Best 5 accounts payable software for large businesses in 2026

- What is enterprise AP automation and how to do it right

- At a glance: AP automation software for large businesses compared

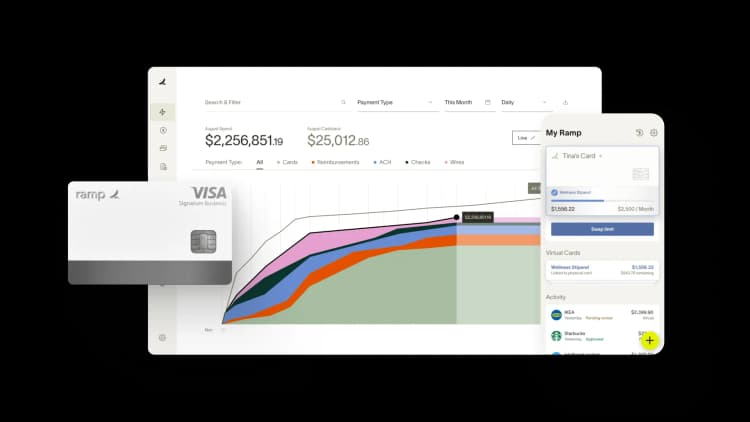

- 1. Ramp Bill Pay

- 2. Sage Intacct

- 3. Coupa

- 4. Stampli

- 5. SAP S/4HANA Cloud

- What to consider before you implement an AP automation platform

- Choose the best-rated AP software for large businesses

- Ramp and The Second City: AP automation success story

- Ramp Bill Pay: A month of AP done in minutes

Managing accounts payable (AP) at the enterprise level means dealing with thousands of invoices, complex approval chains, and large volumes of vendor payments. In these environments, even minor delays or manual errors can lead to significant financial and operational disruptions. That’s why automation isn’t a nice-to-have—it’s essential.

Enterprise AP automation software helps streamline invoice processing, approval workflows, and payments to drive accuracy, speed, and internal control. But large organizations need more than just basic automation. They need platforms built for scale, integration, and reliability.

Based on verified user ratings from review platforms like G2, we’ve compiled five of the best AP software systems for large businesses:

- Ramp Bill Pay

- Sage Intacct

- Coupa

- Stampli

- S/4HANA Cloud

Before we dive into why these platforms are consistently recommended for enterprise AP, let’s walk through what features matter most when evaluating solutions at this scale.

What is enterprise AP automation and how to do it right

Enterprise AP automation refers to the use of digital tools to manage every step of the payables process—from invoice intake to payment reconciliation—within a single, integrated system. It replaces fragmented workflows, manual data entry, and email-based approvals with technology that ensures consistency, transparency, and efficiency across the organization.

Unlike AP tools designed for small businesses, enterprise-grade solutions are built to support:

- Large transaction volumes

- Complex approval routing

- Multi-entity accounting and consolidated reporting

- Seamless ERP integrations

To be effective, AP software must align with your company’s operational structure, compliance needs, and vendor ecosystem. It should also scale with growth—whether that’s across departments, entities, or global locations.

Core features to look for in AP software for large businesses

The most reliable AP platforms for large businesses offer a comprehensive set of features that reduce risk, improve data accuracy, and drive operational efficiency at scale. Key capabilities include:

- Intelligent invoice capture: Uses OCR and machine learning to extract data from any invoice format—paper, PDF, or digital—minimizing manual touchpoints

- Two-way and three-way matching: Matches invoices to purchase orders and receiving documents to detect discrepancies and prevent overpayments

- Flexible payment execution: Supports ACH, wire transfers, virtual cards, and other payment types, with built-in scheduling tools to manage payment timing

- Automated approval workflows: Routes invoices automatically based on department, spend thresholds, or custom business rules

- Real-time reporting and dashboards: Tracks liabilities, payment statuses, and bottlenecks across departments, business units, and entities

- Compliance and audit readiness: Enforces internal controls, logs approvals, and maintains detailed audit trails to support regulatory compliance

- Vendor self-service portals: Reduces support burden by allowing suppliers to submit invoices, update details, and track payment status independently

- Two-way ERP syncs: AP software with bidirectional ERP syncs allow enterprises to reduce manual rekeying of data, effectively resulting in time savings

Why more large businesses are automating AP

The benefits of AP automation go well beyond cutting a few steps from the payment process. It allows for real, measurable improvements across finance, operations, and vendor management.

Here's what large companies gain by picking the right AP solution:

- Increased efficiency and focus: Teams can spend less time on data entry and approvals, and more time on vendor strategy and cash management

- Lower operational costs: Automation reduces errors, prevents duplicate payments, and helps capture early payment discounts

- Better data reliability: Systematic capture and matching of invoice data improves reporting and reduces the time spent resolving discrepancies

- Audit and compliance support: With built-in controls and complete approval trails, it’s easier to maintain audit readiness year-round

- Improved vendor relationships: On-time payments and clearer communication build trust and long-term supplier confidence

- Stronger cash flow management: Real-time visibility into outstanding liabilities helps finance leaders plan payments and optimize working capital

Key takeaways

Enterprise AP automation is about more than going paperless. It’s about choosing a platform that can scale, integrate deeply, and handle complex workflows. The best solutions offer high reliability, strong user ratings, and robust features that reduce risk, improve accuracy, and support global operations.

Next, we’ll compare the leading AP software platforms so you can find the one that best fits how your large business.

At a glance: AP automation software for large businesses compared

The best AP automation software for large businesses balances power, flexibility, and usability—especially as invoice volume, approval layers, and system integrations become more complex. Ramp Bill Pay, Sage Intacct, Coupa, Stampli, and SAP S/4HANA Cloud all offer enterprise-grade solutions, each with its own strengths depending on your priorities.

This table gives a quick look at how top platforms compare across market focus, customer satisfaction, and pricing transparency—so you can start narrowing down the right fit for your finance team.

Platform | G2 rating | Market segment | Pricing tiers |

|---|---|---|---|

Ramp Bill Pay | 4.8 | Small businesses | Free tier |

Sage Intacct | 4.3 | Mid-market | N/A – All pricing is quote-based |

Coupa | 4.2 | Mid-market | N/A – All pricing is quote-based |

Stampli | 4.6 | Small businesses | N/A – All pricing is quote-based |

SAP S/4HANA Cloud | 4.5 | Mid-market | N/A – All pricing is quote-based |

When you need to manage accounts payable at scale, the right software makes all the difference. Here's a break down of five AP solutions that excel in automation, efficiency, and reliability for large enterprises.

1. Ramp Bill Pay

Ramp Bill Pay is a top accounts payable platform for large enterprises that want to simplify AP management without sacrificing powerful automation tools.

The software runs on autonomous technology with four AI agents managing invoice coding, fraud monitoring, approval documentation, and card payment execution. Ramp’s OCR hits 99% accuracy while capturing line-item details and processes invoices 2.4x faster than traditional AP platforms1.

Use Ramp Bill Pay as your sole AP system, or integrate it with Ramp’s corporate cards, expense management, and procurement tools for complete spend control.

To be fully transparent, we’re pretty proud of our AP software, and we believe its capabilities make it the top choice for large businesses. With intuitive automation features and a focus on minimizing friction, Ramp is a reliable solution for scaling financial operations. Even up to 95% of companies gain better oversight of their payables after adopting Ramp2.

But we’re not the only ones who think so. G2 reviewers rate Ramp a 4.8 out of 5 stars, and we consistently earn high marks for ease of use, quick implementation timelines, and high return on investment.

Key features

- Invoice scanning and automated matching: Automatically captures all invoice line items with 99% accuracy and converts them into an electronic format to ensure invoice information is searchable and prime for automation. Ramp also automates data entry to handle 3-way matching, reconciliation, and more.

- Four AI agents for touchless AP: Ramp provides AI agents that code invoices based on past transaction data, flag fraudulent payments before they process, create approval summaries, and execute card payments.

- Customizable approval workflows: Build smart approval workflows and establish routing rules to ensure reviewers can approve payments without delays.

- Seamless payment processing: Supports ACH, check, card, and international wire payments.

- Vendor management tools: Centralized vendor records and payment histories simplify relationships and compliance.

- Bulk W-9 collection: Request all W-9s and e-consent at once instead of chasing vendors with one-off emails.

- AI-powered 1099 prep: Ramp automatically maps bill pay spend to 1099-NEC and 1099-MISC boxes with calculations done for you.

- One-click IRS filing: File directly with the IRS and eligible states in minutes—no extra portals or logins.

- Smart corporate cards: Get unlimited physical and virtual corporate cards with automated receipt capture and built-in controls that can automatically enforce your expense policy

- ERP and accounting software integrations: Syncs seamlessly with tools like QuickBooks, Sage, Oracle NetSuite ERP, Xero, Microsoft Dynamics, and more to streamline reconciliation and reporting.

Serviceable markets

Ramp supports businesses of all sizes, from small business to enterprise level needs. It’s particularly suited to companies with high invoice volumes and complex vendor networks.

ERP integration strengths

Ramp includes integrations for major ERPs like QuickBooks Online, Microsoft Dynamics Business Central, and NetSuite, supporting real-time, bidirectional data flow. Their API ecosystem also enables custom integrations with other financial systems. Multi-entity support lets you standardize AP processes across the enterprise while maintaining entity-specific configurations.

Pricing

Ramp’s free plan includes core AP features like OCR invoice extraction, basic approval workflows, and paying bills with check or ACH.

The Plus package is $15 per user per month, giving you access to advanced approval workflows, batch payments, and payment release approvals. The Enterprise package offers customized and scalable pricing for additional features and dedicated support.

2. Sage Intacct

Sage Intacct is a cloud-based financial management platform recognized for its strong accounting capabilities within Sage's software ecosystem. Its AP automation features streamline workflows by addressing common challenges like manual data entry, approval bottlenecks, and lack of visibility into payables.

Sage received a rating of 4.3 out of 5 stars from G2. Reviewers like its user-friendly interface, ability to handle multiple entities, and customized reporting options.

Key features

- Centralizes payables across multiple entities, making it easier to consolidate and organize invoices for complex enterprises.

- Dashboards provide insight into payables, payments, and cash flow.

- Integrates with popular ERP systems and other tools, including ADP, Avalara, Salesforce, and more.

Serviceable markets

Sage Intacct provides AP tools for mid-sized companies and large enterprises operating across multiple locations or entities. It offers specialized features for industries like healthcare, professional services, software-as-a-service (SaaS), and nonprofits.

ERP integration strengths

Sage Intacct offers pre-built connectors for major business applications and an open API architecture for custom integrations. Multi-entity integration keeps your connections consistent across entities while accommodating unique requirements where needed.

Pricing

Sage Intacct tailors pricing to each customer’s needs, with costs varying based on modules, features, and the number of users. Prospective customers must request a consultation to get a quote.

3. Coupa

Coupa is a spend management platform known for its procurement, invoicing, and expense management capabilities. Its AP automation software serves large businesses by addressing pain points like inefficient invoice processing, lack of vendor collaboration, and fragmented payment workflows. By streamlining these processes, Coupa helps companies reduce errors, save time, and gain visibility into their spending.

Coupa has a rating of 4.2 out of 5 stars on G2. Users like its ability to integrate AP processes with broader spend management and advanced analytics tools.

Key features

- Employees can easily find and manage requests and ensure they get to the right approvers through centralized requests and approvals.

- Provides vendors with a collaboration portal to submit invoices, check payment statuses, and communicate with AP teams.

- Supports multi-currency and multi-language invoicing for international operations.

Serviceable markets

Coupa targets large international organizations with complex supply chains and high transaction volumes. Industries like manufacturing, retail, healthcare, and technology benefit from its end-to-end spend management and AP solutions.

ERP integration strengths

Coupa offers pre-built connectors for major ERPs like SAP and Microsoft Dynamics. They have integrations spanning from procurement, business intelligence, AP, and more.

Pricing

Coupa bases pricing on the size and complexity of the business, with custom packages tailored to meet specific needs. Companies must schedule a demo to access pricing details.

4. Stampli

Stampli’s AP automation platform simplifies invoice management while promoting better collaboration between finance teams and other departments. By tackling common pain points like slow invoice approvals, communication breakdowns, and manual data entry errors, Stampli helps customers improve efficiency and reduce delays.

G2 reviewers give Stampli 4.6 out of 5 stars. Customers like its user-friendly interface and responsive customer support.

Key features

- Stampli centralizes invoice communication by embedding chat tools into its platform, creating a collaborative AP interface.

- Connects with popular ERP platforms to ensure smooth data flow and AP reconciliations.

- Tracks payment statuses and provides visibility to vendors, reducing follow-up inquiries.

Serviceable markets

Stampli is well-suited for mid-sized organizations, particularly those with decentralized teams that need better collaboration and streamlined workflows.

ERP integration strengths

Stampli offers pre-built connectors for ERPs like QuickBooks, Microsoft Dynamics, and more. The API allows custom integrations with other financial systems.

Pricing

Stampli offers custom pricing based on the business size, number of users, and desired features. Interested businesses must request a quote from Stampli.

A month of work done in minutes.

Handle 10x the invoices in half the time. Our standard tier is free.

5. SAP S/4HANA Cloud

SAP S/4HANA Cloud is a comprehensive ERP suite that includes robust AP automation capabilities as part of its finance module. It helps enterprises reduce inefficiencies in invoice processing, improve compliance, and gain real-time insights into payables. Designed for scalability and integration, it’s a solid solution for companies looking to unify their finance operations on a single platform.

SAP S/4HANA Cloud has a rating of 4.5 out of 5 stars on G2. Customers like its effectiveness and ability to unify multiple processes for an entire supply chain.

Key features

- Customizable workflows enable automation of invoice approvals and payment processing, enhancing efficiency and reducing cycle times

- Streamlines the procure-to-pay cycle by integrating purchase orders with real-time visibility for purchasing teams

- Automates data entry by auto-populating recurring or predefined vendor fields

Serviceable markets

SAP S/4HANA Cloud is designed for large enterprises and multinational corporations across multiple industries. It’s well-suited for those that require deep customization and end-to-end financial process automation.

ERP integration strengths

As a native SAP component, S/4HANA Cloud integrates seamlessly with other SAP modules, providing a unified data model and consistent user experience. An extensive API library supports integration with non-SAP systems and specialized applications.

Pricing

While some pricing information is available through SAP’s public materials, most customers will need to talk with SAP’s sales team for a tailored quote based on business requirements.

What to consider before you implement an AP automation platform

Choosing the right AP automation platform a technical and operational decision. For large businesses, success depends on how well the solution fits your systems, scales with your business, and supports your team from day one.

Here are four key areas to evaluate before you set up an AP solution:

1. Integration: Ensure real ERP compatibility

Most enterprise finance teams rely on ERPs like NetSuite, or Workday. Your AP platform should connect directly to these systems—not just pass data back and forth—to avoid duplication and delays.

Choose a platform with pre-built or certified ERP integrations, real-time syncing of invoice, vendor, and payment data, and support for multi-entity structures.

2. Scalability: Be ready for growth and complexity

Enterprise AP needs don’t stay static. Whether through organic growth or acquisitions, invoice volume, vendor networks, and compliance requirements increase over time. Look for a solution that offers reliable performance at high transaction volumes, support for global entities, currencies, and tax rules, and flexible approval chains and user roles that scale with your organization.

3. Usability: Focus on user adoption

The best AP software, especially for large businesses, will fall short if your team doesn’t use it. Finance users and business approvers need a system that works the way they do—fast, clear, and accessible.

Along with a clean, intuitive interface that requires minimal training, look for software that offers role-based dashboards and mobile access for approvals and visibility on the go.

4. Vendor fit: Choose a long-term partner

Enterprise AP automation is a long-term investment. You need a vendor that brings more than software—someone who understands enterprise requirements and can grow with you.

Here’s what to look for before choosing your partner:

- Accounts payable case studies or references from similar industries or org sizes

- Structured onboarding with dedicated implementation support

- Ongoing success programs (account management, SLAs, roadmap visibility)

If a vendor can’t confidently address your enterprise-specific needs during the sales process, that’s a sign they may struggle post-sale.

Key takeaways: Rolling out AP automation at scale takes more than software. By prioritizing integration, scalability, usability, and vendor support, enterprise teams can reduce risk, drive adoption, and make AP a more strategic function across finance and operations.

Choose the best-rated AP software for large businesses

For large businesses, accounts payable automation software must address challenges like handling high invoice volumes and inefficient manual processes while ensuring compliance and providing real-time visibility into financial operations. Ramp stands out as the top platform for AP automation by offering a user-friendly yet powerful solution that meets these requirements and more.

We know we’re biased, but here’s one of many AP automation success stories that showcases how Ramp transforms AP management for large businesses.

Ramp and The Second City: AP automation success story

Before partnering with Ramp, The Second City faced challenges with outdated payables processes. Its existing system involved clunky workflows, slow approvals, and a lack of real-time financial insights, which hindered operational efficiency.

Ramp Bill Pay transformed how The Second City managed invoices and vendor payments by automating invoice processing and approvals. Ramp eliminated manual bottlenecks, ensured timely payments, and integrated with the company’s ERP to streamline workflows so the finance team could focus on strategic tasks. As Frank Byers, Controller at The Second City, shared:

“When we moved to Bill Pay, I was hesitant because we were promised the same type of functionality as our previous technology, which didn’t work. But Ramp’s OCR works seamlessly—it not only recognizes the vendor but reads each individual line item and uses accounting rules to code them correctly. That made adopting Ramp Bill Pay a no-brainer.”

And the results were undeniable:

- 2x faster processing: Freed up valuable team resources

- $50,000 annual savings: Streamlined systems generated meaningful savings

- 8-day efficiency gain: Faster expense reporting eliminated delays

Not only did Ramp help The Second City process payables faster, they gained better visibility into its expenses, and reduced its administrative workload—all while gaining better control over financial operations.

Ramp Bill Pay: A month of AP done in minutes

Accounts payable is only one aspect of your company’s daily financial operations. To maximize the value of your software investment, choose a finance platform that combines AP automation with features like expense management, corporate cards, travel booking, and more.

That’s why we believe Ramp is the ideal choice for small, mid-size, and large businesses. See why leading enterprises choose Ramp Bill Pay for their AP solution.

Sign up for a live demo to see why Ramp stands out as a reliable accounts payable solution for large businesses.

1. Based on Ramp’s customer survey collected in May’25

2. Based on Ramp's customer survey collected in May’25

Don't miss these

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits