- Why businesses are looking for Payhawk alternatives

- At a glance: Payhawk alternatives compared

- Best overall Payhawk alternative: Ramp

- Spendesk

- Tipalti

- Rydoo

- SAP Concur

- Ramp vs. Payhawk: a closer look

- Why finance teams choose Ramp

Payhawk is known for unifying corporate cards, expense management, invoice automation, and AP workflows in a single platform. With a 4.6-star rating on G2, it’s a solid choice for companies managing multi-currency expenses, vendor payments, and employee reimbursements across different markets.

But while Payhawk performs well for global spend management, businesses scaling their finance tech stack—or needing deeper automation, ERP integrations, or travel-specific features—often look elsewhere.

This guide compares five of the best Payhawk competitors based on real user reviews, G2 ratings, and feature sets to help you find the right platform for your business needs.

Why businesses are looking for Payhawk alternatives

Despite its strengths, users report recurring friction points that lead finance teams to explore Payhawk alternatives:

ERP integration depth

Payhawk integrates with common accounting systems, but some users note limitations compared with tools that provide richer ERP support.

Invoice and AP maturity

While Payhawk automates invoice capture and approval, some mid-market and enterprise teams find its AP workflows less robust compared with AP-first platforms.

Travel and expense (T&E) gaps

Payhawk manages expenses and reimbursements effectively, but it lacks traditional T&E features like built-in travel booking, per diems, or mileage tracking.

Learning curve

Some reviewers mention that, while modern and flexible, Payhawk’s breadth of features can take longer to roll out across large or distributed teams.

Support and onboarding speed

Though many users rate support highly, several note slower onboarding or delayed responses during peak hours.

At a glance: Payhawk alternatives compared

Payhawk isn’t the only option for managing company spend. Some competitors zero in on specific pain points like travel expenses or accounts payable, while others are designed to handle every stage of non-payroll spend in one place. The right choice depends on whether a team needs a focused tool or a platform that scales with the rest of their finance stack.

Platform | G2 Rating | Best For | Key Features | Starting Cost |

|---|---|---|---|---|

Ramp | 4.8 | Startups | Expense management | $0 – Unlimited free tier |

Spendesk | 4.6 | Startups Mid-market | Virtual cards Invoice management Expense management | N/A – All pricing is quote-based |

Tipalti | 4.4 | Mid-market, Global AP-heavy companies | AP automation Global payments Tax compliance | $9/month for Select plan |

Rydoo | 4.4 | Travel-heavy SMBs Mid-market | Mobile expense capture Travel sync Multi-currency | $9/month for Essentials plan |

SAP Concur | 4.0 | Enterprise | Expense management Travel booking | N/A – All pricing is quote-based |

Best overall Payhawk alternative: Ramp

Ramp is a finance automation platform that centers on driving cost savings, embedding controls, and automating non-payroll spend. On G2, Ramp holds a 4.8-star rating with over 2,100 reviews.

Key features

- Real-time policy enforcement and receipt matching

- AI-powered invoice parsing and line-item matching

- Procurement workflows and vendor request flows

- Deep integrations with major ERPs and accounting systems

- Unlimited users and cards at the base tier

Ramp vs. Payhawk

While both platforms span cards, expense, and AP, Ramp leans heavier on automation, procurement, and intelligent invoice matching. Users often cite Ramp’s speed, intuitiveness, and time savings as standout strengths. Payhawk’s strengths include its global card issuance, multi-currency support, and usability in expense workflows.

Best for

Teams growing their finance stack, handling moderate to high invoice volume, and needing end-to-end automation across cards, AP, and procurement.

Pricing

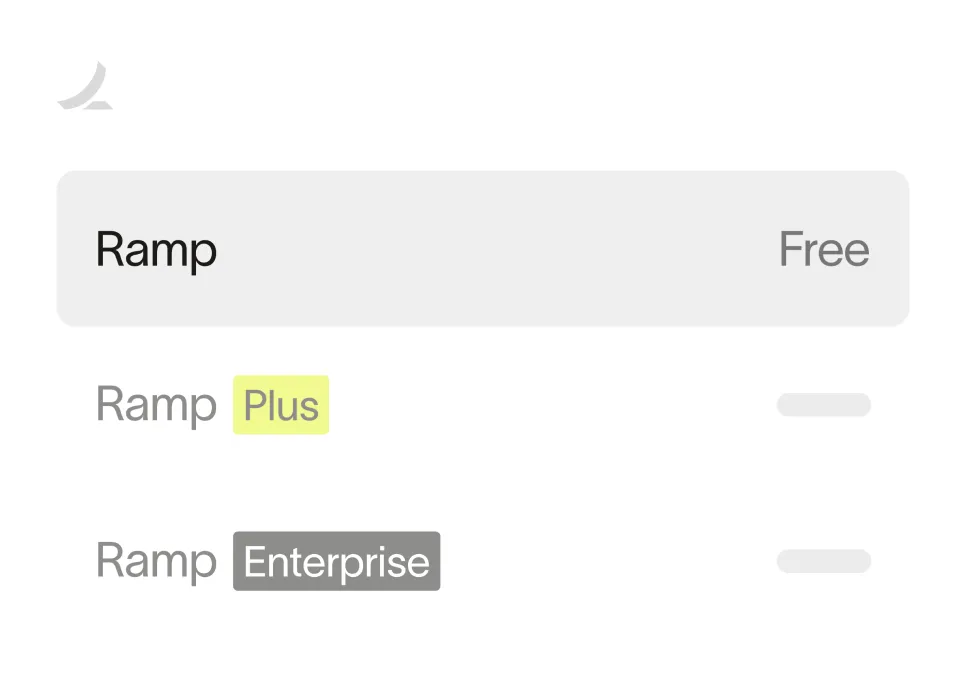

Ramp provides a free core tier; advanced workflows and procurement features are priced per user or quote.

Ready to take control of your finances?

Learn about Ramp’s pricing plans and start saving today.

Spendesk

Spendesk is a spend management tool built for startups and mid-market teams, especially in Europe. On G2, it has a 4.6-star rating from more than 400 reviews.

Key features

- Virtual and physical cards with spend limits

- Invoice processing, approval workflows, and vendor payments

- Real-time spend dashboards and receipt capture

- Lightweight procurement and request flows

Spendesk vs. Payhawk

Both platforms focus on managing internal spend. Spendesk is often praised for its simplicity, European localization, and ease of adoption. Payhawk may outpace Spendesk in multi-currency support, advanced AP workflows, and accounting automation.

Best for

Startups and growing mid-market companies seeking a modern spend tool with strong European support.

Pricing

Spendesk does not publicly disclose pricing; plans are quote-based depending on company size and usage.

Tipalti

Tipalti is focused primarily on accounts payable and supplier payment automation. On G2, it is rated 4.5 stars from more than 350 reviews.

Key features

- End-to-end accounts payable automation (invoice ingestion, matching, workflow)

- Global payments and cross-border disbursements

- Supplier self-service portal

- Tax compliance (1099, VAT) and reconciliation

Tipalti vs. Payhawk

Tipalti excels when supplier payments, reconciliation, and compliance are the main challenges. Its AP engine is deeper than most unified spend platforms. Payhawk, by contrast, offers a broader scope that includes cards and expense workflows.

Best for

Companies with high supplier or invoice volume, distributed vendor payments, and global disbursement needs.

Pricing

Tipalti pricing starts at $99 per month for the Select plan.

Rydoo

Rydoo is an expense-first, travel-friendly tool optimized for mobile use. On G2, it’s rated 4.4 stars with more than 740 reviews.

Key features

- Mobile-first receipt capture and real-time expense submission

- Multi-currency support and global operations

- Travel expense sync, mileage tracking, and approvals

- Integrations with ERPs and accounting systems

Rydoo vs. Payhawk

Rydoo stands out for its streamlined expense and travel experience. Users highlight its mobile-first design and ease of use on the go. Payhawk covers those areas too, but pairs them with stronger AP capabilities and deeper accounting automation.

Best for

Organizations with moderate spend volume, travel-heavy teams, and a need for mobile-friendly expense reporting.

Pricing

Starts at approximately $9 per month for the Essentials plan.

SAP Concur

SAP Concur is an enterprise-grade solution that combines travel, expense, and invoice workflows. On G2, it holds a 4.0-star rating with over 6,200 reviews.

Key features

- Integrated travel booking and expense management

- Audit, compliance, and policy enforcement tools

- Invoice and AP processing modules

- High scalability for global enterprises

SAP Concur vs. Payhawk

Concur’s strength lies in its mature travel and expense ecosystem. It’s often chosen by large enterprises with complex travel programs and compliance requirements. Payhawk offers a more modern interface, faster implementation, and unified spend plus AP features, though it does not match Concur’s travel depth.

Best for

Large organizations with significant travel spend and complex compliance requirements.

Pricing

Concur is usually priced per report, traveler, or module, and often requires an enterprise agreement.

Ramp vs. Payhawk: a closer look

Both Ramp and Payhawk help companies manage spend, but they’re built with different priorities. Payhawk focuses on giving businesses a way to issue cards and track business expenses across currencies. Ramp goes further—automating every stage of non-payroll spend, from cards to invoices to procurement—so finance teams can move faster, save money, and close the books with less effort.

Payhawk is a strong fit if you:

- Need multi-currency support for expenses and reimbursements

- Want a simple way to centralize card usage and approvals

- Are looking for visibility into spend across employees and vendors

Ramp is a strong fit if you:

- Want real-time policy controls and automated compliance at the point of purchase

- Need AI-driven invoice matching and line-item categorization

- Require procurement workflows to manage vendors and contracts in one place

- Rely on ERP integrations to shorten close times and reduce manual work

- Expect measurable cost savings and efficiency gains as you scale

Why finance teams choose Ramp

Payhawk helps companies manage cards and expenses, but Ramp is built to transform how finance teams work. Customers report faster closes, lower costs, and less manual effort thanks to automation across every workflow—cards, reimbursements, bill pay, and procurement.

Instead of adding another point solution, Ramp becomes the foundation of your finance stack. For teams that value efficiency, control, and savings at scale, Ramp’s spend management software is the better way forward. Explore our demo to see how.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits