How long does it take to implement AP software? Typical timelines and steps

- AP software implementation timeline: What to expect

- Step-by-step AP software implementation process and timeline

- Implementation prerequisites: What to prepare before you start

- Tips for communicating timelines to stakeholders

- How to minimize and manage implementation delays

- Exceptions: What can extend your AP software implementation timeline?

- What is Ramp—and how quickly can teams implement its AP software?

- Key takeaways on AP software implementation time

- Get your AP system running—fast

Implementing AP software usually takes between 2 and 12 weeks, depending on the complexity of your chosen solution. Modern cloud-based platforms are typically up and running in 2–4 weeks, while legacy systems may require 8–12 weeks or more.

In this guide, we’ll break down:

- Typical timelines for cloud-based versus legacy systems

- A step-by-step overview of the implementation process

- Key factors that influence your timeline

- How finance teams take less than 2 weeks to set up their AP system with Ramp Bill Pay

Let’s start by looking at what you can expect from a typical implementation timeline.

AP software implementation timeline: What to expect

Your AP software implementation timeline covers everything from project kickoff to when your accounts payable system is fully operational and in use by your team. This includes all setup, configuration, integration, testing, and deployment activities.

Modern cloud-based AP solutions typically take 2–4 weeks to implement. Legacy on-premise systems, on the other hand, often require 8–12 weeks or longer. The faster pace of modern solutions comes from pre-configured templates, easier integrations, and fewer hardware requirements.

Several key factors can influence your implementation timeline. Understanding these will help you plan more accurately:

- Solution complexity: Advanced features like multi-entity support, custom approval workflows, and analytics add configuration time

- Required integrations: Connecting to ERPs, banking platforms, or other financial software—especially older systems—can increase complexity and duration

- Business size: More users, approval levels, and data volume mean longer implementation periods for larger organizations

Factoring in these elements allows you to allocate resources effectively and set realistic expectations with your team. With a clear estimate, you can plan for thorough testing and training, which leads to better adoption and fewer surprises after launch.

Step-by-step AP software implementation process and timeline

The AP software implementation journey follows a structured sequence of phases. Each phase builds on the last to ensure a successful deployment:

Phase 1: Kickoff and project planning

- Define project scope and success criteria

- Identify stakeholders and assign responsibilities

- Establish communication protocols

- Create a detailed project plan

Once your project plan is in place, you can move into data preparation and migration.

Phase 2: Data preparation and migration

Identify which data needs to be migrated, clean up vendor and invoice records, standardize formats, and run test migrations to catch issues early. Ensuring your data is accurate and well-organized at this stage prevents headaches later on.

With clean data, you’re ready to configure the system to fit your business needs.

Phase 3: System configuration and workflow setup

Customize the software by configuring approval hierarchies, spending limits, accounting codes, and custom fields. Align workflows with your processes so the system fits your day-to-day needs.

Next, connect your new AP system to your existing financial infrastructure.

Phase 4: Integration with ERP and accounting systems

Map data fields, establish connection protocols, and test bidirectional data transfer. This ensures seamless data flow and eliminates duplicate entry. Most AP software provides two-way syncs with popular ERPs like NetSuite, Sage Intacct, and Quickbooks.

With integrations in place, focus on preparing your team for launch.

Phase 5: User training and acceptance testing

Conduct role-specific training sessions and test workflows and system functionality. Make sure users are comfortable before go-live to drive adoption and minimize disruptions.

Finally, transition to production use and provide ongoing support.

Phase 6: Go-live and post-launch support

Monitor initial transactions closely, provide support, and make adjustments as needed. Address any remaining issues to solidify adoption and ensure long-term success.

Summary timeline

Implementation phase | Duration (days) | Key objectives |

|---|---|---|

1. Kickoff and project planning | 3-5 | Define scope, establish team, create project plan |

2. Data preparation and migration | 5-10 | Clean and standardize data, perform test migrations |

3. System configuration | 5-10 | Set up workflows, approval rules, accounting codes |

4. ERP/accounting integration | 7-20 | Connect systems, map fields, test data transfer |

5. Training and testing | 3-7 | Train users, validate workflows, confirm functionality |

6. Go-live and support | 1-3+ | Launch system, monitor usage, provide support |

Implementation prerequisites: What to prepare before you start

Before starting your AP software implementation, make sure you’re set up for success by preparing in these key areas:

Data readiness: Gather clean, accurate vendor information, invoice history, and your chart of accounts. Audit your data for completeness, remove duplicates, and standardize formats before kickoff. This prevents migration issues and delays.

Stakeholder alignment: Make sure all departments understand the project's goals and how it will impact their workflows. Secure buy-in from finance, procurement, and IT. Create a stakeholder map to proactively address concerns and identify decision-makers.

IT/system access: Identify all necessary permissions, server access, and API credentials early. Work with IT to document access points and set up a process for granting permissions to the implementation team. Delays here are common if not handled up front.

Vendor list management: Prepare a complete, validated list of active vendors with accurate contact info and payment terms. Review your vendor master file, verify details with key suppliers, and standardize naming conventions to avoid payment disruptions.

Process documentation: Document your current AP workflows, approval hierarchies, and exception handling procedures. Map out your current state, note pain points, and highlight improvement opportunities to guide configuration in the new system.

To help you quickly review your readiness, here’s a checklist summarizing the most important prerequisites:

- Vendor master data cleaned and standardized

- Chart of accounts validated and updated

- Current AP workflows documented

- Approval hierarchies defined

- IT permissions and access requirements identified

- Key stakeholders informed and aligned

- Integration requirements documented

- Success metrics established

- Implementation team roles assigned

- Training plan developed

Tips for communicating timelines to stakeholders

Clear communication keeps everyone aligned and confident throughout your AP software implementation. Here’s how to keep stakeholders informed and engaged at every step:

- Create a visual implementation roadmap: Use charts or timelines to show phases, milestones, and dependencies. This helps stakeholders quickly understand the project scope and duration without technical jargon. Highlight key decision points and resource needs at each stage.

- Segment communications by stakeholder group: Executives want high-level timelines and business impact, while the finance team needs details on process changes and training. Address each group's primary concerns and involvement level.

- Establish regular update cadences: Send weekly status reports with a consistent format. Highlight completed tasks, upcoming milestones, and any timeline changes. This rhythm builds trust and prevents anyone from feeling out of the loop.

When discussing risks or uncertainties, always pair the challenge with a mitigation plan. For example, instead of just saying, "ERP integration may cause delays," explain, "ERP integration complexity could add 3–5 days to Phase 4, but we've scheduled extra IT resources and created a contingency plan." This approach maintains confidence and sets realistic expectations.

Best practices for reporting progress include using consistent metrics, celebrating milestones, and being honest about delays. Share both percentage complete and specific accomplishments to give stakeholders tangible evidence of progress.

Sample stakeholder communication template

Subject: AP Software Implementation Update: Week 2 - Data Migration Phase

Progress summary: We've completed 85% of planned activities for this phase, including vendor data cleansing and test migrations. Implementation remains on schedule for our target go-live date of \[date\].

Key accomplishments:

- Completed vendor master data cleansing (2,500+ records)

- Performed successful test migration of 6 months of historical invoice data

- Finalized approval workflow configurations

Coming next week: Final data validation and beginning system configuration phase

Potential impacts: Training sessions will be scheduled for department representatives during weeks 4–5. Please ensure team availability.

Questions/concerns? Contact \[Project Manager\] at \[contact information\]

How to minimize and manage implementation delays

Common causes of implementation delays

Implementation delays are common, but you can minimize them with proactive planning. Data quality issues are a top roadblock; incomplete vendor info, inconsistent coding, and duplicates can add 3–7 days to your timeline.

Resource constraints often slow things down as well—if key personnel are stretched thin, critical decisions get postponed, causing delays that ripple through the project. Integration challenges with legacy systems can also emerge mid-project, especially if there are incompatible data formats, limited APIs, or undocumented customizations. These may add 1–3 weeks to integration.

Strategies to minimize and manage delays

Conduct thorough accounts payable audits and cleansing before kickoff to prevent setbacks. Consider temporary staff or redistributing workloads during implementation to keep things moving. Schedule early technical discovery sessions with your AP vendor and IT team to spot integration issues before they become blockers.

To manage delays, build buffer time into each phase—especially for high-risk activities like integrations. Where possible, parallelize non-dependent tasks (for example, user training can proceed while integration issues are resolved). Engaging stakeholders early in configuration decisions also helps avoid late-stage change requests.

If a delay threatens the critical path and isn't resolved within a set timeframe, escalate the issue. For example, "Any issue unresolved after 48 hours that impacts the critical path will be escalated to the executive sponsor." When escalating to your software vendor, provide detailed documentation of the issue, steps taken, and business impact for faster resolution.

Exceptions: What can extend your AP software implementation timeline?

Certain scenarios can significantly extend your implementation timeline. These include:

- Complex ERP integrations: Heavily customized or legacy ERPs without modern APIs may require custom middleware and extensive testing. Integration phases can stretch from 1–2 weeks to 4–6 weeks or more.

- Custom workflow requirements: Industry-specific approval processes or unique exception handling may need custom development, adding 2–4 weeks for requirements gathering, development, and testing.

- Regulatory compliance: Highly regulated industries (like SOX for financial institutions, HIPAA for healthcare) require extra verification and documentation, adding 1–3 weeks to the timeline.

- Multi-entity setups: Different operational models, charts of accounts, or banking relationships can double or triple configuration time. A phased approach—starting with one entity—helps manage this complexity.

To minimize these impacts, hold thorough discovery sessions before implementation to identify complications, document special requirements in detail, and include specialists familiar with your challenges on the implementation team. Building buffer time into high-risk phases will help keep the overall project on track.

What is Ramp—and how quickly can teams implement its AP software?

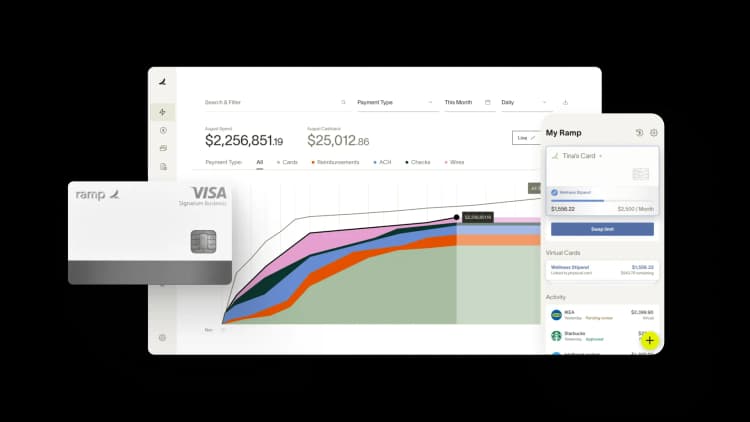

Ramp Bill Pay is autonomous AP software that uses AI agents to code invoices based on transaction patterns, detect fraudulent entries before approval, create detailed approval summaries, and push vendor payments through cards—eliminating manual steps from your AP process.

Unlike legacy tools that require extensive IT support or customization, Ramp is built for quick deployment and self-serve setup.

You can get your new AP system up and running in under 2 weeks with Ramp Bill Pay. That’s because the onboarding process is simple and focused. Finance leads can import vendors, set up approval policies, configure payment methods, and sync with their ERP—all from a single dashboard. Finance teams on G2 even rank it as one of the simplest AP platforms to use.

Ramp also comes pre-configured with best-practice workflows that match how most AP processes actually run. That means less time designing from scratch and more time going live. If questions come up, support is available throughout the process.

Fast implementation doesn’t come at the cost of control. Teams still maintain their own approval logic, compliance standards, and accounting rules—but without a long setup cycle. For most teams, Ramp offers a faster path to automation with fewer internal dependencies—and results they can measure right away.

Key takeaways on AP software implementation time

Knowing what to expect helps you plan resources and set the right expectations. Modern AP solutions like Ramp Bill Pay typically deploy in under 2 weeks, while legacy systems need 4–12 weeks or more. This difference affects both your immediate resource allocation and your time-to-value.

The implementation process is structured and sequential. Investing time in data cleansing and stakeholder alignment up front can help you finish 30–40% faster than starting with disorganized data and processes.

Complexity scales with business size and industry requirements. Enterprises and multi-entity organizations should plan for longer timelines, while smaller businesses can expect faster deployments. Recognizing these differences helps you choose the right solution and set realistic project goals.

Key aspect | Typical timeline | Main blockers | Ramp's advantage |

|---|---|---|---|

Overall implementation | 2-12 weeks | Data quality, resource constraints | 2-4 week implementation with guided process |

ERP integration | 1-4 weeks | Legacy systems, custom fields | Pre-built connectors, simplified mapping |

User training | 3-10 days | User availability, complex workflows | Intuitive interface, role-based training |

Get your AP system running—fast

Ramp Bill Pay is built for speed without cutting corners. Setup takes days, not months, and most teams are fully operational in under two weeks. No consultants, no long lead times—just smart defaults, intuitive workflows, and fast support when you need it.

There’s no reason to wait 90 days to fix your AP process. You can streamline invoice approvals, eliminate manual entry, and gain real-time visibility before your next cycle even begins.

But Ramp Bill Pay offers even more that fast implementation time.

The platform's OCR pulls invoice information at up to 99% accuracy and processes invoices 2.4x faster than legacy software1—cutting AP cycle times to save your team time and money. Companies using Ramp also report up to 95% improvement in financial visibility2.

Key Ramp Bill Pay features that drive AP efficiency include:

- Automated PO matching: Runs 2-way and 3-way comparisons between invoices and purchase orders to identify pricing errors and overbilling

- Intelligent invoice capture: Extracts data across all line items with 99% OCR accuracy for thorough invoice handling

- Real-time invoice tracking: Tracks invoices from initial receipt to final processing for end-to-end visibility

- Custom approval workflows: Creates multi-level approval chains that match your org structure and authorization rules

- Payment methods: Processes vendor payments via ACH, corporate card, check, or wire according to payment preferences

- Vendor Portal: Gives vendors secure access to monitor payment status and manage account information

- Real-time ERP sync: Integrates bidirectionally with ERPs including NetSuite, QuickBooks, Xero, Sage Intacct, and more for aligned financial records

- Vendor onboarding: Gathers W-9s, confirms TINs, and tracks 1099 data for regulatory compliance

- Four AI agents: Automatically categorize expenses by analyzing historical invoices, spot fraudulent activity and irregularities, generate approval records with vendor background and pricing data, and execute card payments directly in vendor systems

- Batch payments: Groups vendor payments together for streamlined processing operations

- Reconciliation: Matches transactions automatically at month-end to speed up book closing

What sets Ramp Bill Pay apart

Ramp Bill Pay shows what AP automation achieves—accurate data capture, autonomous workflows that remove manual tasks, touchless operations that boost speed, and real-time visibility that strengthens spend control.

Use Ramp Bill Pay independently as your core AP solution, or link it with Ramp's corporate cards, expense management, and procurement platform for unified spend management.

Get started with Ramp Bill Pay and see how fast your team can move.

Don't miss these

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits