Salesforce charges

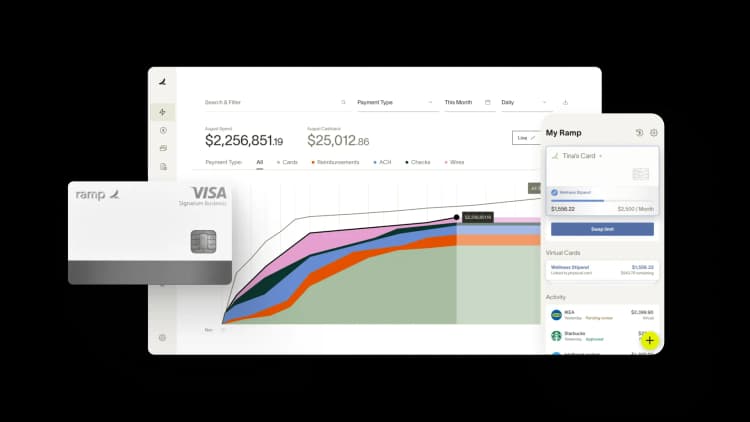

Ramp has processed 336154 transactions for Salesforce.

You might see Salesforce listed on your credit card statement as:

- SALESFORCE.COM

- SALESFORCE.COM SERVICE

- SALESFORCE

- SALESFORCE UPSK

- SALESFORCE APPEXCHANGE

Salesforce could appear on your statement as:

- SALESFORCE.COM

- SALESFORCE.COM SERVICE

- SALESFORCE

- SALESFORCE UPSK

- SALESFORCE APPEXCHANGE

What is Salesforce?

Salesforce is a leading customer relationship management (CRM) company that helps businesses of all sizes connect with customers, streamline their operations, and drive growth. With a wide range of cloud-based software solutions, Salesforce empowers organizations to build strong customer relationships, improve sales and marketing productivity, and deliver exceptional customer service.

- Sales Cloud: Salesforce's Sales Cloud is a CRM platform that enables businesses to manage their sales processes, track leads, and close deals more effectively.

- Service Cloud: The Service Cloud is a customer service and support platform that allows organizations to deliver personalized and efficient customer service across multiple channels.

- Marketing Cloud: Salesforce's Marketing Cloud provides businesses with tools to create personalized marketing campaigns, manage customer journeys, and analyze campaign effectiveness.

- Commerce Cloud: Commerce Cloud helps businesses create engaging online shopping experiences, deliver personalized recommendations, and streamline their ecommerce operations.

- App Cloud: Salesforce's App Cloud is a platform that enables businesses to build custom applications without the need for extensive coding knowledge, allowing for greater flexibility and agility.

Salesforce website

https://www.salesforce.com/“Accurate classification of expenses is vital for businesses as it forms the backbone of financial reporting, tax compliance, and strategic decision-making. It enables businesses to track and analyze their spending patterns, identify cost-saving opportunities, and assess the profitability of various operations or projects.”

Senior Manager, Accounting, Ramp