range | Typically 17% to 30% variable (excluding introductory offers) |

Rewards | Often includes cash back, points, or miles on purchases |

Other notable characteristics of business credit cards:

- Revolving credit line: As with a line of credit, your available credit replenishes as you pay down your balance each month. You can reuse your credit limit repeatedly without needing to reapply.

- Physical cards to make purchases: Business credit cards come with physical cards you and your employees can use to make business purchases. Employee cards typically have customizable spending limits for greater control.

- Separation of personal and business expenses: Business credit cards often come with features tailored to company needs, such as expense tracking tools, the ability to issue cards to employees, and rewards programs designed for business spending. They provide a convenient way to separate business expenses from personal charges, simplifying bookkeeping and tax preparation.

Pros and cons of business credit cards

Pros:

- Convenient to make business purchases in-person or online

- Interest-free grace period on new purchases

- Earn rewards like cash back or travel miles/points

- Reporting tools to easily track and categorize expenses

- Allows you to build business credit history with responsible use

Cons:

- Higher interest rates than other types of financing if you carry a balance

- Easy to accumulate debt if not managed responsibly

- Some cards have annual fees and other costs

- Missed payments can damage your personal and business credit

Business line of credit vs. business credit card: Which is best for your business?

Features | Business line of credit | Business credit card |

|---|---|---|

Credit limit | Typically higher credit limits, often $50,000 to $500,000 | Lower credit limits, usually $5,000 to $50,000 |

Interest rates | Often lower interest rates, especially for well-qualified businesses | Higher interest rates compared to lines of credit |

Repayment terms | Flexible repayment, interest-only payments allowed, repay and redraw funds as needed | Required monthly minimum payments, carry a balance or pay in full each month |

Rewards | Typically do not offer rewards or cash back on spending | Many offer rewards points, miles or cash back on business spending |

Collateral | May require collateral such as business assets or personal guarantee | Typically unsecured, no collateral required in most cases |

Fees | May have annual fees, origination fees, or draw fees | May have annual fees, balance transfer fees, cash advance fees, and foreign transaction fees |

Credit reporting | Typically reported to business credit bureaus, helping build business credit | Late payments and serious delinquencies reported to consumer credit bureaus, impacting personal credit scores |

Expense tracking | May offer some expense tracking features, but typically more limited | Often comes with robust expense tracking and reporting tools for easier business expense management |

A business line of credit is an excellent financing tool for a wide range of working capital needs. Consider a line of credit if:

- You need a flexible source of cash for any business expense, like payroll, inventory, equipment, or expansion.

- You want the ability to borrow larger amounts than a typical credit card limit.

- You only want to pay interest on funds actually used, not a lump sum.

- You prefer not to use a credit card or want to keep some expenses separate.

- You have a more established business with good financials and several years of operating history.

On the other hand, business credit cards are a popular choice for everyday spending and covering smaller ongoing expenses. You may want a business credit card if:

- The majority of your business spending is from vendors that accept credit cards.

- You want to earn rewards like cash back, travel points/miles, or other perks on your business spending.

- You need to issue multiple cards to employees and want an easy way to track their spending.

- You want an interest-free way to borrow money short-term.

- You're looking to build or boost your business credit.

The Ramp advantage: A smarter way to pay and control spend

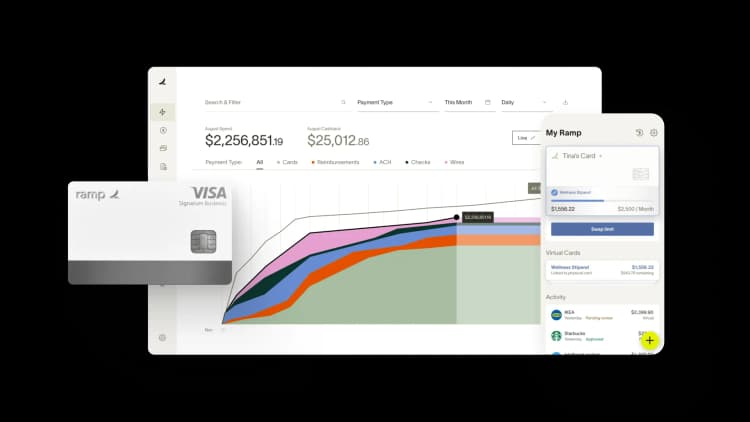

For businesses looking for a modern twist on the traditional credit card, Ramp offers a compelling alternative. With Ramp, you get an innovative corporate card that combines the flexibility of credit with powerful spend management tools.

Ramp has no fees, and credit limits are based on company financials. Cards also include features like automatic receipt matching, expense categorization, and integrations with popular accounting systems.

Ramp goes beyond traditional corporate cards with our advanced spend controls, real-time reporting, and exclusive partner rewards. On average, Ramp helps businesses save 5% on expenses while simplifying financial management.

Don't miss these

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits