Accounts payable forecasting: How to project future payments

- What is forecasting accounts payable?

- Key components of effectively forecasting accounts payable

- How to build an accounts payable forecast

- Best practices for forecasting accounts payable

- The cost of poor forecasting: Example scenario

- The role of AP automation in forecasting

- Connecting AP forecasting to cash flow management

- Ramp Bill Pay is the leading AP automation solution

- What sets Ramp Bill Pay apart

Imagine you’ve got vendor invoices piling up, early payment discounts slipping away, and you’re unsure whether you can cover next month’s bills without scrambling. Poor payment timing creates stress, damages supplier relationships, costs you money, and makes financial planning nearly impossible.

Forecasting accounts payable predicts when and how much cash you’ll need to pay your bills over a specific period. This practice gives you better control over cash flow, can help you negotiate better terms with vendors, and enables smarter financial decisions that keep your business running smoothly.

What is forecasting accounts payable?

Forecasting accounts payable is the process of projecting your future payment obligations to suppliers and vendors. It goes beyond tracking only current bills. Instead, it creates a forward-looking view of when payments will come due and how much cash you’ll need at specific points in time.

While general cash-flow forecasting looks at all money moving in and out of your business, AP forecasting focuses specifically on cash outflows to vendors. That means it shows when money will leave your business rather than when it arrives. This targeted view lets you anticipate payment crunches, identify periods of high cash demand, and plan accordingly.

The core components include payment schedules that map out due dates, invoice tracking systems that monitor what you owe, and cash-outflow predictions that estimate your future payment needs. These elements together give you a clear picture of your upcoming financial obligations.

Why forecasting accounts payable matters

Effectively forecasting accounts payable directly affects your working capital management. When you know exactly when payments are due, you can maintain optimal cash reserves without tying up excess funds. The result is better cash-flow predictability and clearer operational visibility, with more money available for growth opportunities, emergencies, earning interest, or operational investments.

Your vendor relationships depend on reliable, timely payments. Forecasting helps you avoid late payments that damage trust and may result in penalty fees. It also reveals opportunities to take advantage of early payment discounts that improve your bottom line.

Forecasting accounts payable connects to your broader business strategy by providing visibility into future cash needs. This insight informs decisions about expansion timing, inventory purchases, and hiring. You can pursue growth initiatives with confidence when you have a clear view of your payment obligations.

Key components of effectively forecasting accounts payable

Successfully forecasting accounts payable requires tracking several key metrics and processes that give you visibility into your payment obligations.

Invoice aging analysis

Invoice aging analysis categorizes your outstanding invoices based on how long they’ve been unpaid. This method organizes payables into time buckets so you can see which bills are coming due soon and which ones are overdue.

Common aging buckets include:

- 0–30 days: Current invoices within normal terms

- 31–60 days: Bills approaching or slightly past due dates

- 61–90 days (overdue): Invoices likely to incur penalties

- 90+ days (overdue): Long-overdue payments that risk damaging vendor relationships

Aging reports help you prioritize which invoices to pay first. Bills in the 0–30 day range can be scheduled according to your cash availability, while those in older buckets may require immediate attention to avoid late fees or strained vendor relationships.

Aging report example

Here’s what a simple aging report might look like:

| Accounts Payable Aging Report | |||||

|---|---|---|---|---|---|

| As of 10/31/2025 | |||||

| Vendor | 0–30 | 31–60 | 61–90 (overdue) | 90+ (overdue) | Total AP Balance |

| Vendor 1 | $200 | -- | -- | -- | $200 |

| Vendor 2 | $3,400 | -- | $125 | -- | $3,525 |

| Vendor 3 | $830 | -- | -- | -- | $830 |

| Total | $4,430 | -- | $125 | -- | $4,555 |

If you see balances aging into the overdue columns, investigate whether an approval delay or a workflow gap caused the slippage so you can prevent repeats.

The only overdue item is a small amount for Vendor 2. Why was the invoice paid late? Was there a breakdown in your AP workflow? Once you answer those questions, you can also compare this to prior AP aging reports to see if this is a trend. If it is, you may be damaging your relationship with that vendor.

Days payable outstanding (DPO)

Days payable outstanding (DPO) measures the average number of days your company takes to pay suppliers after receiving an invoice.

DPO = (Accounts payable / Cost of goods sold) * Number of days in period

Example: If AP = $60,000, COGS = $550,000, and the period is 30 days, then DPO = ($60,000 / $550,000) * 30 = 3.3 days.

This metric reveals your payment patterns and how efficiently you’re using vendor credit. A higher DPO means you’re holding cash longer before paying suppliers, which can improve short-term liquidity. However, excessively high DPO may signal payment struggles or missed discount opportunities. Industry benchmarks vary by sector; the median across all industries is about 40 days (APQC), with retail closer to 30–40 and some manufacturers at 60–90.

Payment terms and schedules

Payment terms define when and how you’ll pay invoices, and each term type affects your cash flow differently. Common terms include:

- Net 30: Payment due in 30 days

- Net 60: Payment due in 60 days

- 2/10 Net 30: 2% discount if paid within 10 days, otherwise due in 30 days

Early payment discounts such as 2/10 Net 30 often deliver returns that exceed typical investment yields. Taking a 2% discount for paying 20 days early translates to an annualized return of roughly 36%. For example, consider a $10,000 invoice with 2/10 Net 30 terms. If you pay within 10 days, you save $200 and remit $9,800; if you wait 30 days, you pay $10,000. Over a year with multiple invoices, these discounts add up.

Managing multiple schedules requires coordination. Some vendors expect payment upon receipt, others offer extended terms, and some provide tiered discounts. Tracking these variations helps you optimize payment timing to capture discounts without jeopardizing other obligations. If you need a refresher on mechanics, here’s a primer on how to pay an invoice.

Early payment discount example

Consider a $10,000 invoice with 2/10 Net 30 terms. If you pay within 10 days, you save $200 (2% of $10,000) and only pay $9,800. If you wait the full 30 days, you pay the entire $10,000.

That $200 savings for paying 20 days early represents an annualized rate of about 36%. Over a year with multiple invoices, these discounts add up substantially. For a company processing $500,000 in annual payables with similar terms, capturing these discounts could save $10,000 or more.

The trade-off is paying earlier than required, which temporarily reduces your available cash. Effectively forecasting accounts payable helps you identify when you have sufficient cash to capture these discounts without compromising other obligations.

How to build an accounts payable forecast

Building an accurate forecast requires a systematic approach that starts with data collection and ends with a working model you can update regularly.

Step 1: Gather historical data

Start by collecting at least 12 months of past invoices and payment records. A full year of data captures seasonal patterns and gives you a complete picture of payment cycles across different periods.

Focus on actual payment dates rather than just invoice due dates. Include payment amounts, vendor names, invoice terms, and any discounts taken. Look for seasonal trends such as higher inventory purchases before peak sales periods or increased service costs during specific quarters.

Step 2: Analyze payment patterns

Separate your expenses into recurring and one-time categories. Recurring expenses such as rent, utilities, and subscriptions are predictable and form the foundation of your forecast. One-time purchases require different treatment since they won’t repeat automatically.

Seasonal variations often show up in the data. Retail businesses might see higher payables before holiday seasons, while service companies may have cyclical spikes tied to client needs. Compare your actual payment timing to stated terms. You may consistently pay slightly earlier or later than the invoice terms suggest.

Step 3: Create your forecasting model

Smaller teams can start with a simple spreadsheet that lists expected monthly payments based on historical averages and known upcoming invoices. Include columns for vendors, payment dates, amounts, and notes about assumptions.

Larger organizations benefit from approaches that integrate directly with business accounting software. These tools can pull invoice data, calculate trends, and generate predictions automatically. Templates are a helpful starting point—just make sure they separate fixed, recurring payments from variable expenses and give you space to capture assumptions.

Example: Simple 3-month AP forecast

| Month | Expected Payments | Notes |

|---|---|---|

| Nov 2025 | $42,000 | Includes annual software renewals |

| Dec 2025 | $37,000 | Vendor holiday order spike |

| Jan 2026 | $31,500 | Normalized spending |

Step 4: Factor in variables

Growth projections directly affect your payables. If you’re planning to increase sales by 20%, you’ll likely need more inventory or raw materials, which means higher supplier payments. Build these expectations into your forecast based on your growth timeline.

Account for planned purchases such as new equipment, facility improvements, or technology upgrades. These often represent significant cash outflows that need special attention in your forecast. Include both the initial purchase and any ongoing maintenance or service costs.

Economic factors and market conditions can shift your payment obligations. Rising material costs, supply chain changes, or adjustments to vendor terms all affect your numbers. Review and update your forecast regularly to keep it aligned with reality.

Best practices for forecasting accounts payable

Following proven practices helps you maintain forecast accuracy and adapt quickly when circumstances change.

- Establish regular review cycles: Set up weekly reviews for short-term cash needs, monthly assessments for upcoming payment obligations, and quarterly deep dives to evaluate forecast accuracy and adjust your approach based on what you've learned

- Maintain accurate and up-to-date vendor information: Keep current records of payment terms, contact details, and preferred payment methods for each vendor. Update this information immediately when vendors change terms or when you negotiate new vendor agreements.

- Build buffer zones for unexpected expenses: Include a contingency amount in your forecast to cover surprise invoices or price increases. A buffer of 5%–10% of your total forecast provides cushion without tying up excessive cash.

- Coordinate with procurement and other departments: Connect with teams that initiate purchases to learn about upcoming needs before invoices arrive. Sales forecasts, production schedules, and marketing campaigns all provide clues about future payment obligations.

- Document assumptions and update them regularly: Write down the reasoning behind your forecast numbers, including expected growth rates and planned purchases. Review these assumptions monthly and revise them when conditions change or when actual results differ from predictions.

These practices work together to create a forecasting process that stays current and responds to your business needs.

Common pitfalls to avoid

Even experienced teams can make forecasting less accurate and cause cash flow surprises.

- Overlooking small recurring payments: Subscription services and minor vendor bills add up quickly. These small amounts often slip through but collectively represent meaningful cash outflows.

- Failing to account for payment term changes: Vendors sometimes adjust their terms, offering new discounts or requiring faster payment. Missing these changes throws off your timing and can lead to missed savings or late fees.

- Not considering approval delays: Internal approval processes can slow payment timing significantly. If invoices require multiple sign-offs or get stuck in reviews, your actual payment dates will lag behind your planned schedule.

Avoiding these pitfalls keeps your forecast reliable and prevents unwelcome cash flow surprises down the road.

The cost of poor forecasting: Example scenario

Sarah runs a growing e-commerce business selling outdoor gear. In March, she knew she had roughly $50,000 in upcoming supplier payments but hadn’t built a forecast. She figured she’d pay bills as they came due.

By mid-March, three unexpected bills hit at once: her largest supplier sent an invoice for $18,000 due immediately, her warehouse lease payment of $8,000 came due, and her shipping provider increased rates and billed her $6,000 for the previous month. Sarah suddenly needed $32,000 within days.

Without proper forecasting, she hadn’t anticipated this cash crunch. She missed a 3% early payment discount on the supplier invoice worth $540. She paid the warehouse lease five days late, incurring a $400 penalty. Worst of all, she had to use her business credit card for the shipping bill, paying 18% annual interest on the balance for two months until she could pay it off.

The total cost

The total cost of poor forecasting: $540 in lost discounts, $400 in late fees, and $180 in interest charges, a total of $1,120 in unnecessary expenses from a single month of poor visibility. Over a year, these costs could compound significantly.

Beyond the immediate financial hit, Sarah’s supplier relationship suffered. The late payment meant she lost her preferred customer status and favorable terms for future orders. Her supplier now requires payment within 15 days instead of 30.

With better forecasting, Sarah would have seen this cash concentration coming weeks in advance. She could have delayed discretionary purchases, arranged a short-term line of credit at better rates, or simply held more cash reserves. The $1,120 in direct costs—and the damaged supplier relationship—were entirely preventable.

The role of AP automation in forecasting

Automation tools bring major advantages to forecasting accounts payable by eliminating manual data entry, reducing errors, cutting costs, and providing real-time visibility into payment obligations. In fact, according to the 2024 State of ePayables report by Ardent Partners, automated invoice processing can cost up to 80% less than paper-based methods.

Manual forecasting requires hours of spreadsheet work, data gathering, and constant updates as new invoices arrive. Automation pulls invoice data directly from your systems, tracks payment schedules automatically, and updates forecasts in real time. This accuracy comes from having complete, current information whenever you need it.

Key features to look for in AP automation software include:

- Real-time visibility: Access current data on outstanding invoices, upcoming due dates, and cash requirements at any moment. The system updates automatically as new invoices arrive or payments are processed, giving you a live view of obligations.

- Reporting capabilities: Generate detailed reports on payment trends and vendor spending patterns. Look for dashboards that highlight key metrics and let you drill into specific periods or vendors.

- Integration with existing accounting systems: The software should connect directly with your accounting platform to pull invoice data, payment history, vendor information, and terms without manual transfers. This integration keeps all systems synchronized and reduces errors.

Best-in-class organizations also achieve 82% faster invoice processing time, according to Ardent Partners, underscoring how automation shortens cycle times and frees teams for higher-value work.

The right software turns AP forecasting from a manual process into an efficient, accurate operation that drives better decisions across the business.

Benefits of automated AP forecasting

Automation delivers tangible advantages that improve both the forecasting process and overall financial planning.

- Reduced manual errors: Automated systems eliminate typos and data-entry mistakes by pulling figures directly from source systems and applying calculations consistently

- Time savings and efficiency gains: What once took hours of manual work now happens automatically. Teams can spend their time analyzing results instead of gathering data.

- Better data for decision-making: Automated forecasting provides detailed, accurate information about payment obligations. You can model different scenarios and make decisions backed by reliable data.

- Improved vendor relationship management: Automation helps track payment histories, monitor compliance with terms, and identify opportunities to strengthen relationships. Patterns like which vendors offer the best terms, or where you consistently pay late, become clear.

These benefits compound over time, making your financial operations more efficient and your decisions more informed.

Connecting AP forecasting to cash flow management

Forecasting accounts payable plays a vital role in your overall cash flow management strategy. While accounts receivable forecasting shows when money will arrive, AP forecasting reveals when cash will leave. Together, these forecasts create a complete picture of your cash position at any moment.

Balancing payables with receivables requires careful timing. If major customer payments arrive on the 15th of each month, schedule supplier payments shortly after to maintain adequate reserves. Pairing your AP forecast with AR projections gives you full visibility into cash timing. For example, if you know customer payments tend to clear two days later than expected, you can shift vendor payments accordingly to avoid shortfalls.

Optimizing working capital means holding cash long enough to earn value from it while still paying vendors on time and capturing discounts.

Your forecasts also provide leverage when negotiating with vendors. With data showing consistent payment patterns and volume projections, you can request extended terms, volume discounts, or better early payment incentives. Vendors value customers who demonstrate financial stability and predictable payment behavior.

Strategic decision-making with AP forecasts

Strong forecasts enable smarter decisions about when and how to pay obligations. Early payment discounts often deliver annualized returns between 18% and 36%, depending on timing. Take these discounts whenever you have enough cash reserves and no higher-return opportunities for that capital.

During tight cash periods, prioritize payments based on relationship importance, penalty costs, discount opportunities, and business impact. Essential vendors who keep operations running should come first. Late fees and damaged relationships with key partners can cost more than short delays with less critical suppliers.

Accurate forecasts also guide long-term planning. Before expanding to new locations, launching product lines, or hiring, model how increased activity will affect your payment obligations. Factor in higher inventory needs, additional vendor relationships, and one-time setup costs to avoid cash shortfalls during growth phases.

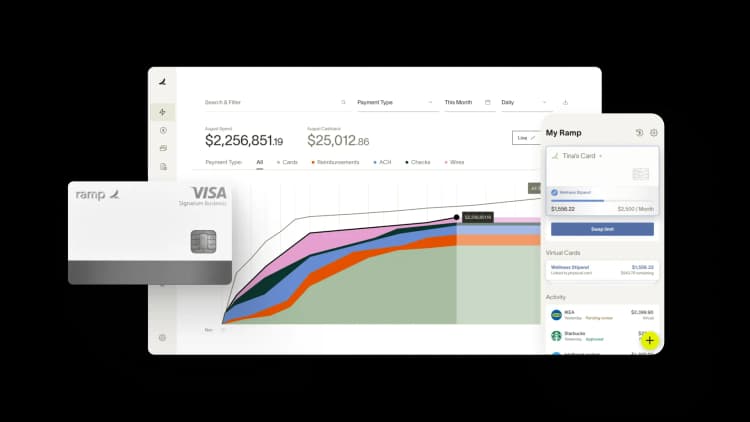

Ramp Bill Pay is the leading AP automation solution

Ramp Bill Pay gives finance teams complete control over accounts payable through advanced automation. The autonomous AP platform runs AI agents that code invoices based on transaction patterns, detect fraudulent entries before approval, create detailed approval summaries, and push vendor payments through cards—eliminating manual steps from your AP process.

The platform's OCR pulls invoice information at up to 99% accuracy and processes invoices 2.4x faster than legacy software1—cutting AP cycle times to save your team time and money. Companies using Ramp also report up to 95% improvement in financial visibility2.

Key Ramp Bill Pay features that drive AP efficiency include:

- Four AI agents: Automatically categorize expenses by analyzing historical invoices, spot fraudulent activity and irregularities, generate approval records with vendor background and pricing data, and execute card payments directly in vendor systems

- Automated PO matching: Runs 2-way and 3-way comparisons between invoices and purchase orders to identify pricing errors and overbilling

- Intelligent invoice capture: Extracts data across all line items with 99% OCR accuracy for thorough invoice handling

- Real-time invoice tracking: Tracks invoices from initial receipt to final processing for end-to-end visibility

- Custom approval workflows: Creates multi-level approval chains that match your org structure and authorization rules

- Approval orchestration: Speeds reviewer workflows while keeping oversight and control intact

- Payment methods: Processes vendor payments via ACH, corporate card, check, or wire according to payment preferences

- Vendor Portal: Gives vendors secure access to monitor payment status and manage account information

- Real-time ERP sync: Integrates bidirectionally with ERPs including NetSuite, QuickBooks, Xero, Sage Intacct, and more for aligned financial records

- GL coding: Maps transactions to correct accounts through AI-driven suggestions

- Vendor onboarding: Gathers W-9s, confirms TINs, and tracks 1099 data for regulatory compliance

- Recurring bills: Manages repeat payment cycles using automated scheduling templates

- Batch payments: Groups vendor payments together for streamlined processing operations

- Reconciliation: Matches transactions automatically at month-end to speed up book closing

What sets Ramp Bill Pay apart

Ramp Bill Pay shows what AP automation achieves—accurate data capture, autonomous workflows that remove manual tasks, touchless operations that boost speed, and real-time visibility that strengthens spend control.

Whether you're focused on reducing cycle times, cutting operational expenses, improving accuracy rates, or gaining better financial oversight—Ramp provides the automation capabilities and data access needed to get there. Finance teams on G2 rank it as one of the simplest AP platforms to use.

Deploy Ramp Bill Pay independently as your core AP solution, or link it with Ramp's corporate cards, expense management, and procurement platform for unified spend management. Start with the free tier covering fundamental AP capabilities, or move to Ramp Plus at $15 per user each month for additional functionality.

Managing AP shouldn't be complex. Ramp Bill Pay simplifies it.

1. Based on Ramp’s customer survey collected in May’25

2. Based on Ramp's customer survey collected in May’25

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Compared to our previous vendor, Ramp gave us true transaction-level granularity, making it possible for me to audit thousands of transactions in record time.”

Lisa Norris

Director of Compliance & Privacy Officer, ABB Optical

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°