What is an accounts payable ledger and how to manage one

- What is an accounts payable ledger?

- Key components of an accounts payable ledger

- Examples of when accounts payables ledgers are used

- General ledger vs. accounts payable ledger

- Benefits of maintaining an accounts payable ledger

- Common mistakes and best practices for managing your AP ledger

- How Ramp Bill Pay is the best way to simplify AP end-to-end

An accounts payable (AP) ledger is a practical tool for tracking short-term liabilities—assuming it's maintained accurately. When used correctly, it helps businesses stay ahead on payments, manage cash more effectively, and strengthen vendor relationships.

Let’s dig a bit deeper into what your AP ledger is and how you can use it to your advantage.

What is an accounts payable ledger?

The AP ledger is a record of all transactions that impact your accounts payable balance. Most entries fall into one of two categories:

- Purchases made from vendors on credit

- Payments issued to those vendors

This ledger doesn’t summarize—it itemizes. It shows a line-by-line view of individual transactions, giving you visibility into how your AP liability changes over time and a reference point if you need to trace payment history.

Key components of an accounts payable ledger

The AP ledger is a subset of the general ledger, focused specifically on accounts payable activity. Like the general ledger, it's structured as a table: each row represents a transaction, and each column breaks down information tied to that entry.

Standard fields typically include:

- Date

- Description

- Debit

- Credit

- Account balance

Depending on how your business categorizes financial data, the ledger may also include:

- Transaction number

- Sub-account name and number (if multiple AP accounts are used)

- Vendor code (to tie payments to individual suppliers)

- Reference code (to classify transactions by department, location, or business unit)

Here’s an example of how an AP ledger might look:

Transaction Number | Date | Description | Vendor Code | Debit | Credit | Balance |

|---|---|---|---|---|---|---|

Beginning balance | $1,000 | |||||

1004512 | 2/1/2025 | Resupply of product X | 124 | $500 | $1,500 | |

1004520 | 2/4/2025 | Purchase office supplies | 137 | $250 | $1,750 | |

1004556 | 2/15/2025 | Payment Invoice #469915 | 124 | $500 | $1,250 | |

1004559 | 2/16/2025 | New laptops | 139 | $5,700 | $6,950 | |

1004579 | 2/26/2025 | New office chairs | 139 | $4,000 | $10,950 | |

1004592 | 3/4/2025 | Payment invoice #497A77 | 137 | $250 |

In double entry accounting, every journal entry affects at least two accounts. Your AP ledger reflects only the entries that impact your accounts payable balance. The corresponding entries appear in other ledgers.

For example, when you pay a vendor via ACH, the transaction hits both the AP ledger and your cash ledger. A $500 vendor payment would be recorded as teh following AP entries:

- A $500 credit in your cash ledger

- A $500 debit in your AP ledger

Accounts payable ledger

Transaction Number | Date | Description | Vendor Code | Debit | Credit | Balance |

|---|---|---|---|---|---|---|

Beginning balance | $1,750 | |||||

1004512 | 2/15/2025 | Payment Invoice #469915 | 124 | $500 | $1,250 |

Cash ledger

Transaction Number | Date | Description | Vendor Code | Debit | Credit | Balance |

|---|---|---|---|---|---|---|

Beginning balance | $50,745 | |||||

1004556 | 2/15/2025 | Payment Invoice #469915 | 124 | $500 | $50,245 |

Each side of the entry keeps your books balanced while giving visibility into both cash outflows and liability reduction.

Examples of when accounts payables ledgers are used

The AP ledger is updated whenever there’s a transaction involving accounts payable. These entries are typically recorded by your AP clerk, bookkeeper, or an automated accounting system.

The most common entries include:

- Purchases from vendors

- Payments made to vendors

Other less frequent entries might include:

- Adjustments: Correcting input errors or misclassifications

- Product returns: Accounting for refunds from returned or rejected items

- Purchase price corrections: Reflecting revised pricing due to invoice errors

- Early payment discounts: Recording vendor-issued discounts for prompt payment

- Late payment penalties: Adding charges for missed invoice due dates

Let’s look at two examples.

Example 1: Recording a product return

On 3/5/2025, your business receives four boxes of office supplies, each valued at $300. The next day, you discover that one of the boxes is incorrect. Instead of requesting a replacement, you return it to the vendor.

The AP ledger entry would reflect a $300 reduction in your accounts payable balance, tied to the return date and vendor information. Here’s what it would look like:

Transaction Number | Date | Description | Vendor Code | Debit | Credit | Balance |

|---|---|---|---|---|---|---|

Beginning balance | $11,900 | |||||

1004595 | 3/6/2025 | Return for Invoice #33195 | 102 | $300 | $11,600 |

Example 2: Late payment penalty

You made a purchase on 2/16/2025 with a due date of 3/16/2025. By 4/16/2025, the invoice was still unpaid. According to your vendor agreement, a $100 penalty applies to payments more than 30 days overdue. On 4/18/2025, you received a penalty invoice. Two days later, you paid the original $5,700 invoice along with the $100 late fee.

The AP ledger would reflect:

- A $100 increase in your accounts payable on 4/18/2025

- A $5,800 payment recorded on 4/20/2025

Transaction Number | Date | Description | Vendor Code | Debit | Credit | Balance |

|---|---|---|---|---|---|---|

Beginning balance | $18,250 | |||||

1004620 | 4/18/2025 | Late payment penalty assessed | 139 | $18,350 | ||

1004622 | 4/20/2025 | Payment for laptops + late payment fee | 139 | $5,800 | $12,550 |

Each entry documents the adjustment and clears the outstanding balance.

General ledger vs. accounts payable ledger

Both the general ledger and AP ledger are transaction listings—but they serve different purposes.

- The general ledger captures every transaction across all accounts

- The AP ledger captures only those affecting accounts payable

Think of the AP ledger as a focused view within your broader general ledger. It isolates activity tied to vendor obligations.

Another key difference: the general ledger balances debits and credits by design. The AP ledger, by contrast, shows only one side of each transaction—specifically, entries that affect your AP account. As a result, it usually carries a credit balance and doesn’t balance on its own.

Benefits of maintaining an accounts payable ledger

A well-maintained AP ledger provides visibility into your short-term liabilities and helps improve financial decision-making. Key benefits include:

1. Improved cash flow

Your AP ledger offers a real-time view of what you owe. Reviewing your ending balance helps plan near-term cash needs. Tracking month-to-month changes can also help forecast AP and upcoming obligations to align cash availability accordingly.

2. Enhanced vendor relations

When disputes arise, your AP ledger can confirm if and when an invoice was paid—and whether it was assigned to the correct vendor. Over time, consistent payment behavior may position you for early payment discounts or better terms.

3. Greater financial visibility

Filtering AP transactions by date helps identify monthly trends. This can inform purchasing decisions and ensure payments better match your business’s cash cycle.

Common mistakes and best practices for managing your AP ledger

If your accounting system is set up correctly, your AP ledger will update automatically. But accuracy depends on clean data entry and regular review.

Common mistakes to avoid

- Missing or incorrect account numbers: If you omit or miscode an account number, transactions won’t appear in your AP ledger. Manual AP reconciliation may be required

- Incorrect dates: Always enter the actual transaction date, even if it reflects a late payment. Backdating can damage vendor trust and create inconsistencies

- Insufficient detail: Include as much relevant information as possible. For example, tagging payments with vendor codes makes it easier to filter and analyze specific transactions later

Best practices to follow

- Use a reliable accounting system: Choose tools that automatically generate and update your AP ledger

- Standardize your data: Create consistent formats for account numbers and names, sub-accounts, vendor codes, and locations and descriptions

- Review regularly: Just like your GL, your AP ledger should be reviewed frequently to catch anomalies or input errors

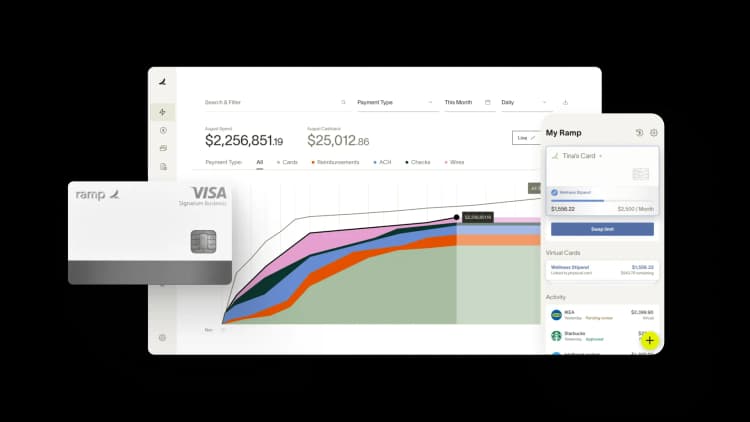

How Ramp Bill Pay is the best way to simplify AP end-to-end

Ramp Bill Pay is an AI-driven accounts payable software designed to address the toughest pain points in AP management. From the moment an invoice is received to final payment and reconciliation, Ramp captures detailed invoice information, streamlines approval routing, and syncs data directly with your ERP—helping your team close the books faster while reducing manual work.

Unlike outdated AP systems that struggle with inflexible integrations, inconsistent PO matching, and fragmented processes, Ramp Bill Pay delivers seamless automation across the entire accounts payable workflow. It gives finance teams the transparency and oversight they need at every stage of the payment cycle.

Ramp is recognized as one of the easiest AP softwares to use, holding an impressive 4.8/5 star rating from more than 2,000+ reviewers. Companies of all sizes rely on Ramp to minimize repetitive tasks, prevent costly mistakes, and maintain accurate financial records. One G2 user even described Ramp as the most user friendly and efficient platform for non-profits, highlighting its impact across diverse organizations.

Common pain points in AP operations

Typical AP processes encounter major obstacles in three critical areas:

- Reconciling invoices that don’t match purchase orders

- Bottlenecks caused by delayed approvals

- Manually entering financial data into accounting systems

Ramp Bill Pay overcomes these hurdles with robust, automation-first AP capabilities:

- Automated invoice capture powered by AI, plus intelligent GL code suggestions

- Purchase order and invoice matching to ensure accuracy

- Customizable approval flows with smart routing and user permission settings

- Management of recurring invoices, batch payment runs, and tracking for vendor payments

- Flexible support for ACH, check, card, and both domestic and international wire payments

- Real-time, two-way ERP integration with NetSuite, QuickBooks, Xero, and other platforms

- Unified controls bringing AP, purchasing, employee spend, and accounting together

Organizations seeking the top AP platform for efficiency and control are turning to Ramp. Recent examples include:

- Quora cut their bill processing time from 5-8 minutes down to 1-2 minutes

- Skin Pharm reduced approval cycles from several weeks to just 48 hours through Ramp’s automated workflows

- The Second City processed bills 2x faster with accurate OCR

Why move forward with Ramp Bill Pay?

Ramp Bill Pay is accounts payable software designed to fit and grow with all teams. With built-in AI, seamless ERP connections, and user-driven workflows, it empowers finance teams to deliver faster results and greater accuracy on every invoice. Ramp offers AP automation with a free starting tier, mid-level pricing at $15/user/month, and tailored options for enterprises.

Let’s show you what top-rated AP automation should look like—get started with Ramp Bill Pay today.

Don't miss these

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide.” ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn’t just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn’t exist in Zip. It’s made approvals much faster because decision-makers aren’t chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits

“More vendors are allowing for discounts now, because they’re seeing the quick payment. That started with Ramp—getting everyone paid on time. We’ll get a 1-2% discount for paying early. That doesn’t sound like a lot, but when you’re dealing with hundreds of millions of dollars, it does add up.”

James Hardy

CFO, SAM Construction Group