Automated bookkeeping for accounting: Tools to succeed

- What is automated bookkeeping?

- Why to invest in accounting automation

- What to look for in an automated bookkeeping tool

- Top options for automated bookkeeping software

- Which accounting processes should you automate?

- Automate bookkeeping with AI that codes, syncs, and reconciles for you

Key takeaways

- Automated bookkeeping transforms manual financial tasks into streamlined processes, reducing month-end close time by up to 22% and eliminating data entry errors.

- Your automation tool should integrate with your existing software and provide real-time transaction syncing, giving you accurate financial insights when you need them.

- Finance teams can automate critical processes including expense tracking, spend management, accounts payable, and financial closes—freeing up time for strategic analysis.

- Companies using automated expense management report higher satisfaction rates and better cost control, with finance teams saving over 330 hours annually on expense reports alone.

Bookkeeping is a key business function, but doing it manually puts businesses at a disadvantage. Automating bookkeeping helps businesses save time and money by handling repetitive tasks, reducing mistakes, and offering financial insights in real time.

The right automation scales with your company and integrates with the payroll and inventory systems you’re already using. That frees up your team members to concentrate on your business’s larger strategy rather than getting bogged down in manual drudgery.

What is automated bookkeeping?

Automated Bookkeeping

Automated bookkeeping is a software-based approach to managing financial transactions and records with minimal human effort, simplifying tasks such as data entry, reconciliation, and reporting.

Bookkeeping automation software optimizes tracking, processing, and other workflows, allowing your accounting team to spend less time in spreadsheets doing everything by hand. Automated bookkeeping eliminates the need for data entry and other manual tasks.

Automating bookkeeping and accounting reduces time spent creating templates and ledgers. Instead, built-in formulas allow finance teams to generate reports more quickly and efficiently.

Why to invest in accounting automation

Like the best tools for finance teams, bookkeeping and accounting automation can streamline your workflows. Key reasons for investing in it include:

Save time and money

Time and money go hand in hand, making automated bookkeeping a two-for-one in savings. Entering financial data and information, checking calculations, running reports, and other repetitive tasks can waste valuable time and pull you and your finance team away from higher priorities, such as data analysis.

Accounting automation software can reduce the amount of manual work for accounts payable and enable you to close out your books more quickly. Shafak Ilyas, Accounting Manager at Shortcut, recently told us that her team uses Ramp to close their books in just an hour each month, a process she says previously took a couple of days.

Improve efficiency

Automated accounting helps cut back on the human error that comes with manual data entry, such as tracking spend. Ramp’s automated expense management improved transaction review by 33%, in fact, giving managers time back to focus on more important objectives. That said, you’ll still need a good accountant to verify that the work is accurate and, if necessary, manipulate the data.

Beef up security

Most automated accounting offerings employ advanced encryption to protect sensitive data. They include access controls to keep out prying eyes, audit trails for easier detection and investigation, regular backups, and real-time monitoring and alerts. And business owners can customize them to ensure compliance with the latest financial standards and regulations.

Speed up cumbersome work

Accounting software is designed to centralize documents and ledger items, so categorizing, naming, and storing files is easier. That makes documents easy to find via secure cloud storage.

Automation also means employees can tackle their side of the business expense process more quickly. For example, because Ramp gives employees access to all their tasks on one page—inputting receipts, providing details on credit card charges and other expenses, and addressing questions or problems—users improve their expense submission rate by 30% thanks to expense automation.

How much time do expense reports take up?

Ramp found that every year, the average 200-person company devotes more than 330 hours to processing expense reports.

What to look for in an automated bookkeeping tool

Your month-end close process is a necessary bookkeeping task. But doing it manually opens you up to a variety of issues and can take hours, if not days, to complete. When considering automation offerings, be sure to choose one that offers the following:

- Direct integrations with accounting tools: Managing a stack of disparate systems is one of an accountant’s biggest pain points. The right platform makes establishing connections a snap. Ramp, for instance, offers a large library of integrations with best-in-class applications such as QuickBooks, Xero, NetSuite, and Sage.

- Real-time transaction syncing: Manual bookkeeping’s major challenge is just that—it’s manual. No matter how hard you try to keep up, you’re always at least a few hours behind. Look for finance automation tools that sync in real time. That way, you know exactly what your business is spending as it happens.

- Automated category mapping: Whether you categorize by merchant or department, look for an accounting automation platform that allows you to easily and quickly create merchant rules that automatically sync to your general ledger

- Support for multiple subsidiaries: Larger businesses need to connect individual units to one another. An automation tool with multiple-subsidiary support provides a comprehensive view of your finances across the entire organization. It also simplifies inter-company transactions and standardizes compliance processes.

Top options for automated bookkeeping software

Narrowing down your choices for accounting automation tools will still leave you with a dozen to choose from. Here’s a quick comparison of the best three options based on features, user-friendliness, scalability, and ease of integration. For a more in-depth look, see our article on the best payroll systems for startups and small businesses.

Platform | Ratings | Key Features | Pricing |

|---|---|---|---|

QuickBooks Online |

| Starts at $30/month | |

Xero |

| Starts at $13/month | |

Wave |

| Free | |

FreshBooks |

| Starts at $17/month | |

Sage Intacct |

| Starts at $50/month | |

NetSuite |

| Pricing varies (custom quotes) |

Check out more bookkeeping automation platforms here.

Which accounting processes should you automate?

The key to automated bookkeeping is focusing on the tasks that help your business save time and reduce human error. Automation helps in these areas:

Expense tracking

Expense automation can make life easier for much of your company. For instance, a recent Morning Consult study found that businesses with automated credit card expense management are 11% more likely to say they’re satisfied with their expense policy than companies that handle it manually. And your accounting department can track business expenses faster.

Spend management

Purchasing and spend management includes tracking purchase orders, invoice verification, accounts payable and bank statement reconciliation, and budget oversight. Automating all that yields well-recognized benefits. Ramp research found that 87% of finance leaders see a greater need for automation that supports decentralized spending and maintains cost control.

Travel reimbursement

Travel expenses took up about 20% of companies’ annual spend on Ramp cards as of mid-2024, so tracking them is critical. But processing expense reporting and reimbursement by hand can mean a big hit to productivity while eating up time for all involved. Automate your T&E expense process’s reporting and reimbursement, and you’ll be more efficient and won’t keep employees waiting for money to land in their bank accounts.

Accounts payable and receivable

Supply orders, payments, and invoices can get tied up in AP, but implementing automation can make it easier to track all of that. Meanwhile, accounts receivable must make sure invoices are handled efficiently and disputes are resolved quickly. Automating your AP process can help save time and money and ensure that you have a consistent, predictable cash flow.

Payroll

Growing companies can be consumed with payroll if they don’t have automated software to help manage laborious tasks. Manually processing payroll every pay period can be a major time suck for someone who could be spending their time on other HR or operational tasks. Payroll automation, however, is more efficient, cost-effective, and reduces the risk of human error.

Financial closes

According to Ventana Research, just 43% of organizations say they can complete their quarterly close within six business days. That’s a drop from the 49% who said they could hit that mark when asked three years earlier. Automating this business process cuts time and can ensure your accounting department is providing you with the most accurate report possible.

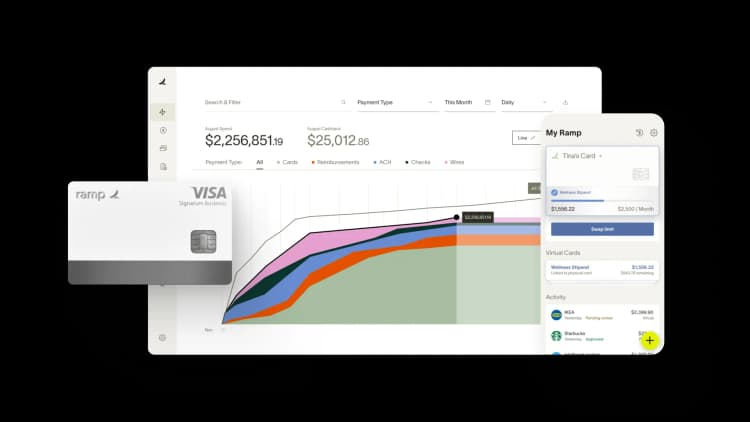

Automate bookkeeping with AI that codes, syncs, and reconciles for you

Manual bookkeeping creates bottlenecks that slow down your close and introduce costly errors. When your team spends hours coding transactions, chasing receipts, and reconciling accounts, mistakes slip through and month-end drags on. Ramp's accounting automation software eliminates these pain points by handling the repetitive work so you can close faster with confidence.

Ramp's AI learns your coding patterns and applies them across all transactions in real time. As spend posts, Ramp codes it to the right GL accounts, departments, classes, and custom fields, then matches receipts and approvals automatically. You'll see a 67% increase in zero-touch codings compared to rules-only automation, which means fewer transactions sitting in review queues waiting for manual attention.

At month-end, Ramp posts and reverses accruals automatically when context is missing, ensuring expenses land in the right period. The reconciliation workspace surfaces variances and missing entries so you can tie out with confidence. Teams using Ramp close their books 3x faster, saving 40+ hours every month that used to go toward manual bookkeeping tasks.

Try a demo to see how Ramp automates your bookkeeping from transaction to close.

FAQs

AI bookkeeping is an advanced form of automated bookkeeping that uses artificial intelligence and machine learning to handle financial tasks with greater accuracy than traditional automation. AI systems automatically categorize transactions, detect anomalies, predict cash flow patterns, and provide strategic insights by learning from historical data.

AI is unlikely to completely replace bookkeepers but may transform their role by automating routine tasks and allowing them to focus on strategic work. While AI excels at data entry, transaction categorization, and basic reconciliation, bookkeepers will likely remain important for complex decision-making, financial analysis, compliance oversight, and strategic guidance.

Yes, QuickBooks is an automated accounting system that offers automatic bank reconciliation, transaction categorization, recurring invoices, and real-time financial reporting. The platform automatically imports bank transactions and generates financial statements without manual data entry, making it popular for businesses seeking accounting automation.

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide.” ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn’t just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn’t exist in Zip. It’s made approvals much faster because decision-makers aren’t chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits

“More vendors are allowing for discounts now, because they’re seeing the quick payment. That started with Ramp—getting everyone paid on time. We’ll get a 1-2% discount for paying early. That doesn’t sound like a lot, but when you’re dealing with hundreds of millions of dollars, it does add up.”

James Hardy

CFO, SAM Construction Group