The cash application process in AR: A complete guide

- What is cash application?

- Why is cash application important for businesses?

- What is the cash application process?

- Challenges with the cash application process

- How to optimize your cash application process with automation

- How Ramp can help simplify cash application

Whether you’re a startup managing tight cash flow or a finance team aiming for accurate financial reporting, getting cash application right is essential for financial health. Poor cash application can lead to misallocated revenue, financial reporting errors, and issues with lenders.

This guide covers why cash application matters, common challenges, automation, and how to optimize the process for better results.

What is cash application?

Cash application is the process of matching incoming payments to the correct customer accounts and outstanding invoices, ensuring payments are accurately posted in the accounts receivable (AR) system. As a critical step in the AR cycle, cash application helps businesses maintain accurate financial records, resolve payment discrepancies quickly, and optimize cash flow for efficient operations.

Cash applications can be manual or automated, but automation is faster and more accurate, which we will touch on later.

Key elements of cash application

The cash application process relies on three main elements: Invoice, payment, and payment remittances, which provide crucial details for matching payments to invoices.

- Invoice: The document sent to customers detailing products or services provided and payment terms. It’s the foundation for matching payments in accounts receivable.

- Payment: Customers receive funds through various methods like checks, credit cards, or ACH transfers.

- Remittance advice: A notification or document from the customer that confirms payment and includes details like invoice numbers, amounts paid, and any adjustments.

Why is cash application important for businesses?

Cash application is crucial for managing cash flow, improving payment operations, and reducing errors that cause invoice disputes. By accurately matching payments to invoices, businesses can maintain up-to-date financial records, lower Days Sales Outstanding (DSO), and free up capital for growth.

It also quickly strengthens customer relationships by resolving payment issues and offers insights into payment trends, helping identify profitable clients and products. Automating the cash application process can help eliminate errors, speed up the process, and ensure transparency, keeping businesses ahead in their financial operations.

Benefits of cash application when done right

Cash application directly affects financial reporting, particularly the balance sheet. Accounts receivable don't change until the customer payment has been registered. That causes the cash number to go up, which affects the income statement and statement of cash flows. None of this happens without cash application.

Here’s why you want to get it right:

- Accurate reporting: Ensures all financial statements reflect precise, up-to-date numbers.

- Improved cash flow management: Proper allocation of payments prevents confusion and supports cost coverage like COGS and expenses.

- Stronger lender relationships: Transparent revenue tracking builds confidence with banks and lenders, aiding loan approvals.

- Informed decision-making: Clear financial data empowers stakeholders to make smarter business decisions.

- Reduced risk: Eliminates untracked payments and minimizes the chance of financial errors.

Efficient management of receivables through accurate cash application ensures businesses can better handle transactions and maintain smooth payment operations.

What is the cash application process?

Properly documenting and matching customer payments to invoices is critical for accurate financial records. Skipping these steps in the cash application process can cause accounting errors, compliance risks, and customer service challenges.

Since this process directly impacts financial reporting, it’s crucial to get it right. Here’s a step-by-step guide to streamline your cash application process:

- Step 1—Payment is received: The first step in cash application is receiving payments through various B2B payment options such as checks, credit cards, or ACH transfers. Payment details are then verified against invoices or accounts receivable records and allocated to the correct customer account to ensure accuracy and streamline cash flow.

- Step 2—Data entry: Payment information is recorded in the company’s accounting system, creating a digital trail essential for tracking and reconciling.

- Step 3—Remittance advice: A receipt or notification confirms payment received. While not legally required, this helps match payments to invoices and avoid errors in financial records.

- Step 4—Payment matched to invoice: Payments are matched to the corresponding invoices, including cases where transactions involve partial payment or adjustments. Organizing invoices by date and customer or using automation makes this process smoother.

- Step 5—Posting payments: Once payments are matched, they’re posted to customer accounts to update balances and reduce outstanding invoices.

- Step 6—Cash reconciliation: The total payment amount received is compared to deposits made into the bank account, ensuring transactions align and any partial payment discrepancies are resolved.

- Step 7—Reporting and analysis: Generate reports to gain insights into cash flow, customer payment trends, and Days Sales Outstanding (DSO) metrics. This step helps businesses optimize processes and identify improvement opportunities.

Challenges with the cash application process

Even the most straightforward accounting processes can get complicated. In a perfect world, payment amounts would match invoices, and remittance details would automatically sync into your system.

But when things aren’t that seamless, here are some common challenges with cash application:

- Data capture issues: Payment data often comes from scattered sources—emails, bank files, vendor portals—and inconsistent formats can make matching payments to invoices a headache.

- ERP inefficiencies: Entering payment data into outdated or disconnected systems slows reconciliation. Inefficiencies in an ERP system make it harder to track receivables and resolve payment remittances promptly.

- Human error: Manual processes leave room for mistakes, from miskeyed numbers to missed payments. These errors can disrupt cash flow, hurt financial reporting, and even shake investor confidence.

- Matching invoices to receipts: Exceptions need to be created when payments don't match invoices. This often means closing out the old invoice, creating a new one for the balance, and managing extra reconciliation steps.

- Disorganized processes: Poor record-keeping or inefficient workflows create unnecessary bottlenecks, making it harder for teams to manage payments and cash flow.

How to optimize your cash application process with automation

Streamlining your cash application process with automation software can save time, reduce errors, and improve cash flow visibility—setting your business up for success.

What is cash application automation software?

Cash application automation software is a digital solution that streamlines the process of matching incoming payments to open invoices. By using technologies like AI and machine learning, the software eliminates manual data entry, reduces errors, and accelerates reconciliation.

This means businesses can improve cash flow visibility, minimize payment disputes, and free up teams to focus on strategic, higher-value tasks. Many solutions also integrate seamlessly with other accounts receivable tools like invoicing and collections, offering a comprehensive approach to AR management.

Key considerations for cash application automation software

When evaluating cash application automation software, look for tools that deliver these essential features:

- Automatic payment matching: The software should automatically match incoming payments (from bank statements or remittance data) to open invoices and customer accounts, reducing manual effort.

- Advanced technology: AI, machine learning, and OCR enable the software to extract and analyze payment data, identify matches, and resolve discrepancies quickly.

- Comprehensive data capture: Effective application software can handle all payment types, digitize remittance advice, and process complex remittance scenarios.

- Error reduction and efficiency: By automating repetitive tasks, the software minimizes errors, accelerates processing times, and enhances cash flow visibility.

- ERP and accounting system integration: Seamless integration with existing ERP or accounting systems ensures smooth data flow and eliminates silos in your financial processes.

- Strategic value: Automation frees your finance team to focus on high-value tasks like forecasting and financial analysis rather than manual reconciliation.

With the right automation software for cash application , businesses can transform their financial processes and set the stage for greater efficiency and growth.

How Ramp can help simplify cash application

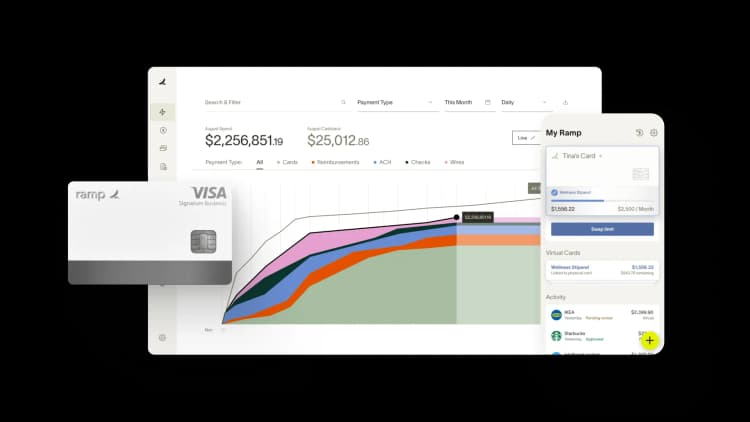

With Ramp’s accounts payable software, it takes the complexity out of cash applications by automating invoicing and payment processing to reduce manual work and improve accuracy.

With our platform, businesses can easily:

- Automate invoice processing: Ramp's AI-powered system categorizes and processes invoices automatically, reducing manual effort and speeding up reconciliation.

- Integrate with accounting systems: Direct API connections sync payment data instantly with your accounting software, eliminating manual data transfers.

- Track payments in real-time: Monitor payment statuses to identify and address delays or discrepancies quickly.

Save time, improve accuracy, and streamline your cash management process with Ramp Bill Pay.

FAQs

Collections focus on recovering overdue payments from customers and managing accounts receivable balances. On the other hand, cash application happens after payments are received, ensuring they're accurately applied to invoices and reconciled in financial records. Both are essential, but they address different parts of the payment lifecycle—collections bring the cash in, and cash application ties it to the books.

Accounts receivable (AR) focuses on managing customer payments, from tracking balances owed to collecting overdue payments. Order-to-cash (O2C) encompasses a broader scope, covering all processes related to a sale, from order placement and fulfillment to payment collection and financial analysis. In short, AR is a piece of the puzzle, while O2C is the full picture of how revenue flows into your business.

Don't miss these

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits