- What is ecommerce accounting?

- Challenges in ecommerce accounting

- Accounting methods for ecommerce sellers

- Should your ecommerce business hire an accountant?

- Key accounting metrics ecommerce business owners must monitor

- Automate multi-channel ecommerce accounting with Ramp

Accounting is crucial for every business, but ecommerce founders and finance leaders face unique challenges due to complexities in inventory management, logistics, online payments, and handling customer returns. And these challenges can be insurmountable.

A recent study revealed that the high failure rate of businesses can be attributed to the lack of financial literacy among business owners. So while you’d much rather focus on maximizing your product sales and increasing the overall profitability of the business, thinking about accounting is highly relevant.

What is ecommerce accounting?

Ecommerce accounting involves collecting, analyzing, organizing, and reporting financial data specific to online retail businesses. It accommodates the complexities of online sales channels, multi-currency transactions, and variable tax jurisdictions, going beyond traditional accounting practices.

Ecommerce accounting

E-commerce accounting is the specialized practice of tracking, recording, and analyzing financial transactions for online businesses, including sales across digital platforms, payment processing fees, and inventory management.

Ecommerce accounting vs. traditional accounting

While traditional business accounting focuses on managing financial records for brick-and-mortar operations, ecommerce accounting addresses the unique challenges of online businesses.

Modern ecommerce operations must seamlessly integrate with multiple sales channels, payment processors, and fulfillment systems—each generating its own stream of transaction data. This complexity is further amplified by the global nature of online sales, where businesses routinely handle multiple currencies and navigate diverse international tax regulations.

Also, while conventional businesses might rely on standard accounting software, ecommerce ventures require advanced cloud-based solutions capable of syncing with marketplaces like Amazon and Shopify while handling multiple payment gateways, refunds, and chargebacks in real-time.

Unlike traditional retail, online businesses often utilize multiple fulfillment models simultaneously—from dropshipping to third-party logistics (3PL) providers. This requires sophisticated tracking of varying shipping costs, fulfillment fees, and inventory levels across different warehouses or virtual locations.

Tax compliance in ecommerce introduces another layer of complexity. Online sellers must navigate sales tax nexus requirements across different jurisdictions, manage VAT obligations for international sales, and ensure compliance with rapidly evolving digital tax regulations. This stands in stark contrast to traditional accounting's focus on local tax codes and simpler compliance requirements.

These fundamental differences underscore why ecommerce businesses require specialized accounting approaches that go beyond conventional bookkeeping methods to ensure accurate financial management and regulatory compliance in the digital marketplace.

Challenges in ecommerce accounting

Ecommerce businesses face a distinct set of accounting challenges as soon as they start selling across multiple channels and international borders. A single online store might simultaneously process thousands of orders across Shopify, Amazon, and wholesale channels—each with its own payment processors, fee structures, fulfillment methods, and settlement timeframes.

The following sections break down how these accounting complexities play out across eight critical areas.

Managing large transaction volumes

Ecommerce businesses handle thousands of transactions daily, leading to administrative burdens, increased chances of errors, and challenges in e-commerce cash flow management. This high volume can make manual data entry and reconciliation impractical.

Automating transaction recording and reconciliation with advanced accounting software or automated bookkeeping tools reduces errors and saves time. Scalable systems that grow with your business can handle increasing transaction volumes efficiently, allowing you to focus on strategic growth.

Handling multiple sales channels

Selling through various channels like marketplaces, social media, and your own website introduces complexity due to different terms, payment gateways, and transaction fees. Consolidating data from multiple sales channels can be daunting but is essential for accurate financial reporting.

Integrated ecommerce platforms can synchronize data across all channels, simplifying tracking and analysis. Establishing consistent accounting practices ensures data accuracy across platforms.

Inventory management challenges

Effectively managing inventory and handling inventory accounting in e-commerce is critical yet challenging in ecommerce. Keeping track of stock levels, accounting for inventory costs, and synchronizing inventory across multiple platforms require robust systems. Inaccurate inventory accounting can lead to stockouts or overstocking, affecting customer satisfaction and profitability.

Implementing inventory management tools that integrate with your accounting system can provide real-time insights and streamline operations.

Dealing with returns and refunds

High return rates are common in ecommerce, complicating revenue recognition and inventory management. Processing returns affects sales figures and inventory levels, and may involve adjustments between accounts payable vs. accrued expenses, requiring precise accounting to maintain accurate financial statements.

Establishing clear return policies and integrating return management into your accounting processes can mitigate these challenges.

Payment processing and fees

Ecommerce businesses often use multiple payment processors, each with unique fee structures and settlement periods. Accounting for these fees and reconciling payments can be complex. Implementing accounting software that integrates with payment gateways can automate fee tracking and reconciliation, providing clarity on net revenues and cash flow.

Sales tax reporting compliance

Sales tax regulations vary by state and country, making compliance a significant challenge for ecommerce businesses. Collecting, reporting, and remitting sales taxes correctly is essential to avoid legal penalties.

Staying informed about changes in tax laws and utilizing tax compliance software that updates rates automatically can help navigate complex obligations. Engaging with tax professionals specializing in ecommerce ensures adherence to all applicable tax regulations.

International taxation and regulations

Selling internationally introduces additional complexities such as customs duties, value-added taxes (VAT), and compliance with foreign regulations. Each country may have specific tax laws that impact pricing, profitability, and legal compliance.

Leveraging global ecommerce platforms that handle multi-currency transactions and international tax calculations can ease these challenges. Consulting with experts in international trade law ensures compliance and smooth operations abroad.

Data security and privacy compliance

Ecommerce businesses handle sensitive customer information, making data security a critical concern. Compliance with regulations like GDPR and CCPA requires stringent data protection measures.

Failing to secure customer data can result in legal penalties and damage to reputation. Implementing robust cybersecurity protocols and regular audits protects both the business and its customers.

Accounting methods for ecommerce sellers

Ecommerce sellers primarily use two accounting methods: cash basis accounting and accrual accounting. Understanding the differences between cash vs. accrual accounting helps you select the one that best suits your business needs.

Cash basis accounting

Cash basis accounting records revenues and expenses only when cash is received or paid out. This method provides a straightforward view of cash flow, making it easier to see how much cash is on hand at any given time. It's often favored by small businesses due to its simplicity.

Cash basis accounting offers a few advantages:

- Simplicity: Easier to implement and understand without extensive accounting knowledge.

- Immediate cash flow insight: Provides a clear picture of actual cash inflows and outflows.

- Tax timing benefits: Income is only taxed when cash is received, potentially deferring tax liabilities.

Cash basis accounting makes sense for small ecommerce businesses with straightforward transactions or when immediate cash flow information is critical for daily operations.

Accrual accounting

Accrual accounting records revenues and expenses when they are earned or incurred, regardless of when cash is exchanged. By understanding accrual accounting, you can get a more accurate financial picture by matching revenues with the expenses incurred to generate them.

Accrual accounting offers the following advantages:

- Accurate financial representation: Reflects true financial performance and profitability.

- Improved financial analysis: Better for long-term planning and assessing business health.

- Compliance: Required by Generally Accepted Accounting Principles (GAAP) and for larger businesses.

Medium to large ecommerce businesses with complex operations must adopt accrual accounting since cash-basis accounting cannot handle the complexities of these businesses’ transactions. If you need detailed financial reports for investors, lenders, or regulatory compliance, accrual accounting is the right choice.

Also, if you manage significant inventory levels, accrual accounting aligns expenses with revenues effectively, making it a better choice compared to cash basis accounting.

Should your ecommerce business hire an accountant?

Deciding whether to hire an accountant for your e-commerce business is a significant consideration. While handling accounting tasks independently may seem feasible initially, the complexities of financial management can quickly escalate as your business grows.

An accountant brings expertise in managing finances, ensuring compliance, and providing strategic financial advice that can be invaluable to your business.

When to hire an accountant

If your sales volume and revenue are steadily increasing, managing finances becomes more complex. An accountant can help scale your financial processes effectively. Also, if administrative tasks like bookkeeping and tax preparation consume significant time, hiring an accountant allows you to focus on core business activities.

Compliance also plays a role. Navigating tax laws, sales tax obligations, and financial regulations can be challenging. An accountant ensures compliance, reducing the risk of legal issues and penalties. If your business deals with multiple currencies, international sales, or intricate inventory systems, professional accounting support becomes essential.

If you’re seeking to expand, secure financing, or improve profitability, an accountant can provide valuable insights and financial forecasting.

What to look for when screening for an accountant

Finding the right accountant for an ecommerce business goes beyond basic credentials. While a CPA certification demonstrates core expertise, what truly matters is their hands-on experience with the digital commerce ecosystem—from managing marketplace transactions to reconciling payment gateways and tracking inventory across multiple channels.

A deep understanding of technology shapes an accountant's effectiveness in the ecommerce space. The best candidates seamlessly work with modern accounting software and should demonstrate this expertise by sharing specific examples of how they've helped other online businesses navigate complex financial challenges.

Many ecommerce entrepreneurs find that clear communication makes the difference between a good accountant and a great one. The most valuable accountants translate complex financial data into actionable insights, proactively flag potential issues, and guide strategic decisions with data-backed recommendations.

When evaluating potential accountants, ask about their communication style and request client references specifically from other ecommerce businesses. While their fees may be higher than traditional accountants, the strategic value they bring through optimized financial management and growth planning often delivers significant returns on the investment.

Key accounting metrics ecommerce business owners must monitor

Monitoring specific e-commerce financial metrics is essential for ecommerce business owners to assess financial performance, make informed decisions, and drive growth. The following five key metrics provide valuable insights into various aspects of your business operations:

1. Gross Profit Margin

Gross Profit Margin measures the percentage of revenue that exceeds the cost of goods sold (COGS). It is calculated by subtracting COGS from total revenue and dividing the result by total revenue. This metric indicates how efficiently you are producing or sourcing your products compared to the sales price.

Gross profit margin

Gross Profit Margin is the percentage of revenue remaining after subtracting direct costs of goods sold (COGS), calculated as (Revenue - COGS) / Revenue × 100, indicating how efficiently a company produces and sells its products.

Why it's crucial: A healthy gross profit margin ensures that you have sufficient funds to cover operating expenses, invest in marketing, and achieve profitability. Tracking this metric helps you adjust pricing strategies and control production or procurement costs to maximize profits.

2. Net Profit Margin

Net Profit Margin represents the percentage of revenue remaining after all operating expenses, interest, taxes, and other expenses have been deducted from total revenue. It provides a comprehensive view of your overall profitability.

Net profit margin

Net Profit Margin is the percentage of revenue remaining after all operating expenses, interest, and taxes have been deducted, calculated as Net Income / Revenue × 100, showing how much profit a company generates from its total sales.

Why it's crucial: Monitoring net profit margin allows you to assess the efficiency of your business operations and cost management. A declining net profit margin may signal rising expenses or pricing issues that need to be addressed to maintain financial health.

3. Inventory Turnover Ratio

The Inventory Turnover Ratio indicates how often your inventory is sold and replaced over a specific period. It is calculated by dividing COGS by the average inventory value.

Inventory Turnover Ratio

Inventory Turnover Ratio is a measure of how many times a company's inventory is sold and replaced over a specific period, calculated as Cost of Goods Sold / Average Inventory, indicating how efficiently a company manages its inventory.

Why it's crucial: A high inventory turnover ratio suggests efficient inventory management and strong sales, while a low ratio may indicate overstocking or weak sales. Tracking this metric helps optimize inventory levels, reduce holding costs, and prevent stockouts or excess inventory.

4. Cash Flow from Operations

Cash Flow from Operations measures the amount of cash generated by your business's core activities. It reflects the cash inflows and outflows from regular operations, excluding financing and investing activities.

Cash Flow from Operations

Cash Flow from Operations is the amount of money generated from regular business activities, calculated by adjusting net income for non-cash expenses, changes in working capital, and other operating activities, showing a company's ability to generate cash from its core business.

Why it's crucial: Positive operational cash flow is vital for meeting short-term liabilities, reinvesting in the business, and ensuring solvency. Monitoring this metric helps you understand your liquidity position and manage cash effectively to support ongoing operations.

5. Return on Investment (ROI)

Return on Investment evaluates the profitability of investments made in various aspects of your business, such as marketing campaigns, new product development, or technology upgrades. It is calculated by dividing the net return from an investment by its cost.

ROI (Return on Investment)

ROI (Return on Investment) is a performance metric that evaluates the profitability of an investment, calculated as (Net Profit / Total Investment) × 100, measuring how much financial return is generated relative to the cost of investment.

Why it's crucial: Tracking ROI helps you measure the effectiveness of your investments and allocate resources to initiatives that yield the highest returns. It enables data-driven decision-making to enhance profitability and fuel business growth.

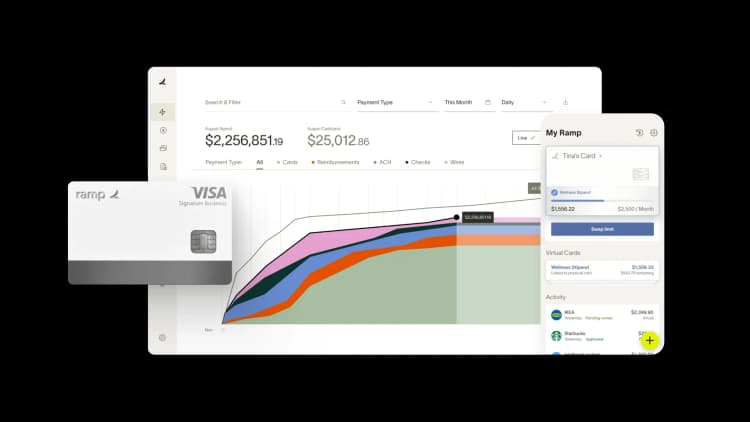

Automate multi-channel ecommerce accounting with Ramp

Managing accounting across multiple sales channels creates chaos for finance teams. You're juggling transactions from Shopify, Amazon, and other platforms while trying to track inventory, calculate sales tax, and keep your books accurate.

Ramp's accounting automation software eliminates this complexity by centralizing your ecommerce operations in one platform. Connect your sales channels, payment processors, and accounting system so every transaction flows automatically from sale to reconciliation.

Here's how Ramp handles multi-channel ecommerce:

- AI-powered coding: Ramp's AI learns your accounting patterns and codes transactions across all required fields in real time, applying the right revenue accounts, cost centers, and tax codes as sales post

- Automated reconciliation: Ramp matches transactions to bank deposits and flags discrepancies automatically, so you can spot missing payments, refunds, or fees without manual spreadsheet work

- Real-time visibility: Access up-to-date financial data across all channels so you can make informed decisions about inventory, pricing, and cash flow without waiting for month-end reports

Ramp handles the tedious work of categorizing, matching, and syncing transactions so you can focus on growing your business instead of chasing down receipts and reconciling accounts.

Try a demo to see how Ramp automates multi-channel ecommerce accounting from sale to close.

Don't miss these

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits