How AP automation improves vendor payment timeliness and reliability

- Why timely vendor payments matter for your business

- The challenges of manual accounts payable processes

- How AP automation improves vendor payment timeliness

- The business impact: ROI and cost savings from AP automation

- Enhancing vendor relationships through reliable payments

- Handling exceptions: How automation adapts to different AP needs

- How Ramp delivers fast, predictable vendor payments

- Choose Ramp Bill Pay for delivering reliable vendor payments

Managing vendor payments is a key driver of supplier trust, operational efficiency, and business resilience. Yet, many organizations struggle to pay vendors on time due to manual processes and bottlenecks.

This guide will review how automating accounts payable can dramatically improve payment reliability and how Ramp Bill Pay makes it much easier to pay vendors on time.

Why timely vendor payments matter for your business

Timely vendor payments are essential for maintaining strong supplier relationships and avoiding costly disruptions. Late or inconsistent payments can lead to strained partnerships, stricter terms, and increased costs. Consistently paying on time builds trust and positions your company as a preferred customer.

However, achieving this level of reliability is challenging when relying on manual processes—a challenge AP automation is designed to solve.

The challenges of manual accounts payable processes

Manual AP processes rely on handling invoices and payments through paper-based or basic digital systems without automation. Typically, invoices are received physically or via email, entered manually into accounting systems, routed for approvals through email or handoffs, prepared for payment by hand, and recorded in spreadsheets or basic accounting software.

These manual processes create specific bottlenecks that delay payments:

- Approval workflows stall when key approvers are unavailable

- Data entry errors lead to payment rejections or incorrect amounts

- Limited visibility makes tracking invoice status difficult

- Physical documents get lost, forcing vendors to resend invoices

These bottlenecks become even more pronounced as invoice volumes grow. A system that handles 50 invoices monthly can quickly become overwhelmed at 500 invoices, forcing companies to hire more AP staff just to keep up—adding unnecessary overhead costs.

How AP automation improves vendor payment timeliness

AP automation digitizes and streamlines accounts payable workflows from invoice receipt through payment. The most effective solutions offer features such as:

- Automated invoice capture

- Intelligent data extraction

- Digital approval routing

- Integrated payment processing

With AP automation, invoices are automatically received and digitized from multiple sources, then routed to the right approvers based on predefined rules. The system flags upcoming due dates, prepares batched payments, and notifies approvers when action is needed. Validation rules catch discrepancies between purchase orders, receiving documents, and invoices before they cause payment delays.

Automated systems also support multiple payment methods, such as ACH for faster processing and automatic remittance, virtual cards for immediate payments and extended float, and traditional checks with improved batch processing and tracking.

The business impact: ROI and cost savings from AP automation

AP automation delivers specific cost savings that can be measured:

- Labor costs decrease as staff shift from data entry to exception handling and strategic work

- Late payment penalties are reduced with automated due date tracking

- Increase in early payment discount capture

- Processing costs per invoice can drop from $5-$10 to $2-$5

Faster payment cycles don’t just reduce late invoice fees—they also improve cash control. By settling payments in one day instead of five, businesses retain access to cash longer, giving them more flexibility to earn interest, invest, or negotiate favorable terms with other vendors.

Beyond cost savings, AP automation reduces payment errors and fraud risk through built-in controls. Features like three-way matching verify invoice details, duplicate invoice detection prevents double payments, and separation of duties with approval thresholds ensures proper oversight.

Automation also enables business growth without adding AP staff as invoice volumes increase. While manual processes require more headcount as you grow, automated systems handle increased volume with minimal extra resources—allowing you to scale operations while keeping AP costs flat.

Enhancing vendor relationships through reliable payments

Reliable, on-time payments are the foundation of strong vendor relationships. When suppliers know they'll be paid on time, they can focus on serving your business instead of chasing payments. AP automation enhances the vendor experience by providing detailed remittance information with each payment, payment status notifications, and clear payment timelines via vendor portals.

These improvements translate directly into business benefits:

- Better contract terms from vendors who see you as a low-risk customer

- Priority service during supply constraints

- Greater supply chain resilience

- Potential for preferential pricing

As vendor relationships strengthen, opportunities for deeper collaboration emerge—from consignment inventory to joint cost reduction initiatives. Reliable payments set the stage for long-term, mutually beneficial partnerships.

Handling exceptions: How automation adapts to different AP needs

Not every invoice follows a standard path. AP exceptions include non-standard situations like:

- Partial payments

- Disputed invoices

- Rush payments

- Invoices requiring extra documentation

Modern AP systems handle these exceptions effectively by using configurable approval matrices to route unusual cases to the right decision-makers, providing override capabilities for authorized users, and offering customizable workflows that adapt to your company's policies.

Here are answers to some common exception scenarios:

How does AP automation handle disputed invoices?

When an invoice is flagged as disputed, the system routes it to a resolution workflow. Designated staff can document the issue, communicate with vendors through the platform, and track progress. Once resolved, the invoice returns to the standard payment process with dispute documentation attached.

Can AP automation process partial payments?

Yes. Modern AP systems allow authorized users to split invoices for partial payment while tracking the unpaid portion. The system maintains the relationship between the original invoice and all partial payments, providing clear documentation for both internal records and vendor remittance.

How are rush payments handled in automated systems?

AP automation platforms include priority flags to accelerate specific invoices through approval workflows. Authorized users can initiate expedited payments that bypass standard batching, while still maintaining proper controls and documentation.

By adapting to real-world scenarios, AP automation ensures your processes remain flexible and controlled, even when exceptions arise.

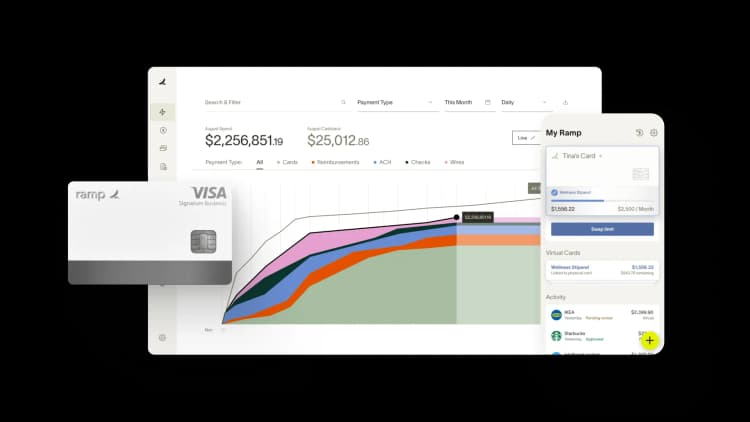

How Ramp delivers fast, predictable vendor payments

Ramp Bill Pay is autonomous accounts payable software that is built to keep payments on schedule—whether you're paying a handful of vendors or processing hundreds of invoices each month. The platform combines intelligent automation, flexible scheduling, and reliable payment rails to help teams deliver on time, every time.

Consistent payment timelines

Ramp processes payments with clear, predictable timing so you can plan ahead with confidence:

- ACH payments: Delivered in 2 business days

- Check payments: Delivered in 10 business days

- Domestic wires: If approved before 1:00 PM ET, funds may arrive same day; otherwise, 0–5 business days (domestic wires cost a flat $15 fee)

- International wires (USD): Funds are ACH-debited in 1–4 business days, then wired to your vendor in 1–5 business days

Ramp also offers no processing fees on standard ACH, check, and card payments through Ramp Bill Pay. For even faster delivery, Ramp Business Account holders get free, unlimited same-day ACH and wire transfers, both domestic and international—without minimum balance requirements or maintenance fees. Learn more about Ramp payment timelines.

Automation that prevents late payments

Ramp’s approval workflows are built to move quickly and stay ahead of payment deadlines. Invoices are routed to the right approvers automatically, based on vendor, department, or custom rules. Due dates and terms are applied directly from vendor records, so there's no need for manual scheduling or deadline tracking.

Recurring payments can be set up for regular vendors, or one-time payments can be scheduled days or weeks in advance. Even during busy cycles or staff absences, payments go out as planned—no last-minute rushes or emergency runs.

Ramp also integrates with major ERPs, keeping records in sync and preventing rekeying errors that commonly delay payments. That means fewer missed deadlines, fewer vendor inquiries, and a smoother AP process end-to-end.

Here’s how Ramp Bill Pay made scaling vendor payments easy for Dragonfly Pond Works.

How Dragonfly Pond Works scaled AP and simplified bill payments with Ramp

As Dragonfly Pond Works expanded, its bill pay process couldn’t keep up. The company had outgrown its bank-based scheduling tool, which lacked flexibility, vendor visibility, and control at scale. Payments were hard to track, and managing timing across growing responsibilities became increasingly manual.

Ramp Bill Pay gave the team a more scalable and reliable way to handle payments. Rather than batching payments through a limited banking portal, Dragonfly’s staff accountant now enters invoices into Ramp, selects the vendor, and schedules payments via ACH or check within the platform.

“Before Ramp, we had a bill pay scheduling function through our bank. The solution worked well, but we simply outgrew the system. We wanted to find ways to improve our process, optimize our days payable outstanding, and allow visibility for our vendors on payments,” says Austin Mcilwain, CFO at Dragonfly Pond Works.

“We also wanted a more scalable way to pay vendors via ACH. Our staff accountant enters all the information through Ramp Bill Pay and can easily schedule, whether via ACH or a check, in a way that we weren’t able to before.”

Since implementing Ramp, Dragonfly has cut a full week off its month-end close. With automated payment scheduling, real-time visibility, and a platform built to scale, the finance team now spends less time chasing down due dates—and more time planning ahead.

Choose Ramp Bill Pay for delivering reliable vendor payments

Ramp Bill Pay is AP automation software that helps finance teams by providing autonomous processing that catches errors, touchless workflows that speed payments, and visibility that strengthens vendor trust.

Whether your focus is eliminating duplicate payments, accelerating payment cycles, maintaining vendor satisfaction, or gaining payment oversight—Ramp provides the controls and automation to make it happen. Finance teams on G2 rate it as one of the easiest AP platforms to get started with.

Use Ramp Bill Pay as your standalone AP solution, or integrate it with Ramp's corporate cards, expense tools, and procurement system for unified spend control. Start with the free tier covering core AP features, or access Ramp Plus at $15 per user per month for advanced duplicate detection and payment capabilities.

Vendor payments shouldn't come with errors. Ramp Bill Pay gets them right.

Don't miss these

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits